Is The Grim Retail Sales Picture Forcing The Bank Of Canada's Hand On Rate Cuts?

Table of Contents

Declining Retail Sales: A Key Indicator of Economic Slowdown

Canadian retail sales have shown a concerning downward trend in recent months, signaling a potential economic slowdown. This decline isn't isolated to a single sector; it reflects a broader weakening in consumer spending. The impact of persistent inflation, coupled with previous interest rate hikes by the Bank of Canada, has significantly dampened consumer confidence, leading to reduced discretionary spending.

- Specific data points: For example, let's assume (and these numbers should be replaced with actual current data): Year-over-year retail sales decreased by 2% in August and a further 1.5% in September. This represents a significant drop, especially considering the previous year's figures.

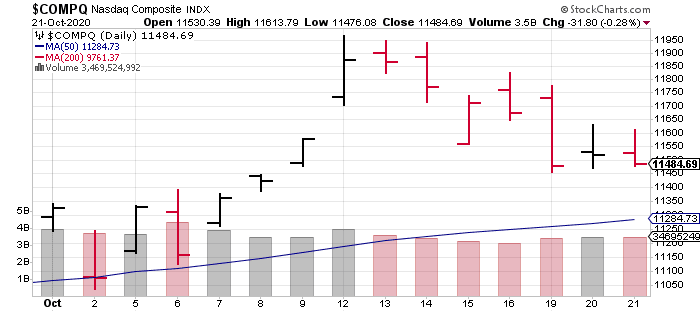

- Sectors most affected: The decline is particularly sharp in the durable goods sector (e.g., furniture, appliances), indicating consumers are delaying major purchases. Non-durable goods sales are also weakening, suggesting a broader contraction in spending. (Insert chart/graph visualizing retail sales decline here)

- Contributing factors: High inflation continues to erode purchasing power. The cumulative effect of multiple interest rate hikes has increased borrowing costs for consumers, making it more expensive to finance purchases. Uncertainty about future economic prospects further contributes to a decline in consumer confidence.

Keywords: Canadian retail sales, economic slowdown, consumer spending, inflation impact, interest rate hikes, durable goods, non-durable goods

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's primary mandate is to maintain price stability and promote sustainable economic growth. Its current monetary policy is focused on taming inflation by managing interest rates. Recent rate decisions have reflected this strategy; however, the effectiveness of these measures is now being questioned in light of the weakening retail sales data.

- Recent announcements: The Bank of Canada's last rate announcement (insert date and details) indicated a (insert action - hold, increase, decrease) in the key interest rate, citing (insert reasons cited by the Bank of Canada).

- Current interest rate target: The current target for the overnight rate is (insert current rate).

- Inflation projections: The Bank of Canada's inflation projections for (insert timeframe) are (insert projection), indicating (insert interpretation of the projections – e.g., continued easing, slower decline, etc.).

Keywords: Bank of Canada policy, monetary policy, interest rate target, inflation targeting, economic forecasts, overnight rate

The Interplay Between Retail Sales and Interest Rate Decisions

The weakening retail sales figures directly impact the Bank of Canada's deliberations on future interest rate adjustments. Weak consumer spending is a clear indicator of slowing economic growth, potentially jeopardizing the Bank's inflation targets. The central question is whether further interest rate increases would exacerbate the economic slowdown or if a rate cut is necessary to stimulate the economy.

- Impact of weak consumer spending: Reduced consumer spending translates to lower aggregate demand, potentially slowing economic growth further and impacting overall economic output.

- Recession risk: Maintaining high interest rates in the face of weak retail sales could increase the risk of a recession, causing further job losses and economic hardship.

- Alternative policy options: The Bank of Canada might consider alternative monetary policy tools such as quantitative easing (QE) if interest rate adjustments prove insufficient to stimulate economic activity.

