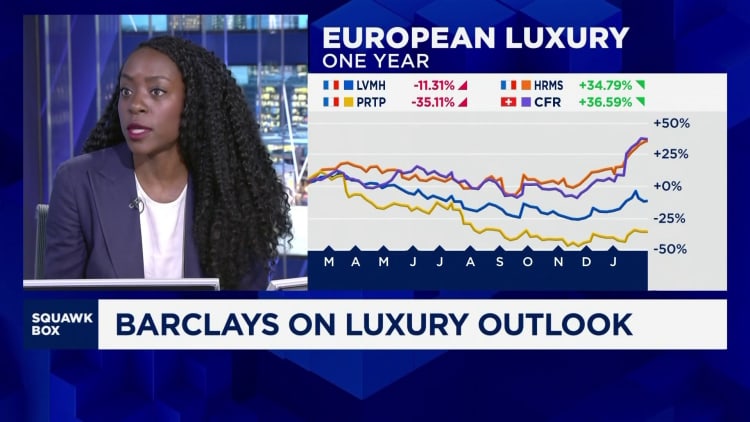

March 7, 2025: Paris Economy Suffers From Luxury Goods Sector Weakness

Table of Contents

Declining Tourist Spending on Luxury Goods in Paris

The Parisian luxury market, traditionally fueled by high-spending international tourists, is experiencing a noticeable slowdown. This decline is a direct consequence of several interconnected factors.

Impact of Global Economic Slowdown

The global economic slowdown is significantly impacting the purchasing power of high-net-worth individuals (HNWIs), a key demographic for the Parisian luxury market.

- Decreased disposable income among high-net-worth individuals: Economic uncertainty has led to a reduction in discretionary spending among HNWIs, affecting their willingness to invest in luxury goods.

- Reduced travel budgets: With increased inflation and economic anxiety globally, many HNWIs are curtailing their travel plans, reducing the number of potential luxury shoppers visiting Paris.

- Shifting consumer preferences towards experiences over material goods: A noticeable trend shows a shift in consumer preferences, with many prioritizing experiential purchases (travel, fine dining) over material possessions, impacting luxury goods sales. This necessitates a re-evaluation of marketing strategies by Parisian luxury brands.

Increased Competition from Emerging Markets

The rise of domestic luxury brands in emerging markets like Asia and the Middle East is presenting a formidable challenge to traditional Parisian luxury houses.

- Growth of domestic luxury brands in Asia and the Middle East: These emerging markets are witnessing a surge in the popularity and accessibility of domestically produced luxury goods, reducing reliance on imported Parisian products.

- Increased accessibility of luxury goods through online platforms: E-commerce platforms have leveled the playing field, allowing consumers worldwide to access luxury products from various brands and regions with increased ease, impacting the exclusivity once associated with Parisian luxury brands.

- Shifting brand loyalty to local or emerging luxury brands: A new generation of luxury consumers shows increased brand loyalty to local or emerging luxury brands that resonate with their cultural values and aspirations, impacting the market share of established Parisian houses.

Challenges Faced by Parisian Luxury Brands

Beyond external pressures, Parisian luxury brands are grappling with internal challenges that impact their ability to thrive in the current economic climate.

Rising Production Costs and Inflation

The current inflationary environment, coupled with supply chain disruptions, is significantly increasing production costs for Parisian luxury brands.

- Higher raw material prices: The cost of raw materials, including precious metals, leather, and high-quality textiles, has increased substantially, impacting the profitability of luxury goods production.

- Increased labor costs: Rising wages and the need to provide competitive compensation packages are also contributing to the increased cost of production.

- Supply chain bottlenecks and transportation costs: Disruptions to global supply chains and increased transportation costs are adding further pressure on production costs, impacting profit margins.

Adapting to Changing Consumer Preferences

Luxury brands need to adapt to the evolving demands of younger, digitally native consumers who prioritize sustainability and ethical sourcing.

- Demand for eco-friendly and ethically sourced materials: A growing segment of luxury consumers is increasingly conscious of the environmental and social impact of their purchases, demanding transparency and sustainability from brands.

- Preference for personalized and unique experiences: Beyond the product itself, consumers seek personalized and unique experiences, requiring luxury brands to innovate in their customer engagement strategies.

- Increased importance of brand transparency and social responsibility: Consumers are increasingly scrutinizing a brand’s values and ethical practices. Transparency and social responsibility are no longer optional but essential for building and maintaining brand loyalty.

The Wider Economic Ripple Effect on Paris

The weakness in the Paris luxury goods economy is not confined to the luxury sector itself; its consequences are rippling across various sectors of the Parisian economy.

Impact on Employment and Related Industries

The downturn is leading to job losses within the luxury sector and impacting associated industries.

- Job cuts in luxury retail and manufacturing: Luxury brands are implementing cost-cutting measures, including job reductions, to offset losses in revenue.

- Reduced demand for related services: The decline in luxury tourism has resulted in reduced demand for supporting industries such as hotels, restaurants, and transportation.

