Revealed: The Financial Implications Of Musk's X Debt Sale

Table of Contents

The Scale of Musk's X Debt Burden

The acquisition of Twitter by Elon Musk involved a substantial debt load, significantly impacting X's financial standing. Precise figures fluctuate based on ongoing refinancing and reporting, but estimates initially placed the total debt at over $13 billion. This debt is a mix of various financial instruments, including high-yield loans, bonds, and potentially revolving credit facilities. These loans carry high-interest rates, demanding significant repayments over a relatively short period, creating a considerable financial strain.

- Debt Amount: While the exact figure changes, reports suggest a debt burden exceeding $13 billion at the time of acquisition, creating significant financial pressure on X.

- Sources of Funding: A consortium of banks and private equity firms provided the majority of the financing for the acquisition, highlighting the scale and risk involved.

- Potential Risks: The high-leverage nature of this acquisition significantly increases the financial risk for X. Any downturn in revenue or unexpected expenses could lead to severe financial distress. Defaulting on these loans would have disastrous consequences.

Impact on X's Financial Performance and Future Strategy

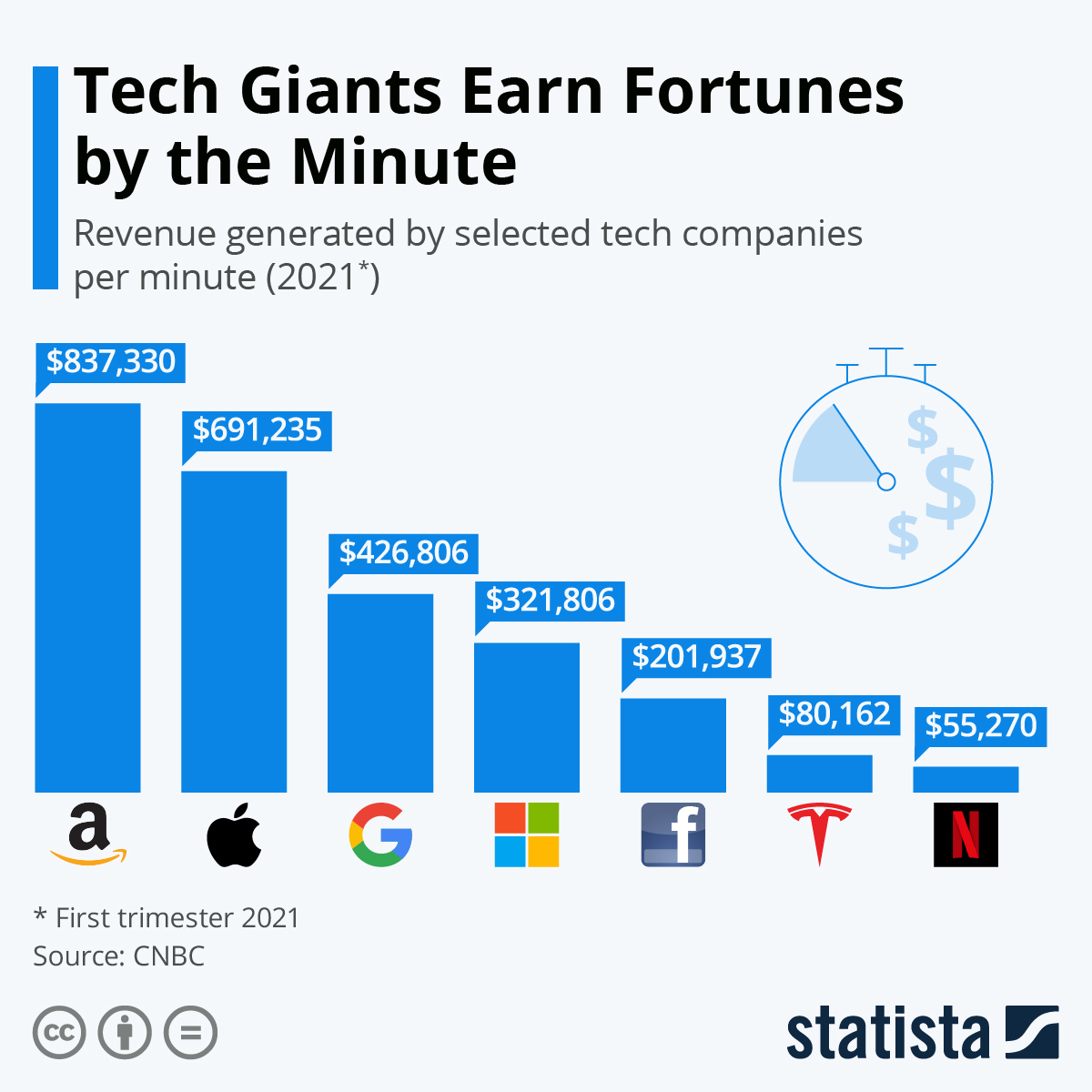

The substantial debt servicing costs directly impact X's financial performance and its future strategic plans. The substantial interest payments consume a large portion of X's revenue, potentially reducing profitability and limiting the company's capacity for investment. This financial constraint could affect X's ability to innovate, develop new products, and compete effectively with other major tech players.

- Revenue Streams & Profitability: X’s profitability is under pressure due to high debt service costs and potentially reduced advertising revenue.

- Cost-Cutting Measures: To mitigate the debt burden, X may implement stringent cost-cutting measures, potentially impacting employee morale and long-term growth potential.

- Future Product Development: The financial strain could limit X's capacity for significant investment in new product development and expansion into new markets.

The Broader Market Reaction to Musk's X Debt Sale

The market's reaction to Musk's X debt sale has been multifaceted. Initially, there was a degree of uncertainty and concern about X's ability to manage the substantial debt. The stock market performance (if applicable, considering X is now a privately held company) may reflect this initial skepticism. However, long-term consequences remain unclear.

