Palantir Stock Down 30%: Is This A Buying Opportunity?

Table of Contents

Analyzing the 30% Stock Drop: Reasons Behind the Decline

Several factors have contributed to the recent downturn in Palantir stock. Understanding these reasons is crucial before considering whether to buy.

Macroeconomic Factors

The current macroeconomic climate has significantly impacted growth stocks, including Palantir.

- Rising Interest Rates: Higher interest rates increase borrowing costs for companies, impacting growth and potentially reducing investor appetite for riskier assets like Palantir stock.

- Inflation and Recession Fears: Inflation erodes purchasing power and can lead to decreased consumer spending, while recession fears further dampen investor confidence, leading to sell-offs in the tech sector.

- Competitor Performance: The performance of competitors in the big data analytics space also influences investor sentiment toward Palantir. Negative news or underperformance from rivals can indirectly impact Palantir stock.

Company-Specific Challenges

Beyond macroeconomic headwinds, Palantir faces some company-specific challenges.

- Slower-Than-Expected Revenue Growth: While Palantir has shown consistent revenue growth, the rate may have fallen short of investor expectations, contributing to the stock price decline. Analysis of recent earnings reports is crucial here. [Link to relevant earnings report]

- Increased Competition: The big data analytics market is becoming increasingly competitive, with established tech giants and emerging startups vying for market share. This heightened competition could put pressure on Palantir's pricing and profitability.

- Profitability Concerns: Palantir's path to sustained profitability remains a concern for some investors. While revenue is growing, achieving consistent profitability is essential for long-term stock appreciation.

Investor Sentiment and Market Volatility

Negative investor sentiment and market volatility played a significant role in the recent Palantir stock drop.

- Sell-offs: Significant sell-offs driven by profit-taking or fear of further declines exacerbated the price decrease.

- Negative Analyst Reports: Any negative analyst reports or downgrades can significantly impact investor confidence and lead to further selling pressure on Palantir stock.

- Short-Selling Activity: Increased short-selling activity, where investors bet against the stock, can also contribute to downward pressure on the price.

Evaluating Palantir's Long-Term Potential: Is the Dip a Buying Opportunity?

Despite the recent decline, Palantir possesses several key strengths that suggest long-term potential.

Strong Government Contracts and Growing Commercial Business

Palantir benefits from substantial government contracts, providing a stable revenue stream.

- Government Contracts: These contracts offer significant revenue and a strong foundation for future growth.

- Commercial Business Growth: Palantir's commercial business is rapidly expanding, demonstrating its ability to attract and retain clients in the private sector. This diversification reduces reliance on government contracts. [Link to relevant case studies showcasing commercial growth].

- Innovative Product Development: Continued investment in research and development ensures Palantir stays at the forefront of big data analytics, offering innovative solutions to its clients.

Valuation and Financial Health

Palantir's current valuation relative to its peers and its financial health are critical factors.

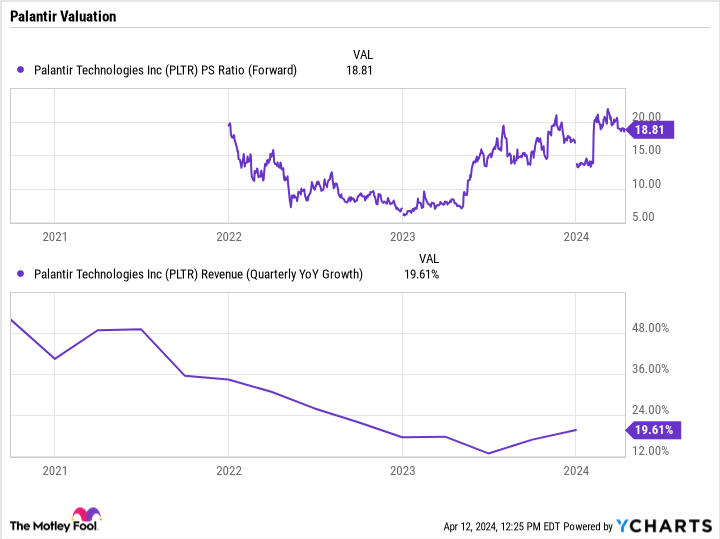

- Price-to-Sales Ratio: Comparing Palantir's price-to-sales ratio to competitors provides context for its valuation.

- Revenue Growth: Sustained and accelerating revenue growth is a positive indicator of long-term potential.

- Cash Flow: Positive and growing cash flow demonstrates the company's financial strength and ability to invest in future growth.

Risk Assessment

Investing in Palantir stock carries inherent risks.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts, creating exposure to changes in government spending.

- Competition: Competition from larger tech firms could impact Palantir's market share and profitability.

- Path to Profitability: The path to consistent profitability remains a key area to monitor.

Alternative Investment Strategies: Diversification and Risk Management

Given the volatility of Palantir stock, diversification and risk management strategies are crucial.

Diversification within the Tech Sector

Diversifying your portfolio across various tech stocks can mitigate risk.

- Alternative Tech Stocks: Consider other tech companies with different risk profiles and market positions. [List examples of alternative tech stocks].

Dollar-Cost Averaging (DCA): A Strategy for Reducing Risk

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the stock price.

- DCA Benefits: This strategy reduces the impact of market volatility and minimizes the risk of investing a large sum at a market peak.

Conclusion

The 30% drop in Palantir stock presents a complex situation. While macroeconomic factors and company-specific challenges contributed to the decline, Palantir's strong government contracts, growing commercial business, and innovative product development suggest long-term potential. However, risks associated with its dependence on government contracts, competition, and path to profitability must be carefully considered. Before making any investment decisions regarding Palantir stock or Palantir shares, conduct thorough due diligence, assess your risk tolerance, and consult with a financial advisor. Remember, diversification is key to mitigating risk in any investment portfolio, including investments in Palantir.

Featured Posts

-

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqdat

May 09, 2025

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqdat

May 09, 2025 -

Strengthening Ties India And Us To Negotiate Bilateral Trade

May 09, 2025

Strengthening Ties India And Us To Negotiate Bilateral Trade

May 09, 2025 -

Preview Bayern Munich Vs Eintracht Frankfurt Potential Lineups And Prediction

May 09, 2025

Preview Bayern Munich Vs Eintracht Frankfurt Potential Lineups And Prediction

May 09, 2025 -

Is Now The Right Time To Invest In Palantir Technologies Stock

May 09, 2025

Is Now The Right Time To Invest In Palantir Technologies Stock

May 09, 2025 -

High Potential Could This Season 1 Character Be The Key To Season 2s Plot

May 09, 2025

High Potential Could This Season 1 Character Be The Key To Season 2s Plot

May 09, 2025