RBC Earnings Miss Estimates Amidst Rising Loan Concerns

Table of Contents

RBC's Q[Quarter] Earnings: A Detailed Breakdown

Key Financial Metrics

RBC's Q[Quarter] earnings revealed a mixed bag of results, with several key performance indicators (KPIs) underperforming expectations. Let's examine the specifics:

- Net Income: [Insert actual Net Income figure]. This represents a [Percentage]% decrease compared to the same quarter last year and falls significantly short of the [Insert Analyst consensus figure] predicted by analysts.

- Revenue: [Insert actual Revenue figure], showing a [Percentage]% [increase/decrease] year-over-year. While revenue growth was reported, it failed to offset the impact of increased loan loss provisions.

- Return on Equity (ROE): [Insert actual ROE figure], demonstrating a notable decline compared to previous quarters and reflecting pressure on profitability.

[Insert a chart or graph visually representing Net Income, Revenue, and ROE for the current quarter and the previous two quarters. Clearly label the chart and axes.]

Provision for Credit Losses

A significant factor contributing to RBC's missed earnings estimates was a substantial increase in its provision for credit losses. This reflects a growing concern about the potential for loan defaults.

- The provision for credit losses increased by [Insert Percentage]% compared to the previous quarter, reaching [Insert actual figure].

- This increase is primarily attributed to rising interest rates impacting borrowers' ability to repay loans, particularly in sectors like real estate and consumer credit.

- Increased economic uncertainty and the potential for a recession are further contributing factors to the heightened risk of loan defaults. The bank cited [mention specific reasons given by RBC in their report].

Rising Loan Concerns: A Deeper Dive into the Risks

Impact of Rising Interest Rates

The Bank of Canada's aggressive interest rate hikes aim to curb inflation, but they also put pressure on borrowers. This is particularly true for those with variable-rate mortgages and high levels of debt.

- The real estate sector is particularly vulnerable, with rising interest rates potentially leading to a surge in mortgage defaults.

- Consumer credit, including credit cards and personal loans, is another area of concern, as higher interest rates increase the burden on consumers struggling with debt.

- Government policies aimed at supporting borrowers, such as mortgage stress tests and loan deferral programs, may partially mitigate the impact but not fully eliminate the risk.

Economic Uncertainty and its Role

The global economic landscape is characterized by uncertainty, further exacerbating loan concerns.

- Persistent inflation erodes purchasing power and increases the likelihood of defaults.

- The risk of a recession in Canada and globally casts a shadow over the economy, impacting borrowers' ability to repay loans.

- Geopolitical instability, such as the ongoing war in Ukraine, adds to the overall economic uncertainty and negatively affects investor sentiment. Experts like [mention relevant economists or financial analysts] forecast [mention their forecasts regarding economic growth and recession].

