Representatives To Recover $1.231 Billion In Oil Company Funds

Table of Contents

The Allegations of Misconduct

The case centered on allegations of widespread oil company fraud and financial mismanagement at [Name of Oil Company], a major player in the global energy sector. The accusations included:

- Fraudulent accounting practices: The company allegedly manipulated its financial records to inflate profits and mislead investors. This involved complex schemes to conceal losses and misrepresent the true financial health of the company. These accounting irregularities went undetected for several years, leading to substantial investor losses.

- Misappropriation of funds: Representatives alleged that significant sums of money were diverted from company coffers for personal gain by senior executives, violating their fiduciary duty. This involved secretive offshore accounts and shell corporations designed to obscure the trail of misappropriated funds.

- Breach of contract: The company was accused of violating several contracts with suppliers, partners, and even government entities, leading to significant financial penalties and further losses.

- Environmental violations: Allegations included violations of environmental regulations, leading to substantial fines and cleanup costs that were not properly disclosed to investors. This represents a growing area of concern in oil and gas litigation, where environmental damage is increasingly tied to financial misconduct.

The alleged harm extended far beyond financial losses to investors. Local communities suffered environmental damage and economic hardship, highlighting the far-reaching consequences of corporate malfeasance. The SEC and EPA were involved in the investigation, further emphasizing the gravity of the situation.

The Legal Strategy Employed by the Representatives

The legal team representing the affected parties employed a sophisticated strategy to pursue the case. This involved:

- Class-action lawsuit: A class-action lawsuit was filed, consolidating claims from numerous investors and affected parties, significantly streamlining the legal process and increasing the potential for a substantial settlement amount. This was crucial for achieving a large-scale financial recovery.

- Expert witnesses: The representatives engaged leading experts in forensic accounting, environmental science, and financial analysis to provide irrefutable evidence of the oil company's misconduct. These expert witnesses were crucial in building a robust case and proving the extent of the damage.

- Settlement negotiation: The legal team engaged in rigorous settlement negotiation with the oil company, leveraging the strength of their evidence to secure a favorable outcome. This process involved numerous rounds of negotiation and strategic legal maneuvering.

- Key legal arguments: The legal arguments focused on breaches of fiduciary duty, securities fraud, and violations of environmental regulations, all supported by comprehensive evidence gathered during the investigation. This approach highlighted the interconnectedness of financial and environmental wrongdoing within the oil and gas industry.

The $1.231 Billion Settlement: A Detailed Breakdown

The final settlement resulted in a landmark $1.231 billion payout. This represents a significant victory in asset recovery and demonstrates the potential for holding large corporations accountable for their actions. The distribution of funds is intended to:

- Compensation to investors: A significant portion of the settlement will compensate investors who suffered financial losses due to the oil company's fraudulent activities. This reflects the principle of restitution for victims of corporate malfeasance.

- Remediation of environmental damage: Funds will be allocated to address the environmental damage caused by the company's operations. This includes cleanup efforts and mitigation strategies to protect affected communities.

- Government fines and penalties: A portion of the settlement will cover fines and penalties levied by regulatory bodies, further ensuring corporate accountability.

This settlement significantly impacts the oil company's future operations and financial standing. While the immediate implications are clear, potential further litigation and ongoing legal ramifications remain a possibility.

Implications for Future Oil and Gas Litigation

This case sets a significant legal precedent for future lawsuits against oil companies, emphasizing the importance of thorough investigation and robust legal action. Key implications include:

- Increased corporate accountability: This billion-dollar settlement sends a strong message about the consequences of corporate misconduct in the oil and gas industry. It highlights the growing expectation for increased transparency and ethical practices.

- Industry reform: The case may spur regulatory changes and industry reforms aimed at preventing similar instances of fraud and mismanagement in the future.

- Future litigation: This victory is likely to encourage further litigation against oil companies suspected of engaging in unethical practices. The case establishes a clear path for pursuing oil company funds recovery through legal action.

Conclusion

This landmark case, resulting in the recovery of $1.231 billion in oil company funds, underscores the crucial role of robust legal action in combating corporate misconduct. The strategic approach employed by the representatives, which included a class-action lawsuit, the effective use of expert witnesses, and strategic negotiation, showcases the potential for significant financial recovery in cases involving oil company fraud and mismanagement. This victory sets a powerful precedent for future litigation and serves as a warning to corporations engaged in unethical practices.

If you suspect your investment portfolio or community has been negatively affected by oil company misconduct, seeking legal representation to recover your funds is crucial. Contact a specialized attorney experienced in oil and gas litigation and oil company funds recovery today.

