Is The Real Safe Bet A Myth? Understanding Investment Risk

Table of Contents

Defining Investment Risk and its Types

Investment risk is simply the potential for losing some or all of your invested capital. It's the possibility that the actual return on an investment will differ from the expected return. Understanding the different types of risk is crucial for effective risk management. These risks can be broadly categorized as follows:

Market Risk (Systematic Risk)

Market risk, also known as systematic risk, refers to the fluctuations in the overall market that impact all investments. These fluctuations are driven by various macroeconomic factors:

- Economic downturns: Recessions and economic slowdowns can significantly impact market performance, leading to widespread losses. The 2008 financial crisis serves as a prime example of the devastating effects of market risk.

- Interest rate changes: Changes in interest rates set by central banks affect borrowing costs and investment returns. Rising interest rates can negatively impact bond prices, for instance.

- Geopolitical events: Global events such as wars, political instability, and natural disasters can trigger significant market volatility and investment risk.

Company-Specific Risk (Unsystematic Risk)

Company-specific risk, or unsystematic risk, refers to the risks associated with individual companies or specific investments. These risks are often unique to a particular company and can include:

- Poor management: Ineffective leadership can lead to poor strategic decisions and financial difficulties, impacting shareholder value.

- Product failures: A poorly received product or service can significantly harm a company's financial performance. Think of a tech company releasing a buggy software update, for example.

- Increased competition: Intense competition can erode market share and profitability, leading to lower investment returns.

Interest Rate Risk

Interest rate risk specifically affects fixed-income investments like bonds. When interest rates rise, the value of existing bonds with lower interest rates falls, and vice versa. This risk is significant for long-term bond holders.

Inflation Risk

Inflation risk is the risk that the purchasing power of your investment will erode over time due to rising prices. If inflation outpaces the return on your investment, your real return will be negative.

Liquidity Risk

Liquidity risk is the risk that you won't be able to easily convert an investment into cash without significant losses. Some investments, like real estate, can be illiquid, making it difficult to sell quickly.

Assessing Your Risk Tolerance

Understanding your personal risk tolerance is paramount before making any investment decisions. Your risk tolerance is determined by several factors:

- Age: Younger investors generally have a longer time horizon and can tolerate more risk.

- Financial goals: Short-term goals like a down payment on a house require a more conservative investment approach than long-term goals like retirement.

- Investment time horizon: The longer your investment time horizon, the more risk you can generally afford to take.

- Risk aversion level: Some individuals are naturally more risk-averse than others, preferring safer investments with lower potential returns.

Numerous online questionnaires and tools can help you determine your risk profile. Based on your assessment, you can then choose investment strategies that align with your comfort level:

- Low-risk: High-yield savings accounts, government bonds.

- Medium-risk: Balanced mutual funds, diversified stock portfolios.

- High-risk: Individual stocks, options trading.

Diversification: Spreading Your Risk

Diversification is a cornerstone of effective risk management. By spreading your investments across different asset classes – stocks, bonds, real estate, commodities – you reduce your exposure to any single investment's risk. Proper asset allocation, based on your risk tolerance and financial goals, is key. Diversification also includes:

- Geographic diversification: Investing in companies and assets from different countries to reduce exposure to country-specific risks.

- Sector diversification: Investing in companies across different industry sectors to reduce the impact of sector-specific downturns.

A diversified portfolio can help cushion the blow of losses in one area by potentially offsetting gains in another.

Risk Management Strategies

Effective risk management is an ongoing process. Key strategies include:

- Setting realistic expectations: Avoid chasing high returns with unrealistic risk.

- Conducting thorough research: Before investing, understand the risks and potential rewards of each investment.

- Seeking professional advice: A financial advisor can help you develop a personalized investment strategy tailored to your risk tolerance and goals.

- Regular portfolio reviews and adjustments: Monitor your portfolio regularly and adjust your investments as needed to maintain your desired risk level.

- Maintaining emergency funds: Having an emergency fund can help you avoid making risky investment decisions during unexpected financial crises.

