Is Apple Vulnerable? Analyzing The Risk Of Future Tariffs On Buffett's Holdings

Table of Contents

Apple's Global Supply Chain and Tariff Sensitivity

Apple's success hinges on a complex, globally dispersed supply chain. A significant portion of its manufacturing takes place in China, making the company particularly sensitive to trade policies and tariffs imposed by various governments. Previous tariff increases have already demonstrated the potential for negative impacts on Apple's profitability and product pricing.

- Percentage of Apple products manufactured in China: While Apple doesn't publicly disclose exact figures, estimates suggest a substantial portion of its products, including iPhones and other key devices, are manufactured in China. This high concentration of manufacturing in a single region exposes Apple to significant risk.

- Examples of past tariff impacts on Apple's pricing and sales: Past tariff increases have led to price hikes for Apple products in certain markets, impacting consumer demand and overall sales figures. These past experiences serve as a cautionary tale for the future.

- Analysis of Apple's efforts to diversify its manufacturing base: Apple has been actively trying to diversify its manufacturing beyond China, exploring options in countries like India and Vietnam. However, this diversification is a long-term strategy and may not fully mitigate the risks associated with future tariff increases in the short term. The success of these efforts remains to be seen.

Warren Buffett's Apple Investment and Exposure to Risk

Berkshire Hathaway's investment in Apple is colossal, representing a substantial portion of its overall portfolio. This massive investment makes Buffett significantly exposed to the potential negative consequences of tariffs impacting Apple's profitability.

- Value of Berkshire Hathaway's Apple shares: Berkshire Hathaway holds a substantial number of Apple shares, representing billions of dollars in investment. This substantial stake highlights the magnitude of potential losses should Apple's valuation decline due to tariff-related issues.

- Percentage of Berkshire Hathaway's portfolio represented by Apple: Apple's holdings constitute a considerable percentage of Berkshire Hathaway's total investment portfolio. This concentration of investment increases the overall risk profile for Buffett's company.

- Potential impact of a significant tariff increase on Berkshire's overall performance: A significant increase in tariffs could trigger a decline in Apple's stock price, directly impacting Berkshire Hathaway's overall financial performance and potentially affecting its long-term investment strategy.

Geopolitical Factors and Future Tariff Predictions

The current geopolitical landscape is characterized by ongoing trade tensions, particularly between the US and China. This volatile environment increases the likelihood of future tariff adjustments, making it crucial to analyze potential scenarios and their implications for Apple.

- Discussion of ongoing trade tensions between the US and China: The ongoing trade dispute between the US and China remains a significant source of uncertainty. Any escalation in these tensions could lead to further tariff hikes impacting Apple.

- Potential impact of other global conflicts or economic shifts on tariffs: Global conflicts and economic shifts can also influence trade policies and tariff decisions. The interconnected nature of the global economy means that events outside of the US-China relationship can still have significant implications for Apple.

- Expert opinions and predictions regarding future tariff policies: Experts' opinions on future tariff policies vary widely. However, the consensus is that the risk of future tariff increases remains a significant concern for companies like Apple with a global supply chain.

Apple's Mitigation Strategies and Resilience

Apple has implemented strategies to mitigate the risk posed by tariffs, but the effectiveness of these strategies remains uncertain. Its resilience to withstand potential tariff shocks will be tested.

- Examples of Apple's diversification efforts (e.g., shifting manufacturing, sourcing components): Apple's efforts to diversify its manufacturing base are crucial to its long-term success. However, this process is complex and takes time.

- Apple’s lobbying activities and political influence: Apple utilizes its political influence to lobby against tariffs and advocate for policies that protect its business interests. The success of these efforts is crucial in mitigating potential risks.

- Analysis of Apple's pricing power and consumer demand elasticity: Apple's pricing power and consumer demand elasticity will play a significant role in determining its ability to absorb tariff-related cost increases.

Conclusion: Is Apple Truly Vulnerable? Evaluating the Long-Term Impact of Tariffs

The potential for future tariffs presents a significant risk to Apple and, consequently, Warren Buffett's substantial investment. While Apple's global supply chain and dependence on specific manufacturing regions create vulnerabilities, its diversification efforts and pricing power offer some resilience. However, the unpredictable nature of global trade policy necessitates continuous monitoring of developments.

The long-term impact of tariffs on Apple remains uncertain, but the potential for negative consequences is undeniable. Stay informed about future tariff developments affecting Apple, monitor the impact of tariffs on Apple's stock, and analyze the long-term implications of tariffs on your investment in Apple. Understanding these risks is crucial for investors and stakeholders alike.

