Palantir Stock Prediction 2025: 40% Increase – Time To Buy?

Table of Contents

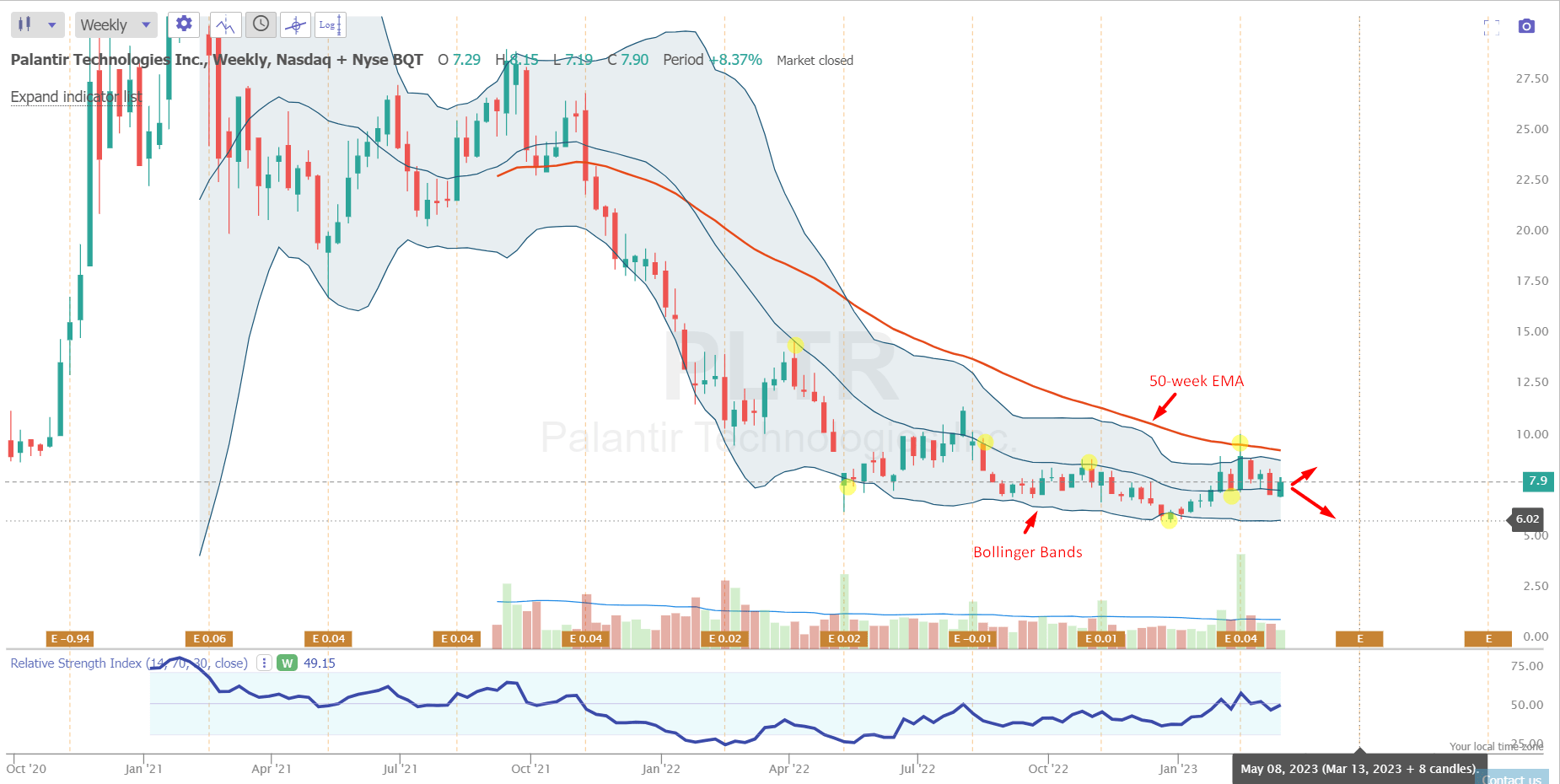

Palantir Technologies (PLTR) has captured the attention of investors worldwide. With its innovative data analytics platform and significant government contracts, the company presents a compelling investment case. Recent market fluctuations have sparked intense debate surrounding a Palantir stock prediction 2025, with some analysts suggesting a potential 40% increase in stock value. This article delves into this bold prediction, examining the factors that could contribute to – or hinder – such substantial growth. We'll analyze Palantir's current market position, explore potential future influences, and discuss the associated risks, helping you form your own informed opinion on a Palantir stock prediction 2025.

2. Main Points:

2.1. Palantir's Current Market Position and Growth Trajectory:

H3: Analyzing Palantir's Financial Performance:

Palantir's financial performance is crucial for any Palantir stock prediction 2025. Recent earnings reports reveal a company experiencing significant revenue growth, though profitability remains a key area of focus. Analyzing key financial metrics is essential.

- Key financial metrics (revenue, EPS, debt): While revenue is growing steadily, analysts closely monitor earnings per share (EPS) and the company's debt levels to gauge long-term sustainability.

