Principal Financial Group (PFG): What 13 Analysts Are Saying

Table of Contents

Analyst Ratings and Price Targets for PFG

Thirteen analysts have weighed in on Principal Financial Group, offering a diverse range of opinions reflected in their ratings and price targets. Understanding these variations is essential for investors seeking to gauge market sentiment toward PFG stock. The analysis reveals a mixed bag of opinions, highlighting the complexities involved in evaluating this financial giant.

- Number of "Buy" ratings: 5

- Number of "Hold" ratings: 6

- Number of "Sell" ratings: 2

- Average price target: $78.50

- Highest price target: $92.00

- Lowest price target: $65.00

Currently, PFG's stock price sits at [Insert Current Stock Price Here]. This means the average analyst price target represents a [Calculate Percentage Change] potential upside (or downside, depending on the current price). The wide range of price targets, from a high of $92.00 to a low of $65.00, emphasizes the varying degrees of optimism and pessimism among analysts regarding Principal Financial Group's future performance. Investors seeking a buy rating PFG should carefully consider these divergences.

Key Factors Influencing Analyst Opinions on PFG

Analyst opinions on Principal Financial Group are shaped by a complex interplay of macroeconomic and company-specific factors. Understanding these influences is crucial for interpreting analyst ratings and price targets.

- Interest rate impact on PFG's performance: Rising interest rates can positively impact PFG's investment income but might also affect consumer demand for certain financial products.

- Impact of market volatility on PFG's investments: Market fluctuations directly impact the value of PFG's investment portfolio, influencing its overall financial performance. This is a significant factor shaping analyst sentiment towards PFG financial performance.

- Effect of PFG's diversification strategies: PFG's diversified product offerings and investment strategies can mitigate risks associated with market volatility and changing economic conditions. Analysts assess the effectiveness of this diversification in their ratings.

- Influence of competition within the financial services sector: The competitive landscape within the financial services industry significantly impacts PFG's market share and profitability. Analysts consider the competitive advantage of Principal Financial Group investment strategy in their assessments.

Strengths and Weaknesses Identified by Analysts

The analysts' reports highlight both strengths and weaknesses within Principal Financial Group. A balanced understanding of these factors is necessary for a comprehensive investment analysis.

- Top 3 strengths identified by analysts:

- Strong balance sheet and financial stability.

- Diverse product offerings catering to a wide range of customer needs.

- Established brand recognition and reputation in the financial services industry.

- Top 3 weaknesses identified by analysts:

- Exposure to market risks associated with interest rate fluctuations and market volatility.

- Competitive pressures from other major players in the financial services sector.

- Potential regulatory changes that could impact PFG's operations and profitability.

- Potential future risks for PFG: Geopolitical instability, economic downturns, and shifts in consumer behavior all pose potential future risks for PFG. A thorough risk assessment PFG is crucial for any investor.

Analyst Consensus and Implications for Investors

The overall consensus among the 13 analysts on Principal Financial Group is cautiously optimistic, with a slight tilt towards holding rather than actively buying the stock. This suggests a balanced view of PFG's future prospects, acknowledging both its strengths and vulnerabilities.

- Overall outlook on PFG's short-term performance: Analysts generally expect moderate growth in the short term, influenced by prevailing macroeconomic conditions.

- Overall outlook on PFG's long-term performance: The long-term outlook is more positive, reflecting PFG's strong fundamentals and diversified business model. This positive outlook for PFG investment is based on the assumption of continued market stability and favorable economic growth.

- Investment recommendations based on the analyst consensus: The mixed signals from analysts suggest a need for careful individual assessment before investing in PFG stock. Investors should consider their own risk tolerance and long-term financial goals.

Conclusion: Principal Financial Group (PFG): Making Informed Investment Decisions

In conclusion, the 13 analysts' opinions on Principal Financial Group present a mixed picture, reflecting the inherent complexities of evaluating a large financial institution in a dynamic market. While there is a degree of optimism regarding PFG's long-term prospects, the varying price targets and ratings underscore the need for thorough due diligence. Understanding the key factors influencing analyst opinions, including macroeconomic conditions, company-specific factors, and potential risks, is crucial for making informed investment decisions with PFG. Therefore, before investing in Principal Financial Group stock, we strongly encourage conducting further research, including reviewing PFG's financial statements and exploring additional analyst reports to gain a complete understanding of PFG's performance. Making informed investment decisions with PFG requires a comprehensive approach that goes beyond this summary analysis.

