Record High Beckons: Frankfurt Equities And The DAX's Continued Ascent

Table of Contents

Strong Economic Fundamentals Fueling the DAX's Ascent

Germany's robust economic performance is a primary catalyst behind the DAX's impressive climb. Strong domestic demand, coupled with positive global economic conditions, has fueled significant growth in company earnings, boosting investor confidence. This positive economic momentum is evident in several key indicators:

- GDP Growth: Germany has consistently demonstrated healthy GDP growth, exceeding expectations in recent quarters. This steady expansion indicates a strong and resilient economy, creating a favorable environment for businesses and the stock market.

- Low Unemployment: The unemployment rate remains remarkably low, indicating a healthy labor market and strong consumer spending power. This sustained employment contributes significantly to robust domestic demand.

- High Consumer Confidence: Consumer confidence remains high, suggesting a positive outlook and willingness to spend, further supporting economic growth and corporate profits.

Several key sectors are driving this growth:

- Automotive: Despite global supply chain challenges, the German automotive industry continues to show signs of recovery, contributing substantially to the DAX's performance.

- Technology: German tech companies are increasingly innovative and competitive on a global scale, benefiting from strong domestic and international demand.

- Industrial Manufacturing: Germany's renowned industrial base continues to be a significant contributor to economic growth, driving strong export numbers and supporting the DAX's overall performance.

Global Factors Contributing to Frankfurt Equities' Performance

While the German economy plays a crucial role, global factors significantly influence Frankfurt equities' performance and the DAX Index. The interplay of international investment, global economic conditions, and geopolitical stability all impact the market's trajectory.

- International Investment: Significant international investment flows into the German market reflect global confidence in the German economy and its potential for growth. This inflow of capital directly impacts stock prices, driving the DAX upwards.

- Interest Rates: Global interest rate trends influence investment decisions, affecting both borrowing costs for businesses and the attractiveness of German equities relative to other markets.

- Inflation: Inflationary pressures globally can impact consumer spending and business profitability, thus potentially moderating the DAX's growth. However, currently, manageable inflation levels haven't significantly dampened the market’s positive momentum.

- Geopolitical Stability: Global geopolitical events can create uncertainty and volatility in the market. While geopolitical risks are always present, currently, the relative stability has contributed to positive market sentiment.

- Supply Chain Dynamics: The ongoing global efforts to improve supply chain resilience and efficiency are influencing the performance of numerous DAX companies, particularly in manufacturing and automotive sectors.

Analyzing Key DAX Companies and Their Contributions

The DAX's impressive performance is driven by the strong financial results of its constituent companies. Several giants contribute substantially to the overall index growth:

- Volkswagen: A global automotive powerhouse, Volkswagen's performance significantly influences the DAX, reflecting the overall health of the automotive sector.

- Siemens: A leading technology conglomerate, Siemens contributes significantly to the DAX, reflecting the strength of the German technological sector.

- BASF: A chemical giant, BASF's performance reflects the state of the German industrial sector and its global competitiveness.

Analyzing these companies' key performance indicators (KPIs) provides deeper insights into the DAX's strength:

- Revenue Growth: Many DAX companies have reported strong revenue growth, indicating increased demand for their products and services.

- Profitability: Improved profitability reflects efficient operations and strong market positioning.

- Innovation: Companies investing heavily in research and development are better positioned for long-term growth, further boosting investor confidence.

Predicting Future Trends for Frankfurt Equities and the DAX

While the current outlook for the DAX is positive, it's crucial to acknowledge potential challenges. Predicting future trends requires considering both upside potential and downside risks:

- Upside Potential: Continued strong economic fundamentals, sustained global investment, and further innovation by DAX companies suggest potential for continued growth.

- Downside Risks: Inflationary pressures, geopolitical instability, and potential interest rate hikes could dampen market enthusiasm and lead to corrections.

Potential future scenarios include:

- Sustained Growth: The DAX continues its upward trajectory, driven by strong fundamentals and global investment.

