Investor Concerns About High Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

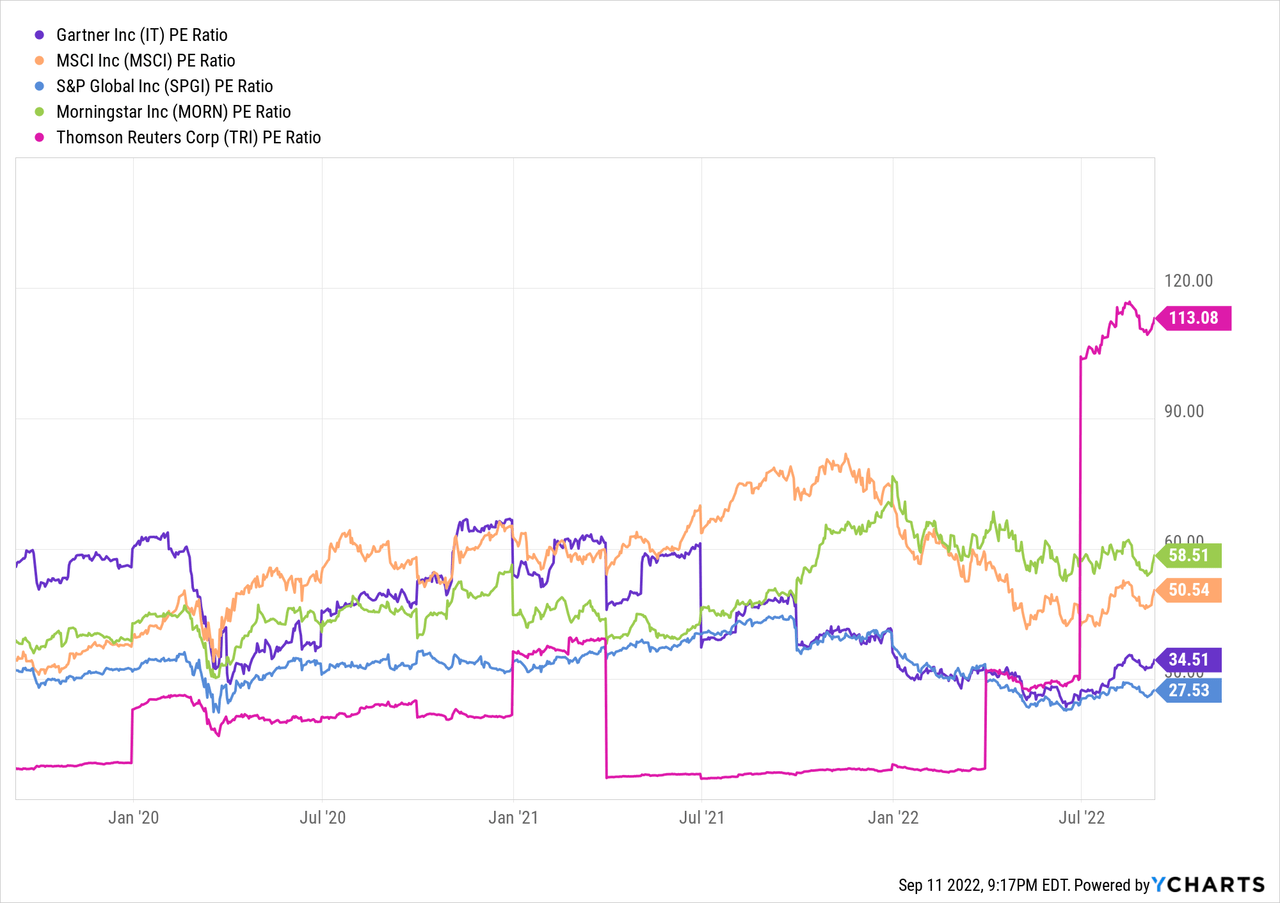

BofA's recent reports acknowledge the elevated nature of current stock market valuations. While not outright declaring them unsustainable, they suggest a cautious approach, highlighting the need for careful consideration of various factors. Their analysis points to a nuanced picture, recognizing both the potential for continued growth and the inherent risks associated with high price-to-earnings ratios (P/E ratios) and other valuation metrics.

- Key arguments: BofA's analysts emphasize the role of low interest rates in supporting current valuations. They also point to strong corporate earnings growth, albeit with some sector-specific variations, as a contributing factor. However, they acknowledge the impact of potential future interest rate hikes and inflationary pressures.

