Palantir Stock Investment: Weighing The Options Before May 5th

Table of Contents

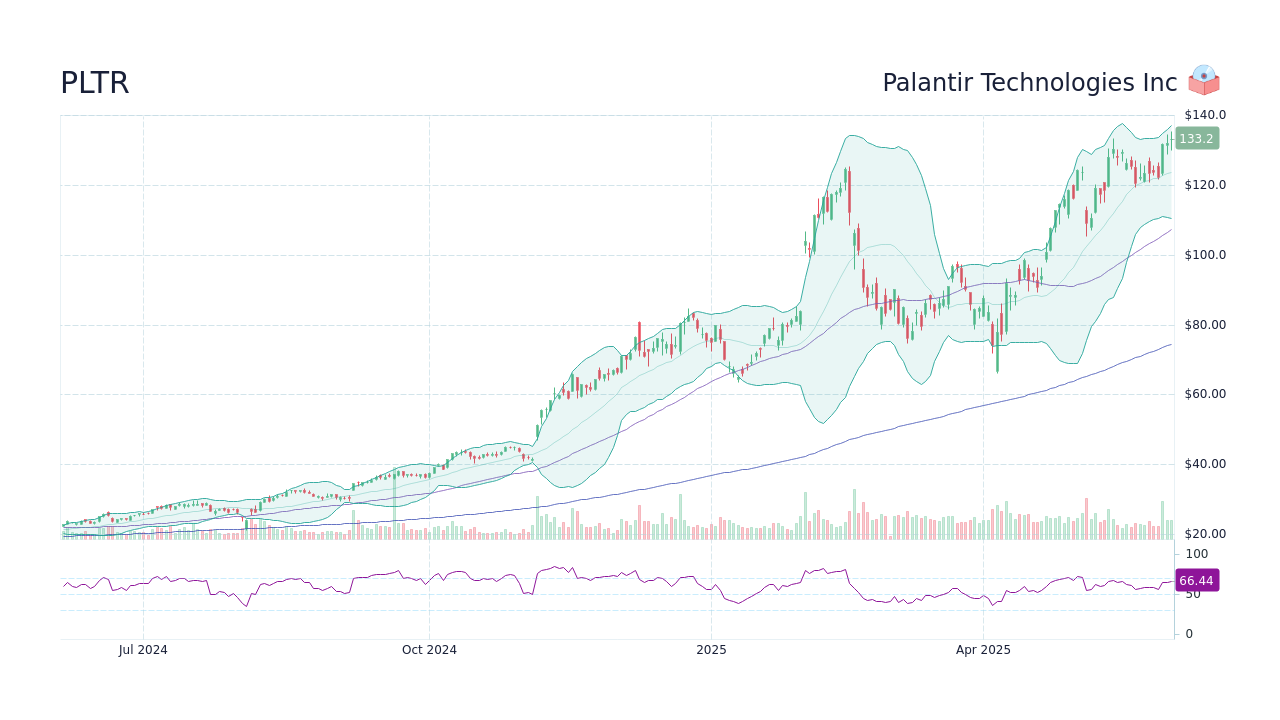

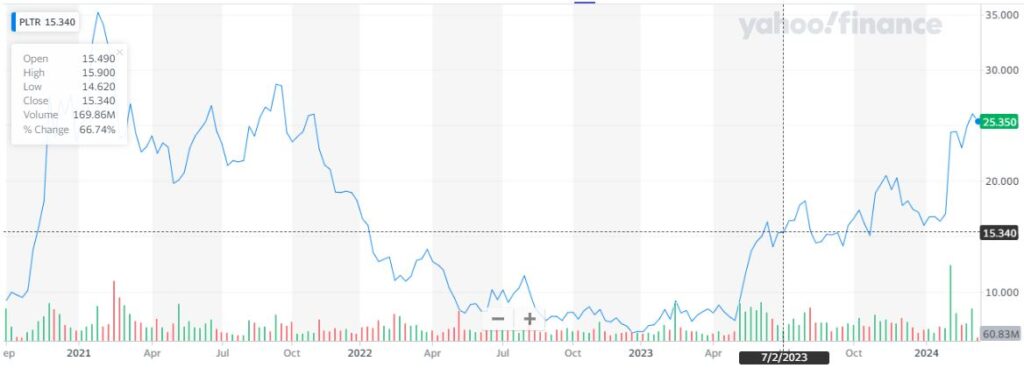

Palantir Technologies (PLTR) stock has experienced significant volatility recently, leaving many investors wondering whether to buy, sell, or hold before May 5th. With potential earnings reports and significant contract announcements on the horizon, the need for careful consideration of a Palantir stock investment is paramount. This article aims to provide a balanced analysis of Palantir, helping you decide whether a Palantir investment before May 5th aligns with your financial goals. We will delve into Palantir's business model, recent performance, associated risks, and alternative investment strategies to help inform your decision regarding a Palantir stock investment.

H2: Understanding Palantir's Business Model and Recent Performance

H3: Data Analytics and Government Contracts: Palantir's core business revolves around providing big data analytics platforms, primarily to government agencies. This reliance on government contracts has been a significant driver of revenue.

- Successful Government Contracts: Palantir boasts numerous large contracts with agencies like the CIA and various branches of the US military. These contracts generate substantial revenue and provide a stable revenue stream.

- Revenue from Government Sector: A significant portion of Palantir's revenue stems from its government contracts, making this sector crucial to its overall financial health.

