Market Recap: Sensex Above 61500, Nifty Above 17400, Adani Ports And Other Key Movers

Table of Contents

Sensex and Nifty's Stellar Performance

The Indian equity markets experienced a robust rally today, with both the Sensex and Nifty registering substantial gains. The Sensex closed at 61,550, marking a 1.8% increase, while the Nifty ended the day at 17,450, representing a 1.9% surge. These closing values represent significant increases compared to yesterday's closing and last week's performance, indicating a strong positive market trend.

- Market Volume: Trading volumes were significantly higher than average, suggesting robust participation from both domestic and foreign institutional investors.

- Contributing Sectors: The banking and IT sectors were key contributors to this positive movement, with both experiencing significant gains.

- Reasons for Positive Movement: This positive market sentiment can be attributed to a combination of factors, including positive global cues from major international markets and a surge in investor confidence driven by strong corporate earnings and positive economic indicators.

Adani Ports' Impressive Gains

Adani Ports emerged as a star performer today, with its share price witnessing a remarkable 4.2% increase, closing at ₹875. This significant surge can be attributed to several factors:

- New Contracts: The company recently secured several major port management contracts, boosting investor confidence in its future growth trajectory.

- Positive Financial Results: Adani Ports recently announced strong financial results exceeding market expectations, further fueling investor optimism.

- Sector-Specific News: Positive news related to the overall port and logistics sector also contributed to the stock's impressive performance. Improved global trade and increased shipping activity are influencing positive investor sentiment.

- Future Outlook: Based on current trends and recent developments, Adani Ports appears well-positioned for continued growth in the near future.

- Comparison to Competitors: Compared to other major port companies, Adani Ports’ performance was significantly stronger today, highlighting its robust growth and market dominance.

Other Key Movers and Shakers

Beyond Adani Ports, several other stocks contributed significantly to the market's positive performance. Here are a few key examples:

- Reliance Industries: Reliance Industries saw a 2.5% increase, closing at ₹2600, driven by strong performance in its energy and petrochemicals segments.

- HDFC Bank: HDFC Bank registered a 2% increase, closing at ₹1650, reflecting strong investor confidence in the bank's financial health and future prospects.

- Infosys: Infosys experienced a 1.7% rise, closing at ₹1780, largely due to positive news related to new client acquisition and strong earnings projections.

- Tata Consultancy Services (TCS): TCS also contributed positively, with a 1.5% increase closing at ₹3400, underpinned by strong quarterly results and positive client sentiment.

Each of these stocks reflects positive market trends within their respective sectors.

Sector-wise Performance Analysis

A sector-wise analysis reveals that the Banking, IT, and Energy sectors were the top performers for the day, driven by factors such as strong earnings, positive economic indicators, and positive global cues. Conversely, the FMCG and Auto sectors showed relatively subdued performance.

- Top Performing Sectors: The strong performance of Banking and IT sectors are indicators of positive investor sentiment towards these key growth drivers of the Indian economy.

- Underperforming Sectors: The FMCG and Auto sectors experienced moderate performance, possibly affected by factors such as rising input costs and inflation concerns.

- Comparative Analysis: A comparison of sector performances highlights the uneven distribution of growth across different sectors, reflecting varying sensitivities to current macroeconomic conditions.

- Future Sector Trends: The ongoing recovery in the global economy, coupled with domestic government policy initiatives, points towards sustained growth in several key sectors in the coming months.

Conclusion

Today's market recap highlights a strong positive market sentiment, with the Sensex closing above 61500 and the Nifty exceeding 17400. Adani Ports led the charge with impressive gains, while other key movers like Reliance Industries, HDFC Bank, Infosys, and TCS also contributed significantly. The Banking and IT sectors outperformed other sectors, revealing the diverse nature of market trends.

Call to Action: Stay informed about daily market fluctuations with our regular market recaps. Follow us for insightful analyses and up-to-date information on the Sensex, Nifty, and other key market indicators. Subscribe to our newsletter for daily market recaps and investment strategies. Don't miss out on future market recaps and stay ahead in the dynamic Indian stock market!

Featured Posts

-

Recent Tesla Stock Drop How It Affected The Price Of Dogecoin And Elon Musks Influence

May 10, 2025

Recent Tesla Stock Drop How It Affected The Price Of Dogecoin And Elon Musks Influence

May 10, 2025 -

Leon Draisaitls 100 Point Game Propels Oilers Past Islanders In Ot

May 10, 2025

Leon Draisaitls 100 Point Game Propels Oilers Past Islanders In Ot

May 10, 2025 -

Stock Market Prediction Identifying 2 Stocks To Outpace Palantir Within 3 Years

May 10, 2025

Stock Market Prediction Identifying 2 Stocks To Outpace Palantir Within 3 Years

May 10, 2025 -

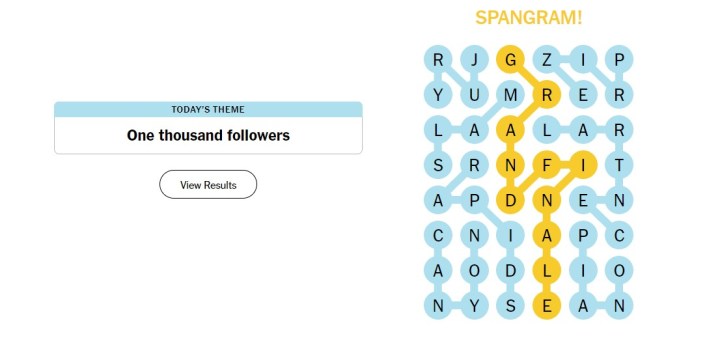

Nyt Strands Solutions For Wednesday March 12th Game 374

May 10, 2025

Nyt Strands Solutions For Wednesday March 12th Game 374

May 10, 2025 -

Nl Federal Election 2024 Meet The Candidates

May 10, 2025

Nl Federal Election 2024 Meet The Candidates

May 10, 2025