- Comparison to competitors: Palantir's performance needs to be benchmarked against competitors like Databricks and Snowflake to ascertain its relative market position and potential for future outperformance.

- Growth projections: Examining analyst growth projections offers valuable insight into potential future performance, although these are inherently uncertain and subject to revision.

H3: Government Contracts and Commercial Growth:

Palantir's revenue stream traditionally leaned heavily on government contracts. However, the company is actively expanding its commercial footprint. The success of this diversification strategy is crucial to any accurate Palantir stock prediction 2025.

- Significant government contracts: These provide a stable revenue base but are often subject to budgetary constraints and political cycles.

- Commercial client acquisition: Securing and retaining significant commercial clients is vital for long-term sustainable growth and reduced reliance on government contracts.

- Market share within respective sectors: Analyzing Palantir’s market share in both the government and commercial sectors gives a clearer picture of its competitive standing and future growth potential.

H3: Technological Innovation and Competitive Advantage:

Palantir’s technological prowess is a major factor in any Palantir stock prediction 2025. Its platforms, Foundry and Gotham, represent significant advancements in data analytics and AI.

- Key technologies (e.g., Foundry, Gotham): These platforms are key to its competitive advantage, enabling sophisticated data analysis across diverse sectors.

- R&D investments: Consistent investment in research and development is vital for maintaining a technological edge against competitors.

- Patent portfolio: A strong patent portfolio protects Palantir’s intellectual property and its competitive advantage.

- Competitive landscape analysis: Analyzing competitors’ advancements and market strategies is crucial for evaluating Palantir's long-term sustainability and potential for market share growth.

2.2. Factors Influencing Palantir Stock Price in the Next Few Years:

H3: Macroeconomic Factors and Market Sentiment:

Global macroeconomic conditions significantly influence investor sentiment towards tech stocks, including Palantir.

- Potential risks (recession, inflation): Economic downturns can negatively impact technology spending, affecting Palantir's revenue growth.

- Opportunities (government spending on tech): Increased government investment in technology can provide a boost to Palantir's government contracts.

- Overall market trends: The overall performance of the technology sector and the broader stock market will significantly impact Palantir's stock price.

H3: Geopolitical Events and their Influence:

Geopolitical instability can create uncertainty and impact Palantir's business operations and stock price.

- Impact of international conflicts: Conflicts can disrupt supply chains and affect client relationships, particularly in government contracts.

- Government regulations: Changes in government regulations, particularly regarding data privacy and security, can impact Palantir's operations.

- Political stability in key markets: Political instability in key markets can negatively affect business operations and investment sentiment.

H3: Competition and Technological Disruption:

The data analytics and AI market is fiercely competitive, with the potential for disruptive technologies to emerge.

- Key competitors: Analyzing the strengths and weaknesses of key competitors is crucial for assessing Palantir’s long-term competitiveness.

- Emerging technologies: New technologies could potentially disrupt Palantir’s market position, requiring constant innovation and adaptation.

- Potential threats to Palantir's market position: Identifying potential threats helps in developing strategies to mitigate those risks.

2.3. Valuation and Investment Considerations:

H3: Analyzing Palantir's Valuation Metrics:

