Palantir Stock: Assessing The 30% Decline And Future Potential

Table of Contents

Analyzing the 30% Decline in Palantir Stock Price

The recent downturn in PLTR stock is a complex issue stemming from a confluence of factors. Let's break down the key contributors:

Macroeconomic Factors and Market Sentiment

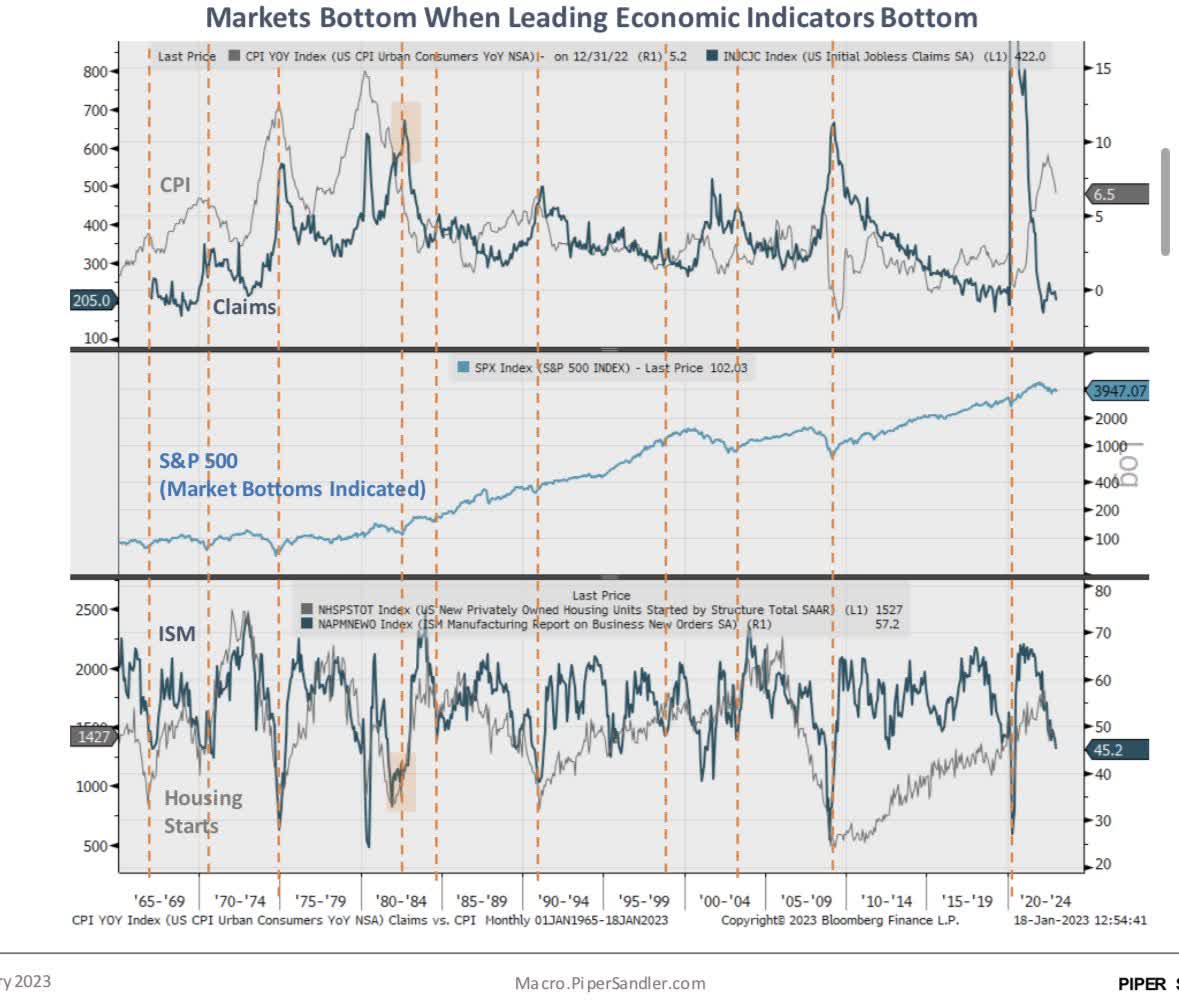

The broader macroeconomic environment has significantly impacted tech stocks, including Palantir. Rising inflation and subsequent interest rate hikes by central banks have increased the cost of borrowing and reduced investor appetite for riskier assets. This has led to a general sell-off in the tech sector, disproportionately affecting high-growth companies like Palantir.

- Increased risk aversion in the market due to inflation and rising interest rates.

- Concerns over high valuations in the tech sector, leading to profit-taking and a reassessment of growth projections.

