Is A Large Down Payment Keeping You From Owning A Home In Canada?

Table of Contents

Understanding the Current Canadian Housing Market and Down Payment Requirements

The Impact of High Home Prices on Down Payment Amounts

The escalating cost of homes across Canada directly impacts the size of the down payment required. Average home prices vary significantly by region, making homeownership more attainable in some areas than others. For instance, while the average home price in Calgary might be considerably lower than in Vancouver, the required down payment still presents a significant challenge for many potential buyers. This disparity highlights the need for region-specific strategies when planning your home purchase.

-

Average Home Prices (2024 Estimates - subject to market fluctuation):

- Toronto: $1,200,000 (estimated)

- Vancouver: $1,500,000 (estimated)

- Calgary: $600,000 (estimated)

- Montreal: $650,000 (estimated)

- (Note: These are estimates and actual prices can vary widely depending on location and property type.)

-

Down Payment Percentages: The required down payment percentage depends on the purchase price. For homes priced below $500,000, a 5% down payment might suffice. However, for homes priced between $500,000 and $1,000,000, a 5% down payment on the first $500,000 and 10% on the portion above $500,000 is typically required. For homes over $1,000,000, a 20% down payment is usually necessary.

-

Impact of the Mortgage Stress Test: The Bank of Canada's mortgage stress test ensures borrowers can handle higher interest rates. This means lenders assess your ability to repay your mortgage even if interest rates rise significantly, which can impact your borrowing power and the size of the mortgage you can qualify for.

Different Down Payment Options Based on Purchase Price

The percentage of your down payment significantly impacts your mortgage. A larger down payment generally translates to a lower interest rate and smaller monthly payments. However, saving for a large down payment can take considerable time and effort.

-

5% Down Payment: Requires CMHC insurance, resulting in higher premiums, but allows homeownership with a smaller initial investment.

-

10% Down Payment: Still requires CMHC insurance, but the premiums are typically lower than with a 5% down payment.

-

20% Down Payment: Eliminates the need for CMHC insurance, resulting in lower overall borrowing costs.

Exploring Alternative Financing Options and Down Payment Assistance Programs

Government-Funded Programs for First-Time Home Buyers

Several government programs in Canada aim to assist first-time homebuyers with their down payment. These programs offer various incentives and financial support, making homeownership more accessible.

-

First-Time Home Buyers' Incentive (FTHBI): This federal program provides a shared-equity mortgage loan, reducing the down payment required. Eligibility criteria apply, including income limits and property type restrictions.

-

Provincial Programs: Various provinces offer their own programs to support first-time homebuyers. These programs may include grants, tax credits, or other financial incentives. It's crucial to research the programs available in your specific province. (Note: Eligibility criteria and program details are subject to change. Always consult the official government websites for the most up-to-date information.)

Private Mortgage Insurance (CMHC)

The Canada Mortgage and Housing Corporation (CMHC) insures mortgages with down payments less than 20%, allowing lenders to offer mortgages to borrowers with smaller down payments. While CMHC insurance adds to the overall cost, it enables homeownership for those who might otherwise struggle to save a larger down payment.

-

CMHC Premiums: The premiums are calculated based on the loan-to-value ratio (LTV). A lower down payment results in a higher premium.

-

Benefits of CMHC: Access to a mortgage with a smaller down payment.

-

Drawbacks of CMHC: Higher overall borrowing costs due to the insurance premiums.

Gift Assistance from Family and Friends

Receiving a gift towards your down payment from family or friends can significantly help you reach your homeownership goal. However, careful consideration of tax implications is necessary.

-

Documentation: Proper documentation of the gift is crucial for tax purposes.

-

Tax Implications: Gifts exceeding certain amounts might have tax implications for both the giver and the receiver. Consult a tax professional for guidance.

Strategies for Saving for a Larger Down Payment Faster

Budgeting and Financial Planning

Creating a realistic budget and sticking to it is critical for accelerating your savings. Tracking your expenses, identifying areas to cut back, and setting clear financial goals are vital steps.

-

Budgeting Apps: Utilize budgeting apps to monitor expenses and track your progress.

-

High-Yield Savings Accounts: Maximize your savings by using high-yield savings accounts to earn a higher interest rate.

-

Investment Options (with caution): While investing can help grow your savings, it carries risk. Consider consulting a financial advisor before investing a significant portion of your savings.

Increasing Income and Reducing Debt

Improving your financial stability and reducing debt are crucial for faster savings.

-

Higher-Paying Job: Actively seeking a higher-paying job or exploring career advancement opportunities can significantly increase your savings potential.

-

Debt Reduction: Prioritize reducing high-interest debt, such as credit cards, to free up more money for savings.

