Is A Housing Market Correction Imminent In Canada?

Table of Contents

Rising Interest Rates and Their Impact on Affordability

The Bank of Canada's aggressive monetary policy, aimed at curbing inflation, has significantly impacted the affordability of housing across Canada.

The Bank of Canada's Monetary Policy

- Increased Borrowing Costs: The Bank of Canada's recent interest rate hikes have led to substantially higher borrowing costs for mortgages. This directly translates to larger monthly payments for prospective homebuyers. For example, a 1% increase in interest rates can significantly increase monthly mortgage payments, impacting affordability.

- Stringent Stress Tests: The Office of the Superintendent of Financial Institutions (OSFI) stress tests, designed to ensure borrowers can withstand higher interest rates, have become increasingly stringent. This makes it harder for many to qualify for a mortgage, further reducing demand.

- Statistics: Data from the Canadian Real Estate Association (CREA) and other sources showing the correlation between interest rate hikes and a decline in home sales would be included here (Note: I cannot access real-time data to provide specific numbers).

Reduced Purchasing Power

Increased interest rates coupled with persistent inflation have drastically reduced the purchasing power of potential homebuyers.

- Impact on First-Time Buyers: First-time homebuyers, already facing significant financial hurdles, are disproportionately affected by higher interest rates and reduced affordability. The dream of homeownership is becoming increasingly distant for many.

- Shrinking Pool of Qualified Buyers: The combination of higher rates and stricter lending criteria has resulted in a shrinking pool of qualified buyers, leading to decreased demand. This is reflected in a slowdown in sales activity and increased unsold inventory in some markets.

- Data on Decreased Sales: Statistics showing a decrease in home sales across various Canadian cities (data would be inserted here).

Oversupply Concerns in Certain Canadian Markets

While certain areas remain strong, concerns about oversupply exist in some Canadian markets.

Regional Variations in the Housing Market

The Canadian housing market isn't homogenous. Conditions vary significantly between cities and provinces.

- High Inventory Areas: Some major cities are experiencing a significant increase in new housing construction, leading to potential oversupply in specific segments of the market. Examples of regions with higher inventory levels would be listed here (Note: I cannot provide real-time market-specific information).

- Market Segmentation: The impact of oversupply is not uniform across all housing types (e.g., condos vs. detached homes).

Impact of New Construction on Prices

Increased housing supply can disrupt pricing dynamics.

- Price Stagnation or Decline: A surplus of housing inventory can lead to price stagnation or even declines, as sellers may need to lower prices to attract buyers in a competitive market.

- Building Permits and Completions: Data on building permits issued and projected housing completions in specific regions could indicate potential future oversupply.

Economic Indicators and Their Correlation to Housing Prices

Several key economic indicators are closely correlated with housing prices.

