Oil Market Trends And Forecasts: May 16, 2024

Table of Contents

Global Oil Demand Analysis

Understanding global oil consumption is crucial for any oil market analysis. The oil demand forecast for the remainder of 2024 hinges significantly on global economic growth. Robust economic activity, particularly in major economies like China, the US, and Europe, fuels increased energy consumption and, consequently, higher oil demand. Conversely, an economic slowdown or recession could trigger a substantial drop in global oil consumption. Seasonal factors also play a role; for example, increased transportation fuel demand during summer months influences overall oil demand.

- Breakdown of oil demand by sector: Transportation remains the dominant consumer, followed by industrial applications and petrochemical production. Shifts in these sectors directly impact overall oil demand.

- Analysis of key economic indicators influencing demand: GDP growth rates, industrial production indices, and consumer confidence levels provide crucial insights into future oil demand. Tracking these indicators is essential for accurate forecasting.

- Discussion of potential demand shocks: Unexpected economic downturns, major geopolitical events, or changes in government policies can cause significant and unpredictable shifts in oil demand.

Oil Supply Dynamics and OPEC+ Influence

Oil supply dynamics are equally vital in shaping oil market trends. OPEC+, the alliance of major oil-producing nations, plays a pivotal role in managing global crude oil production. Their production quotas and adherence to these quotas significantly impact oil supply levels. The impact of shale oil production in the US and other non-OPEC producers should also be considered. Geopolitical instability and sanctions on certain oil-producing countries can create significant supply disruptions, contributing to price volatility.

- Overview of OPEC+ production targets and compliance: Analyzing OPEC+'s production targets and the degree to which member countries adhere to these targets is key to understanding potential supply fluctuations.

- Analysis of non-OPEC oil production levels (e.g., US shale): The US shale oil industry's production capacity and its response to price changes significantly influence global oil supply.

- Assessment of potential supply disruptions due to geopolitical events: Conflicts, sanctions, or political instability in key oil-producing regions can lead to immediate and potentially prolonged supply disruptions.

Geopolitical Risks and Their Impact on Oil Prices

Geopolitical risks are a major driver of oil price volatility. Tensions between major oil-producing and consuming nations, conflicts, and political instability in key regions create uncertainty and can significantly impact both oil supply and market sentiment. This uncertainty often leads to price spikes as investors seek safer havens. Sanctions imposed on oil-producing countries can drastically reduce supply, pushing prices upwards.

- Specific geopolitical events impacting the oil market: For example, ongoing conflicts in certain regions may affect oil supply chains and transportation routes. This can drive up crude oil prices.

- Analysis of their impact on oil supply and demand: Geopolitical events can create immediate supply disruptions, affecting oil demand indirectly through price increases and economic uncertainty.

- Assessment of the risk to energy security: Geopolitical instability highlights concerns about the reliability and security of global energy supplies.

The Energy Transition and its Influence on Long-Term Oil Prices

The global energy transition toward renewable energy sources is a long-term factor influencing future oil prices. The increasing adoption of renewable energy, such as solar and wind power, along with the expansion of electric vehicles and other clean technologies, is expected to gradually reduce long-term oil demand.

- Growth rate of renewable energy sources: The rapid growth of renewable energy capacity is a significant trend to watch for its impact on future oil consumption.

- Impact of electric vehicles on oil demand: The increasing adoption of electric vehicles is expected to reduce gasoline demand over time.

- Long-term price projections considering energy transition scenarios: Different scenarios for the energy transition will result in varying long-term oil price forecasts.

Oil Price Forecast for the Near Future (May 16, 2024)

Based on the preceding analysis, we forecast a range for crude oil prices in the near future. Several factors influence this prediction: the balance between global oil supply and demand, the actions of OPEC+, and prevailing geopolitical conditions. It's crucial to remember that these are predictions, and unforeseen events could significantly alter the market.

- Specific price predictions (with ranges to reflect uncertainty): For example, a range of $70-$80 per barrel might be predicted, acknowledging potential variability.

- Justification for the predicted price range: The justification should incorporate the assessment of supply and demand factors, as well as geopolitical risks.

- Mention any potential upside or downside risks to the forecast: Unforeseen events, such as a major geopolitical crisis or a sharp economic downturn, could significantly alter the price outlook.

Conclusion

As of May 16, 2024, the oil market exhibits a complex interplay of factors influencing crude oil prices. Global oil demand, influenced by economic growth and seasonal variations, interacts with oil supply dynamics, shaped by OPEC+ decisions and geopolitical events. The ongoing energy transition poses a long-term challenge to oil demand, although its near-term impact remains limited. Our oil price forecast incorporates these factors but acknowledges the inherent uncertainties inherent in predicting future oil market trends. To stay abreast of the latest developments and informed about potential shifts in the oil market outlook, subscribe to our updates for in-depth analysis of crude oil price predictions and energy market analysis. Stay informed about future oil market trends to make informed decisions.

