Lowest Personal Loan Interest Rates Today: A Comparison Guide

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several crucial factors determine the interest rate you'll receive on a personal loan. Understanding these factors is the first step towards securing low interest personal loans.

Credit Score: The Cornerstone of Your Interest Rate

Your credit score is arguably the most significant factor influencing your personal loan interest rate. Lenders use your FICO score (Fair Isaac Corporation score) to assess your creditworthiness. A higher credit score indicates a lower risk to the lender, resulting in lower interest rates.

- 750+ (Excellent): Expect the lowest interest rates available.

- 700-749 (Good): You'll likely qualify for favorable rates.

- 650-699 (Fair): Interest rates will be higher, and loan approval may be less certain.

- Below 650 (Poor): Securing a loan might be difficult, and interest rates will be significantly higher, if approved at all.

Improving your credit score before applying for a loan can dramatically reduce your interest rate. Focus on:

- Paying bills on time.

- Keeping credit utilization low (ideally under 30%).

- Maintaining a mix of credit accounts.

- Dispute any errors on your credit report.

Loan Amount and Term: Balancing Affordability and Interest

The amount you borrow and the length of your repayment term (loan term) also impact your interest rate. Generally, larger loan amounts come with slightly higher rates due to increased risk for the lender. Similarly, longer loan terms typically lead to higher overall interest paid, though monthly payments will be lower. Shorter terms mean higher monthly payments but significantly less interest paid over the life of the loan.

- Example: A $10,000 loan at 7% interest over 3 years will have higher monthly payments but less total interest paid than the same loan spread over 5 years.