Featured Posts

-

Limited Time Offer Get 3 Months Of Apple Tv For Only 3

May 17, 2025

Limited Time Offer Get 3 Months Of Apple Tv For Only 3

May 17, 2025 -

Angi Borg Warner And Rockwell Automation Among Wednesdays Best Stocks

May 17, 2025

Angi Borg Warner And Rockwell Automation Among Wednesdays Best Stocks

May 17, 2025 -

Yankees Vs Mariners Expert Mlb Game Prediction And Betting Odds

May 17, 2025

Yankees Vs Mariners Expert Mlb Game Prediction And Betting Odds

May 17, 2025 -

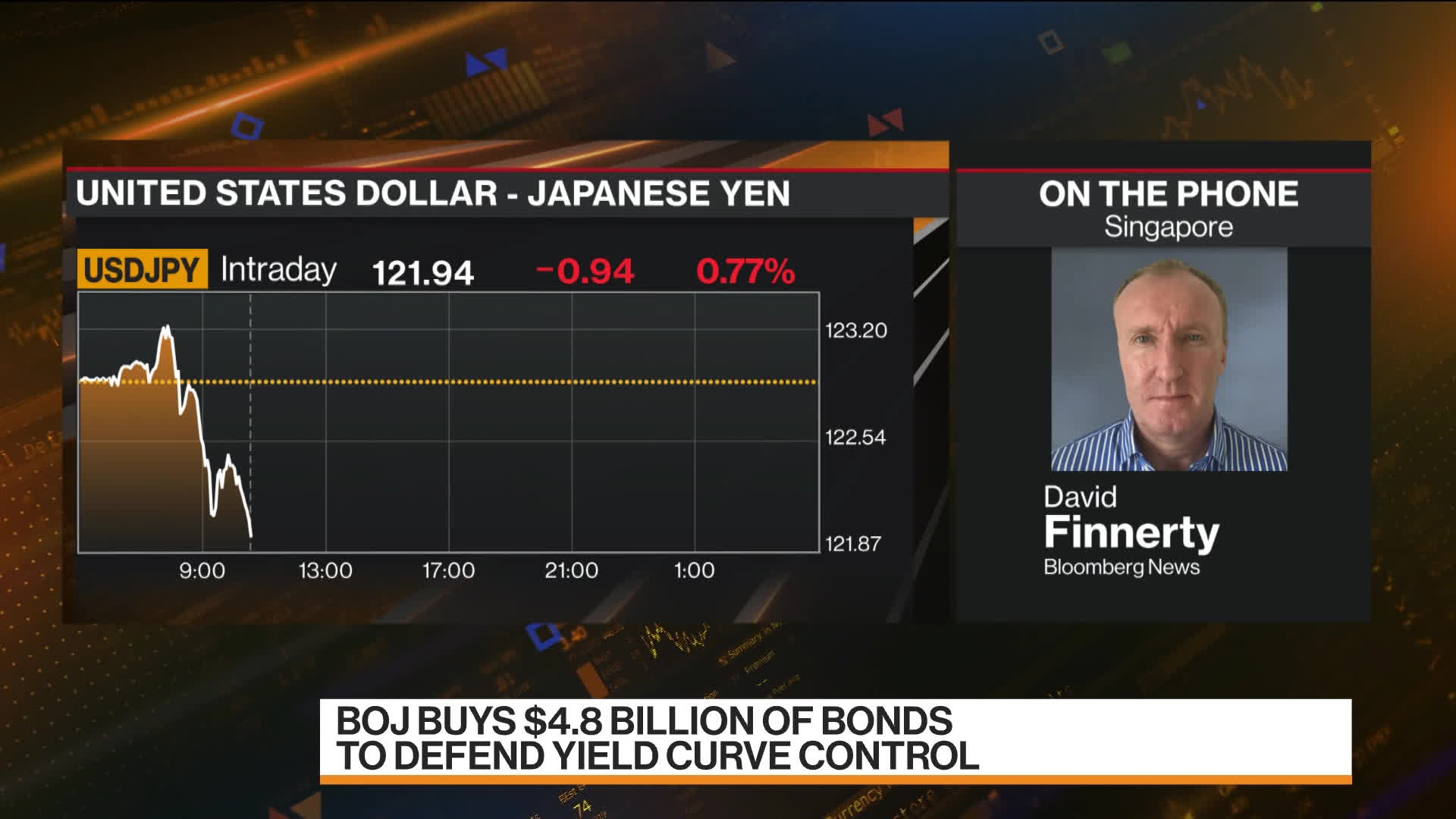

Investor Sentiment Shifts Amidst Japans Steepening Bond Curve

May 17, 2025

Investor Sentiment Shifts Amidst Japans Steepening Bond Curve

May 17, 2025 -

Analyzing Trumps Middle East Trip May 15 2025 Presidential Context And Future Outlook

May 17, 2025

Analyzing Trumps Middle East Trip May 15 2025 Presidential Context And Future Outlook

May 17, 2025