Investing In Palantir Stock: A Pre-May 5th Analysis

Table of Contents

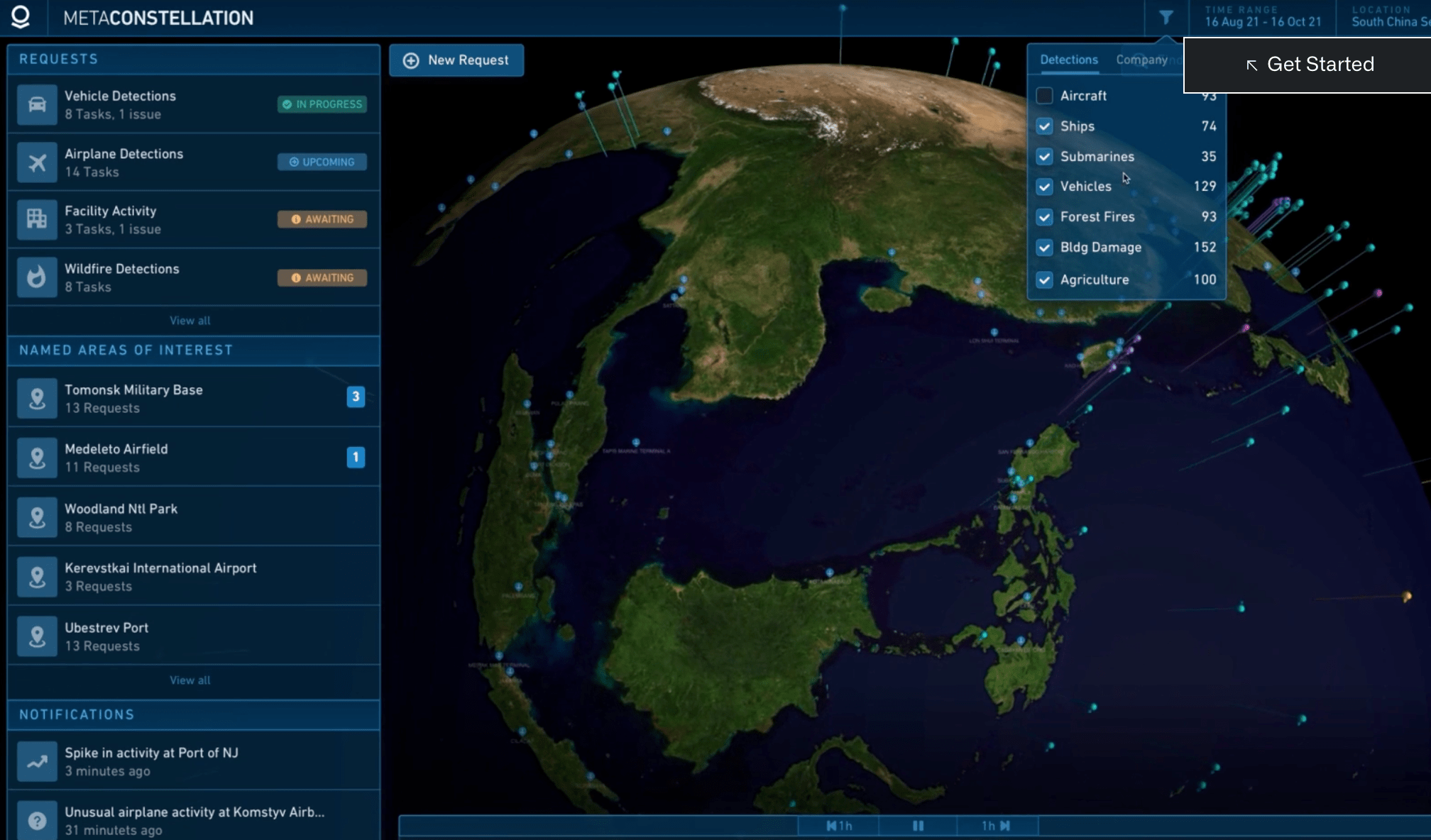

Palantir Technologies (PLTR) has seen significant stock price fluctuations recently, making many investors question whether now is the right time to buy. With May 5th marking a key date – likely the release of their next earnings report – the question of investing in Palantir stock is top of mind for many. This article aims to analyze whether investing in Palantir stock before May 5th represents a viable investment strategy, weighing the potential risks and rewards.

Palantir's Recent Performance and Financial Health

Revenue Growth and Profitability

Palantir's recent financial performance reveals a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus for investors considering investing in Palantir stock. Let's examine the specifics:

- Year-over-Year Revenue Growth: [Insert latest YoY revenue growth percentage]. While this indicates positive growth, the rate of growth may need to be analyzed in comparison to previous quarters and industry benchmarks.

- Net Income: [Insert latest net income figures]. Profitability is still a work in progress for Palantir. Investors should scrutinize the company's path to sustained profitability.