- Potential increase in unemployment rates: Job losses in the luxury sector and related industries could lead to a rise in unemployment rates within Paris.

Implications for City Revenue and Public Services

Decreased tax revenue from luxury sales could impact the city's ability to fund public services and infrastructure projects.

- Reduced tax revenue from sales and corporate taxes: Lower sales and reduced corporate profits within the luxury sector will translate to lower tax revenue for the city.

- Potential cuts to public spending on infrastructure and social programs: Reduced city revenue could necessitate cuts in public spending on essential infrastructure projects and social programs.

- Impact on the city's overall financial stability: The long-term financial stability of Paris could be affected by the sustained weakness in its luxury goods sector.

Conclusion

The weakening of the Paris luxury goods economy presents a significant challenge to the city's overall economic health. The interplay of global economic uncertainty, intensified competition, escalating costs, and shifting consumer preferences poses a complex threat to employment, city revenue, and related industries. Addressing this situation demands a multi-pronged strategy including government support for businesses, investment in innovation and sustainability within the luxury sector, and a concerted effort to attract and retain high-spending tourists. Understanding the nuances of the Paris luxury goods economy and its vulnerabilities is paramount for future planning and ensuring the continued prosperity of the city. To stay informed on the evolving dynamics of the Parisian luxury goods market, continue to follow our news and analysis.

Featured Posts

-

Sterke Prestaties Relx Ai Als Sleutel Tot Succes In Een Onzekere Economie

May 24, 2025

Sterke Prestaties Relx Ai Als Sleutel Tot Succes In Een Onzekere Economie

May 24, 2025 -

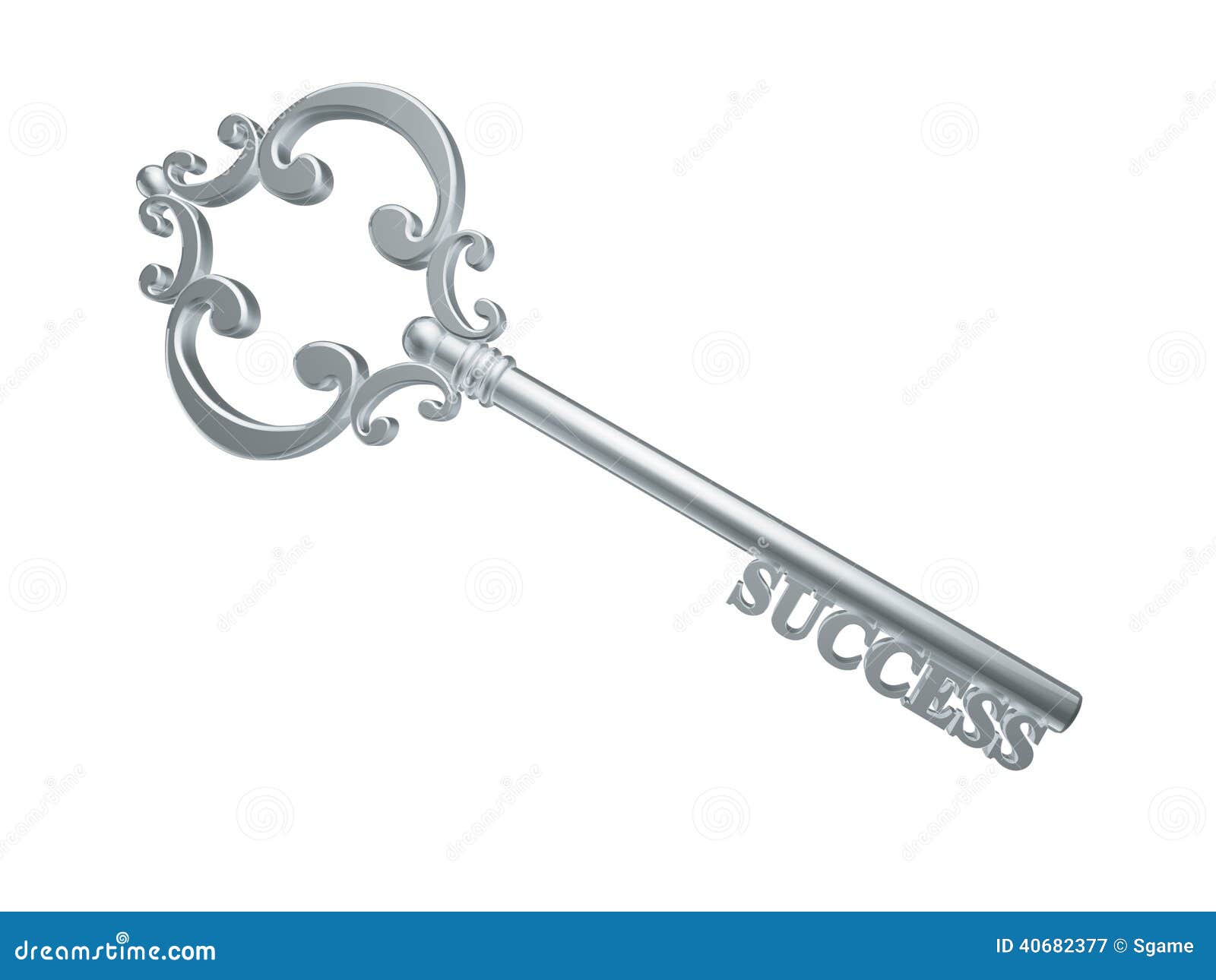

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025 -

Ae Xplore Global Campaign Launches Connecting England Airpark And Alexandria International Airport

