Is Wedbush's Bullish Apple Stance Justified After Price Target Cut?

Table of Contents

Wedbush's Rationale for the Price Target Cut

Wedbush's decision to lower its Apple price target wasn't arbitrary. Their analysis points to several key factors contributing to a more cautious outlook. These concerns, while valid in the short-term, don't necessarily negate the long-term potential of Apple.

-

Potential slowdown in iPhone sales: While the iPhone remains a significant revenue driver for Apple, there are indications of a potential slowdown in sales growth, particularly in key markets. This could be attributed to macroeconomic factors and increased competition.

-

Concerns about macroeconomic headwinds impacting consumer spending: Global economic uncertainty, inflation, and rising interest rates are impacting consumer spending globally. This naturally affects discretionary purchases like iPhones and other Apple products.

-

Competition in the tech market: Apple faces increasingly stiff competition from other tech giants, particularly in the smartphone and wearable markets. These competitors are constantly innovating and challenging Apple's market share.

-

Impact of supply chain issues: While less pronounced than in previous years, lingering supply chain disruptions can still impact Apple's production and sales forecasts.

-

Analysis of Apple's recent financial performance: Wedbush's price target adjustment likely reflects a careful review of Apple's recent financial reports, considering revenue growth, profit margins, and overall financial health. This analysis forms the foundation of their revised price target.

Counterarguments Supporting a Bullish Apple Outlook

Despite the concerns raised by Wedbush, several compelling arguments support a continued bullish outlook on Apple stock. The company's strengths remain substantial, pointing towards robust long-term growth.

-

Apple's robust ecosystem and loyal customer base: Apple boasts a highly loyal customer base deeply invested in its ecosystem of devices and services. This creates a significant barrier to entry for competitors.

-

Growth potential in services revenue: Apple's services segment, encompassing offerings like Apple Music, iCloud, and the App Store, continues to demonstrate strong growth potential. This diversification reduces reliance on hardware sales.

-

Innovation pipeline (e.g., AR/VR, new products): Apple's history of innovation suggests a strong pipeline of future products and services. The anticipated launch of AR/VR products, for example, could be a significant growth driver.

-

Strong brand reputation and pricing power: Apple's premium brand image allows it to maintain strong pricing power, even in the face of competition. This brand loyalty translates into higher profit margins.

-

Long-term market dominance and potential for future growth: Despite near-term challenges, Apple's long-term prospects for market dominance remain strong. Its ability to innovate and adapt to evolving market conditions suggests considerable future growth potential.

Analyzing the Impact on Apple Stock Price

The market's reaction to Wedbush's price target adjustment was varied. While there was an initial dip in Apple's stock price, the overall impact has been relatively muted.

-

Immediate stock price response: The immediate response to the news was a slight decline in Apple's stock price, reflecting investor caution.

-

Investor sentiment analysis (positive, negative, neutral): Investor sentiment remains largely mixed, with some investors expressing concern while others maintain a long-term bullish perspective.

-

Comparison to historical price fluctuations: The price fluctuation is relatively minor compared to Apple's historical volatility, suggesting a degree of resilience in the face of this news.

-

Assessment of potential short-term and long-term price movements: The short-term price movements will likely depend on various factors, including broader market trends and any further news related to Apple's performance. The long-term outlook, however, remains positive for many analysts.

-

Discuss the influence of broader market trends: Overall market conditions, including broader economic factors and investor sentiment towards the technology sector, will influence Apple's stock price.