- Investor Confidence: Investor confidence in X has been impacted by the high debt levels, influencing its valuation and potentially attracting less investment.

- Analyst Opinions: Financial analysts have offered mixed opinions, ranging from cautious optimism to outright concern regarding the sustainability of X's debt levels.

- Comparison with Similar Acquisitions: The acquisition's financial structure can be compared to other high-debt tech acquisitions to gain a better understanding of the potential risks and outcomes.

Potential Strategies for Managing X's Debt

To navigate the considerable debt burden, X may employ various strategies. These include refinancing existing debt at potentially lower interest rates, exploring debt restructuring to adjust repayment terms, or even considering asset sales to generate cash and reduce overall debt. Each strategy carries inherent risks and benefits.

- Refinancing and Restructuring: Seeking more favorable loan terms through refinancing or restructuring could reduce the financial strain.

- Asset Sales: Selling non-core assets could provide the necessary capital to reduce the debt load. This could involve divesting specific business units or technologies.

- Cost Optimization: Aggressive cost-cutting measures, potentially including layoffs and reduced operational spending, could increase profitability and improve debt service capacity.

Conclusion: Assessing the Long-Term Implications of Musk's X Debt Sale

Musk's X debt sale presents a complex financial situation with significant long-term implications. The substantial debt burden poses considerable risks to X's financial health and future growth. However, through strategic debt management, including refinancing, restructuring, or asset sales, X may improve its financial position. The success of these strategies will significantly impact X’s ability to compete, innovate, and fulfill its long-term ambitions. Staying informed about further developments concerning Musk's X debt sale and its consequences is crucial for anyone interested in the future of the platform and the broader tech landscape. Subscribe to our newsletter or follow us on social media for the latest updates on Elon Musk's finances, X's financial future, and the ongoing saga of the Twitter debt.

Featured Posts

-

Post Pope Funeral Meeting Trump And Zelenskys First Face To Face Since Their Heated Exchange

Apr 28, 2025

Post Pope Funeral Meeting Trump And Zelenskys First Face To Face Since Their Heated Exchange

