Retail Sales Surge: Another Bank Of Canada Rate Cut Less Likely

Table of Contents

Robust Retail Sales Figures Exceed Expectations

Recent retail sales data has surprised economists and analysts, revealing a significant increase in consumer spending. This positive economic indicator suggests a healthier Canadian economy than previously projected. Several key factors contribute to this understanding:

-

Specific Percentage Increase: Statistics Canada reported a [Insert Actual Percentage]% increase in retail sales for [Insert Month/Quarter], exceeding analyst forecasts of [Insert Analyst Forecast Percentage]%. This substantial jump signifies a notable shift in consumer spending patterns.

-

Strongest Growth Sectors: The most significant growth was observed in [Insert Specific Sectors e.g., automotive sales, furniture and home furnishings, and electronics]. This suggests increased consumer confidence in larger purchases and a positive outlook on the future.

-

Regional Variations: While the national picture is positive, regional variations exist. [Insert details on regional differences, if available, e.g., stronger growth in Ontario compared to weaker performance in Atlantic Canada]. This underscores the need for a nuanced understanding of the economic recovery.

-

Driving Factors: The surge in retail sales can be attributed to several factors. These include pent-up demand from previous lockdowns, government stimulus measures, and a gradual improvement in consumer confidence. The combination of these elements has fueled a significant increase in spending.

This unexpectedly strong performance deviates significantly from previous trends, which showed more moderate growth. The robust figures indicate a potentially self-sustaining economic recovery, driven by healthy consumer spending.

Implications for Inflation and Monetary Policy

The robust retail sales figures have significant implications for inflation and the Bank of Canada's monetary policy. Strong consumer spending can lead to increased demand-pull inflation, putting pressure on prices.

-

Inflationary Pressures: The surge in retail sales increases the risk of inflationary pressures. As demand outpaces supply in certain sectors, prices are likely to rise.

-

Bank of Canada's Inflation Target: The Bank of Canada maintains an inflation target of [Insert Current Inflation Target]%. The current retail sales data suggests that this target might be under pressure, potentially requiring intervention.

-

Interest Rate Decision: Given the increased likelihood of inflationary pressures, the Bank of Canada is less likely to implement another interest rate cut. In fact, maintaining the current interest rate or even considering a future rate hike is now a possibility.

The Bank of Canada typically responds to changing economic indicators by adjusting its monetary policy tools. A sustained increase in retail sales and inflation would likely prompt a shift towards a more cautious, potentially less accommodative, monetary policy stance. This could involve maintaining current interest rates or even considering a rate hike to curb inflationary pressures.

Alternative Economic Perspectives and Counterarguments

While the retail sales surge points to a strong economic recovery, it's important to consider alternative perspectives and potential counterarguments.

-

Counterarguments: Some economists argue that the retail sales increase is temporary, driven by temporary factors such as pent-up demand or one-time government stimulus. They caution against overinterpreting the data.

-

Factors Warranting a Rate Cut: Despite the strong retail sales, global economic uncertainty and weaknesses in specific sectors (e.g., housing market) could still warrant a rate cut. A more cautious approach remains essential.

-

Temporary Factors: The current increase in retail sales might be influenced by temporary factors that may not reflect sustained long-term growth. Further analysis is needed to determine if this is a truly sustainable trend.

Economic forecasting is inherently complex, and unforeseen circumstances can significantly impact future interest rate decisions. Therefore, a balanced perspective acknowledging both positive and negative factors is crucial.

Conclusion

The strong retail sales figures have significantly reduced the likelihood of another Bank of Canada rate cut in the near future. This unexpected surge in consumer spending suggests a more resilient economy than previously anticipated, potentially influencing the central bank's monetary policy decisions. The possibility of inflationary pressure rising due to this surge was also highlighted. Understanding these dynamics is crucial for navigating the current economic landscape.

Call to Action: Stay informed about future developments regarding Bank of Canada rate cuts and their impact on the Canadian economy. Regularly monitor retail sales data and other key economic indicators like the inflation rate and consumer confidence index to better understand potential shifts in monetary policy. Understanding Canadian interest rate changes is crucial for making informed financial decisions.

Featured Posts

-

Bundesliga Aufstieg Der Hsv Und Seine Fans Im Jubelrausch

May 25, 2025

Bundesliga Aufstieg Der Hsv Und Seine Fans Im Jubelrausch

May 25, 2025 -

Polemique Thierry Ardisson Accuse Laurent Baffie De Cracher Dans La Soupe

May 25, 2025

Polemique Thierry Ardisson Accuse Laurent Baffie De Cracher Dans La Soupe

May 25, 2025 -

Global Trade And Tariffs A G7 Perspective

May 25, 2025

Global Trade And Tariffs A G7 Perspective

May 25, 2025 -

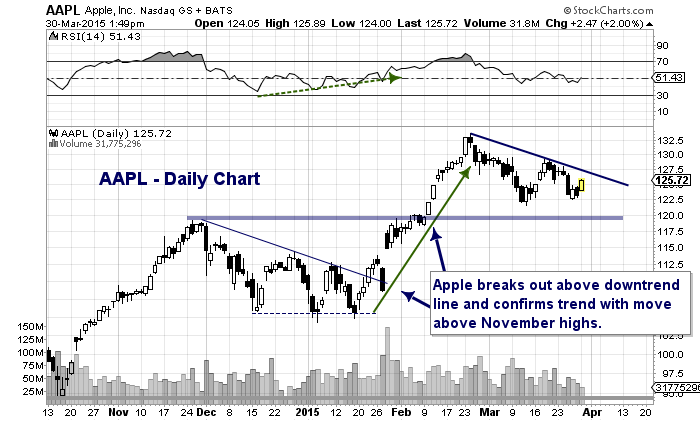

Apple Stock Aapl Price Prediction Key Levels And Support Resistance

May 25, 2025

Apple Stock Aapl Price Prediction Key Levels And Support Resistance

May 25, 2025 -

Hells Angels History Organization And Criminal Activities

May 25, 2025

Hells Angels History Organization And Criminal Activities

May 25, 2025