S&P/TSX Composite Index: Record High Sparks Market Analysis

Table of Contents

Economic Factors Driving the S&P/TSX Composite Index's Surge

Several macroeconomic factors have contributed to the S&P/TSX Composite Index's impressive climb to record highs. Understanding these underlying economic forces is crucial for making informed investment decisions.

-

Strong Commodity Prices: Canada's economy is heavily reliant on natural resources. The recent surge in global commodity prices, particularly oil, natural gas, and various metals, has significantly boosted the performance of energy and materials companies listed on the TSX, driving the overall index higher. This positive effect on commodity prices can be linked to increased global demand and supply chain disruptions.

-

Growth in Specific Sectors: Beyond commodities, other sectors have also experienced robust growth. The technology sector, fueled by innovation and increasing digital adoption, has shown impressive gains. Similarly, the financial sector has benefited from rising interest rates and increased trading activity. This diversified growth points to a broader economic expansion beyond just resource-based industries.

-

Government Policies: Government policies, including fiscal stimulus measures and infrastructure investments, have played a role in supporting economic growth and influencing market sentiment. These policies can impact investor confidence and encourage investment in various sectors.

-

Interest Rate Environment: The interest rate environment, while volatile, has generally been supportive of market growth. While rising interest rates can be a double-edged sword, the current levels haven't significantly dampened investor enthusiasm, allowing for continued growth in the S&P/TSX Composite Index. This also creates a more complex investment landscape requiring careful consideration.

-

Global Economic Conditions: The performance of the Canadian stock market is intrinsically linked to global economic conditions. Positive global growth and strong international demand for Canadian goods and services have contributed to the upward trend of the S&P/TSX Composite Index. Understanding global interconnectedness is vital for analyzing the TSX.

Sector Performance: Winners and Losers in the Recent Rally

Analyzing the performance of individual sectors within the S&P/TSX Composite Index provides a more nuanced understanding of the market's trajectory.

-

Top-Performing Sectors: Energy and materials sectors have been clear winners, driven by the aforementioned commodity price increases. Technology and financials have also demonstrated strong performance, showcasing broader economic health.

-

Underperforming Sectors: While many sectors have participated in the rally, some may have lagged behind due to specific industry challenges or headwinds. Careful examination of underperforming sectors can reveal potential investment opportunities once the factors affecting them improve.

-

Historical Context: Comparing current sector performance with previous periods offers valuable context. Analyzing historical trends helps investors identify long-term patterns and cyclical movements. This requires detailed historical data and analysis for accurate interpretations.

