Private Equity Firm Acquires Boston Celtics For Record-Breaking $6.1 Billion

Table of Contents

The Buyer: Unveiling the Private Equity Firm Behind the Acquisition

The acquisition of the Boston Celtics was spearheaded by [Insert Name of Private Equity Firm Here], a leading private equity firm based in [Insert Location Here]. Known for their strategic investments in high-growth sectors, [Insert Name of Private Equity Firm Here] has built a reputation for identifying and capitalizing on undervalued assets with significant long-term potential. Their investment strategy focuses on sectors demonstrating strong growth trajectories, and their interest in sports represents a strategic expansion of their portfolio into the lucrative world of professional sports investment.

Their portfolio already includes investments in [Insert examples of other notable investments, if applicable, showcasing their financial strength and expertise. If no public info is available, this section can be removed or replaced with a general statement about their investment focus]. This acquisition demonstrates their confidence in the Boston Celtics' brand strength and future growth prospects, as well as their ambition to become major players in the world of NBA ownership.

- Name and location of the private equity firm: [Insert Name and Location Here]

- Summary of their investment history and focus: [Insert Summary Here. Focus on growth and strategic investments.]

- Mention of any previous sports-related investments: [Insert Information Here, or remove if unavailable]

- Their stated goals for the Celtics ownership: [Insert Information Here if available, focusing on growth and potential return on investment.]

The Record-Breaking Price: Analyzing the $6.1 Billion Valuation

The $6.1 billion valuation assigned to the Boston Celtics is unprecedented in NBA history, significantly surpassing previous record-breaking sales. Several factors contributed to this extraordinary price tag. The Celtics boast a rich history, a passionate and loyal fanbase, and consistent strong revenue streams.

Their revenue generation extends beyond ticket sales, encompassing merchandise sales, lucrative media rights deals, and various sponsorship opportunities. The team's consistently strong performance over the years, both on and off the court, plays a crucial role in maintaining its high market value. The potential for future growth, given the ongoing expansion of the NBA's global reach and the increasing value of media rights, further fueled the high valuation.

- Breakdown of the Celtics' revenue streams: Ticket sales, merchandise, media rights, sponsorships, etc.

- Comparison to other high-value NBA franchise sales: [Insert comparisons with other recent sales and percentage increases here]

- Analysis of the potential return on investment for the private equity firm: [Speculate on ROI based on revenue streams and potential future growth. This could be generalized to avoid financial predictions.]

- Factors contributing to the high valuation: Strong brand, loyal fan base, consistent team performance, lucrative media rights deals, potential for future growth.

Impact on the Boston Celtics and the NBA

This acquisition will undoubtedly have far-reaching implications for both the Boston Celtics and the NBA as a whole. The new ownership group’s strategic vision could lead to significant changes in various aspects of the franchise's operations. This could include alterations to the coaching staff, a revised approach to player recruitment and development, and potentially even changes to the fan experience at TD Garden.

The increased financial resources brought in by the private equity firm could also translate to significant investments in team infrastructure, technological advancements, and marketing initiatives aimed at expanding the Celtics' global brand presence. However, the acquisition also raises questions about the competitive balance within the NBA. The influx of capital could create a wider disparity in resources between teams.

- Possible changes in coaching staff or management: [Speculate on potential changes, focusing on experience and potential future changes]

- Expected impact on player recruitment and team strategy: [Speculate on potential shifts in player recruitment based on the new ownership's potential focus]

- Potential changes to game-day experience for fans: [Speculate on improvements or potential changes to the fan experience]

- Broader implications for the NBA league structure and competitive balance: [Discuss the potential for increased disparity in resources between teams]

Speculation and Future Outlook for the Boston Celtics

The long-term strategy of [Insert Name of Private Equity Firm Here] will likely involve significant investments in the Celtics, aiming to maximize the franchise’s value and potential. This could translate into upgrades to team facilities, investments in player development programs, and aggressive marketing campaigns targeting a broader global audience.

