Middle Eastern LPG: China's New Energy Source Amidst US Trade Tensions

Table of Contents

Growing Demand for LPG in China

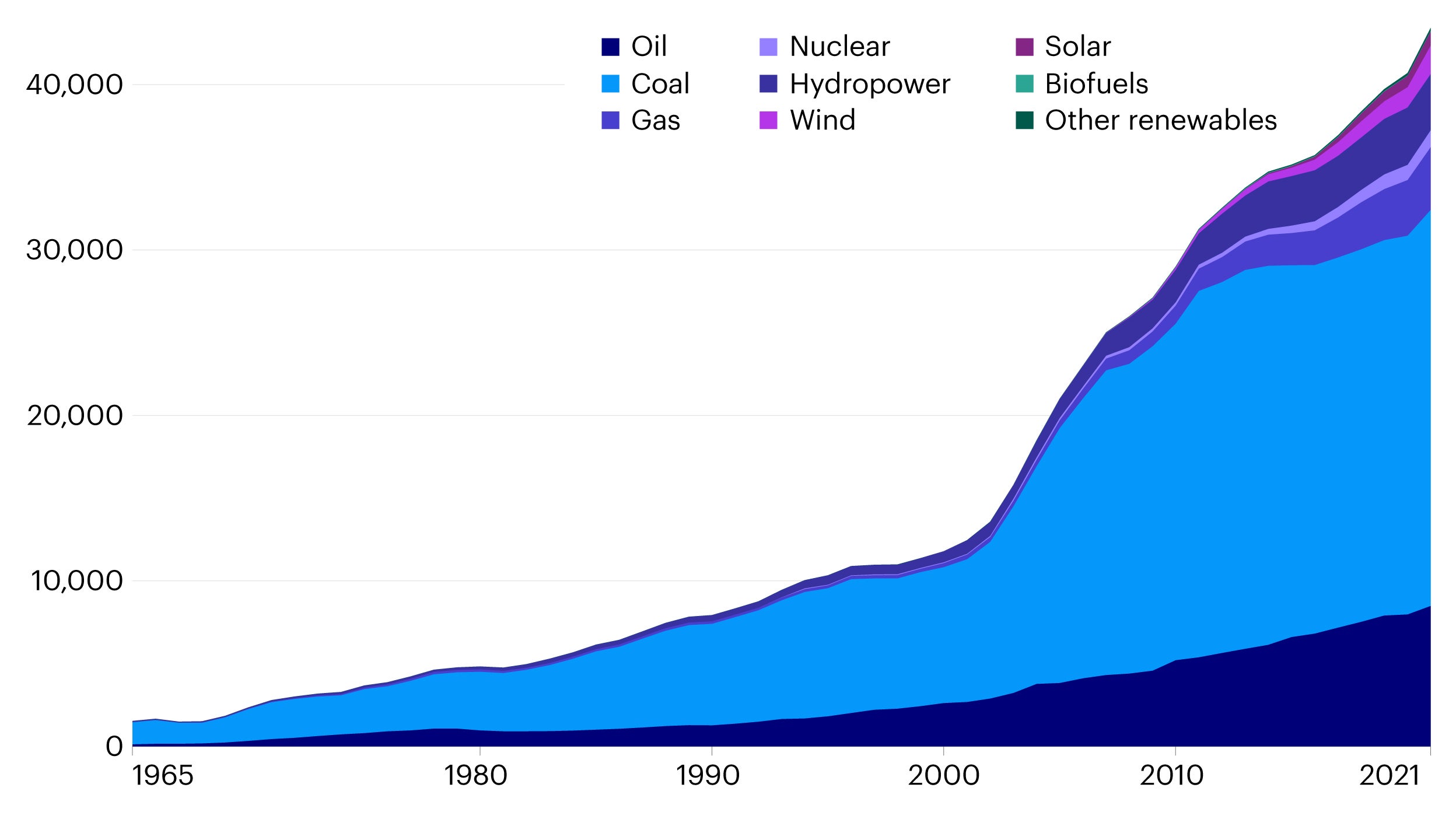

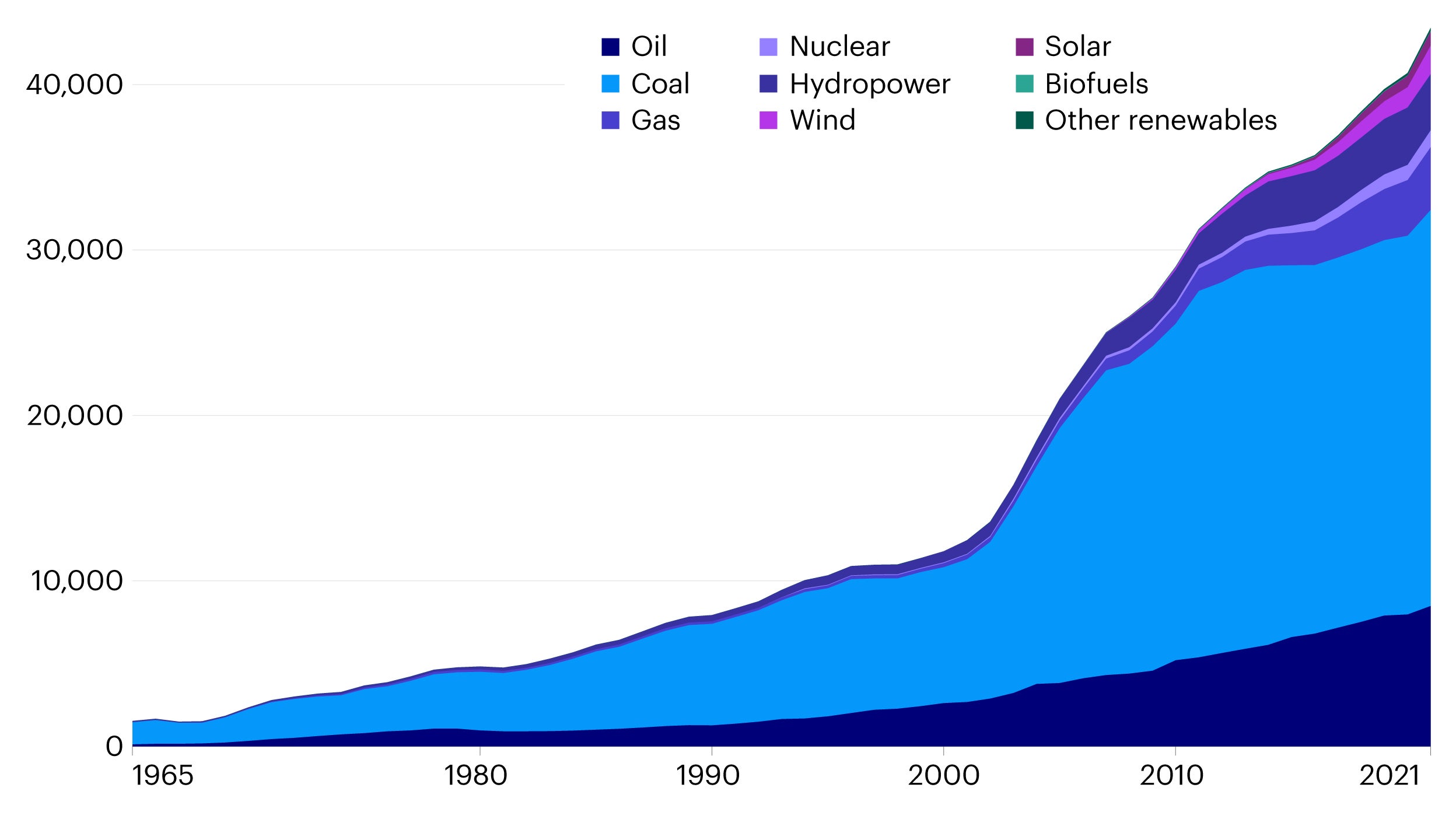

China's demand for liquefied petroleum gas (LPG) is experiencing exponential growth, fueled by several key factors. Industrialization, rapid urbanization, and a rising standard of living have all contributed to this surge. The shift away from traditional, heavily polluting fuels like coal is further accelerating LPG consumption.

- Household Consumption: LPG is increasingly replacing traditional cooking fuels in both urban and rural areas, improving indoor air quality and reducing health risks.

- Industrial Applications: Industries are adopting LPG for various processes, benefiting from its clean burning properties and ease of use.

- Transportation Sector: LPG is gaining traction as a vehicle fuel, particularly in public transport, aligning with China's commitment to cleaner transportation.

- Government Initiatives: The Chinese government's active promotion of cleaner energy sources, alongside its efforts to reduce reliance on coal, has significantly boosted LPG's appeal.