- Risks of Government Contract Dependence: Over-reliance on government contracts carries risks. Budget cuts, changes in administration, or shifts in government priorities could significantly impact Palantir's revenue.

H3: Commercial Growth and Future Prospects: Beyond the government sector, Palantir is actively expanding into the commercial market, targeting large enterprises across various industries.

- Key Commercial Clients: Palantir is securing contracts with major corporations in sectors like finance, healthcare, and energy, signaling its growing commercial footprint.

- Growth Trajectory in the Commercial Sector: The commercial sector presents a significant growth opportunity, but success depends on Palantir's ability to effectively compete with established players.

- Challenges in Competing with Established Players: Competition is fierce in the commercial data analytics market. Palantir must overcome challenges posed by established tech giants with extensive resources and market share.

H3: Financial Performance and Key Metrics: Analyzing Palantir's recent financial performance is crucial for any potential investor.

- Revenue Figures for the Past Few Quarters: Investors should closely examine revenue growth trends to assess the company's financial health and growth potential.

- Profitability Margins: Monitoring profitability margins reveals Palantir's efficiency in converting revenue into profit. Trends in margins will illustrate the company's ability to handle expenses and increase its bottom line.

- Debt Levels and Significant Changes: Understanding Palantir's debt levels provides insight into its financial risk profile. Significant changes in debt levels should be analyzed within the context of the broader financial picture.

H2: Analyzing the Risks Associated with Palantir Stock

H3: Market Volatility and Geopolitical Factors: The tech sector is inherently volatile, and Palantir is susceptible to fluctuations in the broader market and geopolitical events.

- Potential Impacts of Global Economic Downturns: Economic downturns can significantly impact investment in technology, leading to reduced demand for Palantir's services.

- Impact of Changes in Government Policies: Changes in government policies, particularly concerning technology and data privacy, could affect Palantir's contracts and operations.

- Competition within the Data Analytics Industry: The data analytics market is competitive. Palantir faces pressure from established players and emerging startups.

H3: Dependence on Large Contracts and Client Concentration: Palantir's reliance on a few large contracts creates concentration risk. Losing a major client could severely impact its revenue.

- Analysis of Client Concentration: Analyzing the distribution of revenue across clients is crucial for assessing this risk. A highly concentrated client base indicates higher vulnerability.

- Impact of Losing a Major Client: The potential financial consequences of losing a major client must be considered when evaluating the overall risk profile of a Palantir investment.

- Strategies to Mitigate This Risk: Palantir needs to diversify its client base to mitigate this risk and build resilience.

H3: Valuation and Stock Price Considerations: Determining whether Palantir stock is currently overvalued or undervalued requires careful consideration of its valuation metrics.

- Current Stock Price: The current market price reflects investor sentiment and expectations for future performance.

- P/E Ratio Compared to Competitors: Comparing Palantir's P/E ratio to its competitors provides insight into its relative valuation.

- Potential Future Price Targets: Analysts' price targets and future growth projections offer different perspectives on potential future stock performance.

H2: Weighing the Investment Options Before May 5th

H3: Factors to Consider Before Investing: Before investing in Palantir stock, carefully consider these factors:

- Risk Tolerance: Assess your comfort level with the inherent volatility of Palantir stock.

- Investment Timeline: Determine how long you plan to hold the investment, as this affects your risk tolerance.

- Diversification Strategy: Consider how a Palantir investment fits into your overall portfolio diversification strategy.

- Understanding the Company's Financial Health: Thoroughly analyze Palantir's financial statements and key performance indicators.

H3: Alternative Investment Strategies: Depending on your risk tolerance, explore alternative strategies:

- Diversification: Consider diversifying your portfolio across various asset classes to mitigate risk.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Index Funds and ETFs: These offer broader market exposure and potentially lower risk compared to individual stocks.

Conclusion: Making Informed Decisions on Your Palantir Stock Investment

Investing in Palantir stock before May 5th requires careful consideration of its business model, recent performance, and inherent risks. The company's dependence on government contracts, potential competition, and market volatility present significant challenges. However, its expansion into the commercial sector and its innovative data analytics platform offer potential for substantial growth. Before making any Palantir stock investment, conduct thorough due diligence, understand your risk tolerance and investment goals, and consider consulting a financial advisor. Remember, a successful Palantir investment requires a comprehensive understanding of the company's prospects and a realistic assessment of the associated risks. Make informed decisions regarding your Palantir investment strategy.

Featured Posts

-

New Uk Visa Regulations Targeting Visa Misuse And Fraud

May 09, 2025

New Uk Visa Regulations Targeting Visa Misuse And Fraud

May 09, 2025 -

Is It Too Late To Buy Palantir Stock Potential 40 Growth By 2025 Analyzed

May 09, 2025

Is It Too Late To Buy Palantir Stock Potential 40 Growth By 2025 Analyzed

May 09, 2025 -

Brekelmans En India Samenwerking En Toekomstperspectieven

May 09, 2025

Brekelmans En India Samenwerking En Toekomstperspectieven

May 09, 2025 -

February 23 Nyt Strands Solutions Game 357 Hints And Answers Guide

May 09, 2025

February 23 Nyt Strands Solutions Game 357 Hints And Answers Guide

May 09, 2025 -

Stephen Kings Thoughts On Stranger Things And It A Comparison

May 09, 2025

Stephen Kings Thoughts On Stranger Things And It A Comparison

May 09, 2025