Palantir Stock: Buy Before May 5th? Analysis And Predictions

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Revenue Growth and Profitability

Palantir Technologies' financial performance has been a subject of considerable investor interest. Analyzing recent quarterly reports reveals key insights into its growth trajectory. Examining key performance indicators (KPIs) such as revenue growth, net income, and operating margins offers a clear picture of the company's financial health.

- YoY Revenue Growth: [Insert data from recent quarterly reports, e.g., "Palantir reported a 25% year-over-year revenue growth in Q4 2023."]

- EPS (Earnings Per Share): [Insert data from recent quarterly reports, e.g., "EPS showed a positive trend, reaching [insert figure] in the last quarter."]

- Operating Margins: [Insert data from recent quarterly reports, e.g., "Operating margins improved to [insert figure]%, reflecting increased efficiency."]

- Analyst Predictions: Leading financial analysts offer varying predictions, with some projecting continued robust growth based on the company's expanding customer base and innovative product offerings. [Cite specific analyst reports and ratings here.]

- Significant Contracts: Securing large government and commercial contracts significantly impacts profitability. Recent partnerships with [mention specific examples] demonstrate Palantir's ability to secure substantial deals.

Government Contracts and Commercial Growth

Palantir's revenue stream is diversified across government and commercial sectors. Understanding the growth trends in each sector is vital for assessing the overall health of Palantir stock.

- Revenue Breakdown: [Insert data, e.g., "Government contracts currently account for approximately X% of Palantir's revenue, while the commercial sector contributes Y%."]

- Key Government Clients: [List examples of key government clients, highlighting the stability and long-term potential of these contracts.]

- Key Commercial Clients: [List examples, emphasizing growth in this sector and its potential for future expansion.]

- Future Growth Potential: Both sectors offer significant expansion opportunities. The increasing demand for data analytics and AI-driven solutions positions Palantir for sustained growth in both the public and private sectors.

