Liberal Fiscal Policies: A Critical Analysis

Table of Contents

Key Characteristics of Liberal Fiscal Policies

Liberal fiscal policies are fundamentally rooted in the belief that the government plays a crucial role in managing the economy and ensuring social welfare. Core tenets include: increased government spending on social programs; progressive taxation, where higher earners pay a larger percentage of their income in taxes; and active government intervention to stabilize the economy, particularly during recessions. Keywords associated with these policies include progressive taxation, social safety net, government spending, social welfare programs, and income redistribution.

Countries known for implementing extensive liberal fiscal policies often feature robust social safety nets. Examples include:

- Scandinavian countries (Sweden, Denmark, Norway): These nations are renowned for their generous welfare states, providing universal healthcare, subsidized education, and extensive unemployment benefits.

- Canada: Canada boasts a universal healthcare system, robust social security programs, and significant government investment in infrastructure.

- Many Western European nations: Countries like France and Germany also exhibit many characteristics of liberal fiscal policies, albeit with variations in their specific implementations.

Specific examples of programs often associated with liberal fiscal policies include:

- Expanded unemployment benefits, providing substantial financial support to those who lose their jobs.

- Universal healthcare systems, ensuring access to quality healthcare for all citizens regardless of income.

- Subsidized education, making higher education more accessible and affordable.

- Significant investment in public infrastructure projects, such as transportation and renewable energy initiatives.

Economic Arguments For Liberal Fiscal Policies

Proponents of liberal fiscal policies often point to Keynesian economics as their justification. This economic theory posits that during recessions, increased government spending can stimulate aggregate demand, leading to job creation and economic growth. The multiplier effect suggests that each dollar spent by the government has a ripple effect throughout the economy, boosting overall output. Furthermore, arguments for income redistribution emphasize that reducing inequality leads to improved social mobility and better overall societal well-being. Keywords associated with these arguments include Keynesian economics, economic stimulus, demand-side economics, multiplier effect, income inequality, and social mobility.

Potential benefits cited by supporters include:

- Faster economic recovery during downturns.

- Reduced poverty and inequality, leading to a more equitable society.

- Improved public health and education outcomes due to increased government investment.

Economic Arguments Against Liberal Fiscal Policies

Critics of liberal fiscal policies raise concerns about the potential negative consequences of high levels of government debt and budget deficits. Excessive government spending can lead to inflation, as increased demand outpaces the economy's capacity to produce goods and services. The crowding-out effect suggests that increased government borrowing can drive up interest rates, reducing private investment and hindering long-term economic growth. Furthermore, the burden of high national debt can be passed on to future generations, creating intergenerational inequity. Keywords related to these concerns include government debt, budget deficits, inflation, crowding-out effect, government inefficiency, and fiscal sustainability.

Potential drawbacks highlighted by critics include:

- Increased national debt and the potential for sovereign debt crises.

- Higher taxes that can potentially discourage investment and economic activity.

- Potential for misallocation of resources due to government inefficiencies and lack of market signals.

