Navigating The Aftermath: The Challenges Facing The Next Federal Reserve Chair Under Trump's Presidency

Table of Contents

Inherited Economic Conditions from the Trump Era

The next Federal Reserve Chair inherits a unique set of economic conditions shaped significantly by the Trump administration's policies. These conditions present substantial hurdles requiring careful navigation and strategic monetary policy adjustments.

High National Debt and Deficit

The Trump administration oversaw a substantial increase in the national debt and budget deficit. This was fueled by a combination of factors including significant tax cuts and increased military spending. These fiscal policies have created a challenging environment for the next Federal Reserve Chair.

- Increased Military Spending: A considerable rise in defense expenditure contributed directly to the expanding deficit, limiting fiscal flexibility for future economic downturns.

- Tax Cuts: While aiming to stimulate economic growth, the tax cuts reduced government revenue, exacerbating the deficit and increasing the national debt.

- Impact on Interest Rates: The higher national debt increases demand for borrowing, potentially pushing interest rates higher, making it more expensive for businesses and consumers to borrow money. This necessitates careful management of monetary policy to avoid inflationary pressures. The Federal Reserve Chair will need to balance economic growth with managing the risks associated with a high national debt and rising interest rates.

Trade Wars and Global Uncertainty

Trump's trade policies, including the initiation of trade wars with China and other countries, significantly impacted the US economy and created lasting global uncertainty. This uncertainty presents a major challenge for the next Federal Reserve Chair.

- Trade Disputes with China: The trade war with China led to tariffs and retaliatory measures, disrupting supply chains, increasing prices for consumers, and creating uncertainty in global markets.

- Effects on Inflation and Supply Chains: Trade disruptions caused significant supply chain bottlenecks, leading to inflationary pressures and impacting the availability of goods. The Federal Reserve Chair must address these inflationary pressures while avoiding actions that could stifle economic growth.

- Impact on International Relations: The trade wars strained relationships with key trading partners, adding complexity to the global economic landscape and increasing uncertainty for businesses. These international complexities will impact the Federal Reserve Chair's ability to navigate global economic shifts.

Regulatory Rollbacks and Financial Stability

The Trump administration pursued a policy of regulatory rollback, particularly in the financial sector. This deregulation presents significant challenges for maintaining financial stability.

- Reduced Oversight in the Financial Sector: Easing regulations in the financial sector potentially increases systemic risk and creates vulnerabilities in the banking system. The next Federal Reserve Chair will need to carefully monitor and mitigate these risks.

- Potential Risks to Banking System: Reduced oversight could lead to increased risk-taking by financial institutions, potentially destabilising the financial system and requiring swift intervention.

- Challenges for Maintaining Financial Stability: The Federal Reserve Chair will need to develop and implement appropriate supervisory and regulatory mechanisms to address these increased risks while supporting the financial system's stability.

Political Pressures and Independence of the Federal Reserve

The Federal Reserve's independence is crucial for maintaining its credibility and effectiveness. However, the next Chair will need to navigate potential political pressures to maintain this independence.

Navigating Political Interference

The Federal Reserve's independence from political influence is paramount. However, there's always a potential for political interference, particularly regarding interest rate decisions.

- Potential Pressure to Manipulate Interest Rates: Political pressure to lower interest rates before an election, for example, could undermine the Fed's ability to manage inflation and economic stability.

- Defending the Fed's Autonomy: The next chair must be prepared to vigorously defend the Fed’s autonomy from political interference and clearly communicate the rationale behind monetary policy decisions.

- Preserving Credibility: Maintaining the Fed's independence is essential for preserving its credibility and trust, which are critical for the effective functioning of monetary policy.

Managing Public Expectations

Effective communication is crucial for the Federal Reserve Chair. Managing public expectations regarding inflation and economic growth requires transparency and clear messaging.

- Transparency and Clear Communication: Open and transparent communication with the public about economic conditions and policy decisions is critical to building public trust and managing market expectations.

- Building Public Trust: The Federal Reserve Chair must build and maintain public trust through clear, consistent, and factual communication.

- Avoiding Market Volatility through Clear Messaging: Clear and predictable communication about monetary policy can help reduce market volatility and improve economic stability.

Maintaining Economic Stability and Growth

The next Federal Reserve Chair faces the classic challenge of balancing inflation control with the need for job creation and economic growth. This requires navigating complex economic landscapes and unforeseen events.

Balancing Inflation and Unemployment

The challenge of balancing inflation control with unemployment reduction is a cornerstone of macroeconomic policy. The Federal Reserve Chair must skillfully navigate this trade-off.

- Phillips Curve: Understanding the inverse relationship between inflation and unemployment (as depicted by the Phillips Curve) is essential for making informed policy decisions.

- Potential Trade-offs: The Chair must weigh the potential trade-offs between reducing inflation and minimizing unemployment, recognizing that policies designed to curb inflation might lead to higher unemployment, and vice-versa.

- Navigating Unexpected Economic Shocks: Unexpected economic shocks can disrupt this balance, requiring swift and adaptive responses from the Federal Reserve Chair.

Responding to Unexpected Economic Shocks

The ability to adapt to unforeseen economic events and crises is essential for maintaining economic stability.

- Potential Future Recessions: The possibility of future recessions requires the Chair to have contingency plans and the ability to deploy appropriate monetary policy tools effectively and rapidly.

- Managing Global Economic Crises: The interconnected nature of the global economy necessitates a robust response capability to effectively manage global economic crises.

- The Role of Monetary Policy in Stabilization: The Federal Reserve Chair must utilize monetary policy tools – such as interest rate adjustments and quantitative easing – strategically to stabilize the economy during unexpected shocks.