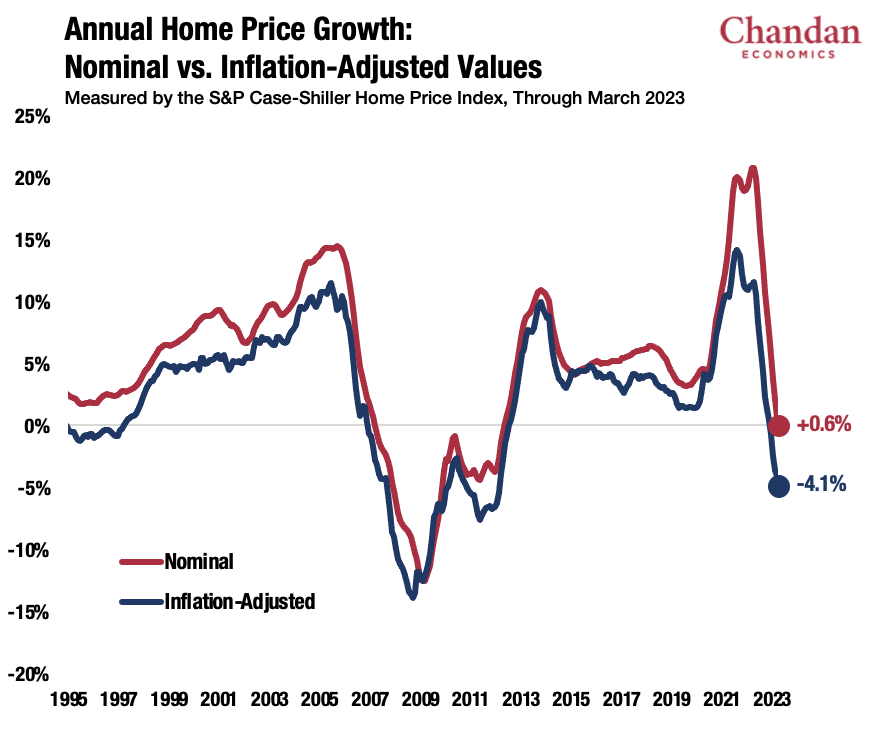

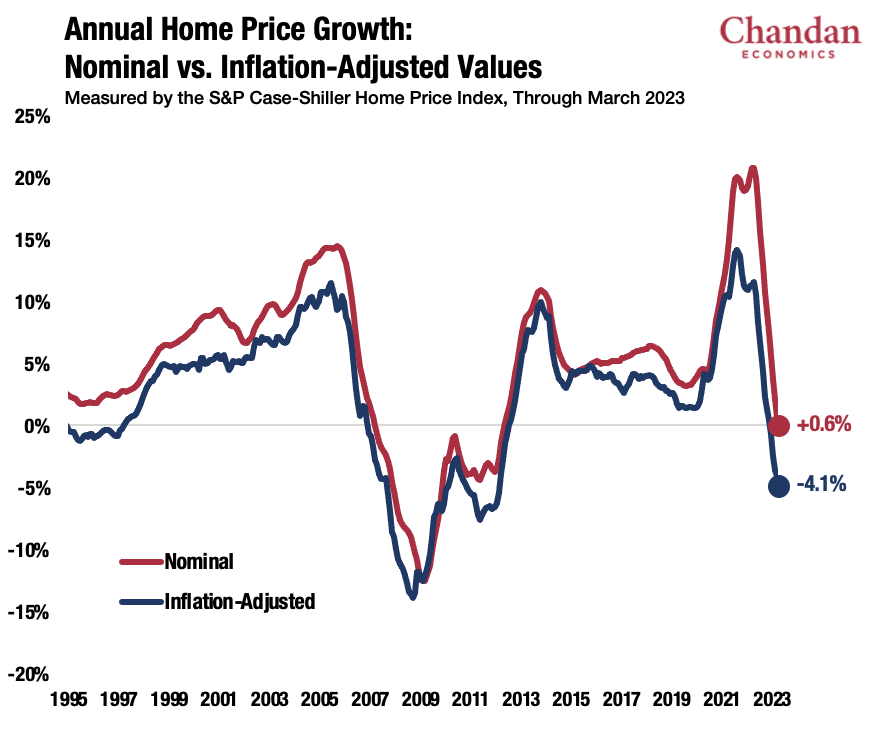

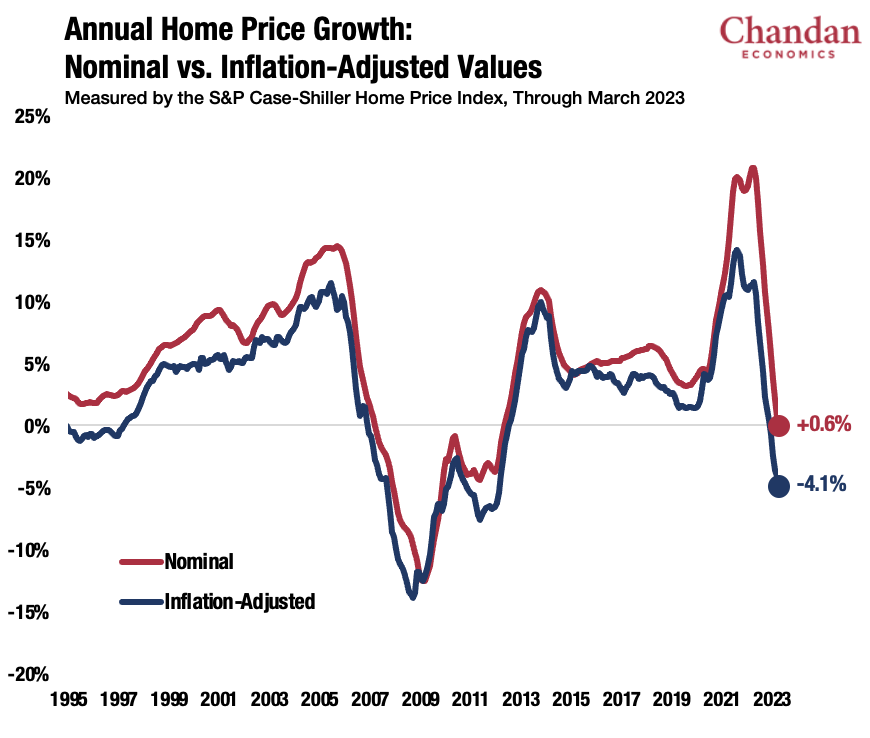

Inflation and Its Influence

Persistent high inflation erodes purchasing power and impacts consumer confidence.

- Impact on Demand: High inflation can dampen demand for housing, as consumers become more cautious about making large financial commitments.

- Inflation Data: Relevant inflation data from Statistics Canada would be integrated here (Note: I cannot access real-time data).

Employment and Unemployment Rates

Employment levels significantly influence housing demand.

- Job Losses and Slowdown: Job losses or a significant economic slowdown can lead to decreased consumer confidence and reduced demand for housing, potentially impacting prices.

- Employment Data: Current employment figures from Statistics Canada would be incorporated (Note: I cannot access real-time data).

Potential Signs of a Canadian Housing Market Correction

While not definitive, several indicators suggest a potential market correction.

Decreasing Sales Activity

Recent trends in housing sales point towards a slowdown.

- Declining Sales: Statistics showcasing declining sales in various regions across Canada (data would be included here). A comparison to previous years would be beneficial.

- Reasons for Slowdown: Analysis of the reasons for slowing sales – interest rates, inflation, economic uncertainty, etc.

Price Adjustments and Increased Inventory

Some markets are showing signs of price adjustments and rising inventory.

- Price Reductions: Examples of specific regions or housing types experiencing price reductions. Case studies showing examples of price decreases could strengthen the argument.

- Increased Days on Market: Statistics illustrating a rise in the number of days properties remain on the market before being sold.

Conclusion

Several factors – rising interest rates, potential oversupply in some areas, economic uncertainty reflected in inflation and employment figures, and observable trends like decreasing sales and price adjustments – suggest a potential Canadian housing market correction. However, it's crucial to maintain a balanced perspective. A "soft landing" remains a possibility, where prices stabilize rather than experience a sharp decline. The extent and timing of any correction will vary considerably across different regions of Canada. Understanding the potential for a Canadian housing market correction is crucial. Stay informed by following economic indicators, market trends, and consulting regularly with reputable sources and real estate professionals for up-to-date information and guidance tailored to your specific needs. Navigating the complexities of the Canadian housing market requires vigilance and informed decision-making.