Real-World Examples and Case Studies

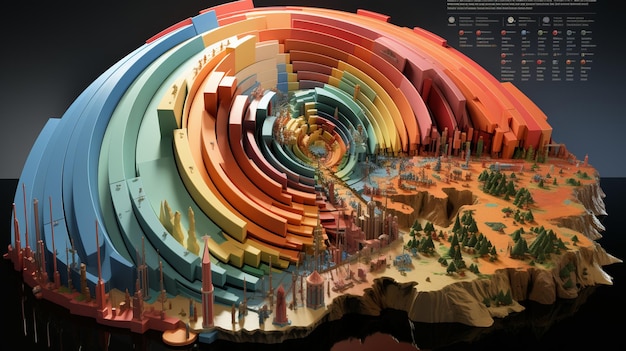

Comparing the economic performance of countries with differing fiscal policies provides valuable empirical evidence. Scandinavian countries, often cited as examples of successful liberal fiscal policies, generally exhibit high levels of social welfare, low levels of income inequality, and strong social safety nets. However, they also often have high tax burdens. Conversely, countries with more conservative fiscal policies may experience faster economic growth in the short term but potentially higher levels of income inequality. Keywords associated with this section include case studies, comparative analysis, empirical evidence, economic performance, and social indicators. A thorough analysis would require examining data on economic growth rates, unemployment rates, income inequality measures (like the Gini coefficient), and other relevant social indicators across various countries and time periods. This analysis would require significant data visualization, ideally through charts and graphs, to effectively communicate the findings.

Conclusion and Future Implications

The effectiveness of liberal fiscal policies remains a complex and hotly debated topic. While they offer the potential for economic stimulus, social welfare improvements, and reduced inequality, they also carry risks of increased government debt, inflation, and potential inefficiencies. The optimal balance between government intervention and market forces is a subject of ongoing debate, with evolving perspectives on the appropriate role of government in the economy. Keywords for this section include policy implications, economic debate, future trends, and government intervention. Further research is needed to refine our understanding of the long-term impacts of these policies, considering factors such as specific policy design, the broader economic context, and the unique characteristics of different countries.

Conclusion: Evaluating the Effectiveness of Liberal Fiscal Policies

In conclusion, liberal fiscal policies present a complex trade-off between potential social benefits and economic risks. While they can effectively address economic downturns and reduce inequality, careful management is crucial to avoid unsustainable levels of debt and inflation. The effectiveness of these policies is highly context-dependent and requires nuanced analysis considering specific national contexts and policy implementations. We encourage readers to delve deeper into the topic of liberal fiscal policies, researching specific policies in their own countries and comparing and contrasting different economic models to form their own informed opinions. Further exploration of alternative economic models and continued research into the long-term effects of various fiscal strategies are essential for informed policymaking.

Featured Posts

-

Bold And The Beautiful Recap April 3rd Liams Health Crisis And Hopes Move

Apr 24, 2025

Bold And The Beautiful Recap April 3rd Liams Health Crisis And Hopes Move

Apr 24, 2025 -

Liberal Fiscal Policies A Critical Analysis

Apr 24, 2025

Liberal Fiscal Policies A Critical Analysis

Apr 24, 2025 -

William Watson Scrutinizing The Liberal Platform Before You Vote

Apr 24, 2025

William Watson Scrutinizing The Liberal Platform Before You Vote

Apr 24, 2025 -

Trump Administration Signals Openness To Harvard Negotiation After Lawsuit

Apr 24, 2025

Trump Administration Signals Openness To Harvard Negotiation After Lawsuit

Apr 24, 2025 -

I Sygkinisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

I Sygkinisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

Latest Posts

-

Vegas Golden Nayts Vyigryvaet U Minnesoty V Overtayme Pley Off

May 10, 2025

Vegas Golden Nayts Vyigryvaet U Minnesoty V Overtayme Pley Off

May 10, 2025 -

Nicolas Cages Lawsuit Dismissal And Ongoing Claims Against Son

May 10, 2025

Nicolas Cages Lawsuit Dismissal And Ongoing Claims Against Son

May 10, 2025 -

Court Dismisses Part Of Lawsuit Against Nicolas Cage Son Weston Remains Defendant

May 10, 2025

Court Dismisses Part Of Lawsuit Against Nicolas Cage Son Weston Remains Defendant

May 10, 2025 -

Nicolas Cage Lawsuit Dismissed Son Weston Still Facing Claims

May 10, 2025

Nicolas Cage Lawsuit Dismissed Son Weston Still Facing Claims

May 10, 2025 -

Minister Announces Accelerated Timeline For 14 Edmonton School Projects

May 10, 2025

Minister Announces Accelerated Timeline For 14 Edmonton School Projects

May 10, 2025