Pakistan, Sri Lanka, Bangladesh Pledge Enhanced Capital Market Collaboration

Table of Contents

Strengthening Regional Financial Stability through Collaboration

Increased collaboration between the Pakistan, Sri Lanka, and Bangladesh capital markets is crucial for bolstering regional financial stability. By working together, these nations can create a more resilient financial ecosystem less vulnerable to external shocks. This strengthened stability translates to numerous advantages:

- Reduced vulnerability to external shocks: A unified approach to financial regulation and risk management can mitigate the impact of global economic downturns, protecting investors and fostering greater resilience.

- Improved risk management practices: Sharing best practices and expertise in risk assessment and mitigation will lead to more robust and sophisticated risk management frameworks across the region.

- Enhanced investor confidence: A more stable and integrated regional market attracts increased foreign investment, boosting economic growth and development. This increased confidence stems from a perception of lower overall risk.

- Increased liquidity in regional markets: Improved market integration will lead to greater liquidity, facilitating easier trading and reducing price volatility.

Attracting significant foreign direct investment (FDI) becomes significantly easier with a unified, stable, and transparent approach. A coordinated strategy to showcase the region's investment potential will attract global investors seeking opportunities in South Asian financial markets.

Boosting Cross-Border Investment and Trade

Improved capital market linkages are pivotal in fostering cross-border investment and trade among Pakistan, Sri Lanka, and Bangladesh. This translates to concrete benefits for businesses operating within the region:

- Simplified regulatory frameworks: Harmonizing regulations and streamlining bureaucratic processes will make it easier for businesses to access capital and expand their operations across borders.

- Harmonized trading standards: Consistent standards will reduce transaction costs and complexities, leading to smoother and more efficient cross-border trade.

- Increased market access for businesses: Businesses will gain access to larger and more diverse markets, fostering competition and innovation.

- Reduced transaction costs: Streamlined processes and reduced bureaucratic hurdles will significantly lower the costs associated with cross-border transactions.

Examples of potential benefits include easier access to Pakistani financing for Sri Lankan infrastructure projects, or Bangladeshi companies leveraging Pakistani expertise in specific sectors. This increased regional trade will ultimately boost the overall economic growth of the entire South Asian region.

Sharing Best Practices and Expertise in Capital Market Development

The collaboration between Pakistan, Sri Lanka, and Bangladesh offers a unique opportunity for knowledge sharing and technical assistance. This exchange of expertise is crucial for developing robust and efficient capital markets:

- Capacity building programs: Joint initiatives can build the capacity of professionals in areas such as securities regulation, risk management, and financial technology.

- Exchange of regulatory expertise: Sharing best practices in regulatory frameworks and oversight can ensure a more harmonized and efficient regulatory environment.

- Sharing of technological advancements: Collaboration in adopting and developing new financial technologies will modernize the regional capital markets.

- Collaboration on market infrastructure development: Joint efforts to improve market infrastructure, such as trading platforms and clearing houses, will create a more efficient and interconnected regional market.

The long-term goal is to potentially develop a unified regulatory framework that simplifies cross-border transactions and fosters a truly integrated South Asian capital market. This will involve careful consideration of the existing differences and a phased approach to harmonization.

Challenges and Opportunities for Enhanced Capital Market Collaboration

While the pledge for enhanced collaboration holds immense potential, several challenges need to be addressed:

- Regulatory differences: Significant differences in regulatory frameworks across the three countries need to be carefully harmonized.

- Political and economic instability in the region: Political and economic volatility can negatively impact investor confidence and hinder the progress of the initiative.

- Infrastructure limitations: Inadequate infrastructure in some areas could limit the effectiveness of cross-border transactions and market integration.

- Lack of investor awareness: Raising awareness among investors about the opportunities presented by the integrated market is crucial for its success.

However, these challenges also present opportunities. Regulatory harmonization, though challenging, can establish a robust, unified regulatory structure, attracting significant FDI. Investment in modernizing infrastructure can stimulate economic growth throughout the region. Targeted investor education campaigns will build confidence and attract capital.

The Future of Capital Market Collaboration in South Asia

The enhanced collaboration between the Pakistan, Sri Lanka, and Bangladesh capital markets holds immense promise for regional economic integration and growth. By strengthening regional financial stability, boosting cross-border investment and trade, and sharing best practices, these nations can unlock the full potential of their capital markets. This initiative is a pivotal step towards creating a more prosperous and integrated South Asia. Stay informed about the progress of this crucial initiative to unlock the full potential of Pakistan, Sri Lanka, and Bangladesh's capital market collaboration and explore the exciting investment opportunities in these dynamic South Asian capital markets.