Featured Posts

-

D Wave Quantum Qbts Stock Market Performance A Detailed Look At Recent Gains

May 20, 2025

D Wave Quantum Qbts Stock Market Performance A Detailed Look At Recent Gains

May 20, 2025 -

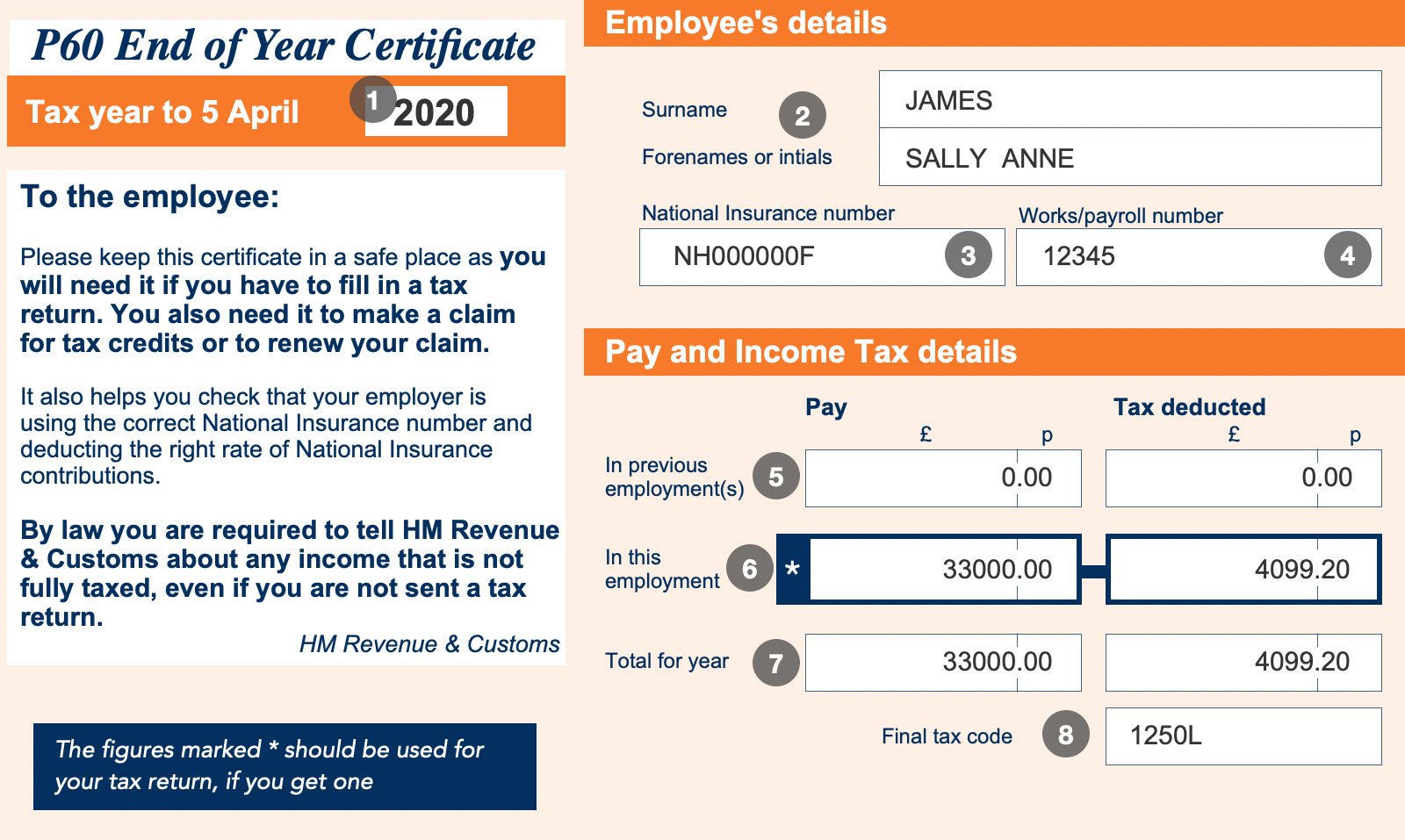

Hmrc Overpayments How To Check Your Payslip And Claim A Refund

May 20, 2025

Hmrc Overpayments How To Check Your Payslip And Claim A Refund

May 20, 2025 -

Michael Schumacher Are O Nepoata Gina Schumacher A Dat Nastere Unei Fetite

May 20, 2025

Michael Schumacher Are O Nepoata Gina Schumacher A Dat Nastere Unei Fetite

May 20, 2025 -

Formula 1 Yeni Sezon Geri Sayim Basladi

May 20, 2025

Formula 1 Yeni Sezon Geri Sayim Basladi

May 20, 2025 -

Kallman Ja Hoskonen Puola Seurasta Laehtoe Mitae Tulevaisuus Tuo

May 20, 2025

Kallman Ja Hoskonen Puola Seurasta Laehtoe Mitae Tulevaisuus Tuo

May 20, 2025