- Developing a well-defined financial plan: A comprehensive financial plan provides a roadmap for your financial journey, helping you make informed investment decisions.

Practical tips for managing risk:

- Dollar-cost averaging: Investing a fixed amount regularly, regardless of market fluctuations.

- Stop-loss orders: Selling a security automatically when it reaches a predetermined price to limit potential losses.

The Illusion of the "Safe Bet": Debunking Common Myths

The idea of a completely "safe bet" in investing is a myth. Even seemingly safe investments carry some degree of risk:

- High-yield savings accounts: While considered relatively safe, they are still subject to inflation risk, meaning their real return might be lower than anticipated.

- Government bonds: Generally considered low-risk, government bonds can still lose value if interest rates rise or the issuing government faces financial difficulties.

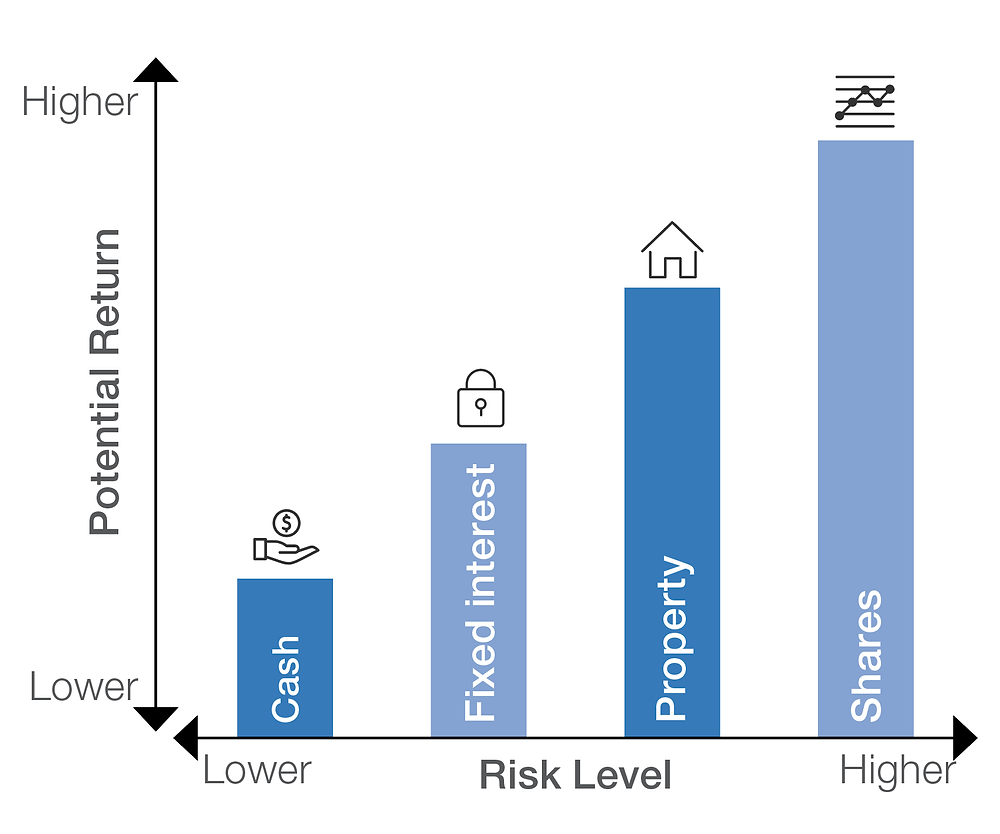

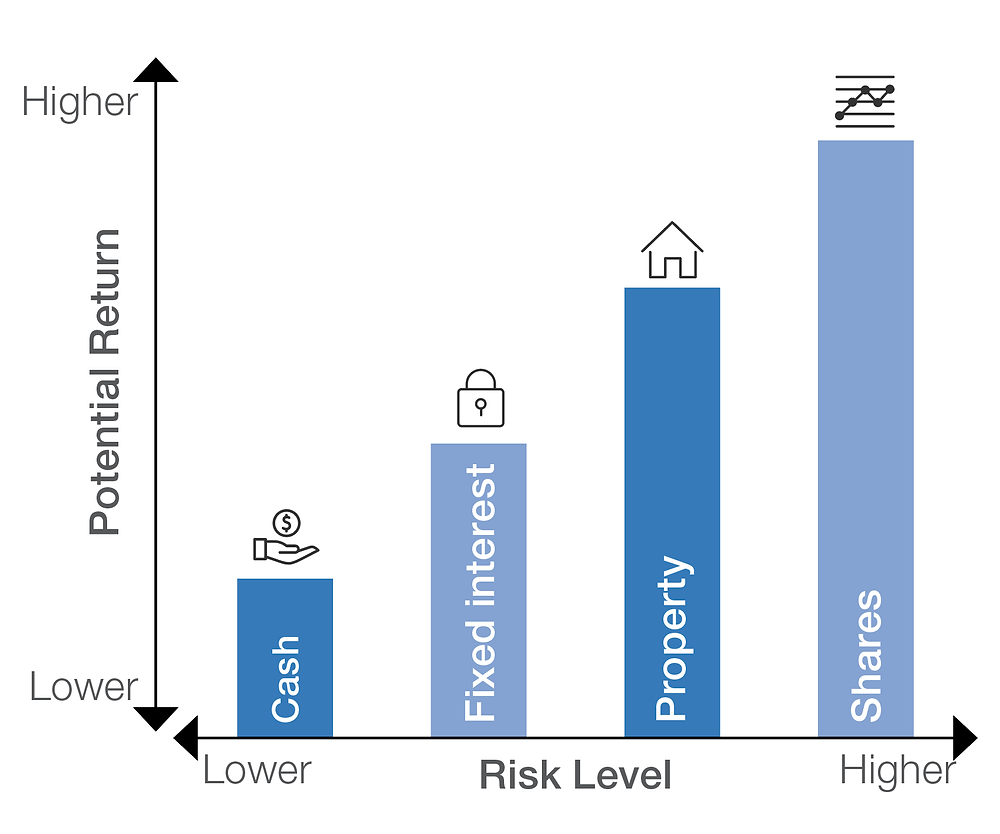

The reality is, there's always a trade-off between risk and return. Higher potential returns usually come with higher risk.

Conclusion: Navigating Investment Risk for Success

