Resorts World Casino Fined: $10.5 Million Money Laundering Penalty In Las Vegas

Table of Contents

The Allegations: Details of the Money Laundering Scheme

Resorts World Casino faces accusations of facilitating a complex money laundering scheme. While specific details remain under wraps due to ongoing investigations, reports suggest the scheme involved a series of suspicious financial transactions designed to obscure the origin and destination of illicit funds. These transactions, likely involving high-roller activity and potentially utilizing structured deposits to circumvent reporting thresholds, raised serious red flags with regulatory bodies.

- Nature of Suspicious Transactions: Reports indicate the suspicious activities involved numerous high-value transactions, potentially including cash deposits, wire transfers, and potentially the use of casino chips as a method of money laundering.

- Regulatory Bodies Involved: The Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury, and the Nevada Gaming Control Board (NGCB) were heavily involved in the investigation, indicating the seriousness of the allegations.

- Timeline of Illegal Activities: The precise timeframe of the alleged money laundering activities is still under investigation but is believed to span several months, potentially years.

The $10.5 Million Penalty: A Breakdown of the Fine and its Implications

The $10.5 million fine represents a substantial financial blow to Resorts World Casino. While not definitively confirmed as the largest ever levied against a Las Vegas casino for money laundering, it stands as a significant penalty reflecting the gravity of the offenses. The financial impact is multi-faceted.

- Fine Amount and Additional Penalties: Beyond the monetary fine itself, there’s the potential for further penalties, including potential restrictions on the casino's gaming license or even temporary closure for non-compliance.

- Impact on Stock Price and Investor Confidence: The news undoubtedly impacted Resorts World's stock price, eroding investor confidence in the company's internal controls and risk management practices. This reputational damage can be far-reaching and long-lasting.

- Legal Ramifications: The casino and potentially its executives face further legal challenges, including potential civil lawsuits and criminal charges, adding to the significant financial and reputational risks.

The Regulatory Response: How Nevada Gaming Regulators Are Addressing the Issue

The Nevada Gaming Control Board (NGCB) responded swiftly to the allegations, conducting a thorough investigation that led to the substantial fine. The NGCB's actions demonstrate a commitment to maintaining the integrity of Nevada's gaming industry and deterring future money laundering attempts.

- Regulatory Actions Taken: The NGCB's response included not only imposing the fine but also a detailed review of Resorts World's AML compliance program and potential implementation of stricter oversight measures.

- Changes to Casino Regulations and Compliance Procedures: This incident is likely to prompt further refinements to Nevada's casino regulations and compliance procedures, potentially including stricter reporting requirements and enhanced scrutiny of high-risk transactions.

- Enhanced Anti-Money Laundering Measures: The entire casino industry is expected to review and strengthen its AML programs in light of this case, adopting more rigorous procedures and investing in advanced technology to detect and prevent money laundering activities.

Strengthening AML Compliance: Best Practices for Casinos

To prevent future incidents, casinos must prioritize proactive and comprehensive AML compliance. This involves a multi-pronged approach:

- Enhanced Employee Training: Regular and thorough employee training on AML regulations and procedures is crucial to ensure staff can identify and report suspicious activities effectively.

- Implementation of Advanced Transaction Monitoring Systems: Utilizing sophisticated software and technology to analyze transaction data in real-time can help casinos detect patterns indicative of money laundering.

- Strengthened Due Diligence Procedures for High-Risk Customers: Implementing rigorous due diligence processes for high-risk customers, including thorough background checks and enhanced monitoring of their transactions, is essential.

Conclusion

The $10.5 million money laundering fine imposed on Resorts World Casino serves as a stark reminder of the critical importance of robust anti-money laundering compliance in the gaming industry. The allegations, the significant penalty, and the regulatory response highlight the serious consequences of failing to implement and maintain effective AML procedures. Casinos must prioritize continuous improvement in their compliance programs, investing in technology, training, and enhanced due diligence to protect themselves and the integrity of the industry. Learn more about Resorts World Casino's response and understand the implications of money laundering in the gaming industry to ensure the future of Las Vegas and beyond remains free from such financial crimes. The fight against money laundering in casinos requires constant vigilance and a commitment to best practices.

Featured Posts

-

Analyzing Marcello Hernandezs Viral Snl Dog Suitcase Moment

May 18, 2025

Analyzing Marcello Hernandezs Viral Snl Dog Suitcase Moment

May 18, 2025 -

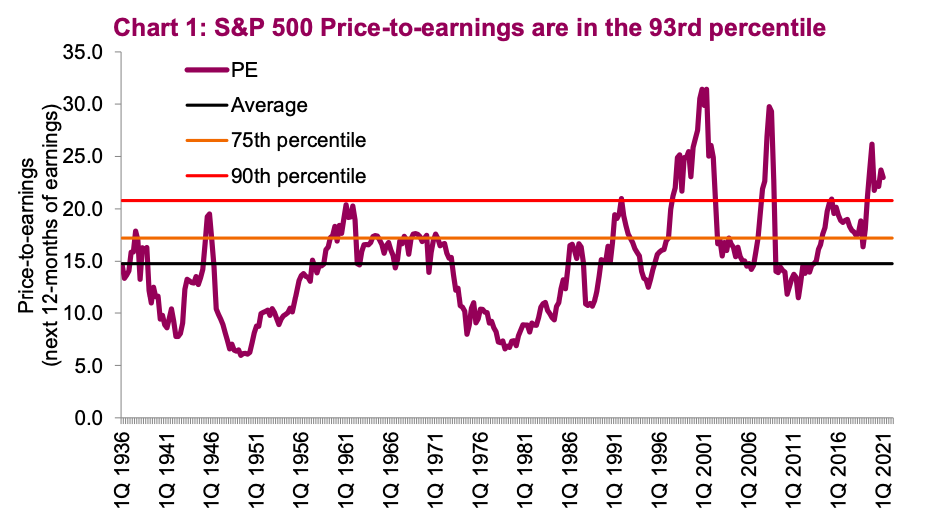

Bof A On High Stock Market Valuations A Reason For Investors To Stay Calm

May 18, 2025

Bof A On High Stock Market Valuations A Reason For Investors To Stay Calm

May 18, 2025 -

Nyt Mini Crossword Answers March 13 Daily Puzzle Solutions And Tips

May 18, 2025

Nyt Mini Crossword Answers March 13 Daily Puzzle Solutions And Tips

May 18, 2025 -

Your Guide To The Best No Deposit Bonus Codes May 2025

May 18, 2025

Your Guide To The Best No Deposit Bonus Codes May 2025

May 18, 2025 -

No Other Land Film Pemenang Oscar Yang Mengungkap Konflik Palestina Israel

May 18, 2025

No Other Land Film Pemenang Oscar Yang Mengungkap Konflik Palestina Israel

May 18, 2025