Luxury Real Estate: The Ultra-Wealthy's Strategy For Economic Uncertainty

Table of Contents

Luxury Real Estate as a Hedge Against Inflation

Inflation erodes the purchasing power of currency, making tangible assets like luxury real estate increasingly attractive. High-end properties, often located in prime locations with limited supply, tend to retain or appreciate in value during inflationary periods. This inherent scarcity acts as a natural buffer against currency devaluation.

- Tangible asset protection against currency devaluation: Unlike stocks or bonds, which can fluctuate significantly with inflation, luxury properties represent a physical asset whose value is often less susceptible to inflationary pressures.

- Potential for rental income to offset inflation costs: Luxury properties can generate substantial rental income, providing a passive income stream that can help offset the rising costs associated with inflation.

- Historical data showcasing luxury real estate's performance during inflation: Throughout history, luxury real estate markets in stable economies have demonstrated resilience during inflationary periods, often outperforming other asset classes.

Diversification Strategies: Beyond Stocks and Bonds

Ultra-high-net-worth individuals understand the importance of diversifying their portfolios to mitigate risk. Luxury real estate offers a compelling diversification opportunity, demonstrating a low correlation with traditional asset classes like stocks and bonds. This means that when the stock market dips, the value of luxury real estate may remain relatively stable or even increase, creating a balanced and resilient investment portfolio.

- Reduced portfolio volatility through asset class diversification: Including luxury real estate in a portfolio helps reduce overall volatility, providing a safety net during market downturns.

- Geographic diversification through international luxury properties: Investing in luxury properties across different countries can further reduce risk and exposure to specific economic or political events. For example, owning properties in both established markets like London and emerging markets like Dubai offers a broader geographic spread.

- Examples of successful diversification strategies using luxury real estate: Many successful investors have demonstrated the efficacy of incorporating high-end real estate into their portfolios, achieving significant returns even during periods of market uncertainty.

Geopolitical Stability and Luxury Real Estate Investment

When economic uncertainty looms large, investors seek stability. Luxury real estate located in politically and economically stable regions serves as a safe haven for capital. These established markets, known for their legal and regulatory certainty, offer a reliable environment for long-term investment.

- Political risk mitigation through strategic property location: Choosing properties in politically stable countries minimizes the risk of unexpected political events impacting investment value.

- Long-term capital appreciation in stable jurisdictions: Stable jurisdictions typically see consistent long-term appreciation in property values, providing a dependable return on investment.

- Examples of safe haven markets for luxury real estate investment: Cities like New York, London, and Hong Kong are consistently favored by investors seeking geopolitical stability and strong legal frameworks.

Tax Advantages and Wealth Preservation

Strategic investment in luxury real estate can offer significant tax advantages, especially within certain jurisdictions. Moreover, luxury properties play a vital role in sophisticated estate planning and wealth preservation strategies.

- Tax benefits associated with property ownership in specific locations: Some countries offer tax breaks or incentives for property ownership, making luxury real estate investment even more attractive.

- Estate planning techniques leveraging luxury real estate: Luxury properties can be strategically used within estate plans to minimize tax liabilities and ensure a smooth transfer of wealth to future generations.

- Potential for tax-efficient wealth transfer through generational property ownership: Passing down luxury properties can offer significant tax advantages compared to other forms of wealth transfer.

The Role of Discretion and Privacy in Luxury Real Estate Purchases

Discretion and privacy are paramount in high-value real estate transactions. The ultra-wealthy often prefer off-market transactions and require secure, confidential financial arrangements. Specialized brokers and agents cater specifically to this clientele, ensuring the utmost privacy throughout the buying process.

- Off-market transactions and private sales: Many high-end properties are sold privately, avoiding public listings and maintaining confidentiality.

- Secure and confidential financial arrangements: Secure payment methods and discreet financial arrangements are crucial for high-net-worth individuals.

- Importance of discretion in maintaining privacy: Privacy is a key consideration for ultra-high-net-worth individuals, and specialized agents are well-versed in protecting their clients' anonymity.