Featured Posts

-

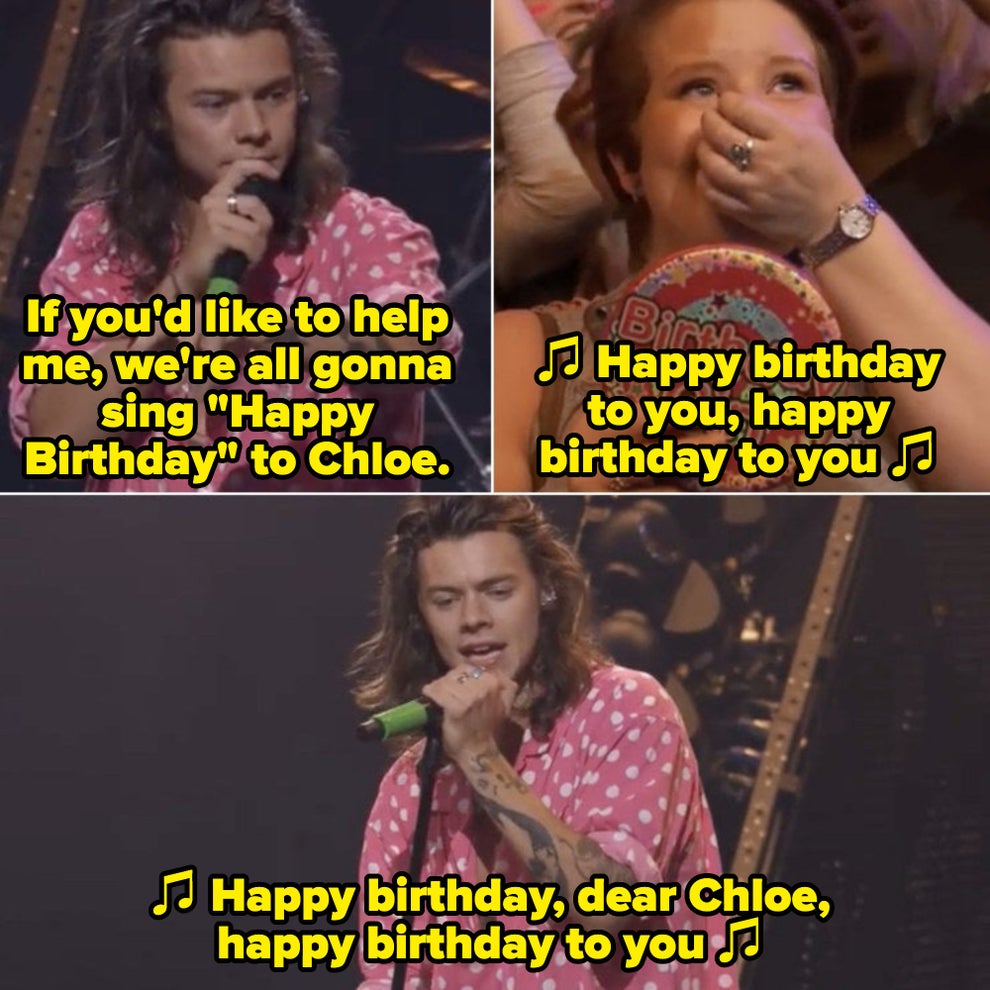

Harry Styles Honest Reaction To A Hilarious And Awful Snl Impression

May 10, 2025

Harry Styles Honest Reaction To A Hilarious And Awful Snl Impression

May 10, 2025 -

Live Womb Transplants A Childrens Hospital Community Activists Suggestion For Transgender Mothers

May 10, 2025

Live Womb Transplants A Childrens Hospital Community Activists Suggestion For Transgender Mothers

May 10, 2025 -

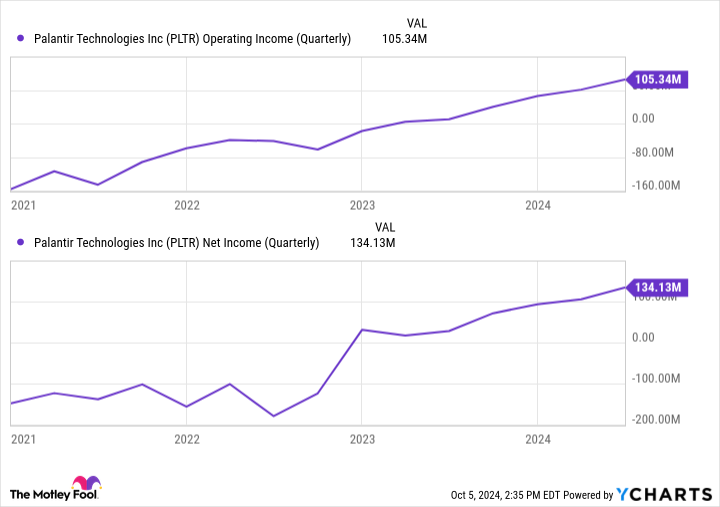

Will Palantir Hit A 1 Trillion Valuation Analyzing The Potential By 2030

May 10, 2025

Will Palantir Hit A 1 Trillion Valuation Analyzing The Potential By 2030

May 10, 2025 -

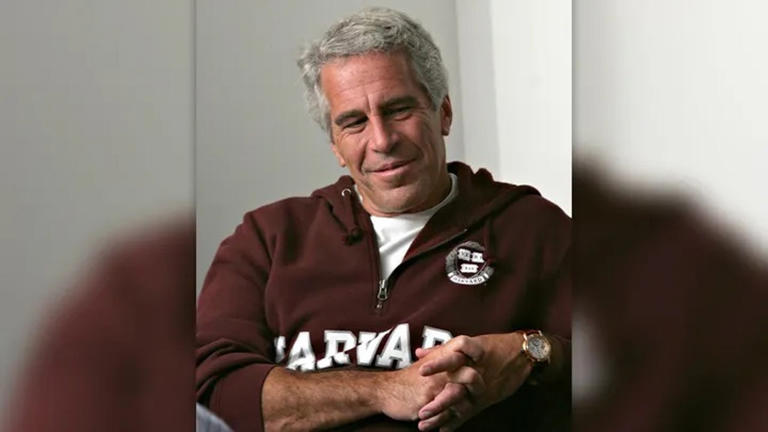

Unsealed Documents What Pam Bondi Knows About The Epstein Client List

May 10, 2025

Unsealed Documents What Pam Bondi Knows About The Epstein Client List

May 10, 2025 -

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

May 10, 2025

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

May 10, 2025