Investing In Belgium: A 270MWh BESS Project Financing Guide

Table of Contents

Understanding the Belgian Energy Landscape and BESS Opportunities

Belgium's commitment to renewable energy and its ambitious targets for reducing carbon emissions create a favorable environment for Battery Energy Storage System (BESS) investments. Understanding this landscape is crucial for successful BESS project financing in Belgium.

Regulatory Framework and Incentives

Belgium offers a supportive regulatory framework for renewable energy and energy storage, encouraging investments in BESS projects through various incentives.

- Specific government programs: The Belgian government actively promotes renewable energy integration through several programs offering subsidies and tax benefits for BESS projects connected to renewable energy sources like solar and wind farms. These programs often include grants, tax credits, and accelerated depreciation allowances.

- Relevant legislation: Legislation such as the “Energy Act” and related decrees provide the legal framework for grid connection, permitting, and operation of BESS systems. Staying updated on these regulations is critical for successful project development.

- Connection to the grid regulations: Clear guidelines for grid connection are available, outlining the technical requirements and procedures for integrating BESS projects into the Belgian electricity grid. Understanding these regulations is crucial for securing grid access.

- EU's renewable energy targets: The EU's ambitious renewable energy targets significantly impact the demand for energy storage solutions, making Belgium an attractive location for BESS investment. The increased reliance on intermittent renewables necessitates the deployment of BESS to manage grid stability and reliability.

Market Demand and Investment Potential

The demand for energy storage in Belgium is rapidly growing due to the increasing penetration of renewable energy sources and the need for grid stabilization. This translates into significant investment potential for BESS projects.

- Growth projections for renewable energy: Belgium's commitment to increasing its renewable energy capacity leads to robust projections for solar and wind power generation. This increased reliance on intermittent renewable energy sources necessitates energy storage solutions like BESS to ensure grid stability and reliability.

- Peak demand management: BESS can effectively manage peak demand, reducing the reliance on expensive peaking power plants and optimizing grid efficiency. This offers considerable revenue opportunities through peak shaving and load shifting services.

- Grid stabilization needs: The increasing integration of renewable energy sources poses challenges to grid stability. BESS projects can provide crucial grid services, such as frequency regulation and voltage support, generating additional revenue streams.

- Potential revenue streams from BESS projects: Besides providing grid services, BESS projects can generate revenue through arbitrage (buying energy at low prices and selling it at higher prices), ancillary services (frequency regulation, voltage control), and capacity market participation.

Securing Financing for Your 270MWh BESS Project

Securing funding for a large-scale BESS project like a 270MWh system in Belgium requires a well-structured approach, combining a strong business plan with the identification of appropriate funding sources.

Identifying Funding Sources

Several financing options are available for large-scale BESS projects in Belgium. Choosing the right mix depends on the project's specific characteristics and investor preferences.

- Bank loans: Traditional bank loans are a common financing option, often requiring strong project financials and collateral.

- Equity financing: Attracting equity investors necessitates a compelling investment proposal showcasing strong returns and a robust business plan.

- Project finance: This structured approach involves financing the project based on the project's cash flows, reducing the reliance on corporate balance sheets.

- Green bonds: These bonds specifically target environmentally friendly projects, offering access to a dedicated pool of investors concerned with sustainability.

- Public-private partnerships (PPPs): PPPs combine public sector funding and expertise with private sector investment and operational management.

Developing a Compelling Investment Proposal

A strong investment proposal is critical for securing financing. It must clearly demonstrate the project's viability and potential for profitability.

- Detailed project feasibility study: This study assesses the technical, economic, and environmental feasibility of the BESS project.

- Robust financial model: A detailed financial model projects the project's cash flows, profitability, and return on investment.

- Risk assessment: A thorough risk assessment identifies potential risks and outlines mitigation strategies.

- Environmental impact assessment: A comprehensive environmental impact assessment is essential for obtaining permits and securing funding from environmentally conscious investors.

- Experienced management team: Demonstrating a team with proven experience in BESS project development and management significantly strengthens the investment proposal.

Navigating Due Diligence and Legal Aspects

Securing financing involves navigating various legal and regulatory hurdles. Careful planning and professional advice are essential.

- Environmental permits: Obtaining necessary environmental permits is crucial for project approval and commencement.

- Grid connection agreements: Securing a grid connection agreement with the relevant grid operator is paramount for the project's operational viability.

- Land acquisition: Securing appropriate land for the BESS project requires careful planning and legal expertise.

- Insurance requirements: Adequate insurance coverage is necessary to mitigate potential risks during construction and operation.

- Contractual agreements with offtakers: Securing long-term agreements with offtakers (customers purchasing the energy storage services) is vital for project revenue stability.

Conclusion

Investing in a 270MWh BESS project in Belgium presents a significant opportunity for growth within the burgeoning renewable energy sector. By carefully navigating the regulatory landscape, developing a compelling investment proposal, and securing appropriate financing, investors can contribute to Belgium's energy transition while achieving substantial returns. This guide provides a framework for successfully financing your BESS project in Belgium. To learn more about specific funding programs and available incentives for your 270MWh BESS project financing in Belgium, contact [Contact Information/Link to relevant resources]. Start planning your BESS project financing strategy in Belgium today!

Featured Posts

-

Alex Pereiras Heavyweight Path Dana White On Ufc 313 And A Potential Jon Jones Super Fight

May 04, 2025

Alex Pereiras Heavyweight Path Dana White On Ufc 313 And A Potential Jon Jones Super Fight

May 04, 2025 -

Electric Vehicle Showdown China Vs America Who Will Win

May 04, 2025

Electric Vehicle Showdown China Vs America Who Will Win

May 04, 2025 -

Marina Rodriguez Vs Gillian Robertson A Comprehensive Ufc Iowa Fight Prediction

May 04, 2025

Marina Rodriguez Vs Gillian Robertson A Comprehensive Ufc Iowa Fight Prediction

May 04, 2025 -

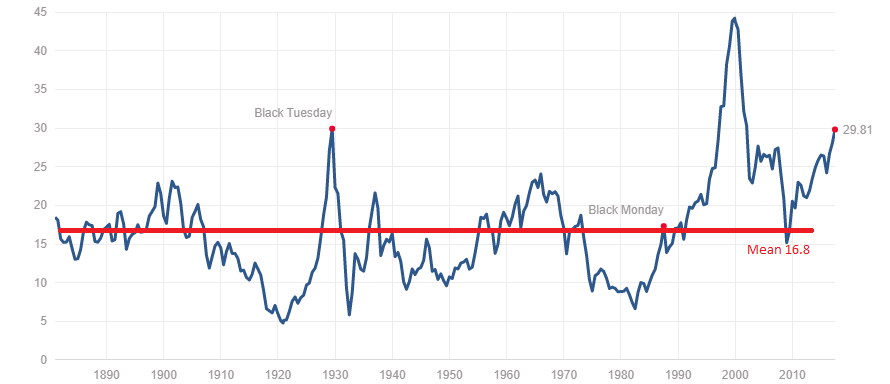

Why High Stock Market Valuations Shouldnt Deter Investors Bof A

May 04, 2025

Why High Stock Market Valuations Shouldnt Deter Investors Bof A

May 04, 2025 -

Enjoy 100 Rebate On Hpc Ev Charging This Raya With Shell Recharge

May 04, 2025

Enjoy 100 Rebate On Hpc Ev Charging This Raya With Shell Recharge

May 04, 2025