Jim Cramer's Bullish Call: Is Foot Locker (FL) A Genuine Winner?

Table of Contents

Foot Locker's (FL) Recent Performance and Financial Health

To assess the validity of Cramer's bullish call, we need to examine Foot Locker's recent financial health. A thorough understanding of its revenue, earnings, debt levels, and inventory management is crucial for informed investment decisions.

Revenue and Earnings Trends

Foot Locker's recent quarterly and annual reports reveal a mixed picture. While the company has shown periods of growth, challenges remain.

- Year-over-year revenue growth percentages: While recent quarters have shown some positive year-over-year growth, the percentages have fluctuated significantly, influenced by various factors including changing consumer preferences and supply chain disruptions. Analyzing these fluctuations is vital for predicting future performance.

- EPS growth/decline: Earnings per share (EPS) has been volatile, reflecting the impact of both positive and negative factors on the company's profitability. Investors should study the trend in EPS to understand the long-term profitability potential of FL stock.

- Impact of supply chain issues: Supply chain disruptions have impacted Foot Locker's ability to meet consumer demand, affecting its revenue and profitability. Analyzing how the company is mitigating these challenges is crucial.

- Profit margins analysis: Analyzing gross and operating profit margins helps understand Foot Locker's pricing power and operational efficiency. Declining margins might signal a need for strategic adjustments.

Debt and Liquidity

Assessing Foot Locker's debt levels and liquidity is crucial to determine its financial stability.

- Debt-to-equity ratio: A high debt-to-equity ratio could indicate higher financial risk. Analyzing this ratio is important to assess Foot Locker’s financial leverage.

- Current ratio: The current ratio assesses Foot Locker's short-term liquidity, indicating its ability to meet its immediate obligations. A healthy current ratio is essential for financial stability.

- Cash flow from operations: Analyzing cash flow from operations reveals Foot Locker's ability to generate cash from its core business activities. This is a key indicator of financial health.

Inventory Management

Effective inventory management is critical for a retail company like Foot Locker.

- Inventory turnover rate: A high inventory turnover rate suggests efficient inventory management and strong sales. A low rate could indicate overstocking or declining demand.

- Days sales of inventory: This metric helps measure how long it takes to sell inventory. A high number could signify potential risks related to obsolete stock.

- Impact of changing consumer preferences: Foot Locker's ability to adapt to changing consumer preferences and adjust its inventory accordingly is critical for its future success. Understanding how well they manage this will be vital for investors.

Analyzing Market Factors Affecting Foot Locker (FL)

Foot Locker operates in a dynamic and competitive market influenced by various factors.

Competition in the Athletic Footwear and Apparel Industry

Foot Locker faces fierce competition from major players like Nike, Adidas, and other athletic brands.

- Competitive landscape analysis: Understanding Foot Locker's competitive positioning against industry giants is essential. Analyzing market share and competitive strategies is crucial.

- Market share trends: Tracking Foot Locker's market share trends reveals its ability to compete effectively. Declining market share could be a warning sign.

- Competitive advantages and disadvantages of Foot Locker: Identifying Foot Locker's unique selling propositions and weaknesses compared to its competitors is essential for a comprehensive analysis.

Macroeconomic Factors

Macroeconomic conditions significantly influence consumer spending and, consequently, Foot Locker's performance.

- Impact of inflation on consumer spending: Inflation can reduce consumer purchasing power, impacting demand for athletic footwear and apparel.

- Sensitivity to interest rate changes: Interest rate hikes can affect consumer borrowing and spending, impacting Foot Locker's sales.

- Consumer confidence index relevance: Tracking consumer confidence indices provides insights into consumer sentiment and its likely impact on retail spending.

E-commerce and Digital Transformation

Foot Locker's success hinges on its ability to adapt to the growing importance of e-commerce.

- Online sales growth: Analyzing the growth of Foot Locker's online sales is crucial to assess its digital transformation success.

- Website traffic and engagement: Website traffic and user engagement metrics reveal the effectiveness of Foot Locker's digital marketing strategies.

- Effectiveness of digital marketing campaigns: Assessing the ROI of Foot Locker's digital marketing campaigns is essential to understand its ability to attract and retain customers online.

Alternative Investment Opportunities in the Retail Sector

While Foot Locker presents a certain investment opportunity, it's crucial to consider alternatives within the retail sector. Companies with stronger growth potential or less susceptibility to macroeconomic headwinds could offer more attractive returns. A comparative analysis of various retail stocks can help you make a more informed investment decision. Diversification is key to mitigating risk.

Conclusion: Is Foot Locker (FL) a Smart Investment Based on Jim Cramer's Call and Our Analysis?

Jim Cramer's bullish prediction on Foot Locker (FL) should be viewed within the context of a thorough analysis of the company's financial health, market position, and the broader economic environment. While Foot Locker has demonstrated periods of growth, challenges related to competition, macroeconomic conditions, and inventory management remain. Our analysis suggests a need for caution. While the company might show potential, it's not necessarily a guaranteed winner.