Featured Posts

-

England Airpark And Alexandria International Airport Partner To Launch The Ae Xplore Global Travel Campaign

May 25, 2025

England Airpark And Alexandria International Airport Partner To Launch The Ae Xplore Global Travel Campaign

May 25, 2025 -

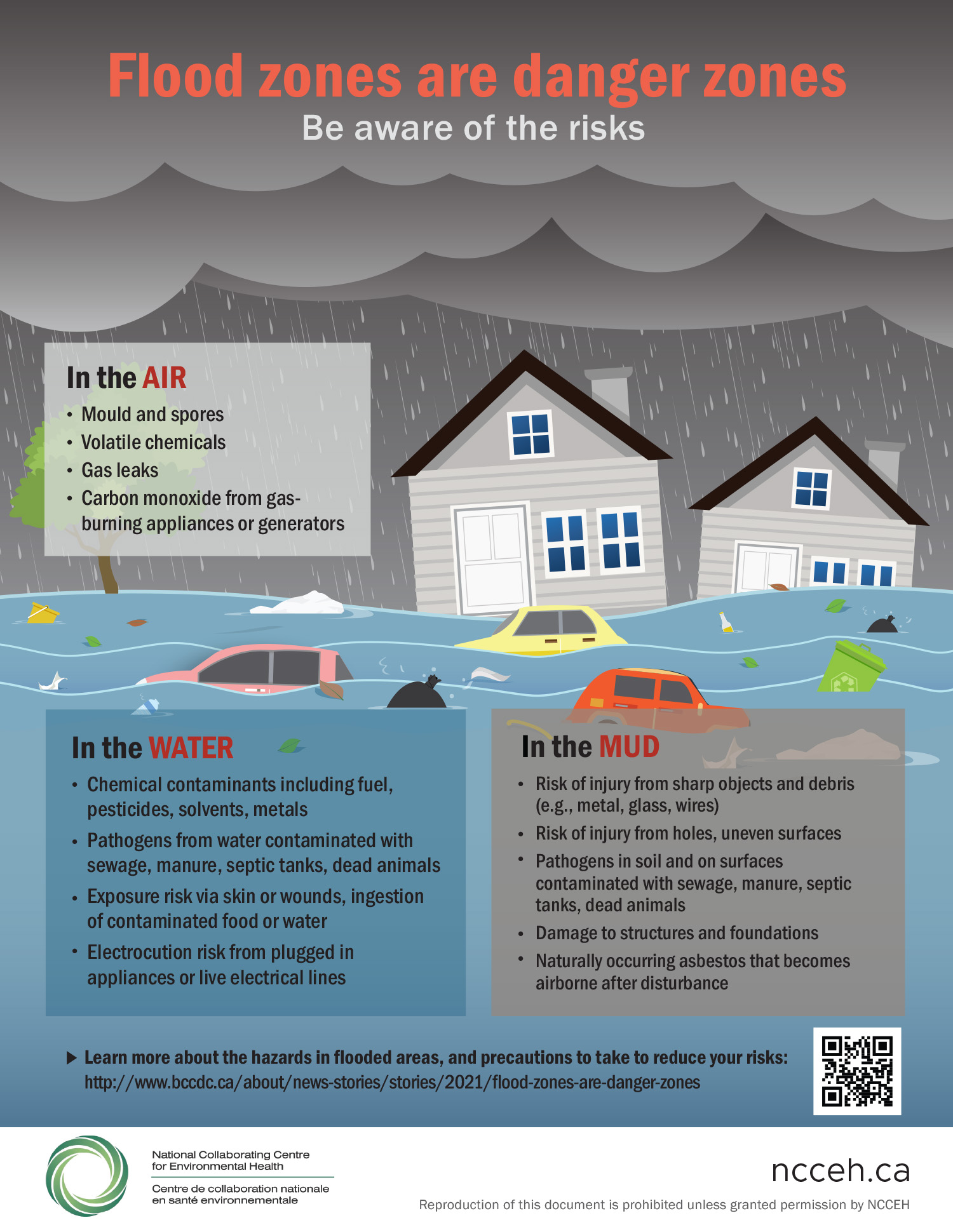

Flash Flood Emergency What To Know And How To Stay Safe

May 25, 2025

Flash Flood Emergency What To Know And How To Stay Safe

May 25, 2025 -

Analyst Predicts 254 For Apple Stock Is Now The Time To Buy

May 25, 2025

Analyst Predicts 254 For Apple Stock Is Now The Time To Buy

May 25, 2025 -

Where To Watch The Saint On Itv 4 Your Complete Guide

May 25, 2025

Where To Watch The Saint On Itv 4 Your Complete Guide

May 25, 2025 -

Naomi Kempbell Nayvidvertisha Fotosesiya Za Vsyu Kar Yeru

May 25, 2025

Naomi Kempbell Nayvidvertisha Fotosesiya Za Vsyu Kar Yeru

May 25, 2025