Investment risk is inherent in all investments; understanding your risk tolerance is crucial; diversification is vital; and actively managing risk is essential for long-term success. There's no truly "safe bet," but informed decisions and effective risk management can significantly improve your investment outcomes. Don't let the myth of the 'safe bet' hinder your financial success. Take control of your investment journey by understanding and managing your investment risk effectively. Assess your risk tolerance, develop a diversified investment plan, and seek professional guidance to navigate the complexities of investment risk.

Featured Posts

-

How To Be A Better Ally This International Transgender Day Of Visibility

May 10, 2025

How To Be A Better Ally This International Transgender Day Of Visibility

May 10, 2025 -

Analysis Operation Sindoor And Its Fallout On The Pakistan Stock Exchange

May 10, 2025

Analysis Operation Sindoor And Its Fallout On The Pakistan Stock Exchange

May 10, 2025 -

Joint Efforts To Develop Capital Markets Pakistan Sri Lanka And Bangladesh Collaboration

May 10, 2025

Joint Efforts To Develop Capital Markets Pakistan Sri Lanka And Bangladesh Collaboration

May 10, 2025 -

Further Eu Action Needed On Us Tariffs French Ministers Statement

May 10, 2025

Further Eu Action Needed On Us Tariffs French Ministers Statement

May 10, 2025 -

Censorship Concerns X Silences Turkish Mayor After Opposition Demonstrations

May 10, 2025

Censorship Concerns X Silences Turkish Mayor After Opposition Demonstrations

May 10, 2025