Is Bitcoin's Golden Cross A Buy Signal? A Deep Dive Into Market Trends

Table of Contents

Understanding the Bitcoin Golden Cross

The Bitcoin golden cross is a technical analysis indicator formed by the intersection of the 50-day moving average (MA) and the 200-day MA. A golden cross occurs when the shorter-term 50-day MA crosses above the longer-term 200-day MA. This crossover is often interpreted as a bullish signal, suggesting a potential upward trend reversal.

-

Definition: The 50-day MA represents short-term price momentum, while the 200-day MA represents long-term price trends. When the 50-day MA breaks above the 200-day MA, it suggests that short-term momentum is overpowering the long-term trend, potentially signaling a bullish market shift.

-

Technical Analysis: In technical analysis, the golden cross is a widely recognized pattern used across various asset classes, including stocks, commodities, and cryptocurrencies. It is considered a lagging indicator, meaning it confirms a trend that has already begun rather than predicting future price movements.

-

Visual Representation:

[Insert a chart or graph here clearly illustrating a Bitcoin golden cross. The chart should show the 50-day and 200-day MAs intersecting, with the 50-day MA crossing above the 200-day MA.]

- Keywords: Bitcoin golden cross, 50-day moving average, 200-day moving average, technical analysis, Bitcoin price prediction, Bitcoin trading signals

Historical Performance of the Bitcoin Golden Cross

Analyzing historical instances of golden crosses in Bitcoin's price chart reveals a mixed bag of results. While some golden crosses have indeed preceded significant price increases, others have proven to be false signals.

-

Past Instances: For example, [cite specific dates and analyze the price movements following those golden crosses]. Include both successful and unsuccessful instances to present a balanced perspective.

-

Bullish vs. Bearish Outcomes: It's crucial to understand that the percentage of times a golden cross accurately predicts a sustained bullish trend varies. While some studies suggest a higher success rate, it's far from guaranteed. A quantitative analysis of historical data is needed to establish this percentage accurately.

-

Factors Influencing Outcomes: Several external factors can influence the outcome after a Bitcoin golden cross, including:

- Macroeconomic conditions: Global economic downturns or positive economic news can significantly impact Bitcoin's price.

- Regulatory changes: New regulations or government policies concerning cryptocurrencies can drastically shift market sentiment.

- Major market events: Events like hacks, significant partnerships, or technological advancements can cause price volatility regardless of the golden cross signal.

-

Keywords: Bitcoin price history, Bitcoin chart analysis, historical data, Bitcoin market trends, bullish signal, bearish signal, Bitcoin price action

Limitations and Cautions of Using the Golden Cross

While the golden cross can be a helpful tool, relying solely on it for Bitcoin investment decisions is risky.

-

False Signals: Numerous instances show the golden cross generating false signals, leading to losses for investors who interpreted it as a guaranteed bullish indicator. These false signals often occur during periods of high volatility or sideways price action.

-

Confirmation Bias: Investors might be prone to confirmation bias, selectively focusing on instances where the golden cross accurately predicted a price increase and ignoring instances where it failed. Objective analysis and careful consideration of all available data are essential to avoid this bias.

-

Other Indicators: The golden cross should never be used in isolation. Combining it with other technical indicators and fundamental analysis provides a more comprehensive view of the market.

-

Risk Management: Regardless of technical indicators like the golden cross, sound risk management is paramount. Never invest more than you can afford to lose, and always diversify your investment portfolio.

Alternative Indicators for Bitcoin Investment Decisions

To enhance investment decisions, consider using these indicators alongside the golden cross:

-

Moving Average Convergence Divergence (MACD): The MACD is a momentum indicator that identifies changes in the strength, direction, momentum, and duration of a trend in the price of a security. It can confirm or contradict the signal given by the golden cross.

-

Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a security. This helps assess the potential for a trend reversal.

-

Volume Analysis: Analyzing trading volume alongside price action is crucial. A strong golden cross signal should ideally be accompanied by increasing trading volume, confirming the strength of the bullish momentum.

-

Keywords: MACD, RSI, trading volume, Bitcoin trading indicators, Bitcoin technical analysis

Conclusion

The Bitcoin golden cross, while a potentially useful signal, is not a foolproof predictor of future price movements. Its historical performance shows a mixed bag of results, highlighting the need for cautious interpretation and the importance of considering it alongside other market indicators and thorough risk management. Relying solely on the golden cross for Bitcoin investment decisions is risky. Successful Bitcoin trading requires a multifaceted approach combining technical analysis, fundamental analysis, and a clear understanding of the inherent volatility of the cryptocurrency market. Before making any investment decisions based on the Bitcoin golden cross or any other single indicator, conduct thorough research and consider consulting with a financial advisor. Remember, understanding the risks and implementing a robust investment strategy are crucial for navigating the ever-changing landscape of Bitcoin and cryptocurrency.

Featured Posts

-

Micro Strategy Vs Bitcoin Which Is The Better Investment In 2025

May 08, 2025

Micro Strategy Vs Bitcoin Which Is The Better Investment In 2025

May 08, 2025 -

Copa Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025

Copa Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025 -

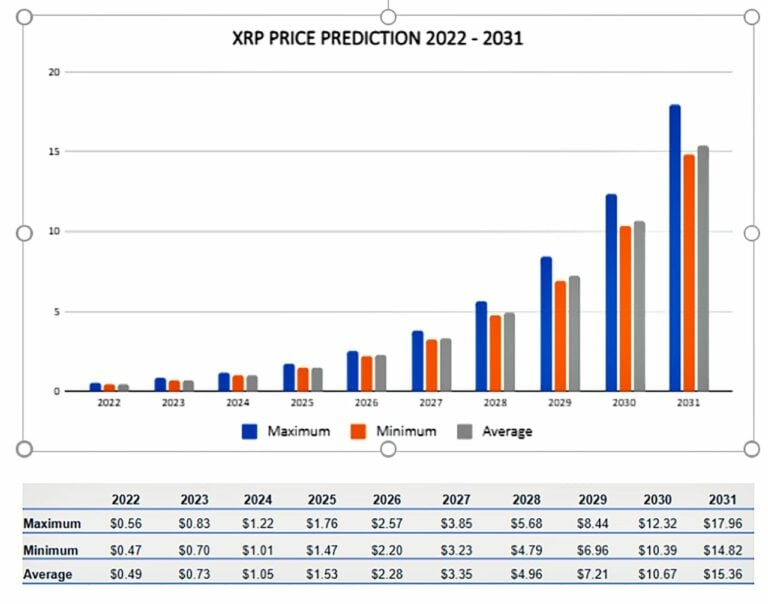

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move For Xrp

May 08, 2025

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move For Xrp

May 08, 2025 -

How To Transfer Data Safely And Securely

May 08, 2025

How To Transfer Data Safely And Securely

May 08, 2025 -

Check Daily Lotto Results For Thursday April 17 2025

May 08, 2025

Check Daily Lotto Results For Thursday April 17 2025

May 08, 2025