Will Palantir Hit A $1 Trillion Valuation? Analyzing The Potential By 2030

Table of Contents

Palantir's Current Market Position and Growth Trajectory

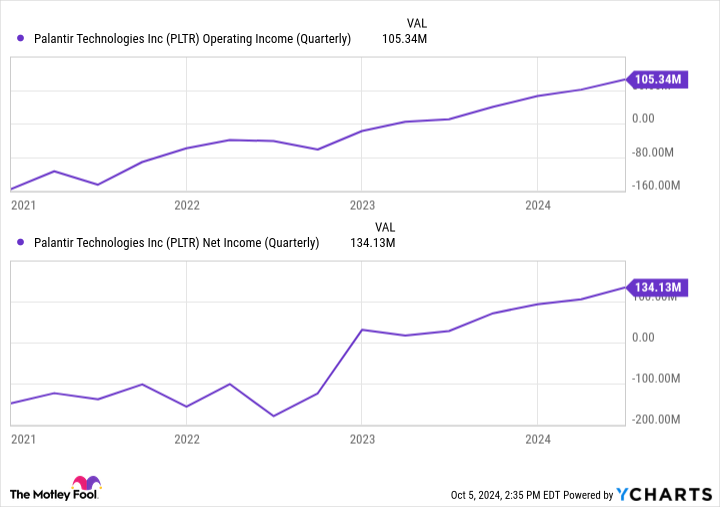

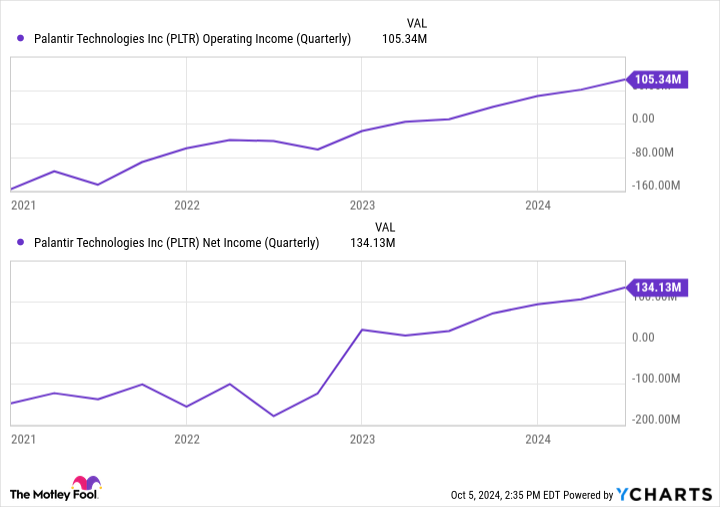

To assess Palantir's potential for a $1 trillion valuation, we must first examine its current standing. As of October 26, 2023, Palantir's market capitalization sits significantly below this target. However, understanding its growth trajectory is crucial. Palantir's revenue streams primarily comprise government contracts and commercial partnerships. Its year-over-year revenue growth over the past few years has been substantial, fueled by increased demand for its data analytics platforms. Predicting the next decade requires analyzing several factors.

- Current market cap (as of October 26, 2023): [Insert current market cap – requires real-time data]

- Year-over-year revenue growth (past 3-5 years): [Insert data – requires research into Palantir's financial reports]

- Key government contracts and their impact on revenue: Contracts with agencies like the CIA and various branches of the US military significantly contribute to Palantir's revenue and provide a stable foundation for future growth. However, dependence on government contracts also carries inherent risks.

- Significant commercial partnerships and their potential: Palantir's expansion into the commercial sector is crucial for long-term growth, with partnerships across diverse industries demonstrating the platform's adaptability and potential for widespread adoption.

Factors Contributing to a Potential $1 Trillion Valuation

Several factors could propel Palantir towards a $1 trillion valuation. These hinge on continued innovation, expansion, and navigating the geopolitical landscape successfully.