- Metrics used: BofA's analysis incorporates a range of metrics, including forward P/E ratios, price-to-sales ratios, and market capitalization-to-GDP ratios. They compare these metrics to historical averages and consider industry-specific benchmarks to gauge relative valuation.

- Caveats: BofA's assessment includes several important caveats. They acknowledge the uncertainty surrounding future economic growth and the potential for unforeseen geopolitical events to impact market performance. They emphasize that their analysis is not a prediction of future market movements but rather an assessment of current conditions.

Identifying Potential Risks Associated with High Stock Market Valuations

High stock market valuations inherently carry several risks. BofA, along with other market analysts, highlights the following potential dangers:

- Market correction or crash: Elevated valuations increase the probability of a significant market correction or even a crash if investor sentiment shifts negatively or unexpected economic news emerges. A sharp decline in prices could lead to substantial portfolio losses.

- Rising interest rates: Increased interest rates typically lead to higher borrowing costs for companies, potentially reducing corporate earnings and impacting stock prices. This is particularly true for growth stocks, which rely on future earnings projections.

- Geopolitical risks: Global geopolitical instability, such as conflicts or trade wars, can significantly impact market sentiment and lead to increased volatility. These unforeseen events can cause rapid market corrections.

- Inflationary pressures: Persistent inflation erodes purchasing power and can put upward pressure on interest rates, negatively influencing stock valuations. High inflation can significantly impact consumer spending and business profitability.

BofA's Strategies for Navigating High Stock Market Valuations

BofA suggests several strategies for investors navigating the current environment of high stock market valuations:

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate) and sectors is crucial to mitigate risk. This reduces exposure to any single market segment.

- Sector-specific recommendations: BofA may offer specific sector recommendations based on their valuation models and future growth projections. Following these recommendations requires in-depth research and analysis.

- Long-term investment horizon: Maintaining a long-term investment horizon allows investors to ride out short-term market fluctuations and benefit from long-term growth. Short-term trading based on valuation anxieties can lead to losses.

- Defensive investment options: Consider incorporating defensive investment options, such as high-quality dividend-paying stocks or government bonds, into your portfolio to reduce volatility during market downturns.

Alternative Perspectives on High Stock Market Valuations

While BofA's assessment provides valuable insights, it's crucial to consider alternative perspectives. Some analysts argue that current valuations are justified by strong corporate earnings growth and low interest rates, projecting continued upward trends. Others maintain a more cautious stance, emphasizing the risks of a market correction.

- Different viewpoints: These differing viewpoints highlight the complexity of assessing stock market valuations and the importance of individual research and risk tolerance.

- Relevant sources: Further research into reports from other major financial institutions and independent market analysts can provide a more comprehensive understanding of the various perspectives on current market valuations. [Insert links to relevant sources here]

- Diversity of opinions: The diversity of opinions in the financial market underscores the importance of thorough due diligence before making any investment decisions.

Conclusion

BofA's analysis of high stock market valuations highlights both the potential for continued growth and the inherent risks associated with elevated prices. While strong corporate earnings and low interest rates contribute to current levels, the potential for market corrections, rising interest rates, geopolitical risks, and inflationary pressures necessitate a cautious approach. BofA recommends diversification, a long-term investment horizon, and consideration of defensive investment options. Understanding the nuances of high stock market valuations is crucial for informed investment decisions. Consult with a financial advisor to develop a personalized investment strategy that addresses your specific risk tolerance and financial goals related to these high stock market valuations.