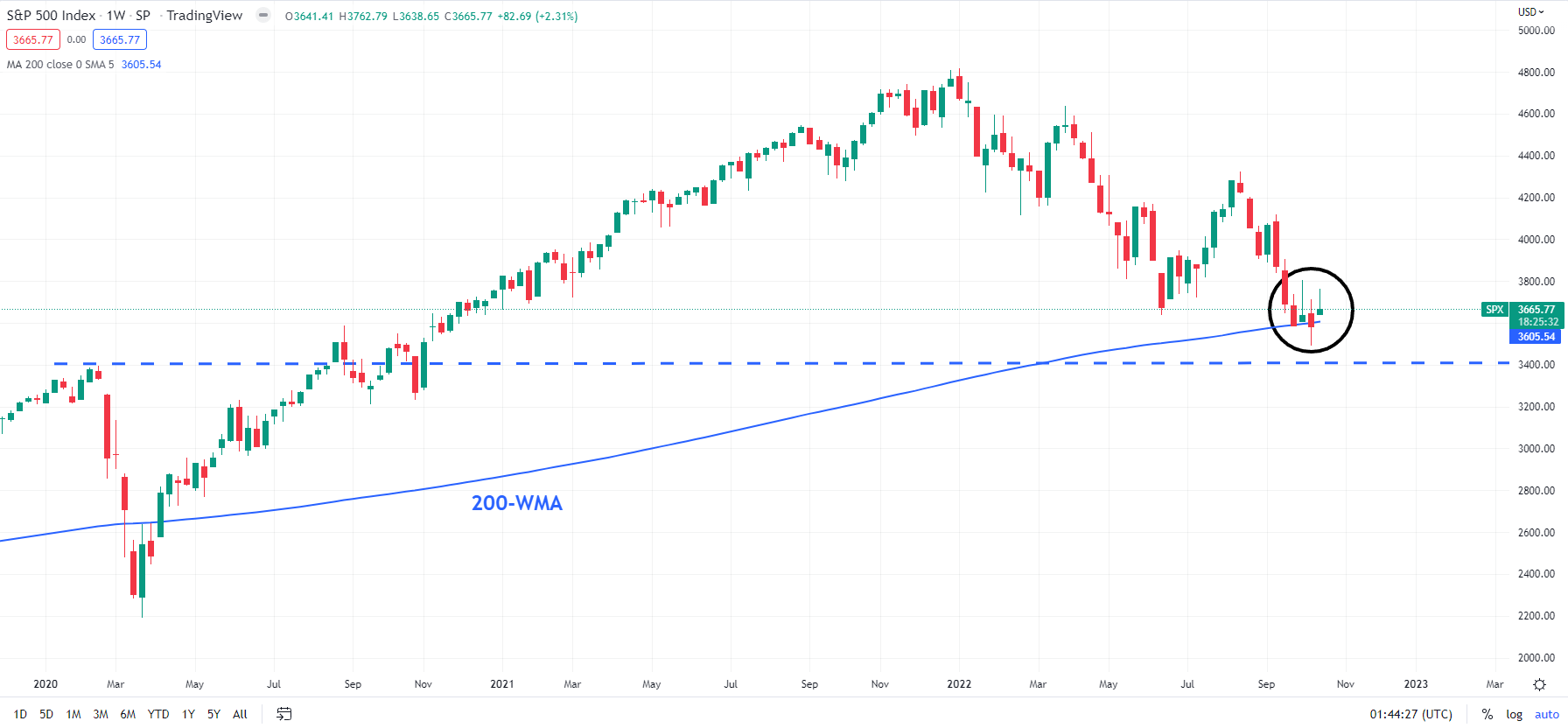

(Insert relevant charts and graphs illustrating sector performance here)

Analyzing the Sustainability of the S&P/TSX Composite Index's Record High

While the current record high is cause for celebration, assessing its long-term sustainability is paramount.

-

Potential Risks and Challenges: Several factors could potentially hinder future growth. Geopolitical instability, escalating inflation, and unexpected economic downturns are all risks that could impact the S&P/TSX Composite Index.

-

Market Valuation: Evaluating the overall valuation of the S&P/TSX Composite Index is crucial. Overvaluation can make the market susceptible to corrections. Careful analysis of valuation metrics is needed to assess potential risks of overvaluation.

-

Investor Sentiment: Investor sentiment plays a significant role in market volatility. Overly optimistic or pessimistic sentiment can drive significant price swings, underscoring the importance of assessing current investor perspectives.

-

Future Catalysts: Identifying potential future catalysts, both positive and negative, is vital for predicting the index's trajectory. Factors such as government policies, technological advancements, and global events can significantly influence the market's future direction.

Investment Strategies for Navigating the Current Market

The current market conditions necessitate a well-defined investment strategy.

-

Diversification: Diversification remains a cornerstone of effective risk management. Spreading investments across various sectors and asset classes reduces exposure to individual sector-specific risks.

-

Sector-Specific Opportunities: While diversification is key, identifying sector-specific opportunities within the S&P/TSX Composite Index can enhance returns. Thorough research into individual sectors is essential for finding promising investments.

-

Long-Term Investment Planning: Maintaining a long-term investment horizon helps weather market volatility. Short-term market fluctuations should not derail a well-defined long-term investment strategy.

-

Asset Allocation: Considering different asset classes, including bonds, real estate, and alternative investments, provides further diversification and risk mitigation. A well-balanced asset allocation strategy is crucial for managing overall portfolio risk.

Conclusion: Making Informed Decisions with the S&P/TSX Composite Index

The S&P/TSX Composite Index's record high reflects a confluence of economic factors and sector-specific performance. While the current market trend presents opportunities, it also entails risks. Understanding the underlying economic forces, analyzing sector performance, and assessing potential future catalysts are crucial for making informed investment decisions. Monitor the S&P/TSX Composite Index closely, understand the S&P/TSX Composite Index trends, analyze the S&P/TSX Composite Index performance, and develop a sound investment strategy based on your risk tolerance and financial goals. By conducting thorough research and employing a well-diversified approach, you can aim to build a successful S&P/TSX Composite Index investment strategy that aligns with your long-term objectives.