- Free Cash Flow: [Insert latest free cash flow figures]. Analyzing free cash flow offers a clearer picture of the company's operational cash generation capabilities, which is crucial for long-term sustainability. A strong and increasing free cash flow is often seen as a positive sign for investors considering investing in Palantir stock.

Compared to competitors like [mention competitors e.g., Snowflake, Databricks], Palantir's growth trajectory and profitability need further evaluation.

Government Contracts and Commercial Growth

Palantir's revenue streams are bifurcated: government contracts and commercial sales. The balance between these two sectors is vital for assessing the long-term prospects of investing in Palantir stock.

- Government Sector: This segment remains a significant contributor to Palantir's revenue. However, reliance on government contracts introduces potential risks related to budget fluctuations and political changes.

- Commercial Sector: Growth in this sector is crucial for long-term sustainability and diversification. The success of Palantir's commercial expansion will significantly impact future revenue streams and ultimately affect the viability of investing in Palantir stock.

A balanced and robust commercial portfolio alongside continued success in government contracts is essential for a healthy growth outlook and should be a factor considered when investing in Palantir stock.

Market Sentiment and Analyst Predictions

Stock Price Volatility and Trading Volume

Palantir's stock price has been notably volatile, experiencing periods of both significant gains and losses. Analyzing trading volume provides context:

- Price Volatility: [Include charts and graphs illustrating price fluctuations]. The reasons for this volatility are multi-faceted, including market sentiment, news events (like contract wins or losses), and overall market trends.

- Trading Volume: High trading volume often indicates increased investor interest and activity. Conversely, low volume might suggest decreased interest. Observing these trends is crucial when considering investing in Palantir stock.

Understanding the reasons behind price fluctuations is crucial for evaluating the risk involved in investing in Palantir stock.

Analyst Ratings and Price Targets

Analyst opinions on Palantir stock are varied, reflecting the complexity of its business model and market position.

- Buy Ratings: [Number] analysts currently rate Palantir as a "buy," citing [reasons].

- Hold Ratings: [Number] analysts recommend a "hold" position, pointing to [concerns].

- Sell Ratings: [Number] analysts suggest selling Palantir stock, citing [risks].

- Price Targets: Analyst price targets range from [low] to [high], indicating a significant divergence in expectations.

Considering the range of analyst opinions is crucial when deciding whether to invest in Palantir stock.

Risks and Opportunities Associated with Investing in Palantir

Potential Risks

Investing in Palantir stock carries inherent risks:

- Competition: The data analytics market is highly competitive, with established players and new entrants constantly emerging.

- Regulatory Hurdles: Government regulations and data privacy concerns can impact Palantir's operations and growth.

- Dependence on Large Contracts: Reliance on a few large contracts introduces significant risk if these contracts are not renewed or if there are delays in payments.

- Market Fluctuations: The overall market environment can significantly influence Palantir's stock price, regardless of its intrinsic value.

Potential Growth Opportunities

Despite the risks, Palantir also presents significant growth opportunities:

- Expansion into New Markets: Palantir's technology has potential applications in various industries beyond its current focus areas.

- Technological Advancements: Continuous innovation and development of new data analytics capabilities can enhance Palantir's competitive advantage.

- Strategic Partnerships: Collaborations with other technology companies can expand Palantir's reach and market penetration.

Conclusion: Should You Invest in Palantir Stock Before May 5th?

This pre-May 5th analysis reveals a complex picture for Palantir. While the company exhibits revenue growth and boasts innovative technology, profitability remains a concern. Market sentiment is mixed, with analyst opinions varying significantly. The upcoming earnings report on May 5th will likely have a significant impact on the stock price. Investing in Palantir stock involves considerable risk, but also presents potentially high rewards.

Therefore, the decision of whether or not to invest in Palantir stock before May 5th is a personal one, dependent on your individual risk tolerance and investment goals. Conduct thorough due diligence, consult with a financial advisor, and make an informed decision based on your own research. To learn more about Palantir, visit their investor relations page: [Insert link to Palantir's investor relations page]. Remember, this analysis is for informational purposes only and does not constitute financial advice. Investing in Palantir stock requires careful consideration of all factors.

Featured Posts

-

Projet Viticole A Dijon Secteur Des Valendons 2500 M

May 10, 2025

Projet Viticole A Dijon Secteur Des Valendons 2500 M

May 10, 2025 -

Wynne And Joanna All At Sea Plot Summary And Character Analysis

May 10, 2025

Wynne And Joanna All At Sea Plot Summary And Character Analysis

May 10, 2025 -

Nhl Playoffs Oilers Vs Kings Prediction And Betting Tips For Tonights Game

May 10, 2025

Nhl Playoffs Oilers Vs Kings Prediction And Betting Tips For Tonights Game

May 10, 2025 -

Uy Scuti Release Date Tease Young Thugs New Album

May 10, 2025

Uy Scuti Release Date Tease Young Thugs New Album

May 10, 2025 -

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Package Firstpost

May 10, 2025

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Package Firstpost

May 10, 2025