Market Reaction and Investor Sentiment

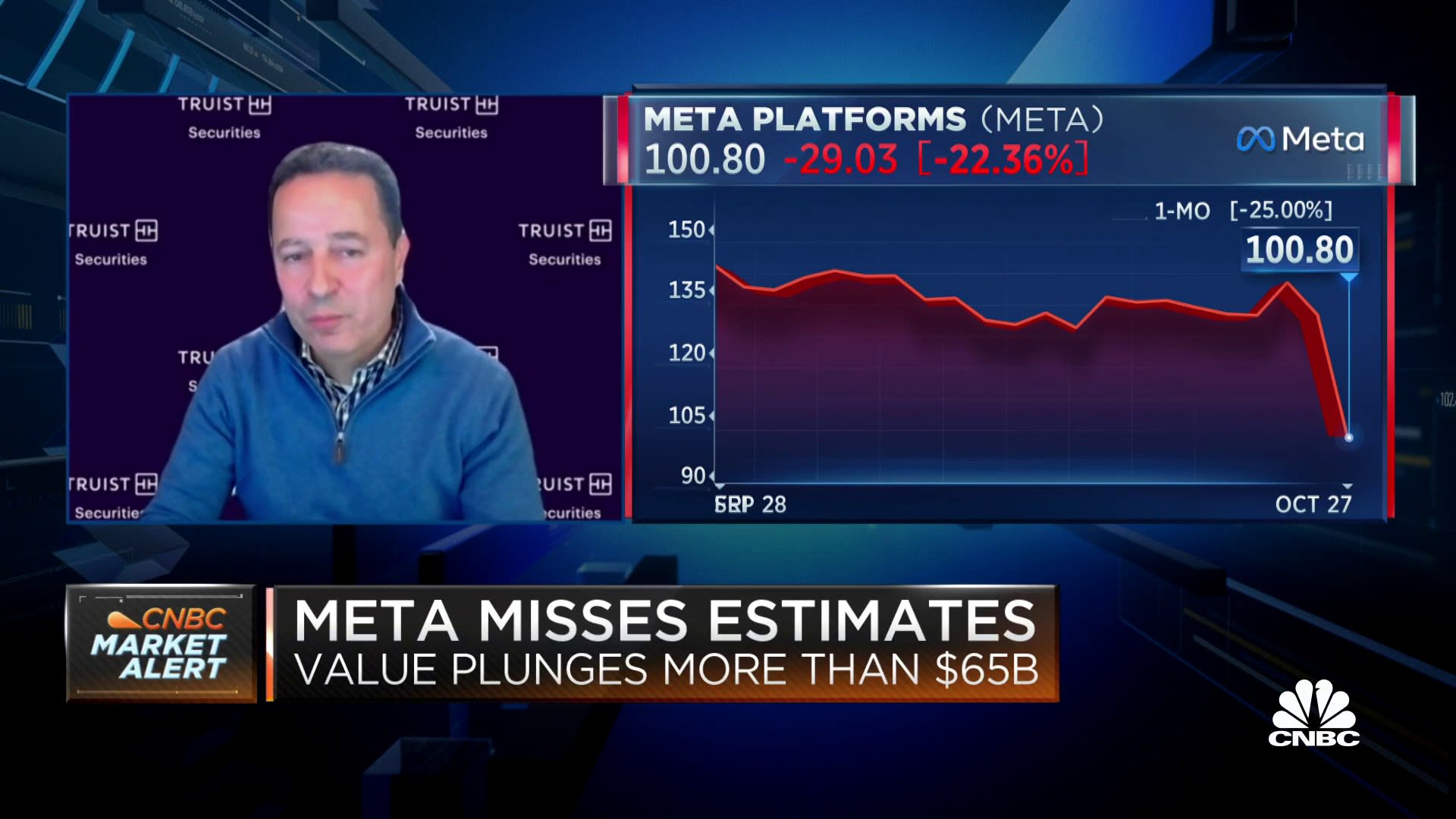

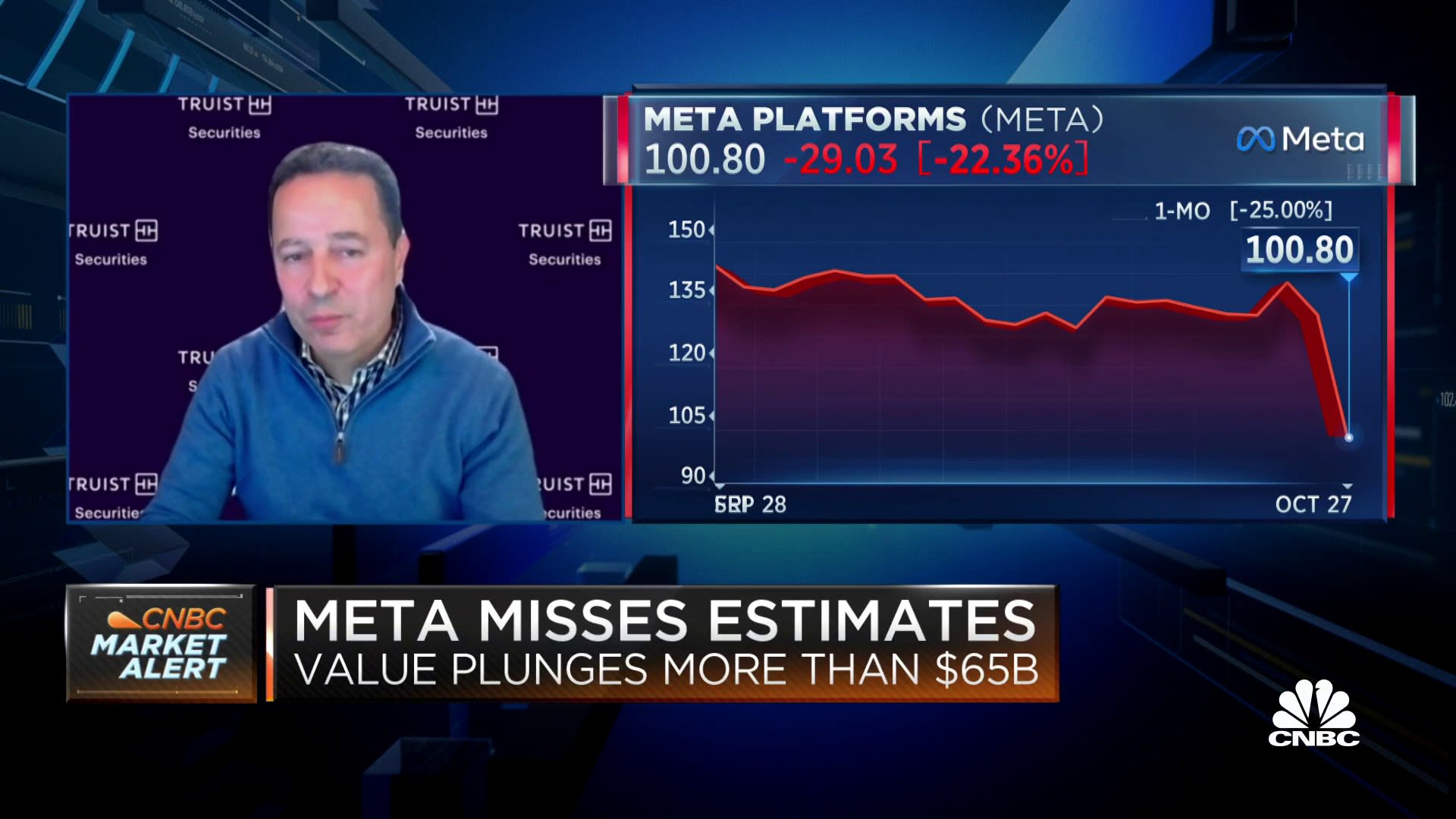

RBC Stock Performance

The disappointing earnings report had a predictable impact on RBC's stock price.

- RBC's stock price experienced a [Percentage]% drop following the earnings announcement, reflecting investor concerns.

- Trading volume surged, indicating heightened market activity and investor response to the news.

- Compared to its competitors, [mention competitor banks' stock performance for comparison, e.g., "TD Bank's stock showed a less dramatic decline,"]. Analyst ratings and price targets have been revised downwards following the earnings report.

Investor Concerns and Future Outlook

Investors expressed concerns about RBC's ability to navigate the current economic challenges and maintain profitability.

- Statements from RBC executives emphasized the bank's proactive approach to managing risk and its commitment to supporting borrowers. [Mention any specific actions or strategies highlighted by RBC executives].

- Investor calls and press releases provided further insights into the bank's future strategies, including potential cost-cutting measures and adjustments to its lending practices.

Conclusion: Analyzing RBC Earnings Miss and the Future of the Bank

RBC's Q[Quarter] earnings report revealed a significant shortfall in expectations, driven primarily by increased loan loss provisions amidst a backdrop of rising interest rates and economic uncertainty. The market reacted negatively, with RBC's stock price declining and