Market Sentiment and Analyst Opinions on Palantir Stock

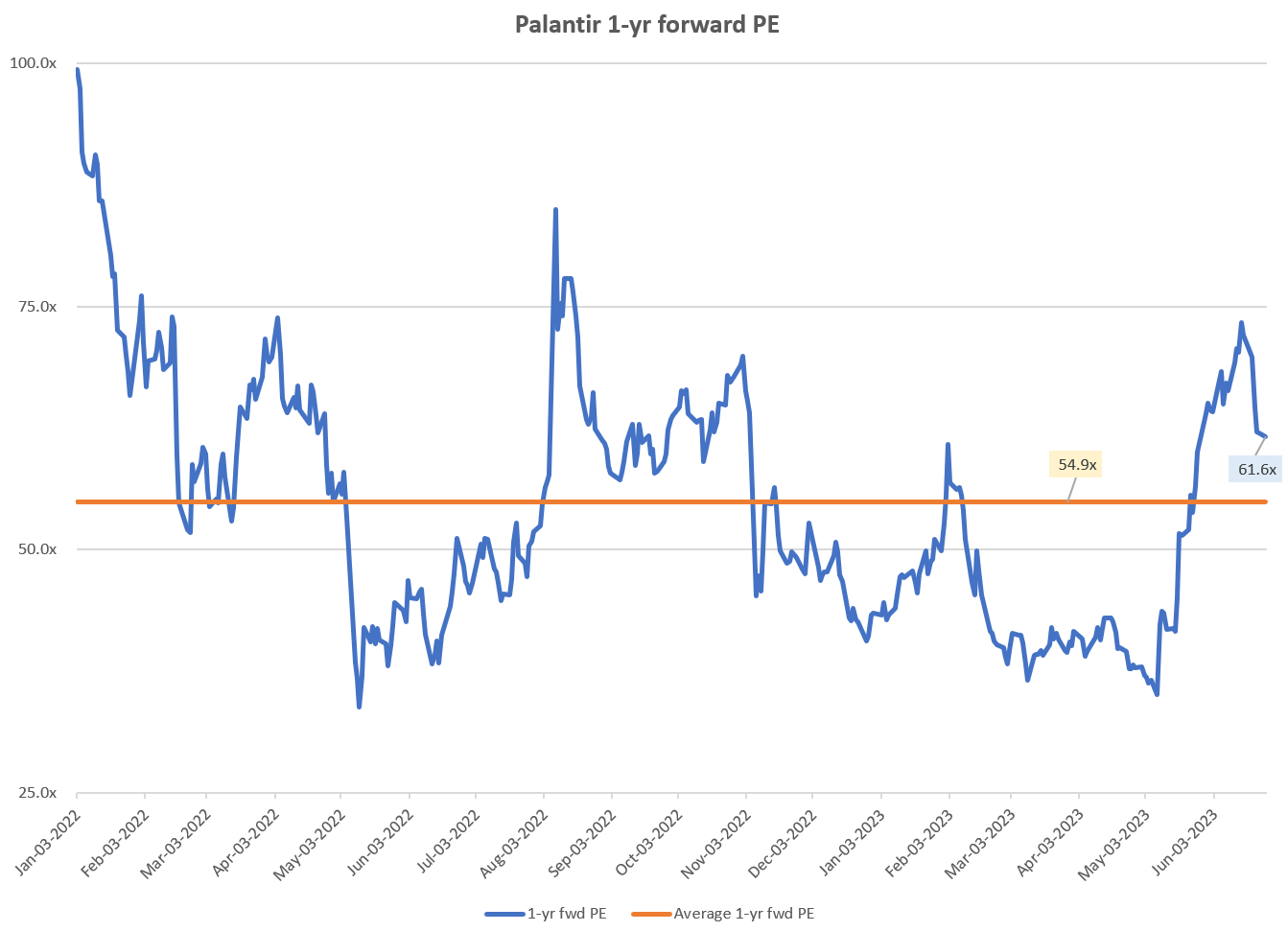

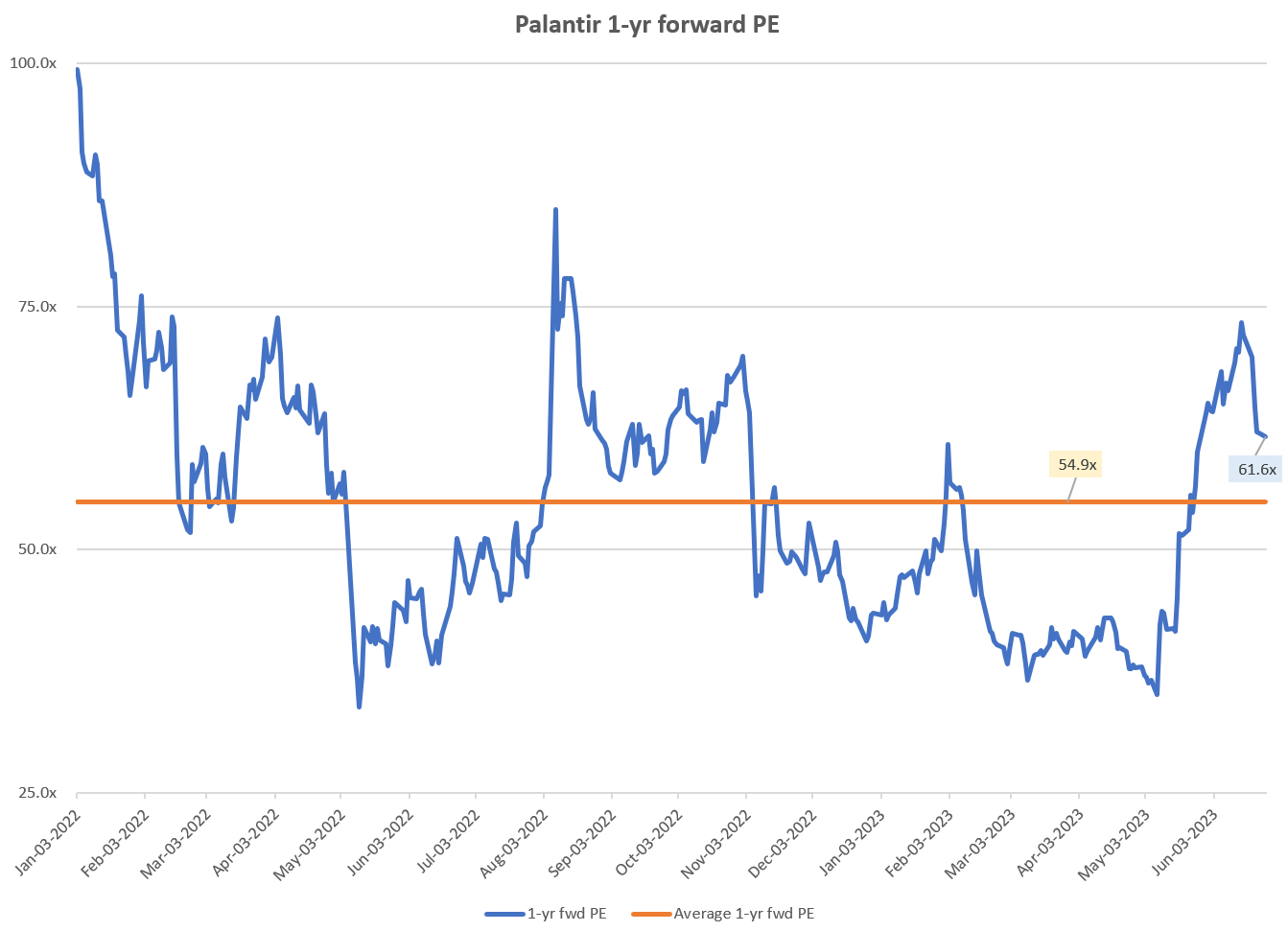

Stock Price Analysis

Analyzing Palantir's stock price movements provides valuable insights into market sentiment. Looking at historical highs, lows, and significant trends helps to identify potential support and resistance levels.

- Recent Price Movements: [Describe recent price trends, referencing specific dates and price points. Include a chart if possible.]

- Technical Indicators: [Mention relevant technical indicators such as moving averages, RSI, or MACD, if applicable. This section requires expertise in technical analysis.]

- Support and Resistance Levels: [Identify key support and resistance levels that could influence future price movements.]

Expert Opinions and Predictions

Gathering insights from leading financial analysts helps to gauge market sentiment and understand potential future price movements.

- Analyst Ratings: [Compile a summary of analyst ratings (Buy, Hold, Sell) and target prices from reputable sources. Always cite sources.]

- Bullish vs. Bearish Sentiment: [Summarize the overall sentiment expressed by analysts – are they generally bullish or bearish on Palantir stock?]

Risks and Potential Downsides

While Palantir presents opportunities, investors need to acknowledge potential risks.

- Competition: The data analytics and AI market is highly competitive. [Discuss specific competitors and the potential impact on Palantir's market share.]

- Geopolitical Factors: Geopolitical instability can affect government contracts and overall market sentiment.

- Economic Downturns: A broader economic downturn could reduce demand for Palantir's services, impacting its financial performance.

Factors to Consider Before Investing in Palantir Stock Before May 5th

Overall Market Conditions

The broader macroeconomic environment significantly impacts stock market performance.

- Interest Rates: [Discuss the impact of prevailing interest rates on investor sentiment and stock valuations.]

- Inflation Levels: [Analyze how inflation might influence Palantir's costs and profitability.]

- Overall Market Sentiment: [Assess the overall mood of the stock market and how it may affect Palantir stock.]

Company-Specific Risks