Statistics reveal a dramatic upward trend in China's LPG consumption. Annual growth rates have consistently exceeded [Insert relevant statistic, e.g., 5%] for the past [Insert number] years, underscoring the nation's increasing reliance on this versatile fuel. This transition away from coal is crucial for mitigating air pollution and achieving broader environmental goals.

Middle East as a Reliable LPG Supplier

The Middle East possesses substantial LPG reserves and boasts a robust export infrastructure, making it a natural and reliable supplier for China. Its geographic proximity offers significant logistical advantages, reducing transportation costs and transit times compared to other potential sources.

- Key Producers: Countries like Saudi Arabia, Qatar, and even Iran, despite geopolitical complexities, are major LPG producers with established export capabilities.

- Infrastructure: Existing pipeline networks and well-developed sea routes facilitate efficient LPG transportation from the Middle East to China.

- Political Stability (in some areas): While regional instability exists, several key LPG-producing nations in the Middle East offer relatively stable political and economic environments, enhancing the predictability of supply.

Compared to alternative LPG sources like the US or Russia, the Middle East offers China greater geopolitical stability and reduced vulnerability to trade disputes or sanctions. This reliable supply chain is a key factor driving China's growing reliance on Middle Eastern LPG.

The Impact of US Trade Tensions on China's Energy Strategy

US-China trade tensions have significantly impacted China's energy security calculus. Tariffs and trade restrictions on US liquefied natural gas (LNG), for example, have highlighted the vulnerabilities of relying on a single, politically charged supplier. This has spurred China to diversify its energy portfolio, actively seeking alternative sources like Middle Eastern LPG.

- Trade Restrictions: The imposition of tariffs on US LNG and other energy imports has forced China to reassess its energy import strategies.

- Diversification Strategy: China is actively pursuing a more diversified energy approach to reduce its reliance on any single nation or region.

- Geopolitical Implications: This shift towards Middle Eastern LPG has profound geopolitical implications, strengthening economic and diplomatic ties between China and key Middle Eastern nations.

Economic and Political Implications of Increased LPG Imports

The growing trade in Middle Eastern LPG offers substantial economic benefits for both China and the exporting nations. It creates new trade avenues, stimulates investment, and fosters economic growth.

- Trade Agreements: The increased LPG trade is likely to lead to strengthened bilateral trade agreements and investment partnerships.

- Strengthened Ties: This burgeoning energy relationship fosters closer diplomatic ties between China and several Middle Eastern countries.

- Challenges and Risks: However, the relationship is not without challenges. Price volatility in the global LPG market and potential geopolitical instability in the region pose ongoing risks.

Conclusion: The Future of Middle Eastern LPG and China's Energy Security

In conclusion, China's increasing demand for LPG, coupled with the strategic advantages offered by Middle Eastern suppliers and the complexities of US trade relations, positions Middle Eastern LPG as a cornerstone of China's energy security strategy. This diversification not only ensures a reliable energy supply but also shapes the geopolitical landscape, fostering closer economic and diplomatic partnerships across Eurasia. To stay informed about the evolving landscape of Middle Eastern LPG and its impact on China's energy security, continue reading our expert analyses and market reports.