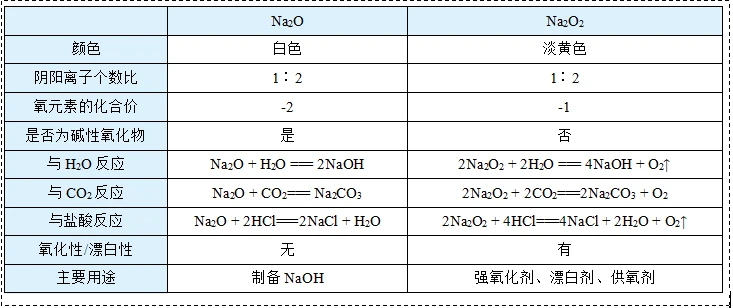

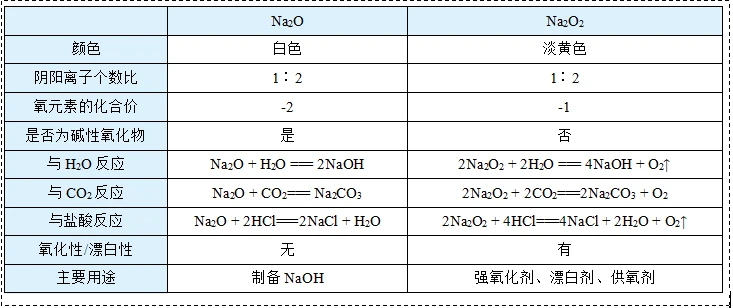

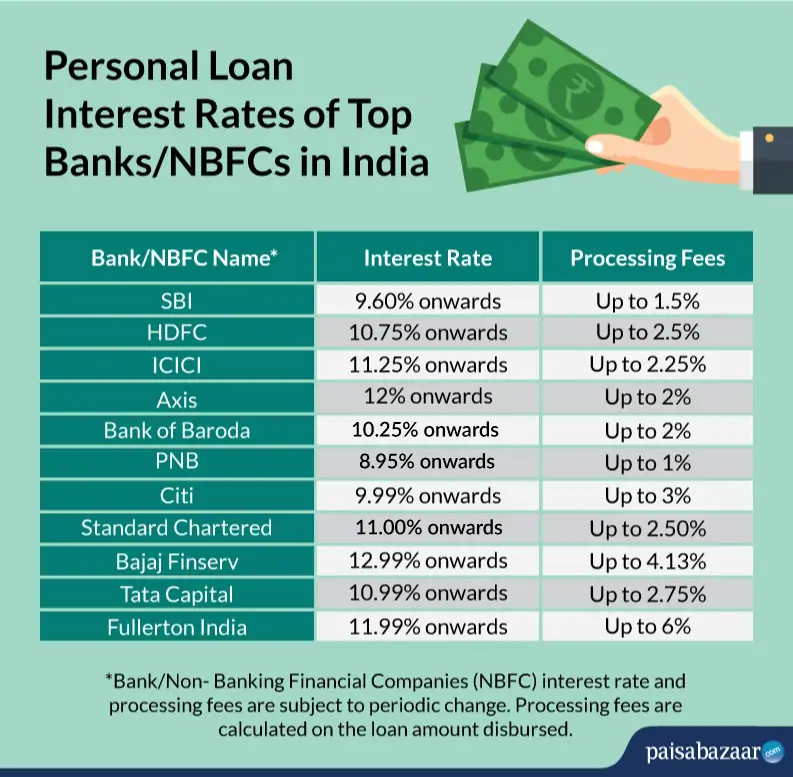

Lender Type: Banks, Credit Unions, and Online Lenders

Different types of lenders offer varying interest rates and loan terms.

- Banks: Often offer competitive rates but may have stricter requirements.

- Credit Unions: May provide lower rates for members, focusing on community benefits.

- Online Lenders: Can offer convenient application processes but rates can vary considerably. Carefully research their reputation and read reviews.

Income and Debt-to-Income Ratio (DTI): Financial Stability Matters

Your income and debt-to-income ratio (DTI) – the percentage of your gross monthly income dedicated to debt payments – are crucial factors in loan approval and interest rates. A lower DTI signifies greater financial stability, increasing your chances of securing a lower interest rate.

- Strategies for improving your DTI: Pay down existing debts, increase your income, or both.

How to Find the Lowest Personal Loan Interest Rates

Finding the best personal loan rates requires a strategic approach.

Use Online Comparison Tools

Reputable online comparison tools allow you to compare offers from multiple lenders simultaneously, saving you time and effort. However, always double-check information on the lender's website before committing.

- Tips: Use multiple comparison tools, focus on APR (Annual Percentage Rate) rather than just the interest rate, and carefully read reviews.

Check Pre-Approval Offers

Pre-qualification and pre-approval offers allow you to see potential interest rates without a hard credit inquiry (pre-qualification) or with a soft one (pre-approval), minimizing the impact on your credit score.

- Difference: Pre-qualification is a preliminary check, while pre-approval is a more formal assessment.

Negotiate with Lenders

Don't hesitate to negotiate interest rates with lenders, especially if you have a strong credit score and multiple offers.

- Tips: Highlight your financial strength, mention competing offers, and be polite but firm.

Read the Fine Print

Before signing any loan agreement, meticulously review the terms and conditions.

- Key terms: APR, origination fees, prepayment penalties, late payment fees.

Types of Personal Loans and Their Interest Rates

Different types of personal loans carry different interest rates.

Secured vs. Unsecured Loans

Secured loans (using collateral like a car or savings account) typically offer lower interest rates due to reduced risk for the lender. Unsecured loans (no collateral) have higher rates.

Debt Consolidation Loans

These loans help simplify debt repayment by combining multiple debts into a single loan, potentially resulting in lower overall interest payments.

Home Equity Loans

These loans use your home's equity as collateral. While offering potentially lower rates, they carry the risk of foreclosure if payments are missed.

Conclusion: Securing the Best Personal Loan Interest Rate Today

Finding the lowest personal loan interest rates today involves understanding your credit score, loan amount, term, lender type, and income. By leveraging online comparison tools, securing pre-approval offers, negotiating effectively, and meticulously reviewing loan terms, you can significantly improve your chances of securing the best possible rate for your needs. Don't overpay on interest! Start your search for the lowest personal loan interest rates today by using our recommended comparison tools and strategies outlined above.

Featured Posts

-

Chase Field In 2025 A Complete Guide To Arizona Diamondbacks Promotions And Giveaways

May 28, 2025

Chase Field In 2025 A Complete Guide To Arizona Diamondbacks Promotions And Giveaways

May 28, 2025 -

Are Bmw And Porsches China Problems A Sign Of Broader Market Shifts

May 28, 2025

Are Bmw And Porsches China Problems A Sign Of Broader Market Shifts

May 28, 2025 -

Kanye Wests New Companion Is It A Bianca Censori Look Alike

May 28, 2025

Kanye Wests New Companion Is It A Bianca Censori Look Alike

May 28, 2025 -

Trumps Tariff Decision Eu Goods Deadline Extended To July 9

May 28, 2025

Trumps Tariff Decision Eu Goods Deadline Extended To July 9

May 28, 2025 -

Personal Loan Interest Rates Today Find Your Lowest Rate

May 28, 2025

Personal Loan Interest Rates Today Find Your Lowest Rate

May 28, 2025