Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Table of Contents

What is Net Asset Value (NAV) and how is it calculated?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. Simply put, it's the underlying value of your investment per share. The formula is:

(Assets - Liabilities) / Number of Shares = NAV

Let's break down the components:

- Assets: For an ETF like the Amundi Dow Jones Industrial Average UCITS ETF (Distributing), assets primarily consist of the underlying securities it tracks—in this case, the 30 stocks that make up the Dow Jones Industrial Average. This also includes any cash holdings and accrued interest.

- Liabilities: These are the ETF's outstanding expenses, such as management fees, administrative costs, and any payable dividends.

The daily NAV is calculated at the close of the market, reflecting the market value of all the ETF's holdings at that specific time. Market fluctuations throughout the trading day directly impact the daily NAV, leading to variations in its value. Keywords: NAV calculation, ETF assets, ETF liabilities, market fluctuations, daily NAV

How NAV Impacts the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) directly reflects the performance of the Dow Jones Industrial Average. If the Dow performs well, the NAV will generally increase, and vice-versa. This is because the ETF aims to mirror the index's performance.

-

Dividend Distributions: The ETF being a "distributing" ETF means it distributes dividends to shareholders. These dividend payments reduce the NAV of the ETF after the distribution date, as the assets held are reduced.

-

Investment Performance Tracking: Investors use the daily NAV to track their investment performance. By comparing the initial NAV at the time of purchase with the current NAV, they can determine the percentage gain or loss.

-

Buy and Sell Orders: The NAV influences buy and sell orders. Investors often buy low (when the NAV is relatively low) and sell high (when the NAV is relatively high). However, it's crucial to remember that the market price may differ from the NAV. Keywords: Amundi Dow Jones Industrial Average UCITS ETF, Dow Jones Industrial Average, dividend distribution, investment performance, buy/sell orders

Finding and Interpreting the Daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is straightforward. You can typically find it on:

- Amundi's Website: The official Amundi website will have the most up-to-date NAV information.

- Financial News Sources: Major financial news websites and platforms often provide real-time or end-of-day NAV data for various ETFs.

Interpreting the NAV data requires understanding its context. A rising NAV usually indicates positive performance, while a falling NAV suggests negative performance. However, it's crucial to consider the NAV alongside other performance indicators, such as the ETF's expense ratio and historical performance, for a comprehensive view. Keywords: Daily NAV, Amundi website, financial news, investment strategy, performance indicators

NAV vs. Market Price: Understanding the Difference

While NAV reflects the intrinsic value of the ETF's holdings, the market price is the price at which the ETF is actually trading on the exchange. These values can differ due to several factors:

- Supply and Demand: High demand can push the market price above the NAV (creating a premium), while low demand can push it below the NAV (creating a discount).

- Trading Volume: Low trading volume can lead to larger discrepancies between NAV and market price.

Understanding the difference between NAV and market price is vital for making informed investment decisions. A significant premium or discount might signal an opportunity or indicate market inefficiencies. Keywords: NAV vs. market price, premium, discount, ETF pricing

Conclusion: Mastering Net Asset Value (NAV) for Informed Investment Decisions

Understanding Net Asset Value (NAV) is essential for investors in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) and any ETF for that matter. Regularly monitoring the daily NAV, combined with an analysis of other performance indicators, enables effective investment management. By understanding how the NAV reflects the underlying asset performance and the impact of market fluctuations and dividend distributions, investors can make more informed decisions. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) and how to effectively utilize Net Asset Value (NAV) information to optimize your investment strategy. Regularly check the NAV of your Amundi Dow Jones Industrial Average UCITS ETF (Distributing) holdings for informed decision-making. Keywords: Net Asset Value (NAV), Amundi Dow Jones Industrial Average UCITS ETF, investment strategy, investment management, informed decisions

Featured Posts

-

Pameran Otomotif Dan Seni Porsche Indonesia Classic Art Week 2025

May 24, 2025

Pameran Otomotif Dan Seni Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Escape To The Country Finding Your Perfect Rural Haven