- Moderate Correction: A period of consolidation or mild correction follows, allowing for a more sustainable long-term growth path.

- Sharp Correction: Significant global events could trigger a more substantial market correction.

Conclusion: Navigating the Record High Beckon for Frankfurt Equities and the DAX

The DAX's remarkable ascent is fueled by a combination of strong domestic economic fundamentals, favorable global conditions, and the robust performance of its constituent companies. While the potential for record highs remains, investors should maintain a balanced perspective and acknowledge inherent market risks. A diversified investment strategy, focused on long-term growth, is recommended for those interested in the Frankfurt equities market. Stay tuned for further updates on the DAX's ascent and discover how to capitalize on the opportunities within the Frankfurt equities market by conducting thorough research and staying informed about market developments. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Mengungkap Sejarah Porsche 356 Di Zuffenhausen Jerman

May 24, 2025

Mengungkap Sejarah Porsche 356 Di Zuffenhausen Jerman

May 24, 2025 -

Alqfzt Alkbyrt Fy Mwshr Daks Atfaq Jmrky Amryky Syny Kmhrk Ryysy

May 24, 2025

Alqfzt Alkbyrt Fy Mwshr Daks Atfaq Jmrky Amryky Syny Kmhrk Ryysy

May 24, 2025 -

New Ferrari Flagship Facility Opens In Bangkok A Report From The Bangkok Post

May 24, 2025

New Ferrari Flagship Facility Opens In Bangkok A Report From The Bangkok Post

May 24, 2025 -

Konchita Vurst Evrovidenie 2014 Zhizn Kaming Aut I Plany Na Buduschee

May 24, 2025

Konchita Vurst Evrovidenie 2014 Zhizn Kaming Aut I Plany Na Buduschee

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

Latest Posts

-

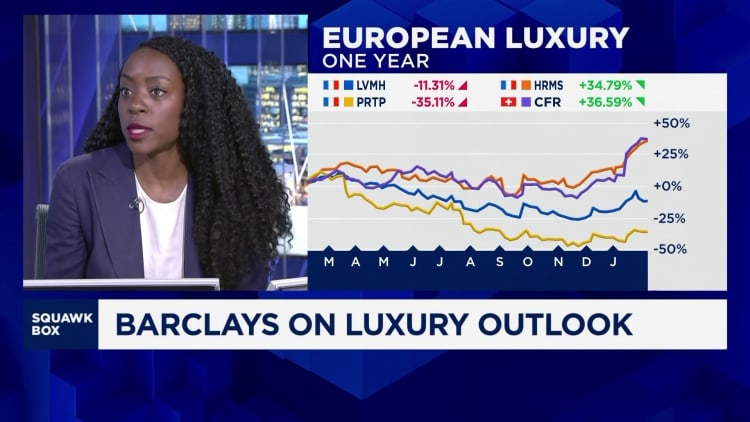

March 7 2025 Paris Economy Suffers From Luxury Goods Sector Weakness

May 24, 2025

March 7 2025 Paris Economy Suffers From Luxury Goods Sector Weakness

May 24, 2025 -

Paris Faces Economic Headwinds Luxury Sector Decline March 7 2025 Update

May 24, 2025

Paris Faces Economic Headwinds Luxury Sector Decline March 7 2025 Update

May 24, 2025 -

Luxury Slump Impacts Paris Economy Analysis Of March 7th 2025 Report

May 24, 2025

Luxury Slump Impacts Paris Economy Analysis Of March 7th 2025 Report

May 24, 2025 -

Paris In The Red Luxury Goods Sector Slowdown Hits Hard March 7 2025

May 24, 2025

Paris In The Red Luxury Goods Sector Slowdown Hits Hard March 7 2025

May 24, 2025 -

Paris Economic Downturn Luxury Sector Impact March 7 2025

May 24, 2025

Paris Economic Downturn Luxury Sector Impact March 7 2025

May 24, 2025