Securing Your Future with Luxury Real Estate

In conclusion, luxury real estate offers a compelling investment strategy during times of economic uncertainty. Its ability to act as a hedge against inflation, its low correlation with traditional asset classes, and its role in wealth preservation and diversification make it an attractive option for the ultra-wealthy. Strategic location within politically stable regions further enhances its appeal as a safe haven for capital. Are you ready to explore the potential of luxury real estate as a hedge against economic uncertainty? Contact our expert team today to discuss your investment strategy.

Featured Posts

-

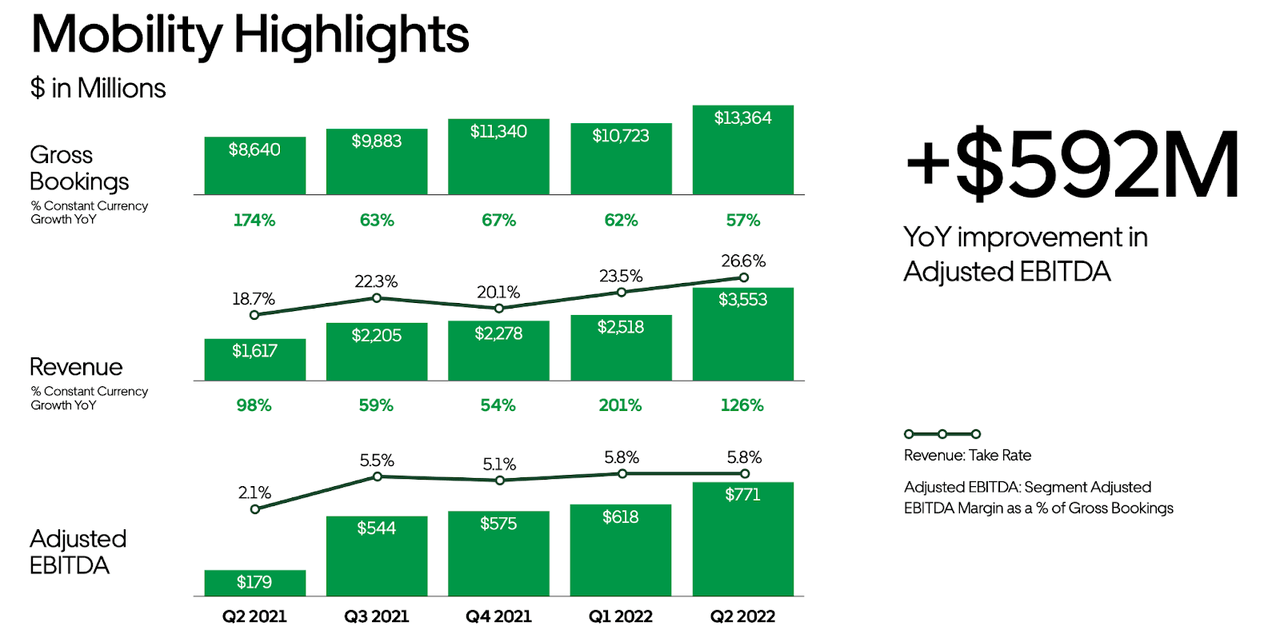

Is Uber Recession Proof Analyst Insights On Stock Performance

May 17, 2025

Is Uber Recession Proof Analyst Insights On Stock Performance

May 17, 2025 -

Student Loan Overhaul Understanding The Gops Proposed Changes

May 17, 2025

Student Loan Overhaul Understanding The Gops Proposed Changes

May 17, 2025 -

Auto Dealers Push Back Against Mandatory Electric Vehicle Sales

May 17, 2025

Auto Dealers Push Back Against Mandatory Electric Vehicle Sales

May 17, 2025 -

Novak Djokovic In Zirve Doenuesue Kortlarin Hakimi

May 17, 2025

Novak Djokovic In Zirve Doenuesue Kortlarin Hakimi

May 17, 2025 -

Reta Nba Teisejo Klaida Lemia Pistons Ir Knicks Pralaimejima

May 17, 2025

Reta Nba Teisejo Klaida Lemia Pistons Ir Knicks Pralaimejima

May 17, 2025