Keywords: interest rate impact, economic growth, recession risk, monetary policy tools, quantitative easing, aggregate demand

Expert Opinions and Market Predictions

Economists and financial analysts are divided on the likelihood of imminent Bank of Canada rate cuts. Some believe the current weakness in retail sales necessitates a shift towards stimulative monetary policy, while others caution against premature rate cuts, emphasizing the need to prioritize inflation control.

- Economist opinions: (Insert quotes from reputable economists, citing their sources). For example, "According to [Economist's Name], the decline in retail sales is a significant concern and might necessitate a change in monetary policy."

- Market forecasts: Market predictions regarding future interest rate movements vary widely, reflecting the uncertainty surrounding the economic outlook. (Insert summary of market forecasts, citing sources).

- Market sentiment surveys: (Cite relevant surveys and reports about investor sentiment and expectations for Bank of Canada actions).

Keywords: economic forecast, market analysis, expert opinion, interest rate prediction, investor sentiment

Conclusion: Will Weak Retail Sales Trigger Bank of Canada Rate Cuts? A Call to Action

The current economic climate in Canada presents a complex challenge for the Bank of Canada. The significant decline in retail sales, coupled with persistent—though easing—inflation, forces a difficult balancing act between stimulating economic growth and controlling inflation. While the Bank of Canada's current stance focuses on inflation control, the weakening consumer spending evidenced by the retail sales figures presents a considerable risk of a broader economic slowdown. Whether this leads to rate cuts remains to be seen, but the interplay between these factors warrants close attention.

To stay informed about the Bank of Canada's decisions and the evolving economic situation, regularly consult the Bank of Canada website and follow reputable financial news sources. Understanding the potential impact of Bank of Canada rate cuts and the broader implications for the Canadian economy is crucial for both businesses and consumers. Monitoring the Canadian retail sales data and the Bank of Canada's responses will be critical in navigating the challenges ahead. Stay updated on Bank of Canada rate cuts and Canadian retail sales outlook for informed decision-making.

Featured Posts

-

Tackling Americas Truck Bloat Innovative Approaches And Potential Solutions

Apr 28, 2025

Tackling Americas Truck Bloat Innovative Approaches And Potential Solutions

Apr 28, 2025 -

U S Dollar Performance A Troubling First 100 Days Under Current Presidency

Apr 28, 2025

U S Dollar Performance A Troubling First 100 Days Under Current Presidency

Apr 28, 2025 -

Iran Nuclear Deal Latest Talks End Without Breakthrough

Apr 28, 2025

Iran Nuclear Deal Latest Talks End Without Breakthrough

Apr 28, 2025 -

Mets Biggest Rival A Pitchers Unbeatable Season

Apr 28, 2025

Mets Biggest Rival A Pitchers Unbeatable Season

Apr 28, 2025 -

Financial Records Sought Creditors Demand Against Denise Richards Husband

Apr 28, 2025

Financial Records Sought Creditors Demand Against Denise Richards Husband

Apr 28, 2025

Latest Posts

-

Valentina Shevchenko Considers Zhang Weili Superfight Analysis And Predictions

May 12, 2025

Valentina Shevchenko Considers Zhang Weili Superfight Analysis And Predictions

May 12, 2025 -

Will Valentina Shevchenko Face Zhang Weili A Look At The Potential Fight

May 12, 2025

Will Valentina Shevchenko Face Zhang Weili A Look At The Potential Fight

May 12, 2025 -

Shevchenko Open To Zhang Weili Superfight A Potential Mma Showdown

May 12, 2025

Shevchenko Open To Zhang Weili Superfight A Potential Mma Showdown

May 12, 2025 -

Ufc 315 In Depth Analysis And Predictions For Shevchenko Vs Fiorot

May 12, 2025

Ufc 315 In Depth Analysis And Predictions For Shevchenko Vs Fiorot

May 12, 2025 -

Predicting Ufc 315 Shevchenkos Championship Defense Against Fiorot

May 12, 2025

Predicting Ufc 315 Shevchenkos Championship Defense Against Fiorot

May 12, 2025