Plummeting Home Sales Indicate Housing Market Crisis

Table of Contents

Factors Contributing to the Decline in Home Sales

Several interconnected factors are driving the decline in home sales, creating a perfect storm for the housing market. These include high mortgage rates, rampant inflation, recession fears, and ironically, an inventory shortage.

-

Rising Mortgage Rates: The Federal Reserve's aggressive interest rate hikes have significantly increased mortgage rates. This has made homeownership considerably less affordable for many potential buyers, sharply reducing demand. Even those who can afford higher monthly payments are hesitant given the uncertainty in the market. The impact of higher rates on affordability is immense, pricing many potential first-time homebuyers out of the market entirely.

-

High Inflation: Soaring inflation is eroding purchasing power. Consumers are facing higher prices for everyday goods and services, leaving less disposable income for large purchases like homes. This reduced spending power directly impacts demand, contributing to the decrease in home sales. The uncertainty about future inflation also contributes to buyer hesitation.

-

Recession Fears: Growing concerns about a potential recession are causing many prospective buyers to postpone their purchasing decisions. Uncertainty about job security and future economic stability makes committing to a significant financial investment like a home a risky proposition. This cautious approach further dampens demand.

-

Inventory Shortage (A Paradox): While it might seem counterintuitive, the limited supply of homes on the market is also contributing to the decline in sales. The current inventory simply isn't meeting the demand at the current price points. The lack of inventory means fewer available homes for sale and less competition, resulting in fewer transactions. This shortage is further compounded by increased construction costs, making it more expensive to build new homes, thus reducing supply even more.

-

Increased Construction Costs: The cost of building materials, labor, and land has skyrocketed. This has made it more expensive for developers to build new homes, leading to a further reduction in supply and contributing to the affordability crisis. This is a cyclical problem; fewer builds mean less inventory which further drives prices up, creating an even tighter market.

The Economic Impact of Plummeting Home Sales

The consequences of plummeting home sales extend far beyond the real estate sector, rippling through the broader economy.

-

Reduced Revenue for Related Industries: Fewer home sales mean reduced revenue for real estate agents, mortgage brokers, home builders, contractors, furniture stores, and other related businesses. This impacts jobs and investment in local economies.

-

Potential Job Losses: A slowdown in the housing market inevitably leads to job losses in the construction sector and related industries. This has a cascading effect, potentially impacting local communities heavily reliant on construction-related employment.

-

Negative Impact on Local and National Economies: The housing market is a significant driver of economic activity. A downturn in home sales translates to decreased consumer spending, reduced tax revenue for local governments, and a general slowdown in economic growth.

-

Decreased Tax Revenue for Local Governments: Property taxes are a crucial source of revenue for many local governments. Fewer home sales and lower property values can significantly impact their budgets, leading to potential cuts in essential services.

-

Impact on Investor Portfolios: Investors heavily invested in real estate may see a decline in their portfolio values, causing a ripple effect on investment strategies and potentially affecting broader markets.

Signs of a Housing Market Crisis and Potential Solutions

The current situation raises concerns about a potential housing market crisis. While some argue it's merely a market correction, the severity of the decline warrants careful consideration.

-

Market Trend Analysis: Analyzing current market trends, including price reductions, increased inventory in certain segments, and shifts in buyer behavior, is crucial for forecasting the future. Predictions vary widely, depending on the influencing economic factors.

-

Government Intervention: Government intervention, such as adjustments to interest rates or policies aimed at stimulating the market, could play a significant role in stabilizing the housing market. However, the effectiveness and timing of such interventions are often debated.

-

Changes in Buyer Behavior: Understanding changes in buyer behavior—increased caution, stricter financial qualification requirements, and shifting preferences—is crucial for both buyers and sellers to navigate the market effectively.

-

Strategies for Navigating the Market: Both buyers and sellers need to adopt strategic approaches to navigate the market effectively. This involves careful planning, realistic price expectations, and understanding current market dynamics.

-

Long-Term Implications: The long-term implications of the current downturn remain uncertain, dependent on various economic factors and government policies. Understanding the potential long-term implications is crucial for making informed decisions.

Conclusion

The plummeting home sales signal a significant challenge for the housing market, and potentially the broader economy. High mortgage rates, inflation, recession fears, and inventory shortages are creating a perfect storm. Understanding the economic impact of this downturn, analyzing current market trends, and exploring potential solutions are crucial steps in mitigating the potential crisis. Monitor the housing market carefully, understand the factors impacting home sales, and prepare for potential market changes. By staying informed and making informed decisions, you can better navigate this challenging period. Continue to research reputable sources to stay abreast of the ever-evolving situation surrounding plummeting home sales and the ongoing housing market crisis.