Technological Innovation and Product Development

Palantir's ongoing investment in research and development is paramount. Its flagship platform, Foundry, along with advancements in AI and machine learning through initiatives like AIP (Artificial Intelligence Platform), are key drivers of innovation. These advancements offer significant competitive advantages, particularly in data integration and complex data analysis.

- Key technological innovations (e.g., Foundry, AIP): These platforms are instrumental in differentiating Palantir from competitors and attracting a broader range of clients.

- Competitive advantages over rivals (e.g., data integration capabilities): Palantir's ability to integrate diverse data sources is a significant competitive strength.

- Potential market disruption through new technologies: Continued innovation in AI and machine learning could lead to disruptive advancements in data analysis capabilities.

Expansion into New Markets and Client Acquisition

Palantir's success depends heavily on penetrating new markets and acquiring a larger customer base. The healthcare, finance, and energy sectors represent significant opportunities for growth. Strategic partnerships, direct sales efforts, and a focus on demonstrating value to potential clients are crucial for success.

- Target markets for expansion: Diversification into sectors beyond government contracts is essential for long-term sustainability.

- Strategies for client acquisition (e.g., partnerships, direct sales): A multi-pronged approach is needed to reach a diverse range of potential clients.

- Potential challenges in scaling operations: Rapid growth necessitates careful planning and investment in infrastructure and personnel.

Government Contracts and Geopolitical Landscape

Government contracts remain a significant component of Palantir's revenue, however, geopolitical shifts and changes in government priorities could significantly impact its future. The company needs to diversify its revenue streams while mitigating risks associated with political instability and budget fluctuations.

- Percentage of revenue from government contracts: [Requires data from Palantir financial reports]

- Key geopolitical factors impacting Palantir's prospects: International relations and defense spending levels significantly impact opportunities for government contracts.

- Mitigation strategies for geopolitical risks: Diversification and a focus on commercial clients are crucial mitigation strategies.

Challenges and Risks Hindering a $1 Trillion Valuation

Despite the potential, several challenges could hinder Palantir's path to a $1 trillion valuation.

- Key competitors and their market share: The data analytics market is highly competitive, with established players and emerging startups vying for market share.