- Inflation impacting growth projections and potentially squeezing profit margins for data analytics companies.

Palantir's Financial Performance and Earnings Reports

Analyzing Palantir's recent earnings reports reveals a mixed picture. While the company has shown consistent revenue growth, it has also faced challenges in meeting certain expectations. Investors are scrutinizing key financial metrics to gauge the sustainability of Palantir's growth trajectory.

- Revenue growth rate compared to previous quarters and years needs to be evaluated against industry benchmarks. Sustained growth is crucial for justifying the current valuation.

- Profitability margins are a key indicator of operational efficiency and long-term viability. Investors are watching closely for improvements in this area.

- Cash flow generation and its sustainability are vital for a company's long-term health. Positive and predictable cash flow is essential for investor confidence.

Competition in the Data Analytics Market

Palantir operates in a highly competitive data analytics market, facing established giants like AWS, Google Cloud, and Microsoft Azure. While Palantir possesses unique technological capabilities, particularly in its focus on complex data analysis for government and enterprise clients, it faces challenges in terms of market share and pricing pressure.

- Key differentiators of Palantir's technology include its focus on complex data integration and advanced analytics capabilities.

- Market share compared to competitors needs to be carefully analyzed to assess Palantir's competitive positioning. Growth in market share is a positive sign.

- Strengths and weaknesses in areas like pricing and scalability must be considered. Palantir needs to demonstrate competitive pricing while maintaining its operational efficiency.

Assessing Palantir's Future Potential and Growth Opportunities

Despite the recent decline, Palantir possesses several key growth drivers that could fuel future stock appreciation.

Growth of the Government Contracts Sector

Palantir maintains a strong presence in the government contracts sector, particularly within defense and intelligence agencies. The continued need for advanced data analytics solutions within government organizations presents a significant growth opportunity.

- A robust pipeline of future government contracts is essential for consistent revenue growth. Securing large, long-term contracts is critical.

- Expansion into new government sectors like cybersecurity and healthcare could unlock substantial new revenue streams.

- Government spending trends in technology and national security will significantly impact Palantir's future growth.

The Potential of Palantir's Foundry Platform

Palantir's Foundry platform is a key component of its future growth strategy. This platform offers a scalable, customizable data integration and analytics solution for various industries. Its success hinges on its ability to attract and retain clients across diverse sectors.

- New Foundry clients and their impact on revenue are important indicators of the platform's success. A growing client base is crucial.

- Potential for Foundry expansion into new markets like healthcare and finance represents a large addressable market.

- Technological advancements planned for the platform must keep pace with market demands and competitive offerings.

Long-Term Investment Outlook for PLTR Stock

The long-term investment outlook for PLTR stock is complex, requiring careful consideration of both risks and opportunities. Investors should evaluate their risk tolerance, investment horizon, and portfolio diversification.

- Potential upside and downside scenarios for PLTR must be carefully considered.

- Comparison to other tech stocks in the market will help assess its relative valuation and growth prospects.

- Recommendations for investors should be tailored to their individual risk profile and investment goals.

Conclusion: Investing in Palantir Stock: A Long-Term Perspective?

The 30% decline in Palantir stock is attributed to a combination of macroeconomic headwinds, competitive pressures, and investor sentiment. However, Palantir's continued growth in government contracts and the potential of its Foundry platform present significant long-term opportunities. While the risks associated with investing in PLTR are undeniable, a thorough analysis of its fundamentals and future prospects is vital for informed investment decisions. Remember to conduct your own thorough research before making any investment decisions related to Palantir stock. While the recent decline in Palantir stock presents challenges, a careful consideration of its long-term potential, particularly concerning government contracts and the Foundry platform, is crucial for any investor considering a position in PLTR stock. Conduct your own thorough research before investing.

Featured Posts

-

Uk Student Visa Restrictions Impact On Asylum Seekers

May 10, 2025

Uk Student Visa Restrictions Impact On Asylum Seekers

May 10, 2025 -

The Stigma Of Mental Illness In Violent Crime Why We Fail

May 10, 2025

The Stigma Of Mental Illness In Violent Crime Why We Fail

May 10, 2025 -

Otkaz Ot Poezdki V Kiev Starmer Makron Merts I Tusk 9 Maya

May 10, 2025

Otkaz Ot Poezdki V Kiev Starmer Makron Merts I Tusk 9 Maya

May 10, 2025 -

Investing In Palantir Before May 5th A Detailed Look At The Risks And Rewards

May 10, 2025

Investing In Palantir Before May 5th A Detailed Look At The Risks And Rewards

May 10, 2025 -

The Transgender Communitys Response To Trumps Executive Actions

May 10, 2025

The Transgender Communitys Response To Trumps Executive Actions

May 10, 2025