PwC Exits Multiple Countries: A Bangkok Post Report On Accounting Scandals

Table of Contents

The Bangkok Post Report: Key Findings and Revelations

The Bangkok Post report serves as a crucial source of information regarding PwC's involvement in a series of accounting scandals. The report details alleged misconduct and irregularities that have led to PwC's decision to withdraw its services from several countries. While specifics may vary depending on jurisdiction, the overall pattern points towards systemic issues requiring immediate attention.

The report highlights specific instances of alleged:

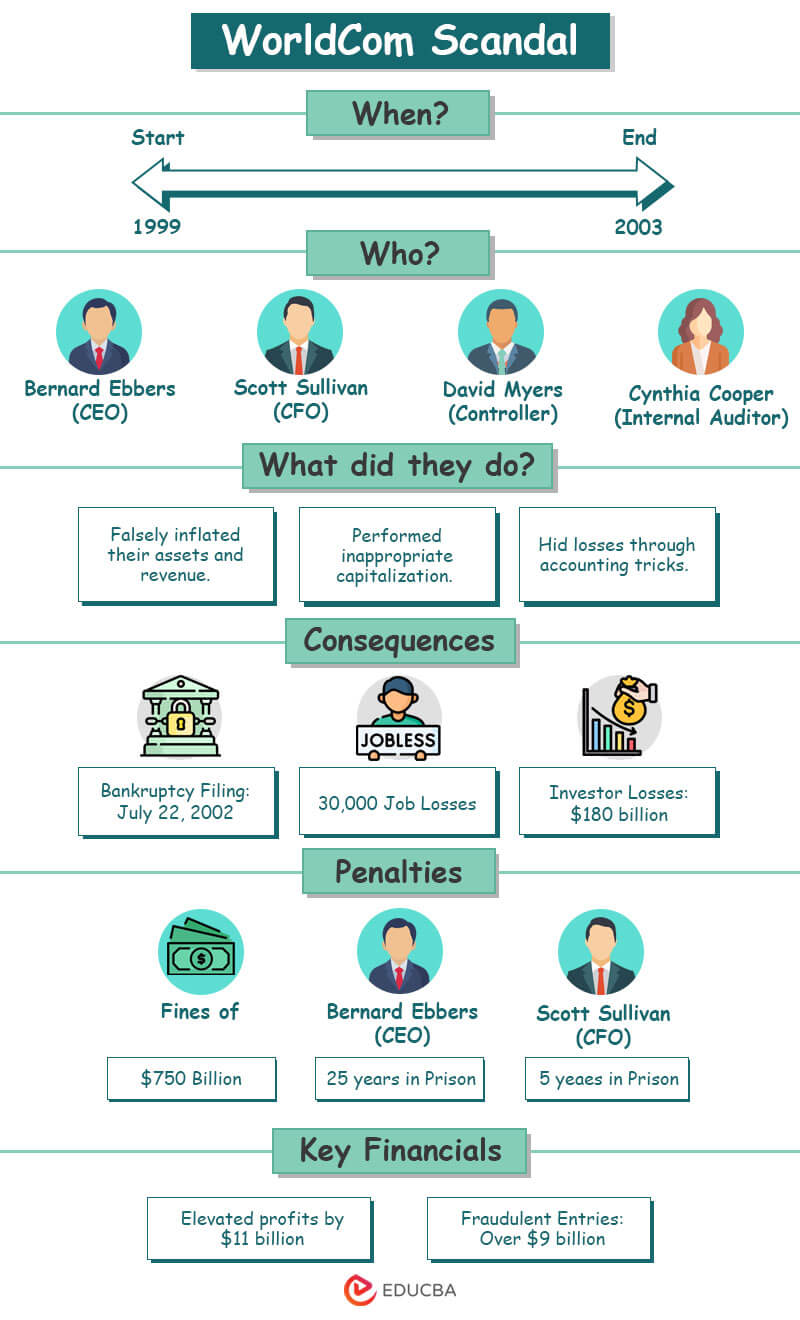

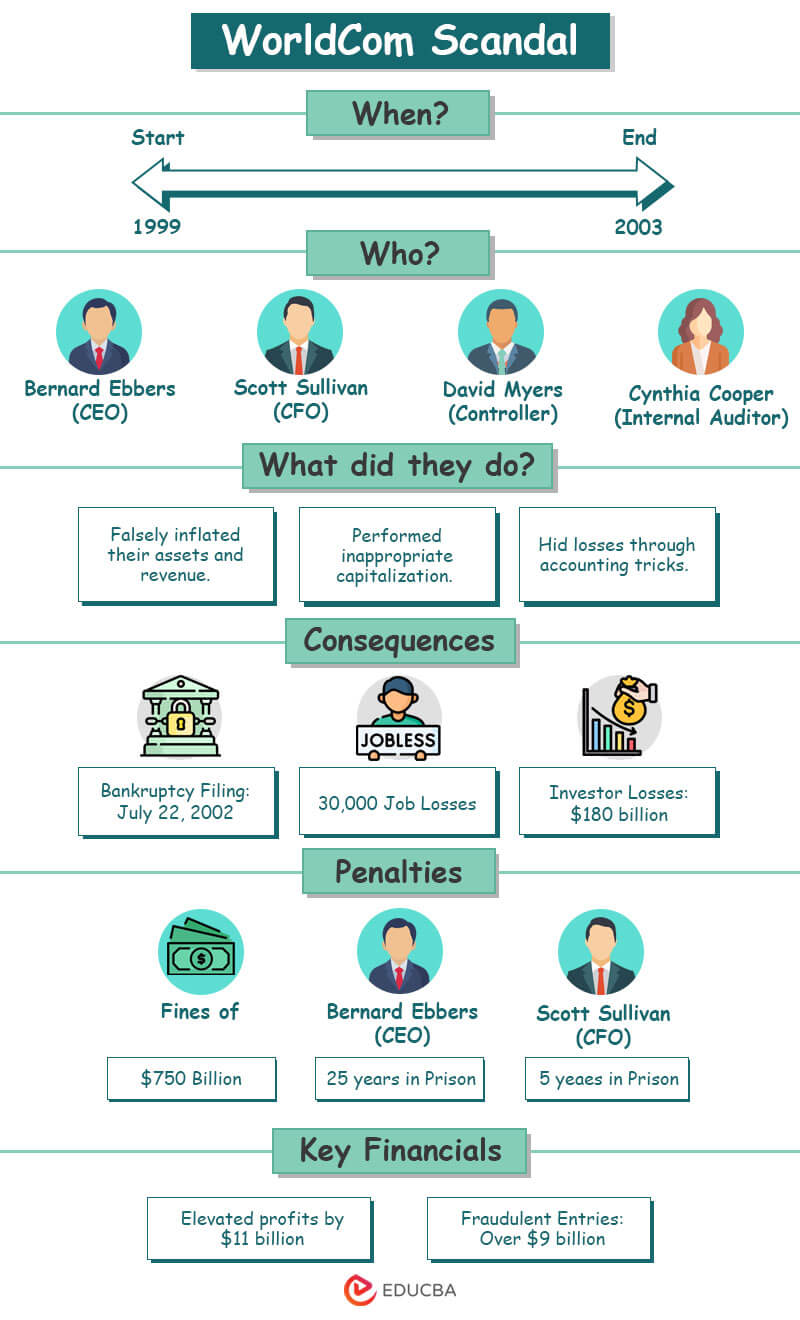

- Fraudulent accounting practices: The report suggests instances where PwC allegedly failed to detect or properly report fraudulent activities by its clients, leading to significant financial losses for stakeholders.

- Misrepresentation of financial data: In several cases, the report alleges that PwC knowingly or unknowingly allowed its clients to misrepresent their financial performance, creating a misleading picture for investors.

- Lack of due diligence: The report criticizes PwC for what it describes as insufficient due diligence in its audits, leading to a failure to identify critical financial irregularities.

Specific examples mentioned in the report include:

- Afghanistan: The report alleges PwC's involvement in audits that failed to detect significant financial mismanagement.

- [Insert another country mentioned in the Bangkok Post report]: [Describe the specific allegations regarding this country].

- [Insert another country mentioned in the Bangkok Post report]: [Describe the specific allegations regarding this country].

