Record High: Canadian Investment In US Equities Amidst Trade War

Table of Contents

Factors Driving Record Canadian Investment in US Equities

Several factors contribute to the record-high Canadian investment in US equities, even amidst trade war anxieties. Understanding these drivers is crucial for assessing the long-term implications for both Canadian portfolios and the broader economic relationship between the two countries.

-

The Strength of the US Stock Market: Despite trade uncertainties, the US stock market has shown remarkable resilience. Strong corporate earnings, innovation, and a relatively robust economy continue to attract foreign investment, including significant inflows from Canada. This makes US equities a compelling option for diversification and potential high returns.

-

Diversification Strategy: Many Canadian investors view US equities as a vital component of a well-diversified portfolio. Diversifying beyond the Canadian market helps mitigate risk, as the performance of different markets isn't always correlated. This strategy becomes even more critical during times of geopolitical uncertainty, allowing investors to balance potential losses in one market with gains in another.

-

Perceived Undervalued Assets: The trade war anxieties have, in some instances, led to a perception of undervalued assets in the US market. Some investors believe that the market has overreacted to trade tensions, creating opportunities to buy stocks at discounted prices, anticipating future growth. This "buy the dip" mentality has contributed to increased Canadian investment.

-

Favorable Currency Exchange Rates: Fluctuations in currency exchange rates play a significant role in cross-border investments. At certain periods, a favorable CAD/USD exchange rate has made US investments more attractive for Canadian investors, increasing their purchasing power in the US market.

-

Positive Long-Term Economic Outlook: Despite short-term trade concerns, many investors maintain a positive long-term outlook for the US economy. This belief in sustained economic growth outweighs the short-term uncertainties associated with the trade war, fueling continued investment.

Risks and Rewards of Investing in US Equities for Canadians

While the potential rewards are significant, investing in US equities from Canada also carries inherent risks. A balanced understanding of these risks and rewards is crucial for informed decision-making.

-

Currency Fluctuation Risk: Changes in the CAD/USD exchange rate directly impact returns. A weakening Canadian dollar can reduce the value of US investments when converted back to Canadian currency.

-

Increased Market Volatility: Ongoing trade disputes and global uncertainty contribute to increased market volatility. This volatility can lead to sharp price swings, creating both opportunities and potential for losses.

-

Political Risk: Shifts in US trade policy and the potential for future tariffs create political risk. These unpredictable policy changes can significantly impact the performance of US companies and the overall market.

-

Potential for High Returns on Investment: If the US market continues its upward trajectory, Canadian investors stand to gain significant returns on their investments. The potential for high growth and strong dividends makes US equities an attractive proposition.

-

Benefits of Portfolio Diversification: Investing in US equities offers significant diversification benefits, reducing overall portfolio risk by reducing reliance on the Canadian market's performance.

Mitigation Strategies for Canadian Investors

To mitigate the inherent risks associated with investing in US equities, Canadian investors should consider the following strategies:

-

Hedging Strategies: Implement hedging strategies to mitigate currency risk. These strategies, often involving financial derivatives, can help protect against losses due to currency fluctuations.

-

Portfolio Diversification: Diversify investments across various US sectors and asset classes. This reduces exposure to any single sector's performance, minimizing potential losses.

-

Due Diligence: Conduct thorough due diligence on individual companies and investment funds before investing. Understanding a company's financial health and prospects is essential for informed investment decisions.

-

Professional Financial Advice: Seek professional financial advice from a qualified advisor. A financial advisor can help assess risk tolerance, create a tailored investment strategy, and provide guidance during periods of market uncertainty.

-

Regular Monitoring: Regularly monitor investment performance and adjust the investment strategy as needed. Markets are dynamic, and regular review allows for timely adjustments to minimize potential losses and maximize returns.

The Implications for the Canadian-US Economic Relationship

The record-high Canadian investment in US equities highlights the strong economic interdependence between Canada and the US. This cross-border investment has several significant implications:

-

Economic Interdependence: The continued high level of Canadian investment underscores the deep economic ties between the two nations. These financial flows demonstrate the integrated nature of their economies.

-

Capital Flows and Economic Health: This significant capital flow influences the overall health and stability of both economies. Investment boosts economic activity and contributes to growth in both countries.

-

Future Trade Negotiations: The level of investment could influence future trade negotiations and agreements between Canada and the US. The mutual economic benefits of strong trade relations are clearly demonstrated.

-

Long-Term Outlook: The long-term prospects for Canadian investment in US equities are intertwined with the evolving trade dynamics and overall economic health of both nations.