Featured Posts

-

Apple Tv Special Offer 3 Months Of Streaming For 3

May 17, 2025

Apple Tv Special Offer 3 Months Of Streaming For 3

May 17, 2025 -

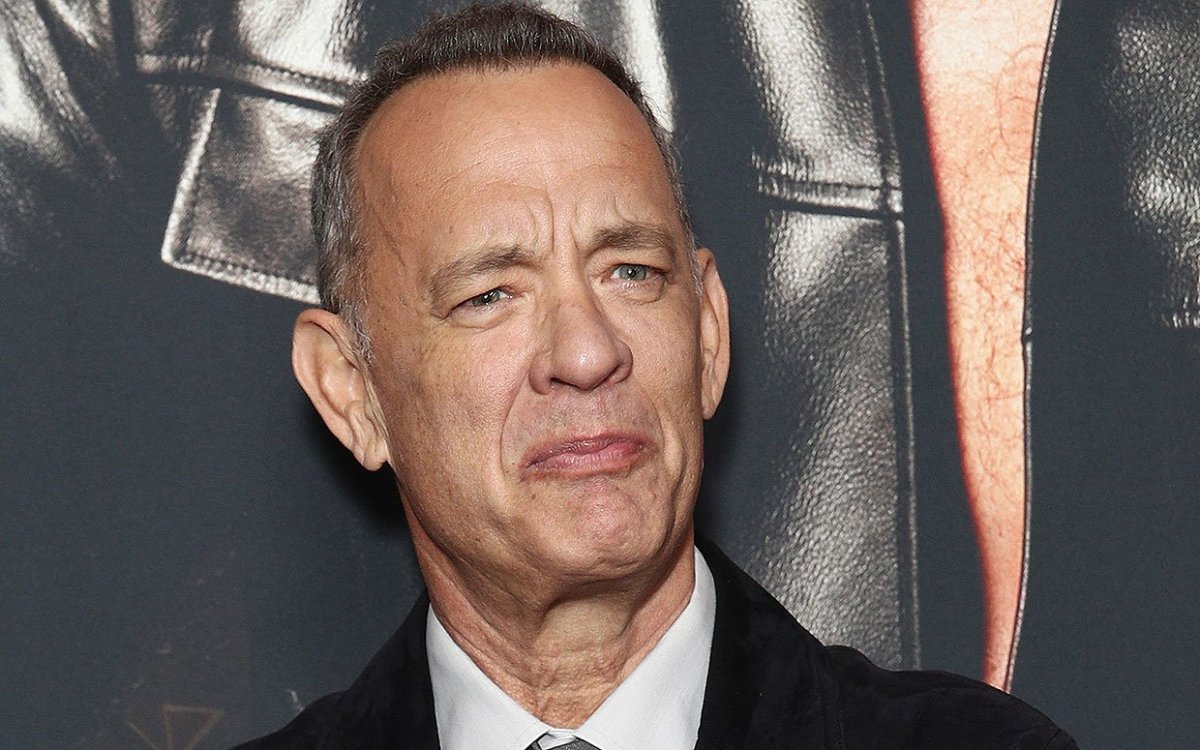

Tom Cruise And Tom Hanks A 1 Debt Story

May 17, 2025

Tom Cruise And Tom Hanks A 1 Debt Story

May 17, 2025 -

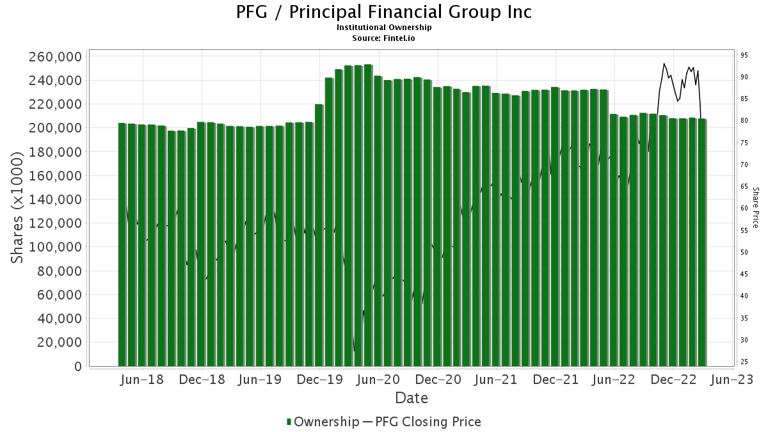

Understanding Principal Financial Group Pfg An Analysis Of 13 Analyst Ratings

May 17, 2025

Understanding Principal Financial Group Pfg An Analysis Of 13 Analyst Ratings

May 17, 2025 -

Kaitlyn Chen First Taiwanese American Drafted Into The Wnba

May 17, 2025

Kaitlyn Chen First Taiwanese American Drafted Into The Wnba

May 17, 2025 -

Find Your Angel Reese Wnba Jersey A Guide For Opening Weekend

May 17, 2025

Find Your Angel Reese Wnba Jersey A Guide For Opening Weekend

May 17, 2025