Revolut's Revenue Surge: 72% Growth Fuels International Expansion

Table of Contents

Analyzing Revolut's 72% Revenue Increase

Revolut's 72% revenue increase is a testament to its successful business model and strategic initiatives. Several key factors contributed to this remarkable achievement.

Increased Customer Base and User Engagement

Revolut's user base has experienced significant growth globally. This expansion isn't solely about acquiring new customers; it's also about fostering high levels of user engagement.

- Growth in Revolut Users: Revolut has consistently attracted millions of new users, driven by its user-friendly app, competitive pricing, and innovative features.

- Increased Transaction Volume: The number of transactions processed through the Revolut app has increased dramatically, reflecting higher user activity and reliance on the platform for daily financial needs.

- Enhanced App Usage: Improvements to the Revolut app, including streamlined user interfaces and the introduction of new features, have contributed to increased user engagement and stickiness.

- New Features Driving Growth: The introduction of features like budgeting tools, investment options, and improved international money transfer capabilities have significantly enhanced user experience and attracted new customers. Keywords: Revolut users, customer acquisition, user engagement, transaction volume, app usage.

Successful Premium and Business Subscription Models

Revolut's tiered subscription model, including Premium and Metal plans, has proven remarkably successful. These premium services generate significant revenue and attract a high-value customer base.

- Revenue Contribution from Premium Services: The revenue generated from Premium and Metal subscriptions constitutes a substantial portion of Revolut's overall income.

- Attractive Premium Features: Features like airport lounge access, travel insurance, higher withdrawal limits, and dedicated customer support are key selling points for these higher-tier subscriptions.

- Business Accounts Driving Growth: Revolut's business accounts offer tailored services for entrepreneurs and small businesses, contributing significantly to revenue growth. Keywords: Revolut premium, Revolut Metal, subscription model, revenue streams, premium features.

Expansion into New Financial Services

Revolut's diversification into new financial services has been a major driver of its revenue growth. By offering a broader range of products, Revolut caters to a wider customer base and reduces reliance on any single service.

- Revolut Investing and Crypto: The introduction of investment and cryptocurrency trading features has attracted a new segment of tech-savvy customers.

- Revolut Insurance Products: The expansion into insurance provides additional revenue streams and further solidifies Revolut's position as a comprehensive financial platform.

- Strategic Diversification: This diversification strategy mitigates risk and ensures long-term sustainable growth in a competitive fintech landscape. Keywords: Revolut investing, Revolut crypto, Revolut insurance, financial services, diversification.

Fueling International Expansion with Revenue Growth

The substantial revenue increase is directly fueling Revolut's ambitious international expansion strategy. This expansion is a multi-faceted process requiring strategic planning and execution.

Strategic Investments in New Markets

Revolut's international expansion is marked by strategic investments in key regions worldwide.

- Key Expansion Regions: Revolut is aggressively expanding into new markets in Europe, Asia, and Latin America.

- Market Entry Strategies: Revolut employs various strategies for entering new markets, including strategic partnerships, acquisitions, and direct market entry.

- Growth Potential in New Markets: Emerging markets offer significant growth potential for Revolut, given the increasing adoption of digital financial services. Keywords: Revolut international expansion, market entry strategy, global expansion, new markets, emerging markets.

Adapting to Local Market Needs

Successful international expansion requires understanding and adapting to the specific needs of each market.

- Market Localization: Revolut customizes its services to meet local regulations and cultural preferences, ensuring a seamless user experience.

- Regulatory Compliance: Compliance with local regulations and banking laws is paramount for successful international operations.

- Local Partnerships: Strategic partnerships with local businesses and financial institutions facilitate market entry and expansion. Keywords: market localization, regulatory compliance, international banking, local partnerships.

Technological Infrastructure for Global Reach

Revolut's technological infrastructure is crucial for supporting its international ambitions.

- Fintech Technology: Revolut's robust technological platform is designed for scalability and reliability, enabling it to handle millions of transactions globally.

- Cloud Infrastructure: Leveraging cloud technology allows Revolut to provide seamless services across different geographical locations.

- Global Payments: A sophisticated payment infrastructure is essential for facilitating international money transfers and transactions. Keywords: fintech technology, scalability, cloud infrastructure, digital banking, global payments.

Conclusion: Revolut's Continued Growth and Future Prospects

Revolut's 72% revenue surge is a significant achievement, driven by increased customer acquisition, successful premium subscription models, expansion into new financial services, and a robust international expansion strategy. The company's focus on technological innovation and adaptation to local market needs positions it for continued growth and dominance in the global fintech arena. We can expect Revolut to continue its aggressive expansion, further solidifying its position as a leader in digital banking. Stay updated on Revolut's continued growth and explore the opportunities within this dynamic fintech company. Keywords: Revolut future, fintech opportunities, Revolut career.