Conduct thorough due diligence before investing in Foot Locker (FL) stock. Consider consulting a financial advisor for personalized investment advice. Learn more about Foot Locker's stock performance and future outlook before making any investment decisions. Remember, this analysis does not constitute financial advice.

Featured Posts

-

Microsofts 6 000 Layoffs What We Know So Far

May 16, 2025

Microsofts 6 000 Layoffs What We Know So Far

May 16, 2025 -

Dpr Mendukung Presiden Prabowo Soal Proyek Giant Sea Wall

May 16, 2025

Dpr Mendukung Presiden Prabowo Soal Proyek Giant Sea Wall

May 16, 2025 -

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 16, 2025

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 16, 2025 -

Belgica 0 1 Portugal Cronica Completa Del Partido Y Goles

May 16, 2025

Belgica 0 1 Portugal Cronica Completa Del Partido Y Goles

May 16, 2025 -

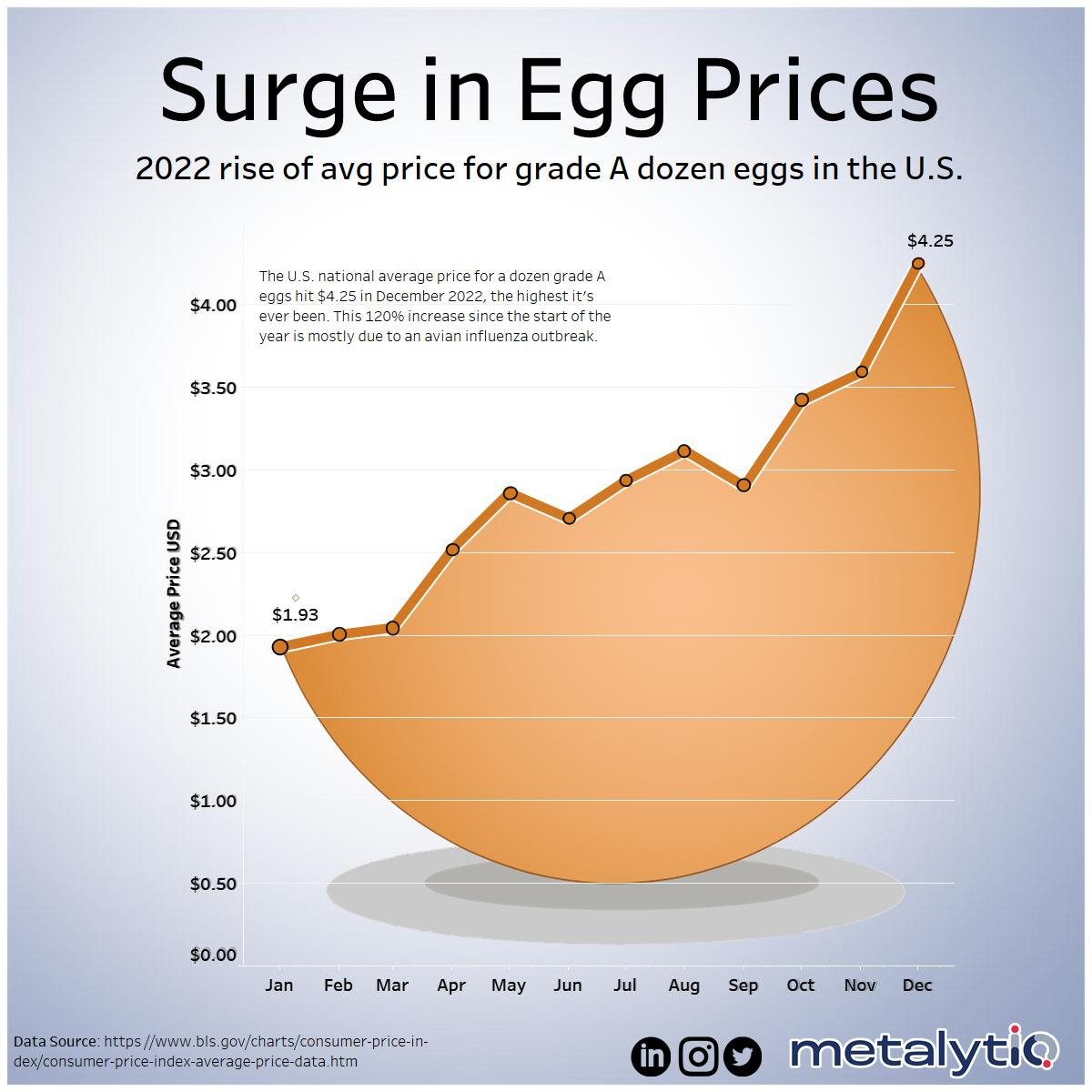

From Fiction To Fact The Rise Of Egg Prices Under Scrutiny

May 16, 2025

From Fiction To Fact The Rise Of Egg Prices Under Scrutiny

May 16, 2025