Featured Posts

-

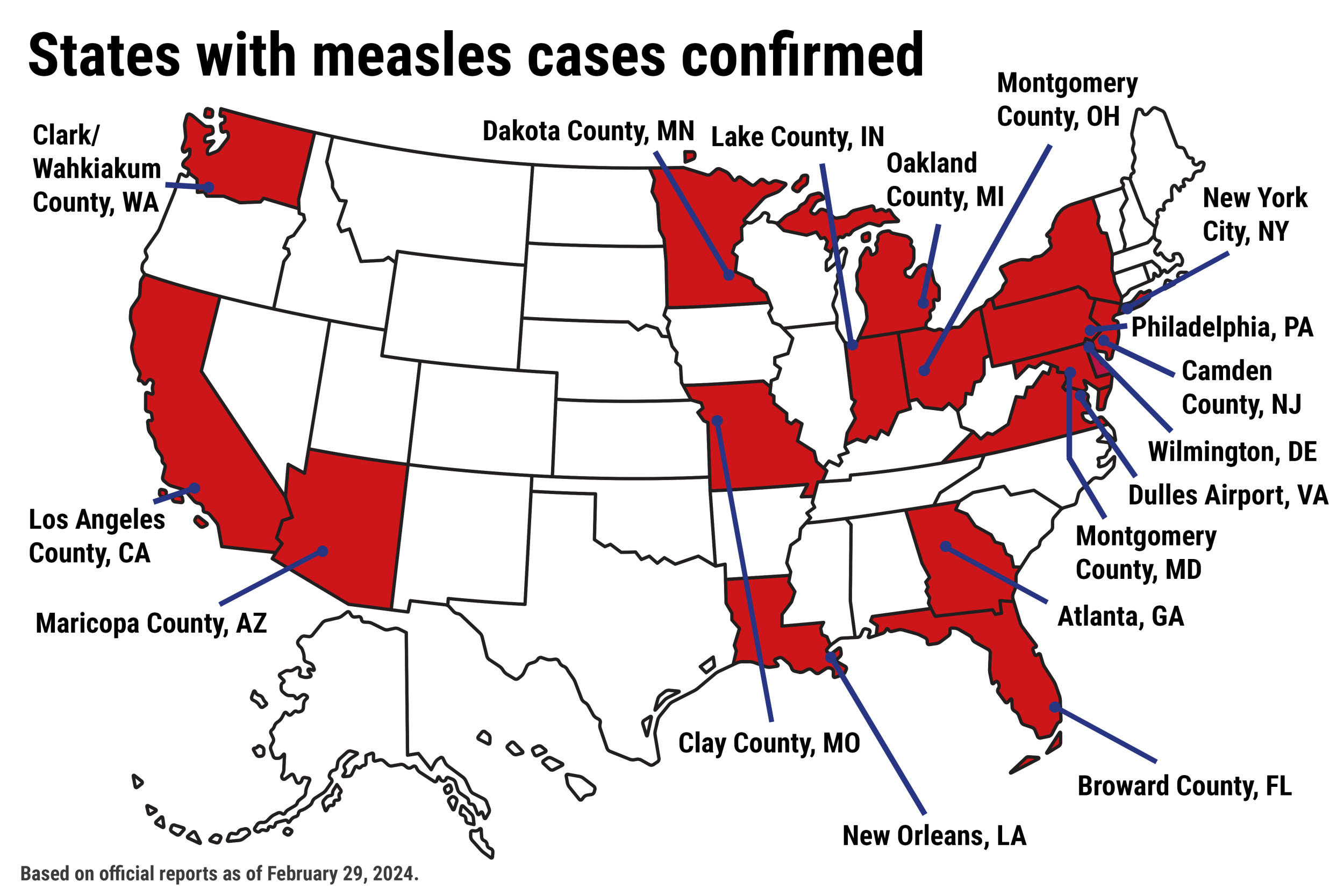

Measles Cases Rising Where The Outbreak Is Affecting The U S

May 30, 2025

Measles Cases Rising Where The Outbreak Is Affecting The U S

May 30, 2025 -

Affaire Marine Le Pen Verdict Appel 2026 L Analyse De Laurent Jacobelli

May 30, 2025

Affaire Marine Le Pen Verdict Appel 2026 L Analyse De Laurent Jacobelli

May 30, 2025 -

Analyser Og Prognose Danmark Portugal Fodboldkamp

May 30, 2025

Analyser Og Prognose Danmark Portugal Fodboldkamp

May 30, 2025 -

Texas Under Extreme Heat Warning 111 F Temperatures Expected

May 30, 2025

Texas Under Extreme Heat Warning 111 F Temperatures Expected

May 30, 2025 -

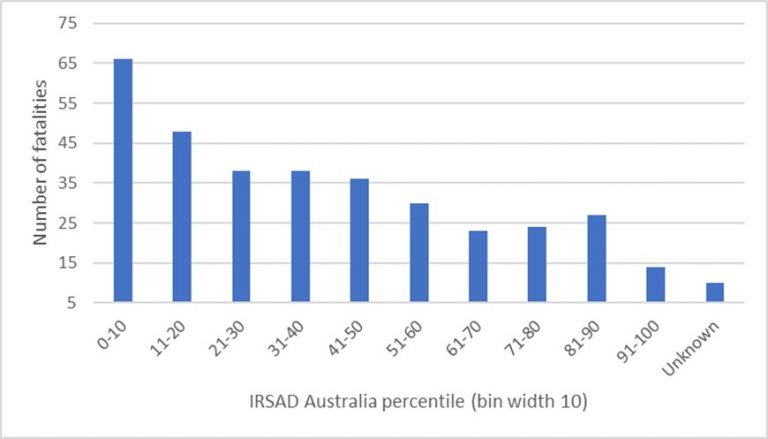

Heatwave Fatalities In England Reach 311 A Call For Improved Heatwave Preparedness

May 30, 2025

Heatwave Fatalities In England Reach 311 A Call For Improved Heatwave Preparedness

May 30, 2025