Ripple's XRP Climbs: Potential For $3.40 Breakout?

Table of Contents

Main Points:

2.1 Recent Market Trends Fueling XRP's Rise:

H3: Positive Ripple News and Legal Developments:

Recent positive developments in the ongoing SEC lawsuit against Ripple Labs have significantly boosted XRP's price. The case, which alleges that XRP is an unregistered security, has been a major factor influencing XRP's price for years. However, recent court rulings and expert opinions have injected a renewed sense of optimism into the market.

- Favorable Judge's Rulings: Several court decisions have shown a more favorable stance towards Ripple's arguments, leading to increased confidence among investors.

- Positive Community Sentiment: The Ripple community has rallied around the positive developments, fueling a surge in trading volume and price.

- Expert Opinions: Several financial experts have expressed increased confidence in XRP's future, citing the potential for a positive outcome in the legal battle. This positive sentiment has a ripple effect (pun intended!) on investor confidence.

- Potential for Settlement: While not confirmed, the possibility of a favorable settlement between Ripple and the SEC further contributes to the positive momentum.

Keywords: XRP SEC lawsuit, Ripple legal battle, XRP price prediction, positive Ripple news, XRP price action.

H3: Increased Institutional Adoption of XRP:

Beyond the legal battles, the growing adoption of XRP by financial institutions is a key driver of its price increase. XRP's speed and low transaction costs make it an attractive option for cross-border payments.

- Strategic Partnerships: Ripple has forged several partnerships with major financial institutions globally, integrating XRP into their payment systems.

- Expanding Utility: The increasing use of XRP for real-world applications, such as remittance payments, strengthens its value proposition.

- Improved Infrastructure: Ripple's ongoing development of its blockchain technology and infrastructure further enhances its appeal to institutional investors.

Keywords: Institutional XRP adoption, Ripple partnerships, XRP utility, XRP blockchain technology, RippleNet.

H3: Overall Cryptocurrency Market Sentiment:

The broader cryptocurrency market sentiment also plays a crucial role in XRP's price. A positive overall market trend often translates into gains for altcoins like XRP.

- Bitcoin's Performance: Bitcoin's price movements often serve as an indicator for the entire crypto market. A bullish Bitcoin market typically boosts altcoin prices.

- Altcoin Season: Periods of heightened altcoin activity, where altcoins outperform Bitcoin, can lead to significant gains for XRP.

- Market Capitalization Changes: Changes in the overall market capitalization of cryptocurrencies can directly impact XRP's market cap and price.

Keywords: Cryptocurrency market trends, Bitcoin price, altcoin market, market sentiment, XRP market cap, crypto market cycle.

2.2 Technical Analysis: Predicting the $3.40 Breakout:

H3: Chart Patterns and Indicators:

Technical analysis of XRP's price chart reveals several positive indicators suggesting a potential breakout.

- Bullish Trendlines: The price chart displays an upward trending pattern, suggesting a sustained bullish momentum.

- Breaking Resistance Levels: XRP has recently broken through key resistance levels, indicating a potential for further price increases.

- Positive RSI and MACD: Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) show bullish signals.

Keywords: XRP technical analysis, chart patterns, support resistance, trading indicators, XRP price chart, technical indicators.

H3: Volume and Trading Activity:

Increased trading volume often precedes significant price movements. Monitoring XRP's trading volume is crucial in gauging the strength of the current rally.

- High Trading Volume: Significant increases in XRP trading volume support the notion of strong buying pressure.

- Whale Activity: The activity of large investors ("whales") can significantly impact XRP's price.

- Exchange Listings: New listings on major cryptocurrency exchanges can increase liquidity and trading volume, boosting the price.

Keywords: XRP trading volume, XRP whale activity, cryptocurrency exchanges, XRP liquidity, order book analysis.

2.3 Risks and Potential Challenges:

H3: Regulatory Uncertainty:

Regulatory uncertainty remains a significant risk factor for XRP and the entire cryptocurrency market.

- SEC Regulations: The ongoing legal battle with the SEC creates uncertainty around XRP's future regulatory status.

- Global Cryptocurrency Regulations: Varying regulations across different jurisdictions pose challenges for global adoption.

- Potential Future Legal Issues: The possibility of future legal challenges cannot be ruled out.

Keywords: Cryptocurrency regulation, SEC regulations, XRP regulatory risks, legal uncertainty, regulatory compliance.

H3: Market Volatility:

The cryptocurrency market is inherently volatile, and XRP is no exception.

- Market Corrections: Sharp price drops ("corrections") are common in the crypto market.

- Unexpected Events: Geopolitical events or unexpected news can significantly impact XRP's price.

- Risk Management Strategies: Investors should always employ proper risk management strategies, such as diversification and stop-loss orders.

Keywords: Cryptocurrency volatility, risk management, XRP price volatility, market risk, investment risk.

Conclusion: Is a $3.40 XRP Breakout Realistic?

Based on the positive developments surrounding Ripple's XRP, including positive legal developments, increased institutional adoption, and positive technical indicators, a price surge towards $3.40 appears plausible. However, it is crucial to acknowledge the inherent risks involved in cryptocurrency investments, including regulatory uncertainty and market volatility. While the potential for significant gains is undeniable, investors must conduct thorough research and implement appropriate risk management strategies before investing in XRP. Stay informed on the latest developments regarding Ripple's XRP and its potential for a $3.40 breakout. Conduct your own thorough research before making any investment decisions.