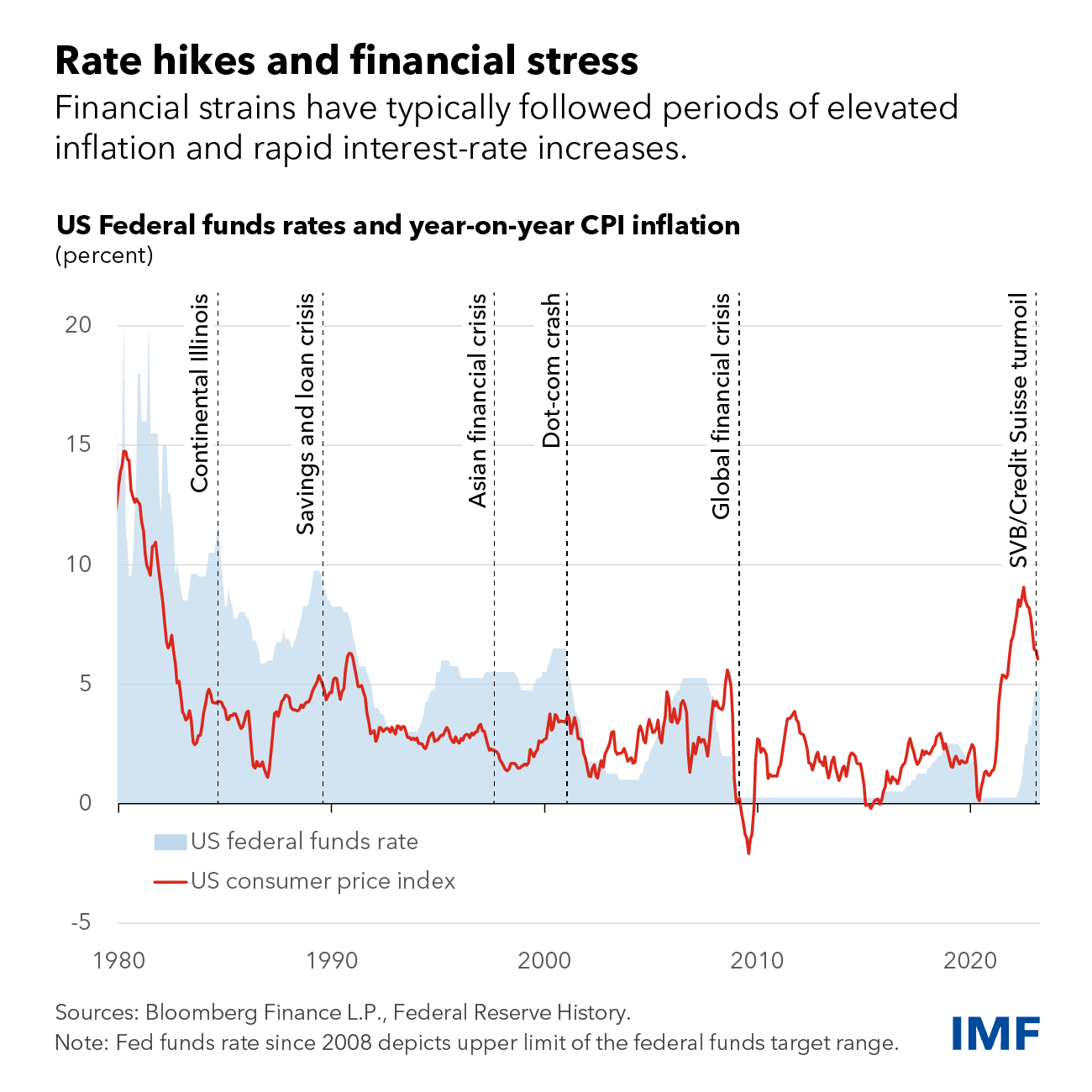

- Economic factors that could hinder growth: Economic downturns could reduce government spending and dampen commercial demand for data analytics services.

- Regulatory risks and compliance challenges: Navigating complex regulatory environments and addressing ethical considerations related to data privacy and security are crucial.

Conclusion

Achieving a $1 trillion valuation for Palantir by 2030 presents a significant challenge. While its technological prowess, growth trajectory, and potential for market expansion are compelling, the company faces considerable hurdles, including intense competition, economic uncertainty, and geopolitical risks. Continued innovation in areas like AI, successful expansion into new markets, and a strategic approach to managing government contracts will be critical. While a $1 trillion valuation for Palantir by 2030 is ambitious, the potential remains. Continue to follow Palantir's progress and further analysis of its $1 trillion valuation potential.

Featured Posts

-

Pakistan Sri Lanka And Bangladesh To Strengthen Capital Market Ties

May 10, 2025

Pakistan Sri Lanka And Bangladesh To Strengthen Capital Market Ties

May 10, 2025 -

Uk Visa Crackdown Stricter Regulations For Work And Student Visas

May 10, 2025

Uk Visa Crackdown Stricter Regulations For Work And Student Visas

May 10, 2025 -

Fed Holds Interest Rates Balancing Inflation And Job Market Risks

May 10, 2025

Fed Holds Interest Rates Balancing Inflation And Job Market Risks

May 10, 2025 -

Thailands Transgender Community A Call For Equality In The Bangkok Post

May 10, 2025

Thailands Transgender Community A Call For Equality In The Bangkok Post

May 10, 2025 -

Jesse Watters Wife Cheating Joke Sparks Hypocrisy Debate On Fox News

May 10, 2025

Jesse Watters Wife Cheating Joke Sparks Hypocrisy Debate On Fox News

May 10, 2025