May 24, 2025

Ae Xplore Global Campaign Launches Connecting England Airpark And Alexandria International Airport

May 24, 2025 -

Picture This Prime Video Every Song Featured In The Soundtrack

May 24, 2025

Picture This Prime Video Every Song Featured In The Soundtrack

May 24, 2025

Latest Posts

-

Rio Tinto Rebuts Forrests Wasteland Claim Pilbaras Future Defended

May 24, 2025

Rio Tinto Rebuts Forrests Wasteland Claim Pilbaras Future Defended

May 24, 2025 -

Are La Landlords Price Gouging After The Recent Fires

May 24, 2025

Are La Landlords Price Gouging After The Recent Fires

May 24, 2025 -

Rising Rental Costs In La Following Fires Price Gouging Concerns

May 24, 2025

Rising Rental Costs In La Following Fires Price Gouging Concerns

May 24, 2025 -

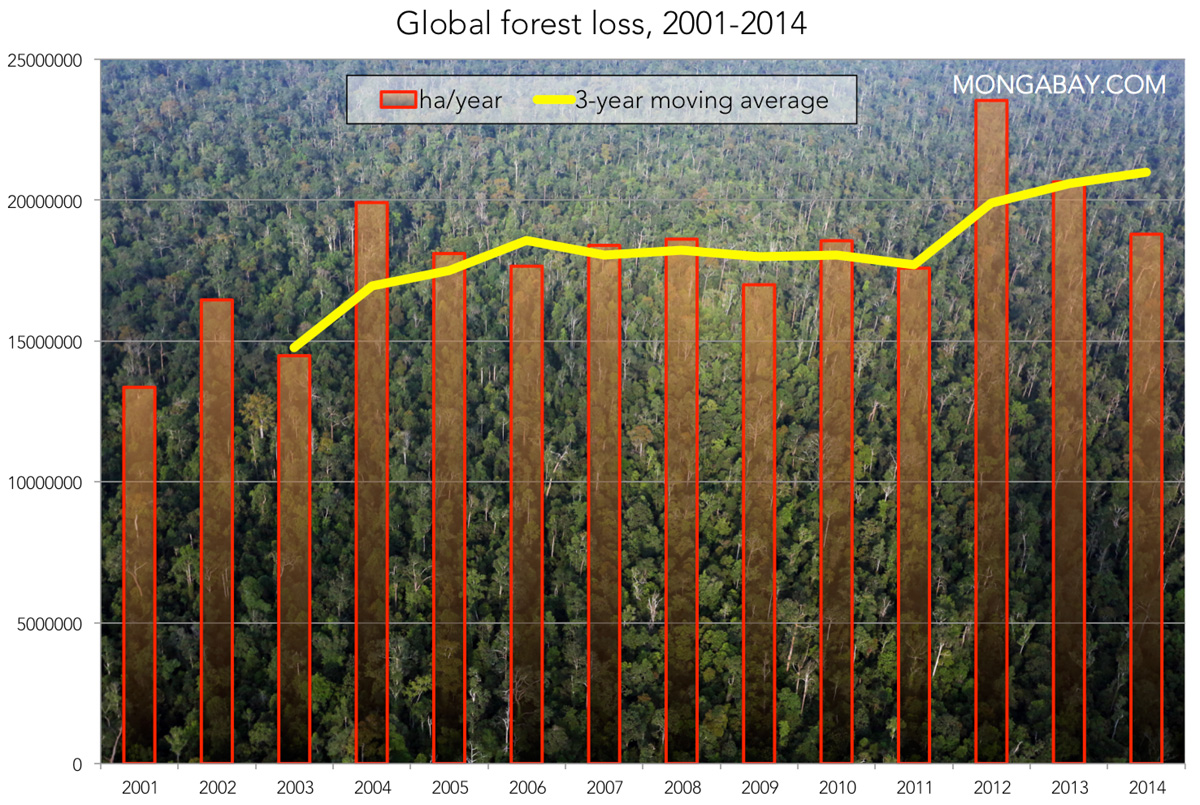

The Devastating Impact Of Wildfires Record High In Global Forest Loss

May 24, 2025

The Devastating Impact Of Wildfires Record High In Global Forest Loss

May 24, 2025 -

Wildfires Drive Record Breaking Global Forest Loss

May 24, 2025

Wildfires Drive Record Breaking Global Forest Loss

May 24, 2025