The impact on clients and stakeholders has been substantial, leading to financial losses, reputational damage, and erosion of investor confidence.

Reasons Behind PwC's Exits from Multiple Countries

PwC's decision to exit several countries is directly linked to the accounting scandals detailed in the Bangkok Post report and other similar investigations. The firm is likely facing a multitude of pressures, including:

- Increased regulatory scrutiny and potential fines: Regulatory bodies across the globe are intensifying their investigations into PwC's auditing practices, potentially leading to substantial fines and legal penalties. The threat of significant financial penalties is a powerful incentive for a proactive response.

- Damage to PwC's reputation and loss of client trust: The negative publicity surrounding the scandals has severely damaged PwC's reputation, leading to a loss of client trust and contracts. Maintaining a strong reputation is vital for any accounting firm. The loss of clients leads directly to a loss of revenue.

- Proactive measures to mitigate further risk: By withdrawing from certain countries, PwC aims to limit its exposure to further legal and reputational risks. This proactive strategy attempts to control the damage and rebuild trust over time.

The Global Impact of PwC's Actions

The ripple effects of PwC's actions extend far beyond the specific countries involved. The scandals raise serious questions about the integrity of the auditing profession and have broader implications for the global financial system:

- Concerns about the auditing profession's integrity: The incidents undermine public trust in the ability of auditing firms to provide accurate and reliable financial reports.

- Potential impact on the reliability of financial reporting: Investors rely on audited financial statements to make informed decisions. The PwC scandals raise concerns about the overall reliability of these reports.

- Increased demand for stricter regulatory oversight: There is a growing call for increased regulatory oversight and stricter auditing standards to prevent similar scandals from occurring in the future.

Future Implications and Potential Reforms in the Accounting Industry

To prevent future accounting scandals of this magnitude, significant reforms are necessary within the accounting industry. These reforms should focus on:

- Enhanced auditing procedures and stricter regulations: Auditing procedures need to be strengthened, with a greater emphasis on detecting and reporting fraudulent activities. Regulatory bodies must establish stricter penalties for non-compliance.

- Increased transparency and accountability measures: Auditing firms need to be more transparent about their practices and more accountable for their actions. Increased public scrutiny and reporting requirements will aid in the process.

- Greater independence of auditing firms: To minimize conflicts of interest, greater independence is needed between auditing firms and their clients. This includes stricter rules on client relationships and the rotation of auditing partners.

Conclusion: The Ongoing Implications of PwC Exits and the Need for Accountability

The Bangkok Post report and PwC's subsequent exits from multiple countries highlight serious flaws in the global accounting system. The alleged accounting scandals have had a profound impact on investor confidence and the reliability of financial reporting. The key takeaway is the urgent need for increased transparency, stronger regulatory oversight, and significant reforms within the accounting industry to prevent similar occurrences. To stay informed about the ongoing developments in the PwC case and the broader accounting industry, we urge you to follow updates on the Bangkok Post and other reputable news sources. Stay informed about the fallout from these PwC accounting scandals, and the continuing investigation into PwC exits and financial irregularities.

Featured Posts

-

Dsv Leoben Praesentiert Neues Trainerteam In Der Regionalliga Mitte

Apr 29, 2025

Dsv Leoben Praesentiert Neues Trainerteam In Der Regionalliga Mitte

Apr 29, 2025 -

Exclusive Porsche 911 S T Riviera Blue Paint To Sample Offered

Apr 29, 2025

Exclusive Porsche 911 S T Riviera Blue Paint To Sample Offered

Apr 29, 2025 -

Sejarah Porsche 356 Asal Usul Dan Pabrik Zuffenhausen Jerman

Apr 29, 2025

Sejarah Porsche 356 Asal Usul Dan Pabrik Zuffenhausen Jerman

Apr 29, 2025 -

Understanding Adult Adhd Diagnosis And Treatment Options

Apr 29, 2025

Understanding Adult Adhd Diagnosis And Treatment Options

Apr 29, 2025 -

Pw C Us Partners Ordered To Sever Brokerage Ties Following Internal Probe

Apr 29, 2025

Pw C Us Partners Ordered To Sever Brokerage Ties Following Internal Probe

Apr 29, 2025