-

Side Hustles: Consider exploring side hustles or part-time jobs to supplement your income.

Conclusion

Securing a mortgage in Canada's competitive housing market can be challenging, especially when facing the significant requirement of a large down payment. However, several options are available to make homeownership a reality. Government programs, CMHC insurance, strategic financial planning, and seeking help from family can all play a significant role. By exploring these options and implementing effective saving strategies, you can overcome the challenges and achieve your dream of owning a home in Canada. Don't let a large down payment deter your Canadian homeownership dreams. Start exploring your options today! [Link to Government Website] [Link to CMHC Website] [Link to Financial Planning Tool]

Featured Posts

-

7 Year Prison Sentence For Gpb Capitals David Gentile In Ponzi Like Case

May 10, 2025

7 Year Prison Sentence For Gpb Capitals David Gentile In Ponzi Like Case

May 10, 2025 -

2024 25 Nhl Season Major Storylines To Watch For The Rest Of The Year

May 10, 2025

2024 25 Nhl Season Major Storylines To Watch For The Rest Of The Year

May 10, 2025 -

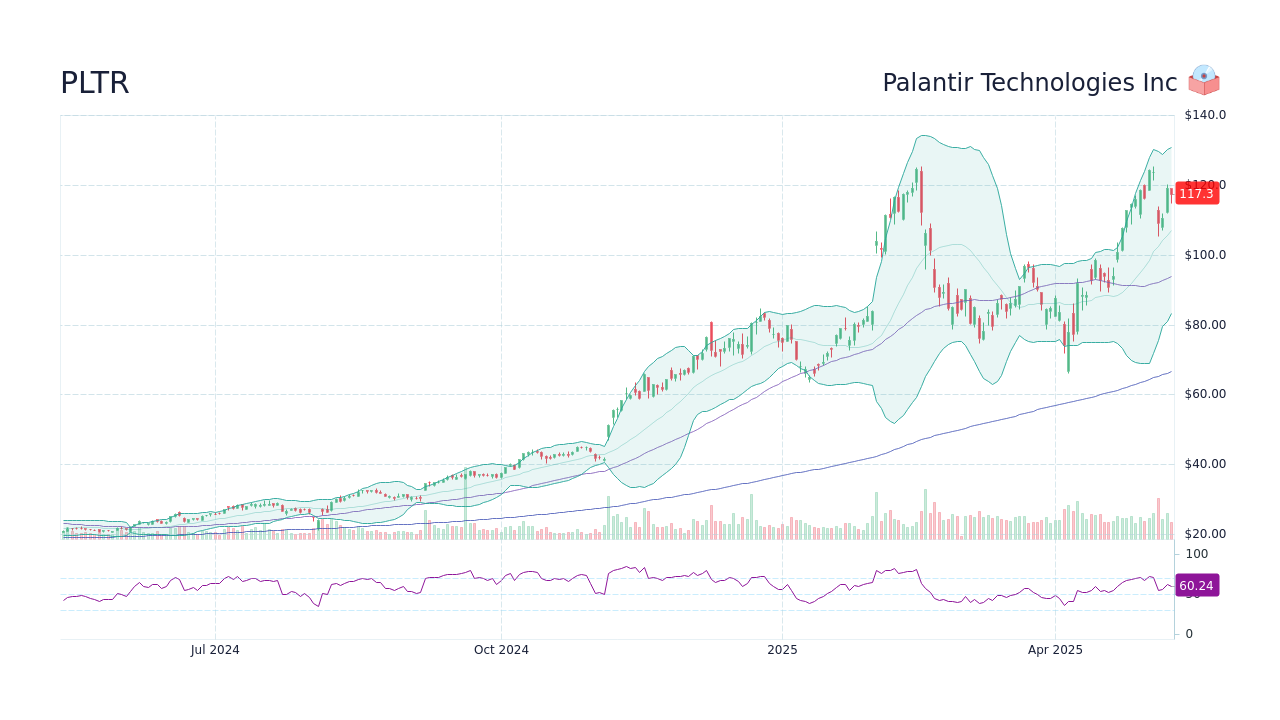

Palantir Stock Forecast Revised A Deep Dive Into The Market Shift

May 10, 2025

Palantir Stock Forecast Revised A Deep Dive Into The Market Shift

May 10, 2025 -

Elizabeth Line Accessibility Addressing Wheelchair User Challenges

May 10, 2025

Elizabeth Line Accessibility Addressing Wheelchair User Challenges

May 10, 2025 -

North Idaho Event Conservative Commentator Jeanine Pirro

May 10, 2025

North Idaho Event Conservative Commentator Jeanine Pirro

May 10, 2025