The possibility of the Celtics becoming a more consistent NBA championship contender under the new ownership is a subject of much speculation. The increased financial resources combined with a strategic approach to team management could significantly improve their chances. The acquisition signifies a new era for the Celtics, one filled with potential for both on-court success and off-court growth.

Conclusion

The acquisition of the Boston Celtics for a record-breaking $6.1 billion by a prominent private equity firm marks a pivotal moment in the history of professional basketball. This unprecedented deal underscores the significant financial value of top-tier sports franchises and reflects the increasing interest of private equity in the sports industry. The future success of the Celtics under their new ownership will be closely watched, and this acquisition is expected to shape the landscape of the NBA for years to come.

Call to Action: Stay tuned for further updates on the Boston Celtics and the impact of this historic acquisition. Learn more about private equity investment in sports and the ever-evolving world of professional basketball. Follow our coverage of the Boston Celtics' journey under new ownership!

Featured Posts

-

Tenis Iga Svjontek Nastavlja Niz Pobjeda

May 17, 2025

Tenis Iga Svjontek Nastavlja Niz Pobjeda

May 17, 2025 -

Mariners Vs Tigers Injured Players For Opening Series March 31 April 2

May 17, 2025

Mariners Vs Tigers Injured Players For Opening Series March 31 April 2

May 17, 2025 -

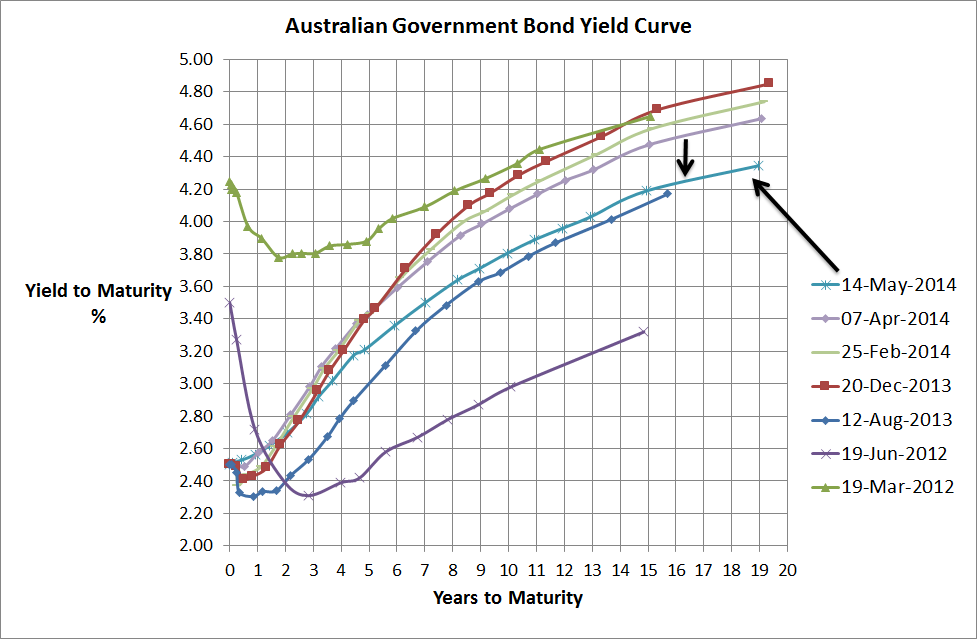

Analysis Japans Steep Bond Yield Curve And Its Economic Impact

May 17, 2025

Analysis Japans Steep Bond Yield Curve And Its Economic Impact

May 17, 2025 -

Reeses Wisdom Van Liths Wnba Preparation

May 17, 2025

Reeses Wisdom Van Liths Wnba Preparation

May 17, 2025 -

Air Traffic Controllers Exclusive Account Of Averted Midair Collision

May 17, 2025

Air Traffic Controllers Exclusive Account Of Averted Midair Collision

May 17, 2025