Conclusion

The record-high Canadian investment in US equities amidst ongoing trade uncertainty demonstrates the complex interplay between economic factors, investor sentiment, and geopolitical risks. While potential rewards are significant, Canadian investors must carefully consider the associated risks and implement appropriate mitigation strategies. Understanding the nuances of Canadian investment in US equities is crucial for navigating the current market landscape. Learn more about optimizing your investment strategy and minimizing risk by researching further into the dynamics of Canadian investment in US equities and consulting with a financial advisor.

Featured Posts

-

Dodgers Roberts Admits One Hit Changed The World Series Outcome

Apr 23, 2025

Dodgers Roberts Admits One Hit Changed The World Series Outcome

Apr 23, 2025 -

Chistiy Ponedelnik 3 Marta 2025 Goda Polnoe Rukovodstvo Po Velikomu Postu

Apr 23, 2025

Chistiy Ponedelnik 3 Marta 2025 Goda Polnoe Rukovodstvo Po Velikomu Postu

Apr 23, 2025 -

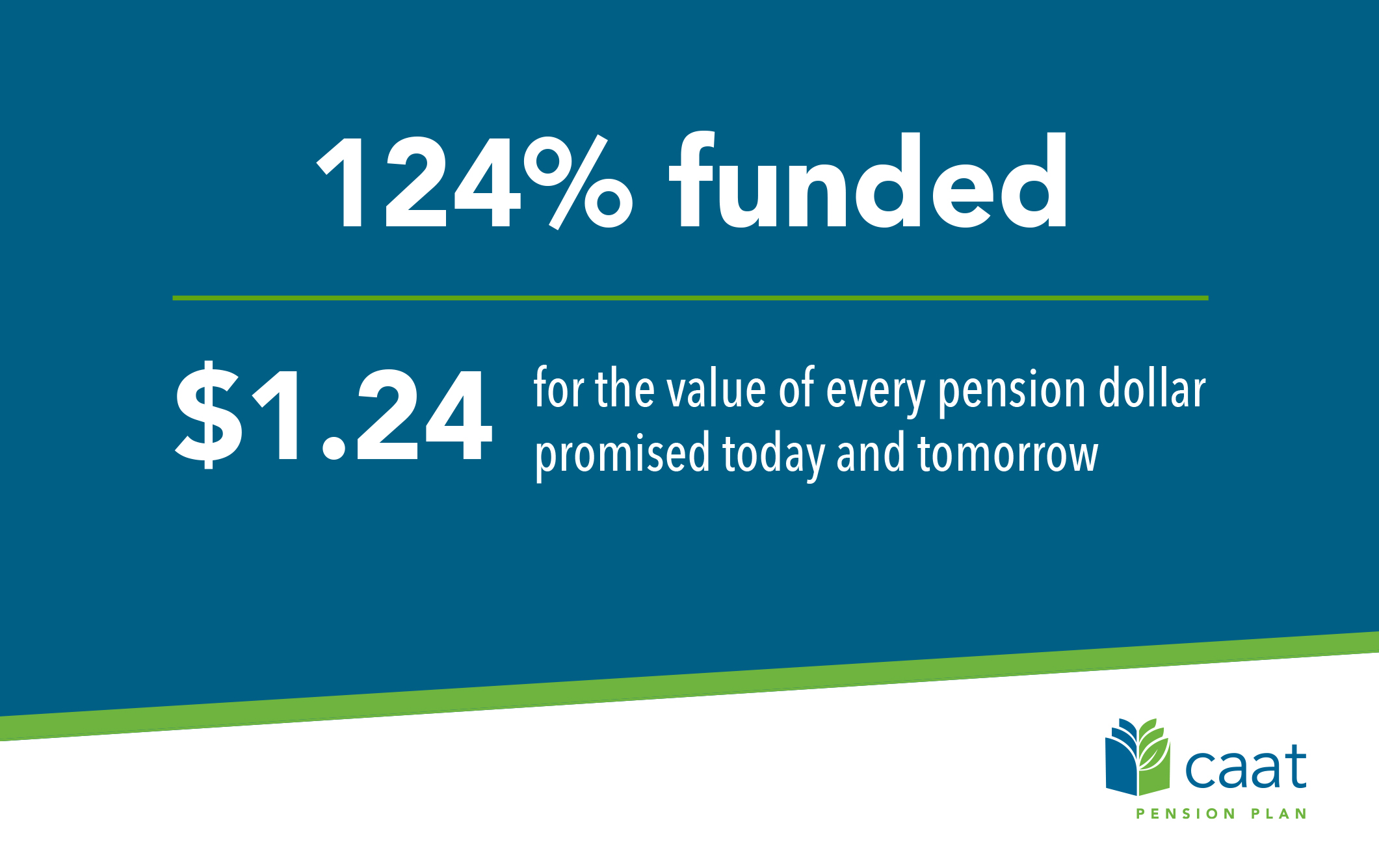

Canadian Private Investment Opportunities Targeted By Caat Pension Plan

Apr 23, 2025

Canadian Private Investment Opportunities Targeted By Caat Pension Plan

Apr 23, 2025 -

Illness Sidelines Terry Francona Brewers Game Missed

Apr 23, 2025

Illness Sidelines Terry Francona Brewers Game Missed

Apr 23, 2025 -

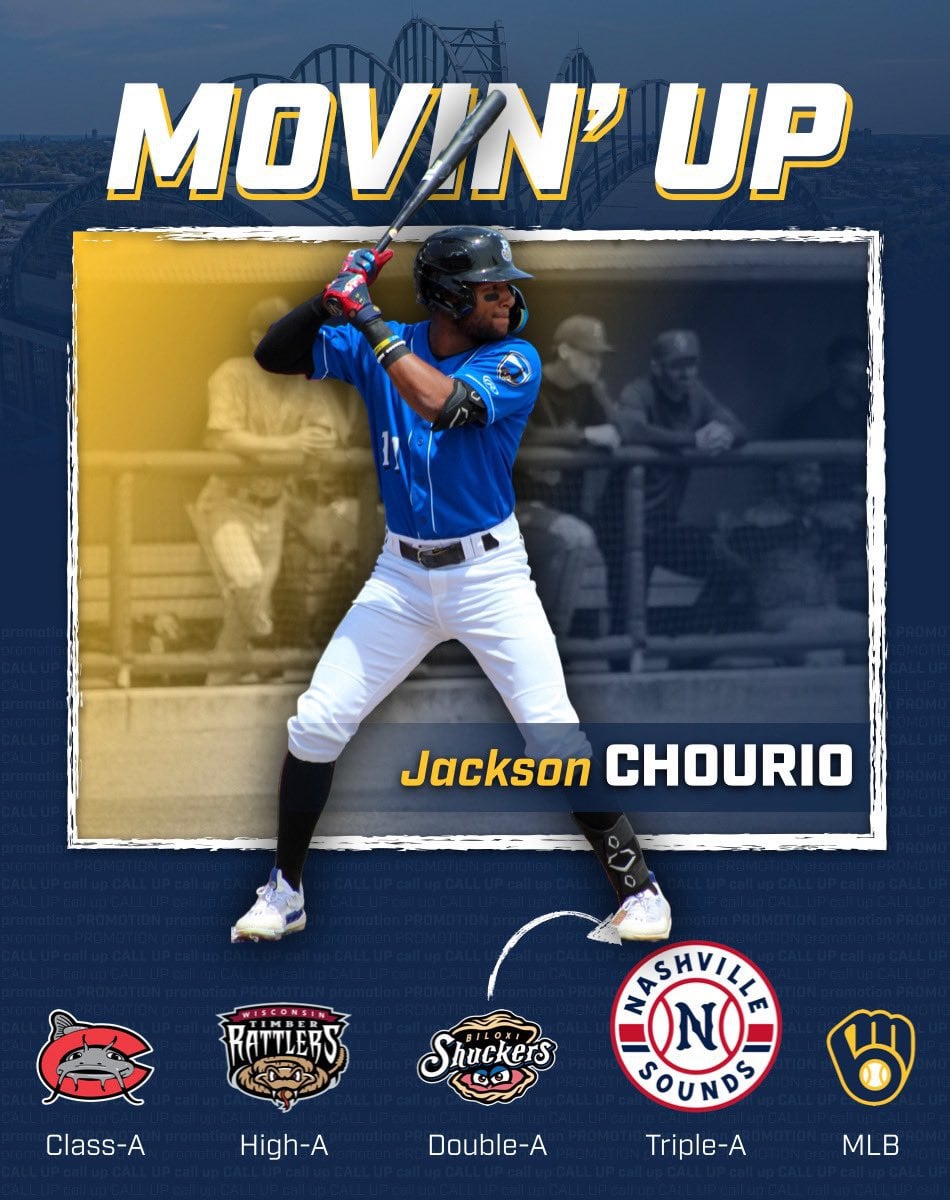

Jackson Chourios Two Hrs Propel Brewers To 8 2 Victory Against Reds

Apr 23, 2025

Jackson Chourios Two Hrs Propel Brewers To 8 2 Victory Against Reds

Apr 23, 2025