Apr 28, 2025 -

Significant Investments And Developments In Abu Dhabi 2024 Review

Apr 28, 2025

Significant Investments And Developments In Abu Dhabi 2024 Review

Apr 28, 2025 -

Nascar Jack Link 500 Your Guide To Best Bets At Talladega 2025

Apr 28, 2025

Nascar Jack Link 500 Your Guide To Best Bets At Talladega 2025

Apr 28, 2025 -

Teslas Rise Lifts Us Stocks Tech Giants Power Market Growth

Apr 28, 2025

Teslas Rise Lifts Us Stocks Tech Giants Power Market Growth

Apr 28, 2025 -

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Returns From Slump

Apr 28, 2025

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Returns From Slump

Apr 28, 2025

Latest Posts

-

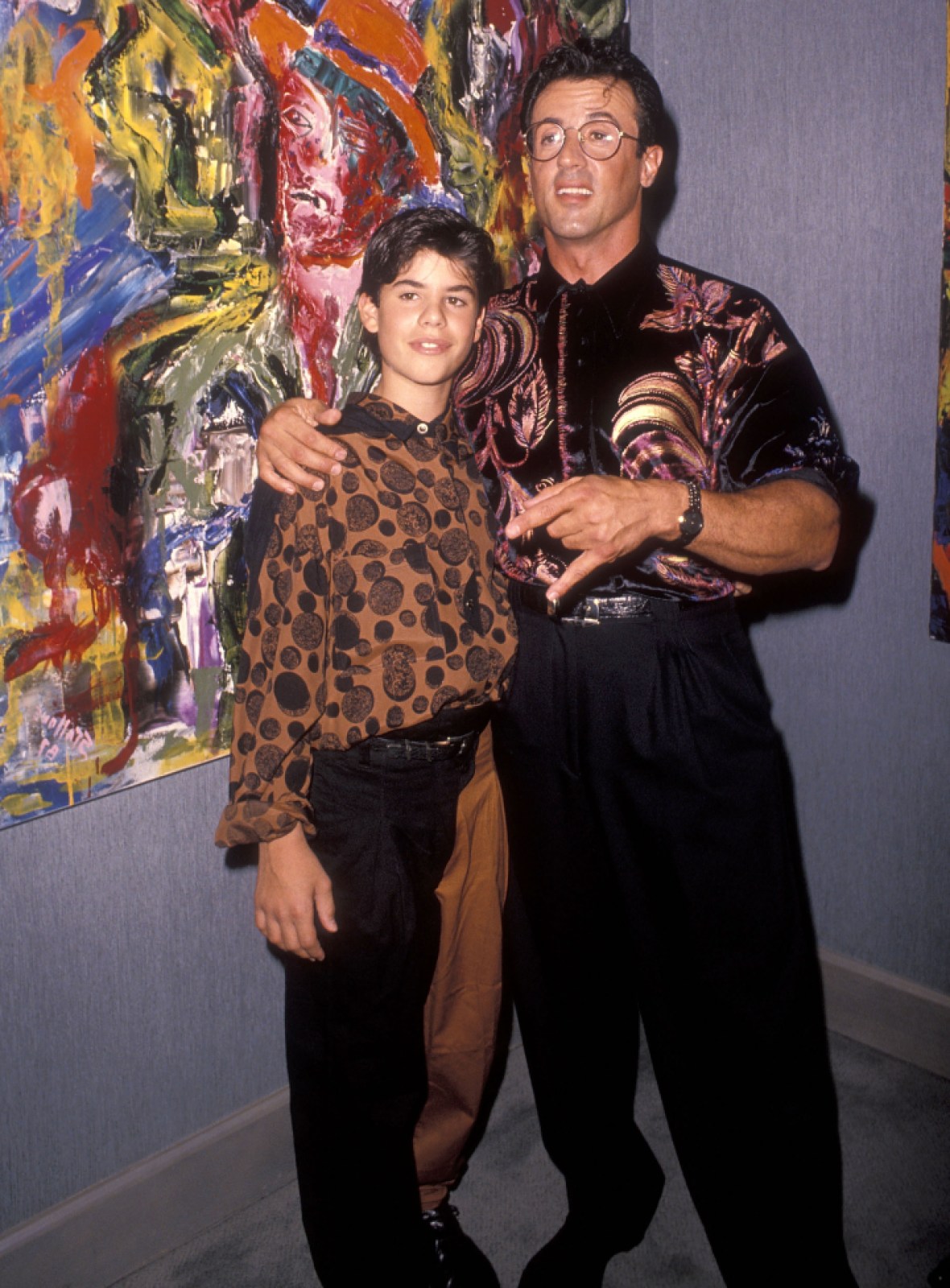

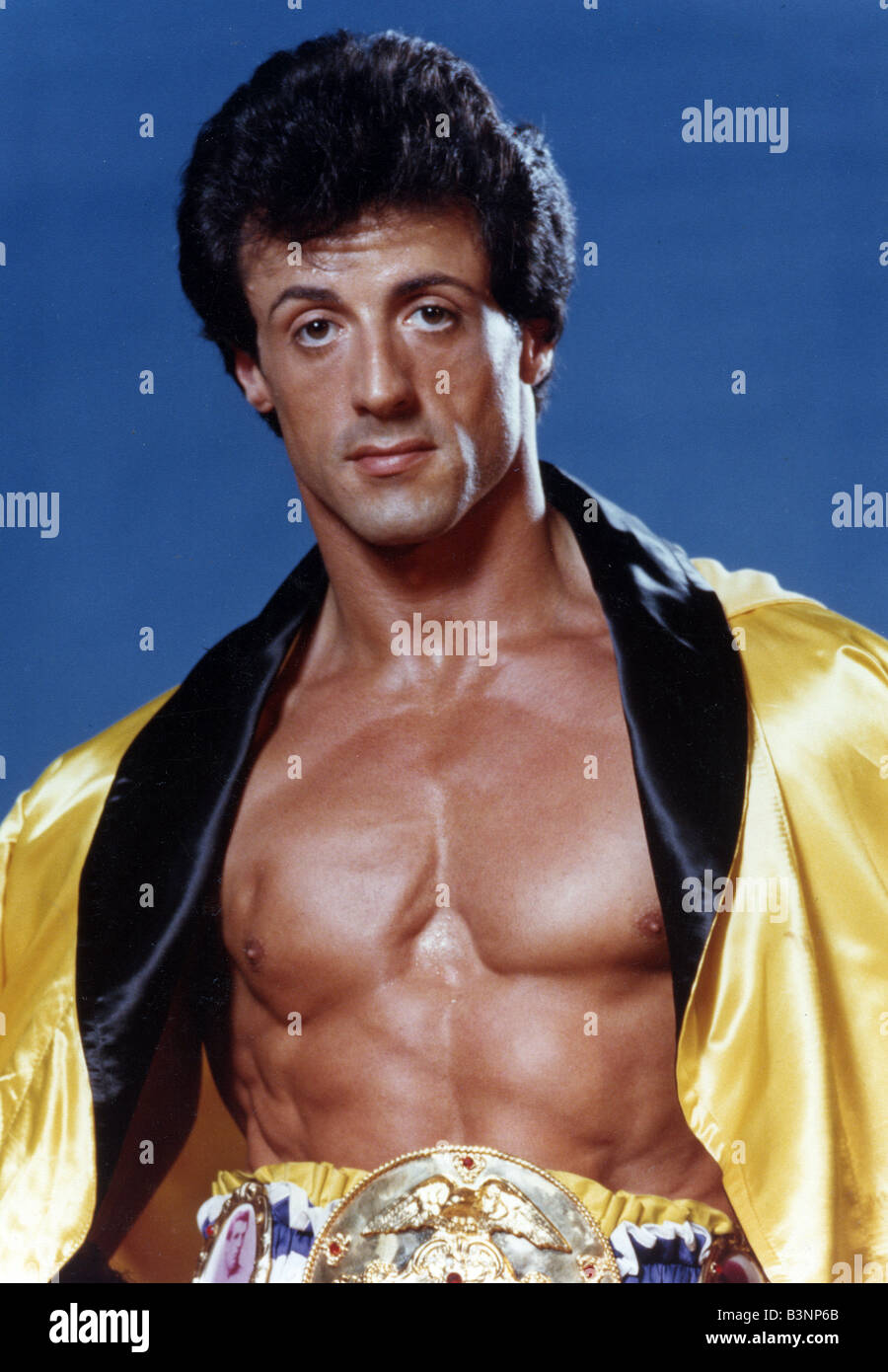

The Most Emotional Rocky Movie Stallones Personal Choice

May 12, 2025

The Most Emotional Rocky Movie Stallones Personal Choice

May 12, 2025 -

Rockys Emotional Core Stallone Reveals His Favorite Film

May 12, 2025

Rockys Emotional Core Stallone Reveals His Favorite Film

May 12, 2025 -

Stallone On Rocky Which Film Touches Him Most

May 12, 2025

Stallone On Rocky Which Film Touches Him Most

May 12, 2025 -

One And Done Analyzing Sylvester Stallones Single Non Acting Directorial Effort

May 12, 2025

One And Done Analyzing Sylvester Stallones Single Non Acting Directorial Effort

May 12, 2025 -

Sylvester Stallones Favorite Rocky Movie A Deep Dive Into The Franchises Most Emotional Entry

May 12, 2025

Sylvester Stallones Favorite Rocky Movie A Deep Dive Into The Franchises Most Emotional Entry

May 12, 2025