Alternative Analyst Views on Apple

It's important to note that not all analysts share Wedbush's outlook. Some maintain a more optimistic view of Apple's future, citing its strong fundamentals and growth potential. Considering diverse perspectives is crucial for a comprehensive understanding of Apple's investment potential. A range of analyst ratings reflects this diversity of opinion, highlighting the importance of independent research. Keywords: Analyst Ratings, Apple Stock Forecast, Investment Advice

Conclusion

Wedbush's price target cut for Apple stock reflects legitimate concerns about near-term headwinds, including potential iPhone sales slowdowns and macroeconomic factors. However, Apple's robust ecosystem, strong brand loyalty, and innovative pipeline suggest considerable long-term growth potential. While cautious optimism is warranted, the long-term prospects for Apple remain strong for many investors. Further research and careful consideration of individual risk tolerance are crucial before making any investment decisions regarding Apple stock. Continue to monitor Apple's performance and industry news for informed decision-making regarding your Apple stock investment strategy. Keywords: Apple Stock Investment, Apple Stock Analysis, Apple Future Prospects, Invest in Apple.

Featured Posts

-

Proverte Svoi Znaniya Roli Olega Basilashvili V Kino

May 24, 2025

Proverte Svoi Znaniya Roli Olega Basilashvili V Kino

May 24, 2025 -

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

Ae Xplore Global Campaign Launches Connecting England Airpark And Alexandria International Airport

May 24, 2025

Ae Xplore Global Campaign Launches Connecting England Airpark And Alexandria International Airport

May 24, 2025 -

Shop Owner Stabbing Previously Bailed Teenager Arrested Again

May 24, 2025

Shop Owner Stabbing Previously Bailed Teenager Arrested Again

May 24, 2025 -

The China Market Slowdown Impact On Bmw Porsche And The Automotive Industry

May 24, 2025

The China Market Slowdown Impact On Bmw Porsche And The Automotive Industry

May 24, 2025

Latest Posts

-

The Future Of Ai Hardware Open Ais Potential Partnership With Jony Ive

May 24, 2025

The Future Of Ai Hardware Open Ais Potential Partnership With Jony Ive

May 24, 2025 -

Open Ai And Jony Ive The Rumored Ai Hardware Acquisition

May 24, 2025

Open Ai And Jony Ive The Rumored Ai Hardware Acquisition

May 24, 2025 -

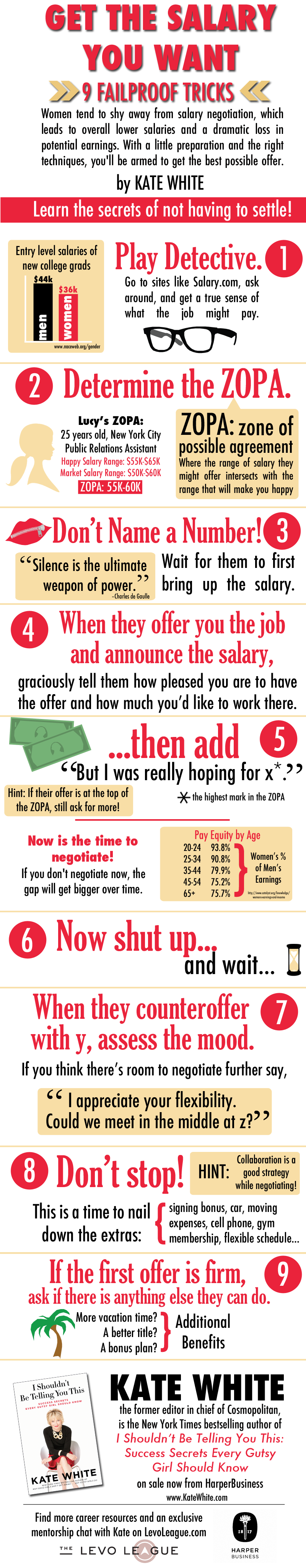

Getting More Than The Best And Final Job Offer A Practical Guide

May 24, 2025

Getting More Than The Best And Final Job Offer A Practical Guide

May 24, 2025 -

Is Open Ai Acquiring Jony Ives Ai Startup Analysis And Implications

May 24, 2025

Is Open Ai Acquiring Jony Ives Ai Startup Analysis And Implications

May 24, 2025 -

Beyond The Best And Final Offer Tips For Successful Salary Negotiation

May 24, 2025

Beyond The Best And Final Offer Tips For Successful Salary Negotiation

May 24, 2025