Reiterating company-specific risks helps to make informed decisions.

- Dependence on Government Contracts: [Discuss the potential risks associated with Palantir's reliance on government contracts.]

- Competition Intensity: [Re-emphasize the competitive landscape and its potential to impact Palantir’s growth.]

Your Investment Strategy and Risk Tolerance

Investment decisions must align with your financial goals and risk tolerance.

- Diversification: [Explain the importance of diversifying your investment portfolio to minimize risk.]

- Responsible Investing: [Emphasize the importance of thorough research and understanding the risks before investing.]

Conclusion: Should You Buy Palantir Stock Before May 5th?

Based on our analysis, Palantir stock presents a potentially attractive opportunity before May 5th, but investors should carefully consider the associated risks. While the company demonstrates strong growth potential, particularly in its expanding commercial sector and continued success in government contracts, the competitive landscape and macroeconomic factors must be carefully weighed. Before making any investment decisions regarding Palantir stock, it is crucial to conduct thorough due diligence, reviewing recent financial reports and analyst opinions. Remember to align your investment choices with your personal risk tolerance and financial objectives. Conduct further research and consult with a financial advisor to make informed decisions about your investment in Palantir stock. For additional resources, you can refer to [link to relevant financial news websites or SEC filings].

Featured Posts

-

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025 -

How To Get Elizabeth Arden Skincare At Walmart Prices

May 10, 2025

How To Get Elizabeth Arden Skincare At Walmart Prices

May 10, 2025 -

Frantsiya Polsha Soglashenie Makrona I Tuska Klyuchevye Punkty I Posledstviya

May 10, 2025

Frantsiya Polsha Soglashenie Makrona I Tuska Klyuchevye Punkty I Posledstviya

May 10, 2025 -

How Many Billions Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025

How Many Billions Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025 -

14 Edmonton School Projects On The Fast Track Ministers Update

May 10, 2025

14 Edmonton School Projects On The Fast Track Ministers Update

May 10, 2025