Featured Posts

-

Nba Playoffs Alex Carusos Historic Game 1 Performance For The Thunder

May 08, 2025

Nba Playoffs Alex Carusos Historic Game 1 Performance For The Thunder

May 08, 2025 -

Universal Credit Hardship Payments Reclaiming Money From The Dwp

May 08, 2025

Universal Credit Hardship Payments Reclaiming Money From The Dwp

May 08, 2025 -

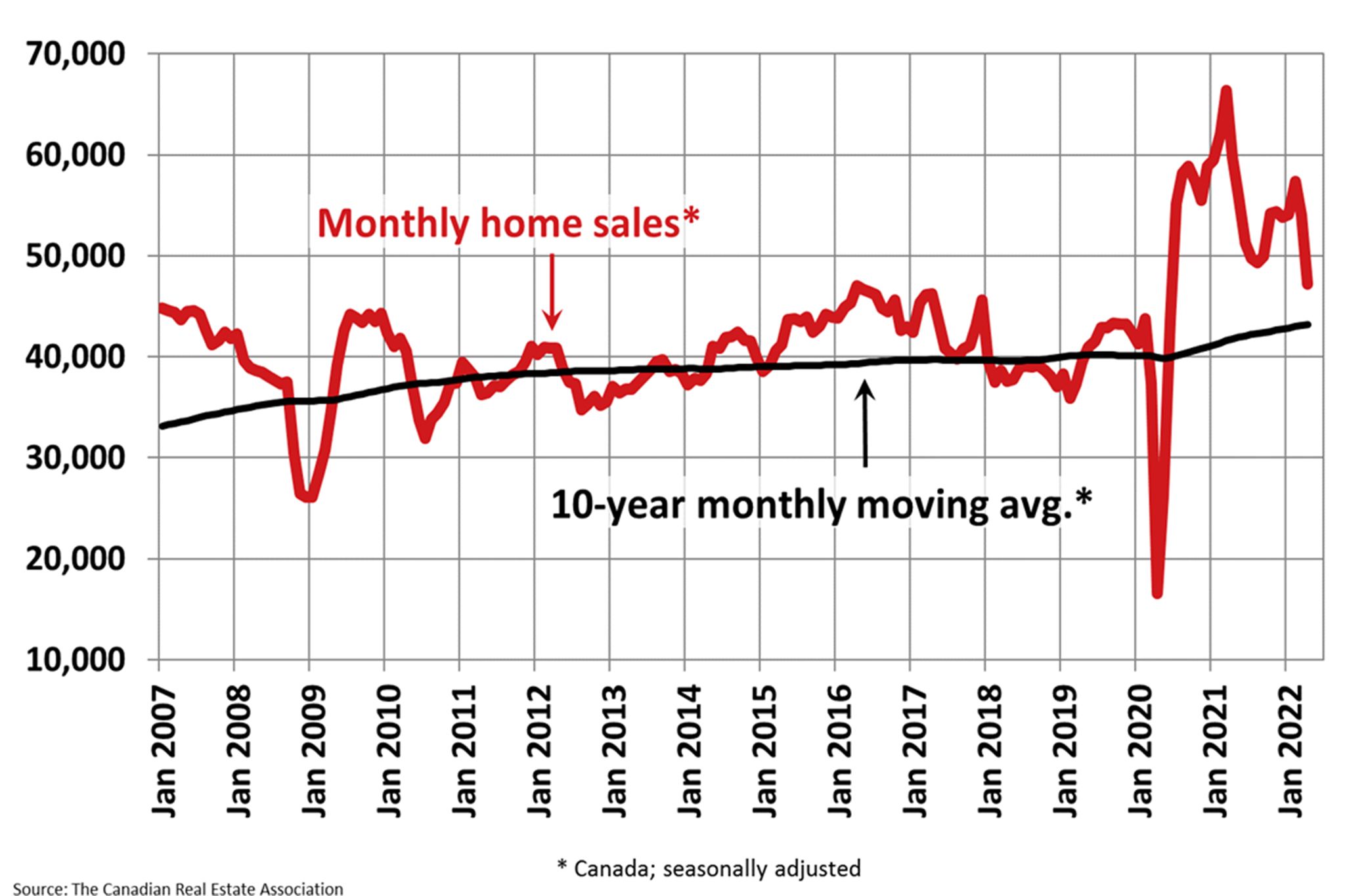

Toronto Housing Market Report Sales Down 23 Prices Down 4

May 08, 2025

Toronto Housing Market Report Sales Down 23 Prices Down 4

May 08, 2025 -

Dwp Update Action Needed For 12 Benefit Payments And Bank Accounts

May 08, 2025

Dwp Update Action Needed For 12 Benefit Payments And Bank Accounts

May 08, 2025 -

Predicting The Arsenal Vs Psg Semi Final A More Difficult Test Than Real Madrid

May 08, 2025

Predicting The Arsenal Vs Psg Semi Final A More Difficult Test Than Real Madrid

May 08, 2025