Featured Posts

-

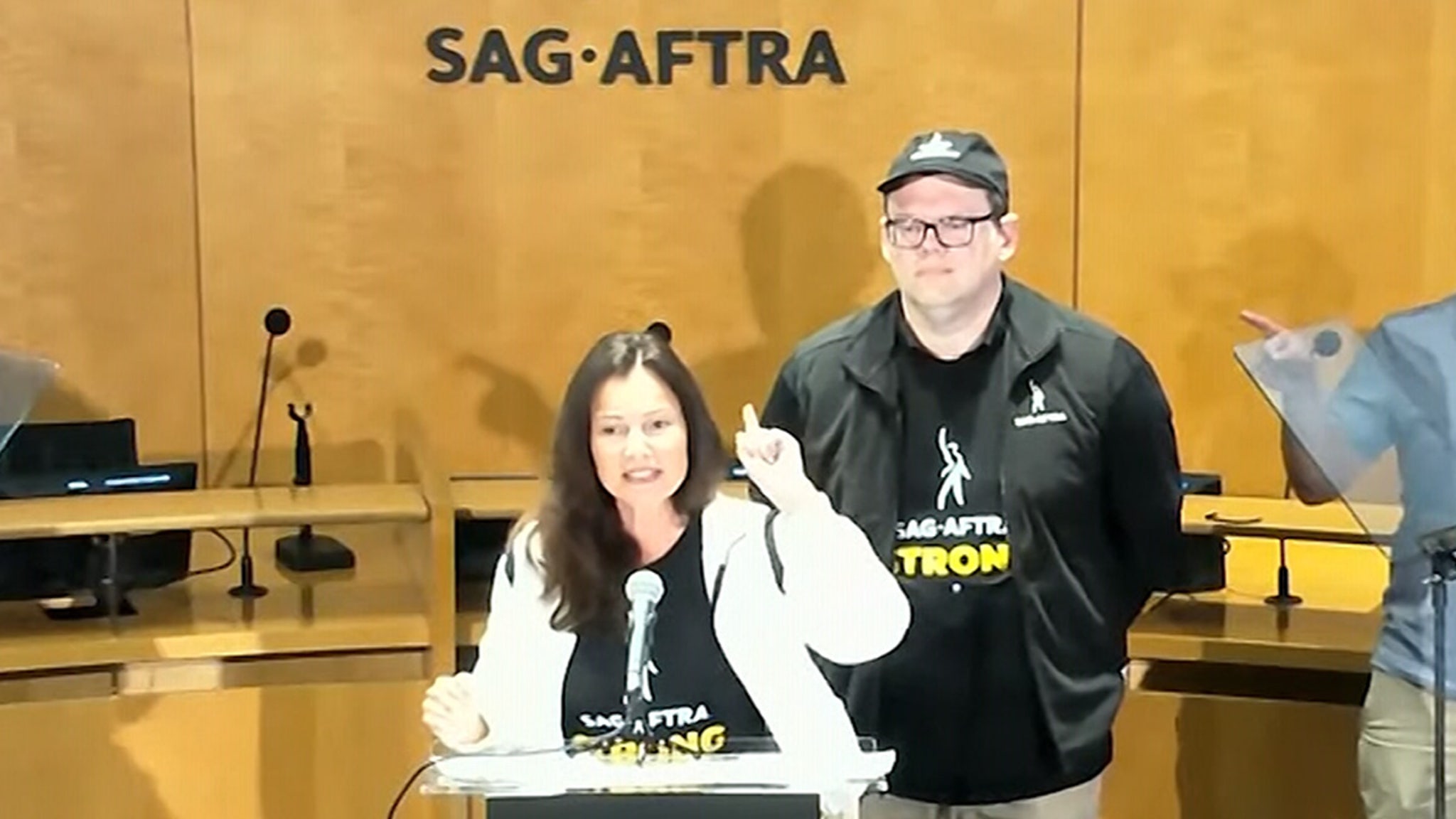

Actors Join Writers Strike Total Hollywood Production Shutdown

May 22, 2025

Actors Join Writers Strike Total Hollywood Production Shutdown

May 22, 2025 -

Understanding The Recent Spike In Gas Prices In Southeast Wisconsin

May 22, 2025

Understanding The Recent Spike In Gas Prices In Southeast Wisconsin

May 22, 2025 -

Is A Housing Market Correction Imminent In Canada

May 22, 2025

Is A Housing Market Correction Imminent In Canada

May 22, 2025 -

Viral Reddit Story The Girl Who Faked Her Disappearance For A Sydney Sweeney Movie

May 22, 2025

Viral Reddit Story The Girl Who Faked Her Disappearance For A Sydney Sweeney Movie

May 22, 2025 -

Tuerkiyes Nato Summit A Defining Role In The Alliances Future

May 22, 2025

Tuerkiyes Nato Summit A Defining Role In The Alliances Future

May 22, 2025