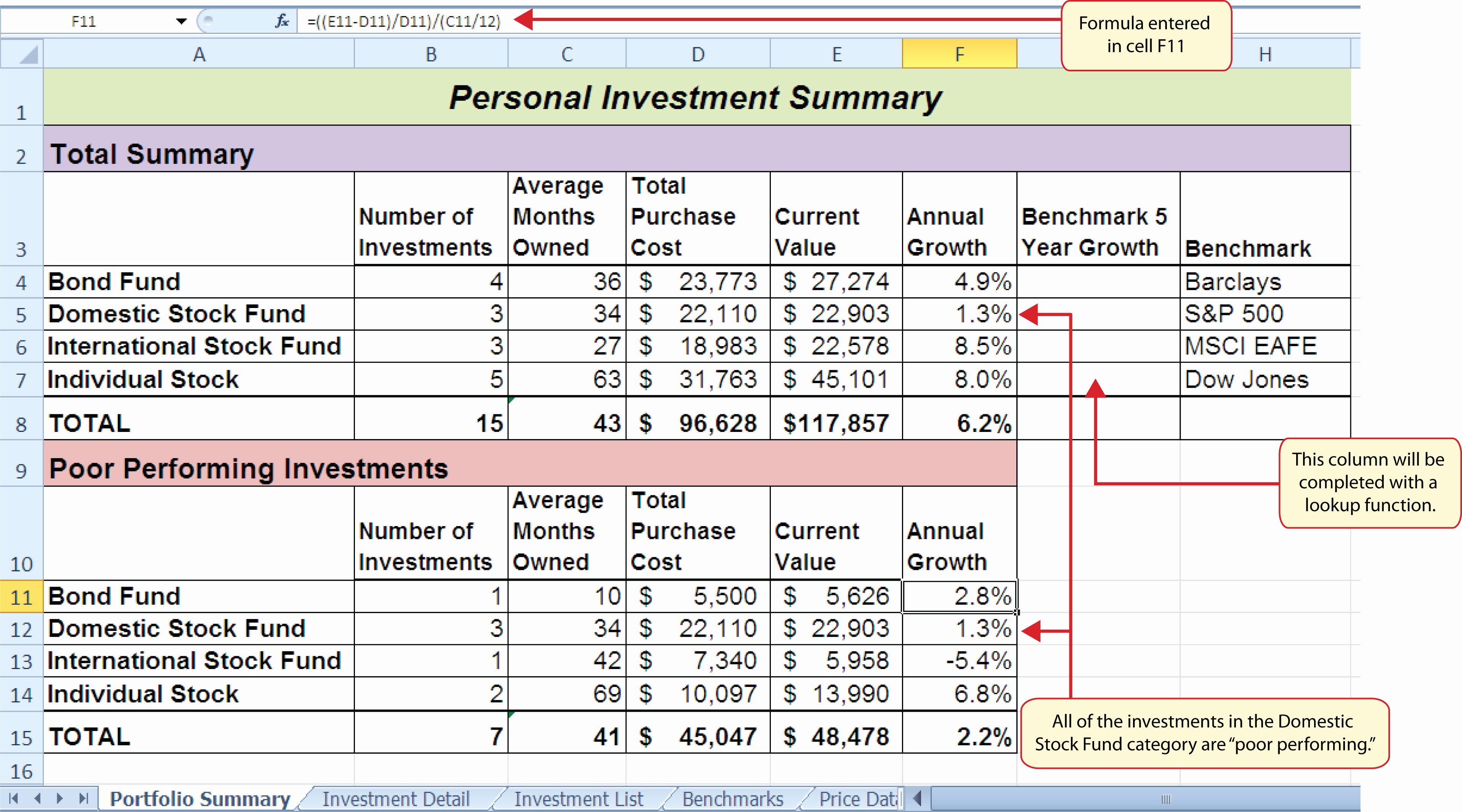

Understanding Palantir’s valuation is crucial for any investment decision related to a Palantir stock prediction 2025.

- Current valuation: Analyzing current valuation metrics, such as the Price-to-Earnings (P/E) ratio and Price/Earnings to Growth (PEG) ratio, provides insights into the company’s relative valuation.

- Comparison to industry peers: Comparing Palantir's valuation with that of its peers offers a perspective on whether it is overvalued or undervalued.

- Potential future valuation based on growth projections: Using projected future earnings, one can estimate a potential future valuation.

H3: Risks and Potential Downsides:

Investing in Palantir carries inherent risks.

- Risks associated with high valuation: High valuations can make the stock vulnerable to market corrections.

- Competition: Intense competition could hinder Palantir’s market share growth.

- Dependence on government contracts: Over-reliance on government contracts exposes Palantir to budgetary constraints and political changes.

- Technological disruptions: The emergence of disruptive technologies could render Palantir’s current offerings obsolete.

H3: Diversification and Risk Management:

Diversification and risk management are essential aspects of any investment strategy.

- Importance of not putting all your eggs in one basket: Diversifying investments across different asset classes reduces overall portfolio risk.

- Risk tolerance: Investors should assess their own risk tolerance before investing in Palantir.

- Investment strategies: Various investment strategies can be employed to mitigate risks and maximize returns.

3. Conclusion: Is a 40% Increase in Palantir Stock by 2025 Realistic?

A 40% increase in Palantir stock by 2025 is certainly ambitious. While Palantir possesses significant potential for growth, driven by technological innovation and expanding commercial reach, it also faces considerable challenges. Macroeconomic factors, geopolitical events, and intense competition could impact its trajectory. A thorough assessment of its financial performance, valuation, and the inherent risks is vital before making any investment decision. Therefore, while a Palantir stock prediction 2025 of a 40% increase is plausible given the potential, it’s not guaranteed. Conduct your own thorough due diligence, consult with a financial advisor, and consider your individual risk tolerance before investing. Further research into Palantir's financials, competitor analysis, and industry forecasts will be invaluable in forming your own informed opinion on a Palantir stock prediction 2025 and whether it's a worthwhile investment for your portfolio.

Featured Posts

-

Your Real Safe Bet Choosing The Right Investment Portfolio For You

May 09, 2025

Your Real Safe Bet Choosing The Right Investment Portfolio For You

May 09, 2025 -

India And Us Set For Bilateral Trade Agreement Negotiations

May 09, 2025

India And Us Set For Bilateral Trade Agreement Negotiations

May 09, 2025 -

Beyonces Cowboy Carter Doubled Streams Post Tour Debut

May 09, 2025

Beyonces Cowboy Carter Doubled Streams Post Tour Debut

May 09, 2025 -

The Trade Wars Impact On Crypto One Cryptocurrency That Could Thrive

May 09, 2025

The Trade Wars Impact On Crypto One Cryptocurrency That Could Thrive

May 09, 2025 -

Wynne Evans Go Compare Advert Future Uncertain After Strictly Controversy

May 09, 2025

Wynne Evans Go Compare Advert Future Uncertain After Strictly Controversy

May 09, 2025