investor sentiment dampened. The rising concerns about loan defaults highlight the challenges facing the Canadian banking sector and the broader economy. The bank's ability to effectively manage these risks will be crucial for its future performance.

Key Takeaways: RBC's missed earnings highlight growing loan concerns, impacting profitability and stock price. Rising interest rates, economic uncertainty, and geopolitical factors all contribute to increased risk of defaults.

Call to Action: Stay updated on the latest developments regarding RBC earnings and loan concerns by subscribing to our newsletter and following our analysis for informed investment decisions. Monitor RBC's performance closely to understand the risks associated with RBC investments and navigate the evolving economic landscape effectively.

Featured Posts

-

Mueritzeum Escape Spiel Raetsel Spannung Und Spass

May 31, 2025

Mueritzeum Escape Spiel Raetsel Spannung Und Spass

May 31, 2025 -

Military Spending And Global Power The Us China Dynamic

May 31, 2025

Military Spending And Global Power The Us China Dynamic

May 31, 2025 -

Isabelle Autissier L Urgence D Une Union Face Aux Defis Environnementaux

May 31, 2025

Isabelle Autissier L Urgence D Une Union Face Aux Defis Environnementaux

May 31, 2025 -

Who New Covid 19 Variant Fueling Case Rise

May 31, 2025

Who New Covid 19 Variant Fueling Case Rise

May 31, 2025 -

Sanofi Acquiert Les Anticorps Bispecifiques De Dren Bio Un Accord Majeur

May 31, 2025

Sanofi Acquiert Les Anticorps Bispecifiques De Dren Bio Un Accord Majeur

May 31, 2025