May 24, 2025

Escape To The Country Finding Your Perfect Rural Haven

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025 -

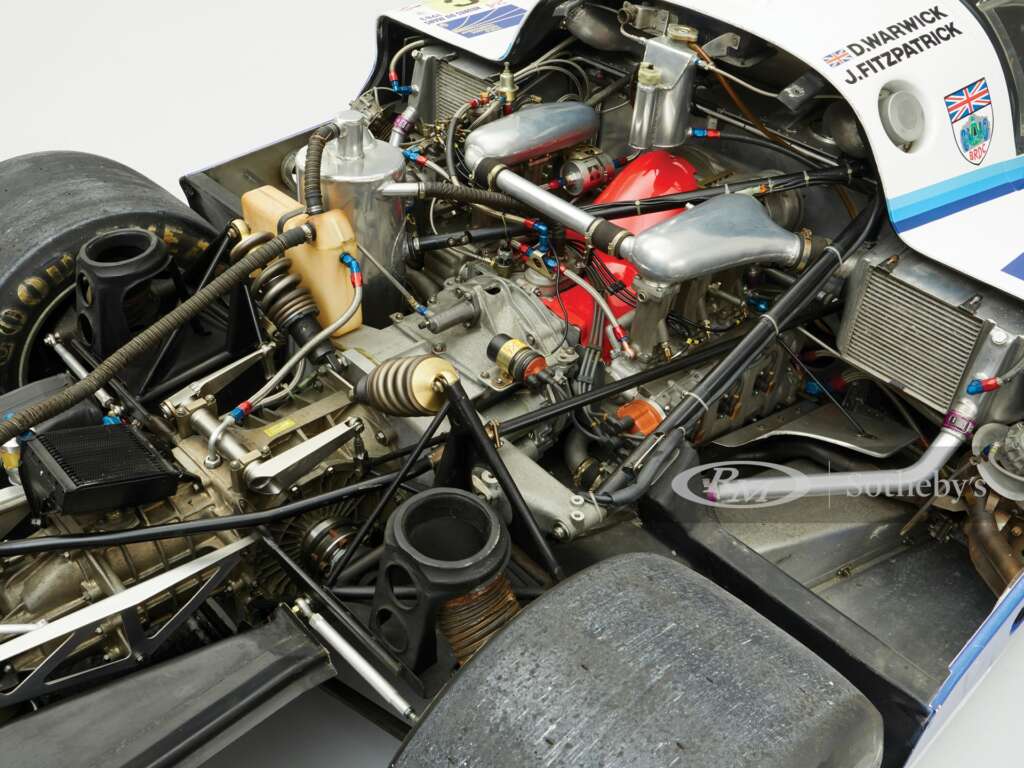

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 24, 2025

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 24, 2025 -

Aex Stijgt Terwijl Amerikaanse Beurs Daalt Analyse Van De Markten

May 24, 2025

Aex Stijgt Terwijl Amerikaanse Beurs Daalt Analyse Van De Markten

May 24, 2025

Latest Posts

-

Aex Stijgt Na Uitstel Trump Analyse Van De Winsten

May 24, 2025

Aex Stijgt Na Uitstel Trump Analyse Van De Winsten

May 24, 2025 -

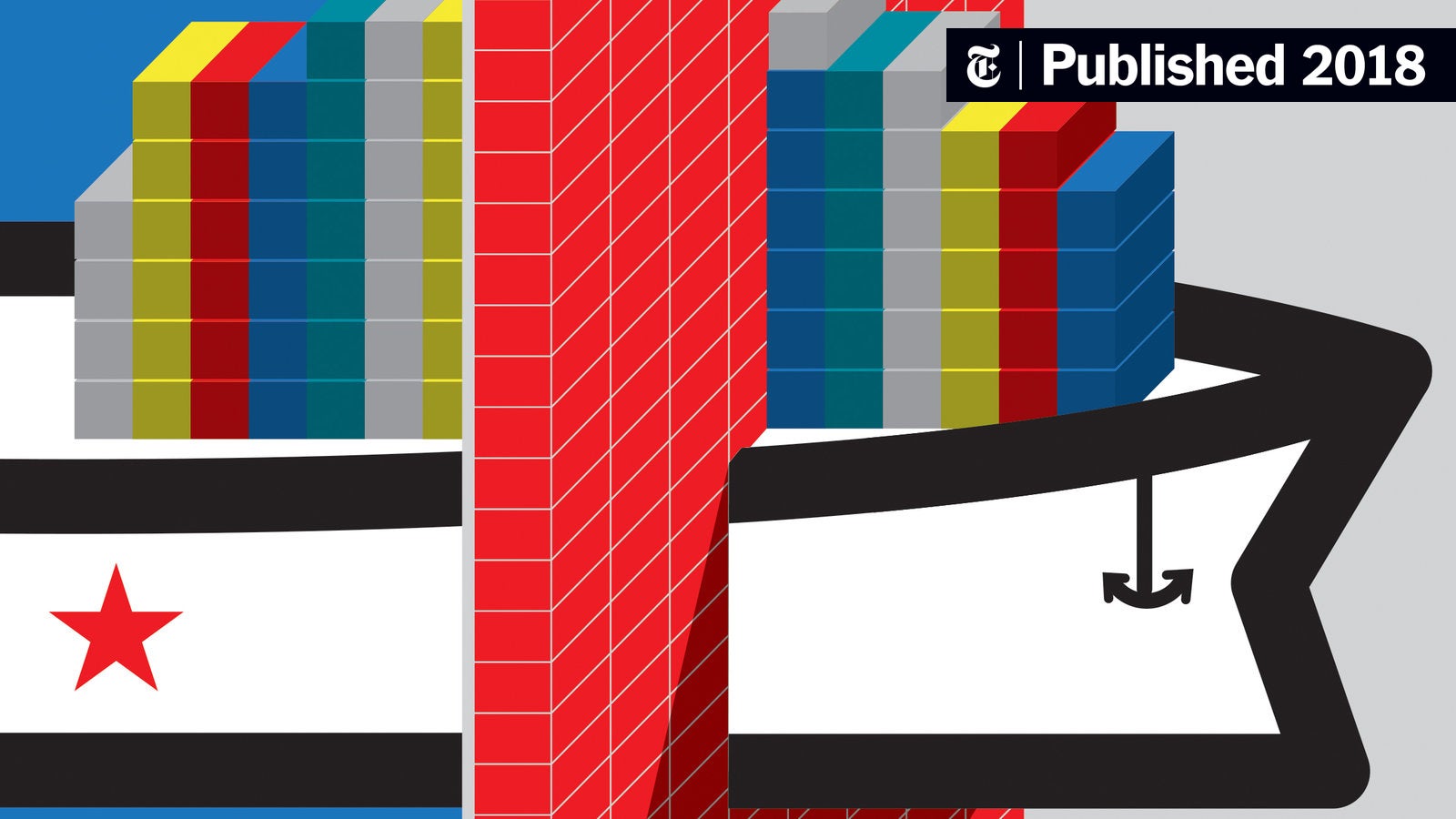

Amsterdam Exchange Falls 2 On Trumps New Tariffs

May 24, 2025

Amsterdam Exchange Falls 2 On Trumps New Tariffs

May 24, 2025 -

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stock Trading

May 24, 2025

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stock Trading

May 24, 2025 -

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025