Featured Posts

-

World Economic Forum New Probe Into Klaus Schwabs Leadership

Apr 24, 2025

World Economic Forum New Probe Into Klaus Schwabs Leadership

Apr 24, 2025 -

Live Stock Market Updates Dow Jumps 1000 Points On Tariff News

Apr 24, 2025

Live Stock Market Updates Dow Jumps 1000 Points On Tariff News

Apr 24, 2025 -

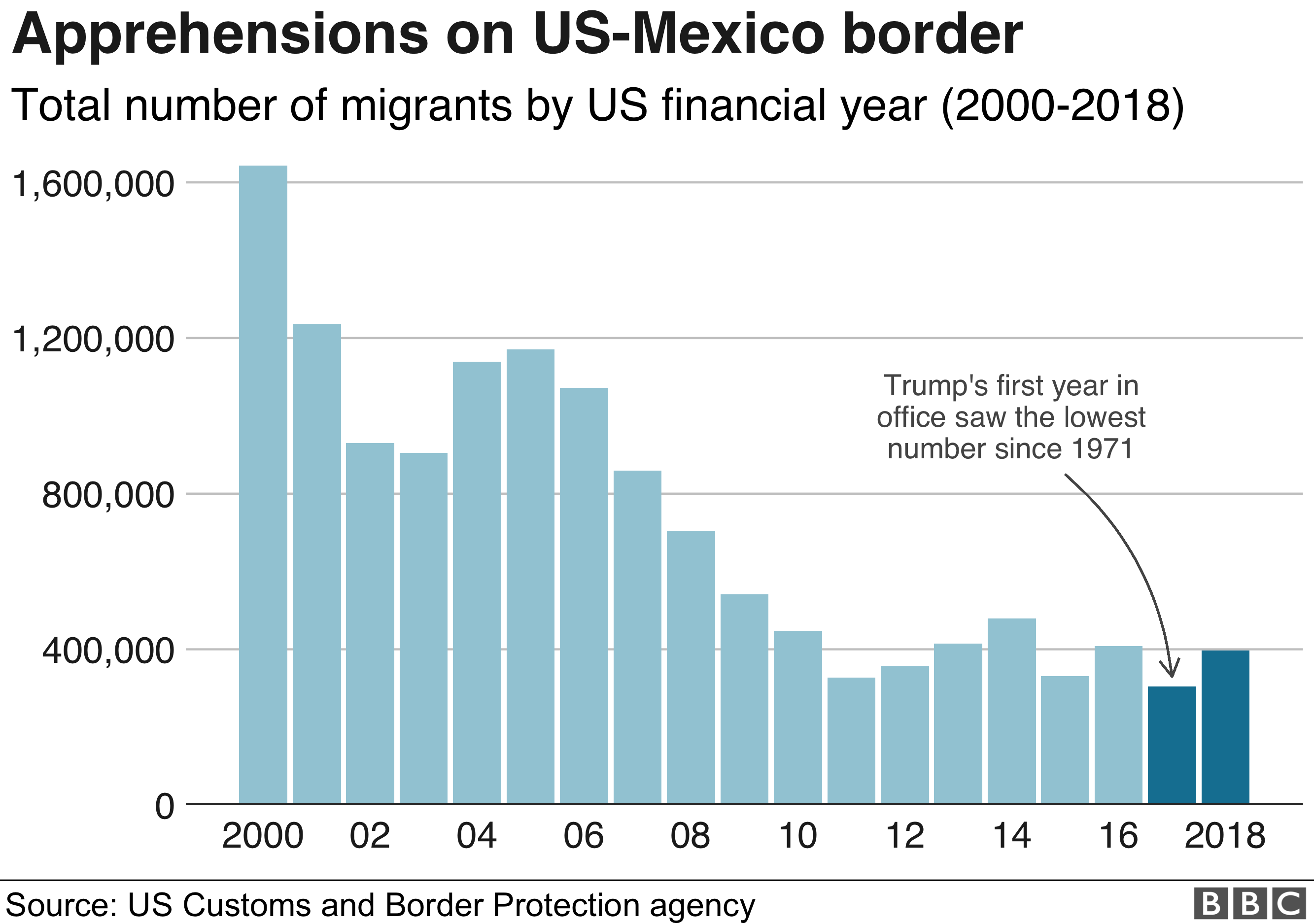

U S Canada Border Crossings Decline White House Data

Apr 24, 2025

U S Canada Border Crossings Decline White House Data

Apr 24, 2025 -

Cybercriminals Millions Office365 Executive Inbox Hacks Exposed

Apr 24, 2025

Cybercriminals Millions Office365 Executive Inbox Hacks Exposed

Apr 24, 2025 -

New Business Hot Spots Across The Country An Interactive Map

Apr 24, 2025

New Business Hot Spots Across The Country An Interactive Map

Apr 24, 2025

Latest Posts

-

5 Times Morgan Faltered High Potential Season 1

May 10, 2025

5 Times Morgan Faltered High Potential Season 1

May 10, 2025 -

Understanding The Trump Presidency A Focus On Day 109 May 8th 2025

May 10, 2025

Understanding The Trump Presidency A Focus On Day 109 May 8th 2025

May 10, 2025 -

Seven Year Absence Ends Actors Reunite In High Potential Finale

May 10, 2025

Seven Year Absence Ends Actors Reunite In High Potential Finale

May 10, 2025 -

High Potential Finale A Surprise Reunion After 7 Years

May 10, 2025

High Potential Finale A Surprise Reunion After 7 Years

May 10, 2025 -

Analyzing The Trump Administration A Case Study Of Day 109 May 8th 2025

May 10, 2025

Analyzing The Trump Administration A Case Study Of Day 109 May 8th 2025

May 10, 2025