Featured Posts

-

Wrongful Death Litigation Separating Fact From Fiction

Apr 25, 2025

Wrongful Death Litigation Separating Fact From Fiction

Apr 25, 2025 -

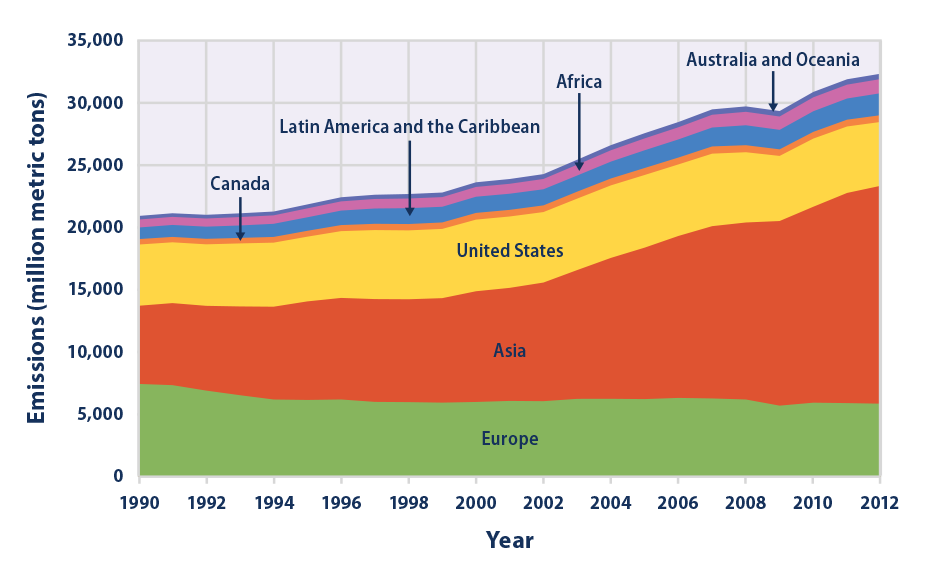

Xis Climate Strategy Chinas Path To Lower Emissions Without The Us

Apr 25, 2025

Xis Climate Strategy Chinas Path To Lower Emissions Without The Us

Apr 25, 2025 -

The Trump Factor A Key Issue In Canadas Upcoming Election

Apr 25, 2025

The Trump Factor A Key Issue In Canadas Upcoming Election

Apr 25, 2025 -

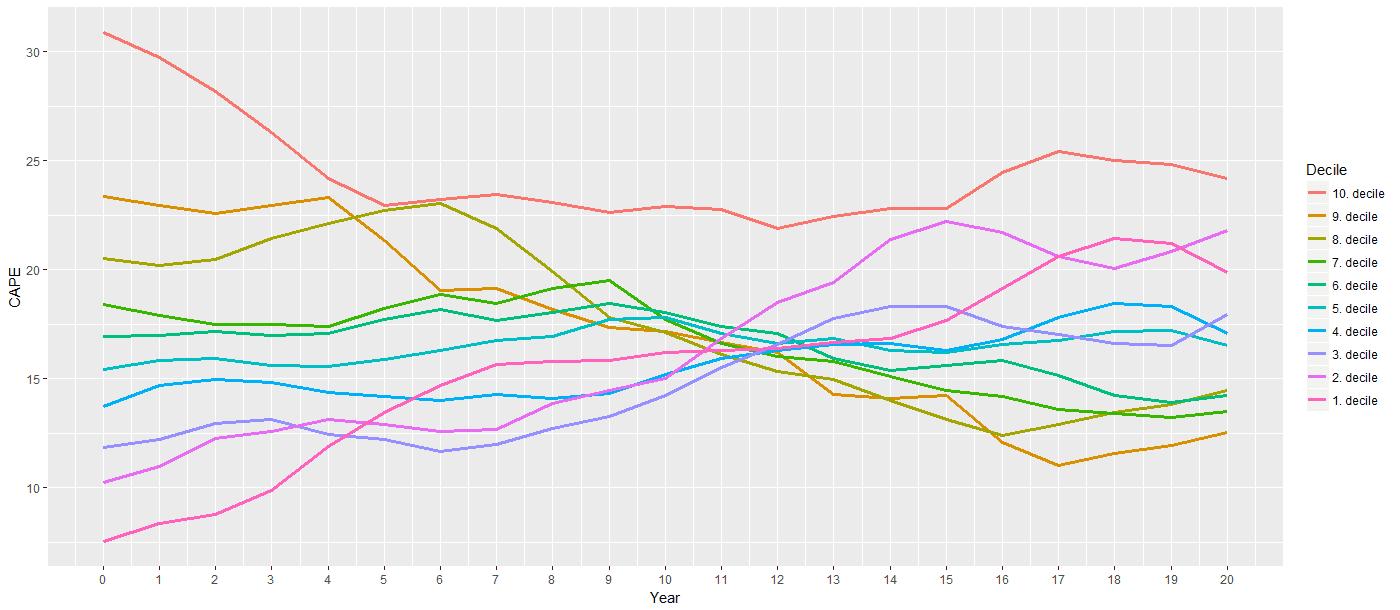

Addressing Investor Concerns Bof A On High Stock Market Valuations

Apr 25, 2025

Addressing Investor Concerns Bof A On High Stock Market Valuations

Apr 25, 2025 -

Remember Monday Uk Eurovision 2025 Hopefuls

Apr 25, 2025

Remember Monday Uk Eurovision 2025 Hopefuls

Apr 25, 2025