Featured Posts

-

The Post Roe Landscape Exploring The Implications Of Otc Birth Control

Apr 24, 2025

The Post Roe Landscape Exploring The Implications Of Otc Birth Control

Apr 24, 2025 -

Stock Market Rally Futures Soar After Trumps Comments On Powell

Apr 24, 2025

Stock Market Rally Futures Soar After Trumps Comments On Powell

Apr 24, 2025 -

Elon Musk Doge And The Epa A Turning Point For Tesla And Space X

Apr 24, 2025

Elon Musk Doge And The Epa A Turning Point For Tesla And Space X

Apr 24, 2025 -

India Market Update Tailwinds Powering Niftys Strong Performance

Apr 24, 2025

India Market Update Tailwinds Powering Niftys Strong Performance

Apr 24, 2025 -

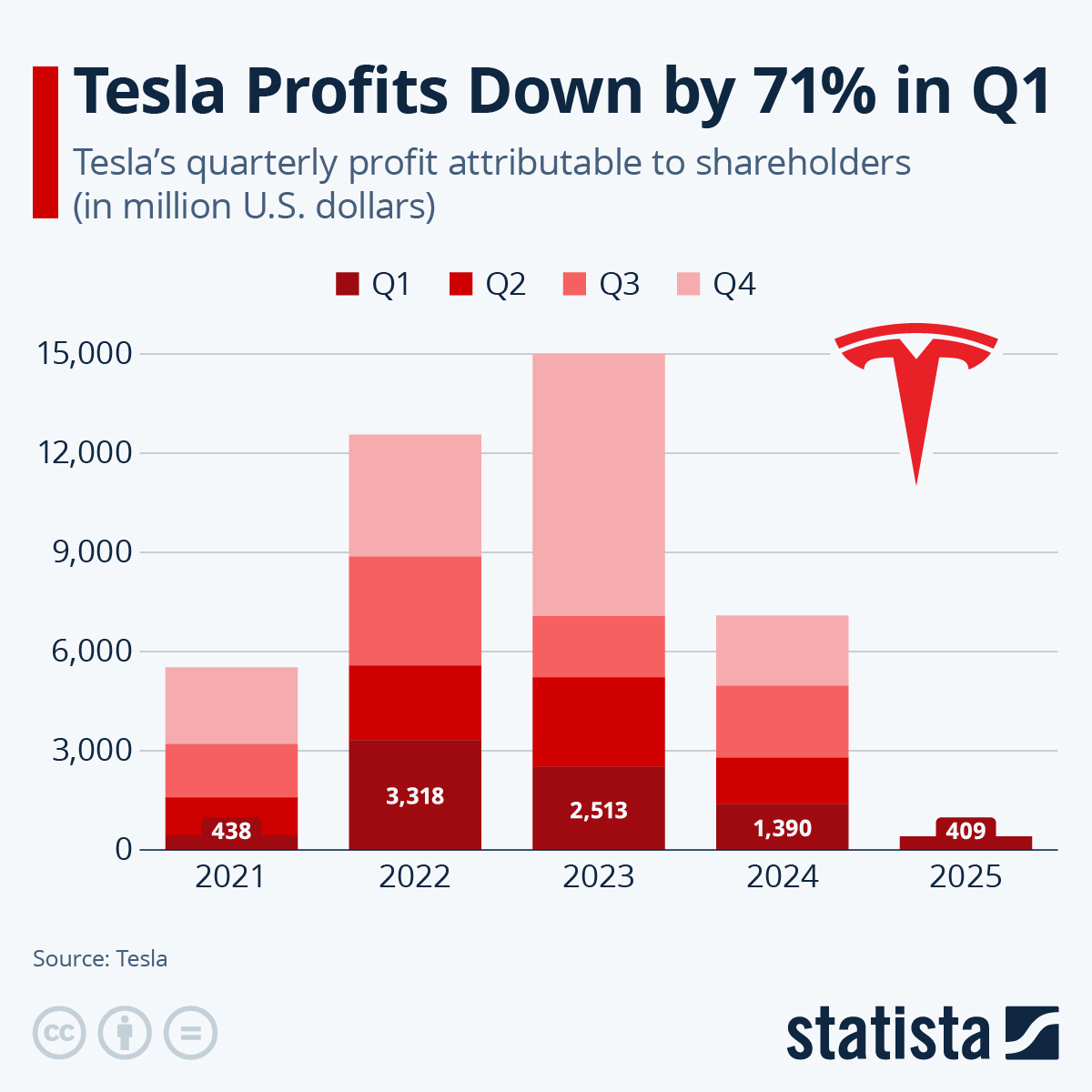

Teslas Q1 2024 Financial Performance Significant Net Income Decline

Apr 24, 2025

Teslas Q1 2024 Financial Performance Significant Net Income Decline

Apr 24, 2025

Latest Posts

-

Understanding Trumps Transgender Military Ban Separating Fact From Fiction

May 10, 2025

Understanding Trumps Transgender Military Ban Separating Fact From Fiction

May 10, 2025 -

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025 -

Discriminacion Y Arresto Universitaria Transgenero Y El Acceso A Banos Publicos

May 10, 2025

Discriminacion Y Arresto Universitaria Transgenero Y El Acceso A Banos Publicos

May 10, 2025 -

Ajaxs Brobbey A Formidable Force In The Europa League

May 10, 2025

Ajaxs Brobbey A Formidable Force In The Europa League

May 10, 2025 -

Ihsaas Transgender Athlete Ban A Post Trump Order Analysis

May 10, 2025

Ihsaas Transgender Athlete Ban A Post Trump Order Analysis

May 10, 2025