Featured Posts

-

The Arsenal Stuttgart Transfer Battle Gunners Hold The Edge

May 17, 2025

The Arsenal Stuttgart Transfer Battle Gunners Hold The Edge

May 17, 2025 -

Foto Toni Naumovski I Nagradata Za Na Transformativen Film

May 17, 2025

Foto Toni Naumovski I Nagradata Za Na Transformativen Film

May 17, 2025 -

Midair Collision Averted An Air Traffic Controllers Exclusive Story

May 17, 2025

Midair Collision Averted An Air Traffic Controllers Exclusive Story

May 17, 2025 -

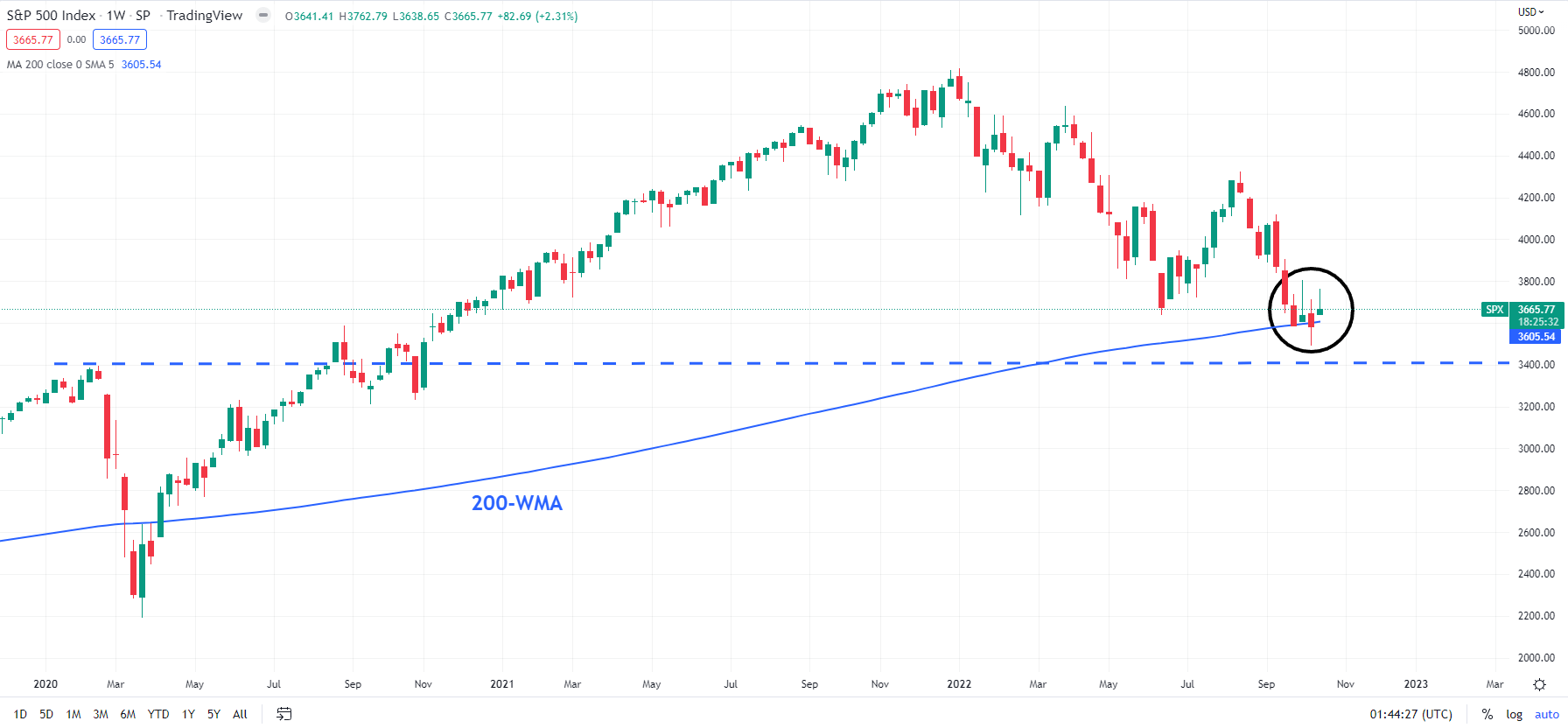

Missed Student Loan Payments Impact On Your Credit Score

May 17, 2025

Missed Student Loan Payments Impact On Your Credit Score

May 17, 2025 -

Identifying And Debunking Fake Angel Reese Quotes

May 17, 2025

Identifying And Debunking Fake Angel Reese Quotes

May 17, 2025