Conclusion

The next Federal Reserve Chair faces an exceptionally challenging task, inheriting a complex economic legacy from the Trump presidency. Success will depend on skillful navigation of inherited economic conditions, adept management of political pressures, and a commitment to maintaining the Fed's independence and credibility. Key challenges include the high national debt, trade uncertainties, potential political interference, and the constant need to balance inflation and unemployment while ensuring economic stability. Understanding these complexities is crucial for anyone following the US economy. Stay informed about the evolving economic landscape and the challenges of navigating the aftermath of the Trump presidency for a deeper understanding of the crucial role of the Federal Reserve Chair and the implications for monetary policy.

Featured Posts

-

Deconstructing The Mission Impossible Dead Reckoning Part Two Big Game Trailer

Apr 26, 2025

Deconstructing The Mission Impossible Dead Reckoning Part Two Big Game Trailer

Apr 26, 2025 -

Exclusive Access A Lucrative Business Model Leveraging Relationships With Elon Musk

Apr 26, 2025

Exclusive Access A Lucrative Business Model Leveraging Relationships With Elon Musk

Apr 26, 2025 -

Colnago Y1 Rs A Look At Pogacars World Champion Bike At The Uae Tour

Apr 26, 2025

Colnago Y1 Rs A Look At Pogacars World Champion Bike At The Uae Tour

Apr 26, 2025 -

Potential Concerns Regarding Deion And Shedeur Sanders A Browns Insider Weighs In

Apr 26, 2025

Potential Concerns Regarding Deion And Shedeur Sanders A Browns Insider Weighs In

Apr 26, 2025 -

Wildfire Betting In Los Angeles A Reflection Of Our Times

Apr 26, 2025

Wildfire Betting In Los Angeles A Reflection Of Our Times

Apr 26, 2025

Latest Posts

-

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025 -

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025 -

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025 -

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

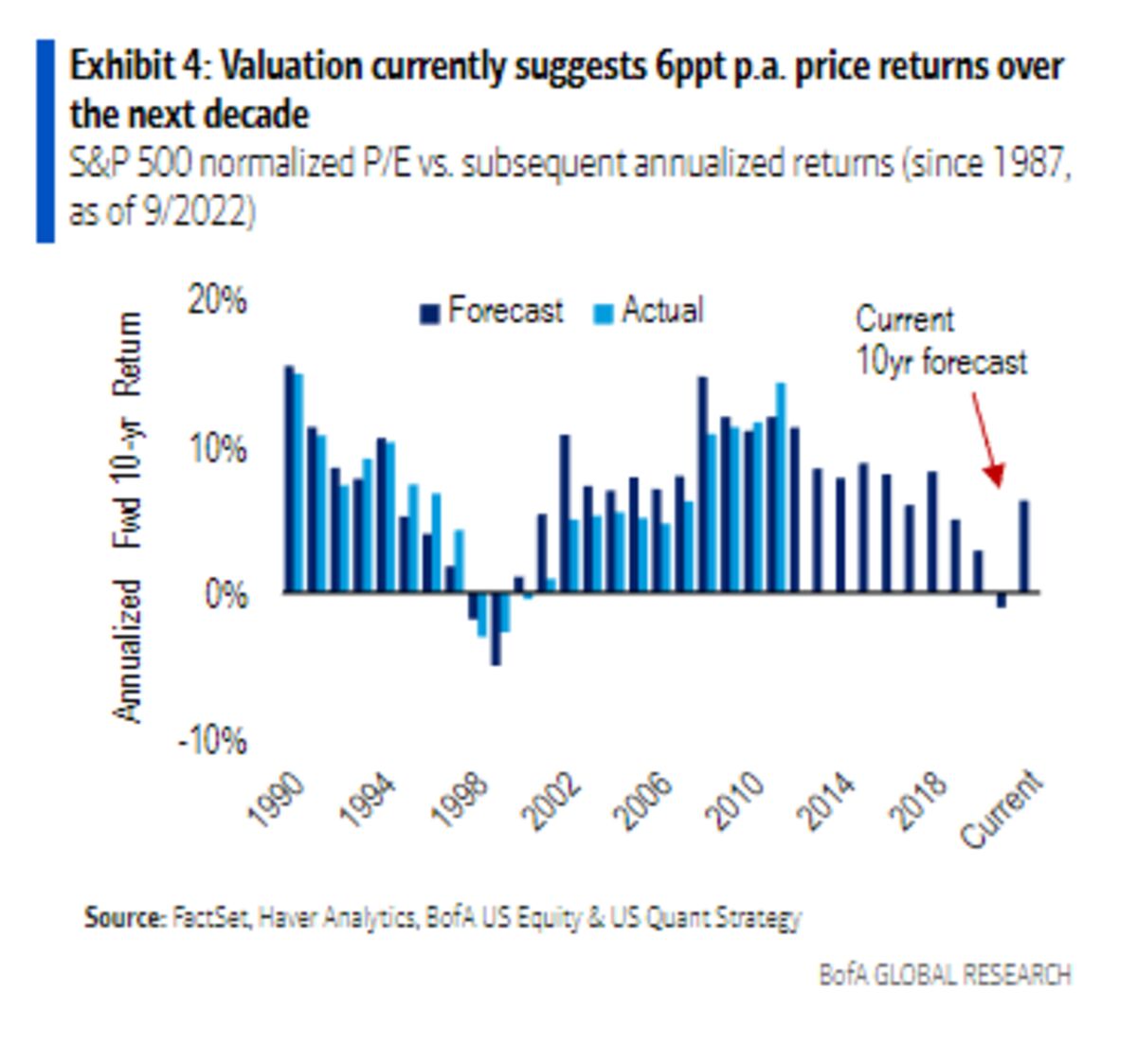

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025