SEC Review Of Grayscale's XRP ETF: Implications For XRP Price

Table of Contents

Potential Positive Implications of SEC Approval

SEC approval of a Grayscale XRP ETF would likely trigger a wave of positive developments for XRP. This regulatory green light would signal a significant shift in how institutional investors perceive the cryptocurrency.

Increased Institutional Investment

- Increased legitimacy and trust: SEC approval would lend significant credibility to XRP, overcoming some of the skepticism surrounding cryptocurrencies.

- Attracting large-scale institutional investors: Many institutional investors have strict guidelines preventing them from investing in unregulated assets. An ETF would open the door for large-scale investment previously unavailable.

- Higher trading volume: Increased institutional participation would naturally lead to a substantial increase in trading volume on exchanges listing XRP.

- Potential price surge due to increased demand: The influx of institutional capital, driven by the increased legitimacy and accessibility, would likely lead to a significant surge in XRP's price. This increased demand would outstrip supply in the short term.

This injection of institutional capital could fundamentally alter XRP's market dynamics. The perceived safety and accessibility would dramatically increase its attractiveness to a wider range of investors.

Enhanced Liquidity and Accessibility

- Easier access for retail investors through brokerage accounts: Investing in XRP would become significantly easier for retail investors who prefer the convenience and familiarity of traditional brokerage accounts.

- Increased trading volume on exchanges: Greater accessibility means more traders, boosting trading volume and providing more robust price discovery.

- Reduced price volatility due to increased market depth: A larger pool of buyers and sellers would create a more stable and less volatile market for XRP.

The improved liquidity will benefit both institutional and retail investors. This improved accessibility fosters a more efficient and mature market for XRP.

Boosted Market Capitalization

- Increased demand leading to higher market cap: The combined effect of increased institutional and retail investment would drive up XRP's market capitalization considerably.

- Improved ranking among cryptocurrencies: A higher market cap would solidify XRP's position among the top cryptocurrencies, attracting even more attention and investment.

- Attracting further investment and development: Increased market capitalization typically leads to increased investment in research, development, and broader adoption of the technology.

A higher market cap translates to greater influence and stability within the cryptocurrency market, creating a positive feedback loop.

Potential Negative Implications of SEC Rejection or Delay

Conversely, a negative decision by the SEC, or even a significant delay, could severely impact XRP's price and market position.

Negative Market Sentiment

- Potential sell-off by investors anticipating rejection: Investors anticipating a negative outcome might preemptively sell their XRP holdings, leading to a price decline.

- Decreased investor confidence in XRP: A rejection would fuel uncertainty and potentially damage investor confidence in the long-term prospects of XRP.

- Temporary price decline: The immediate reaction would likely involve a noticeable drop in price, potentially significant depending on the market's overall sentiment.

The psychological impact of a rejection could be substantial, undermining the positive momentum that an ETF approval could generate.

Continued Regulatory Uncertainty

- Lingering questions about XRP's regulatory status: A rejection would leave unanswered questions surrounding XRP's regulatory status, hindering its broader adoption.

- Inhibiting institutional investment: Continued regulatory uncertainty would keep many institutional investors on the sidelines, limiting the potential for substantial price growth.

- Potential for further price suppression: The lack of clarity could lead to prolonged price suppression, hindering XRP's potential.

This prolonged uncertainty could deter investment and hamper the development and adoption of XRP-based technologies.

Impact on Ripple's Ongoing Legal Battle

- SEC rejection may strengthen the SEC's case against Ripple: A rejection could be interpreted as further evidence supporting the SEC's position in its ongoing legal battle against Ripple Labs.

- Further impacting XRP price: Any negative developments in the Ripple lawsuit would likely exert downward pressure on XRP's price.

- Potential long-term legal uncertainty: The uncertainty surrounding the lawsuit could linger for years, creating a significant headwind for XRP's price.

The legal battle between Ripple and the SEC is a crucial factor that heavily influences XRP's price trajectory.

Factors Influencing XRP Price Beyond the SEC Decision

While the SEC's decision is paramount, other factors also influence XRP's price.

Overall Cryptocurrency Market Trends

- Bitcoin's price movements: Bitcoin's price often acts as a bellwether for the entire cryptocurrency market, impacting XRP indirectly.

- General market sentiment towards cryptocurrencies: Broader market sentiment and regulatory developments in other cryptocurrencies can affect XRP's performance.

- Adoption rates and technological advancements: Overall adoption of cryptocurrencies and advancements in blockchain technology also play a significant role.

Understanding the broader market context is crucial for assessing the full impact on XRP.

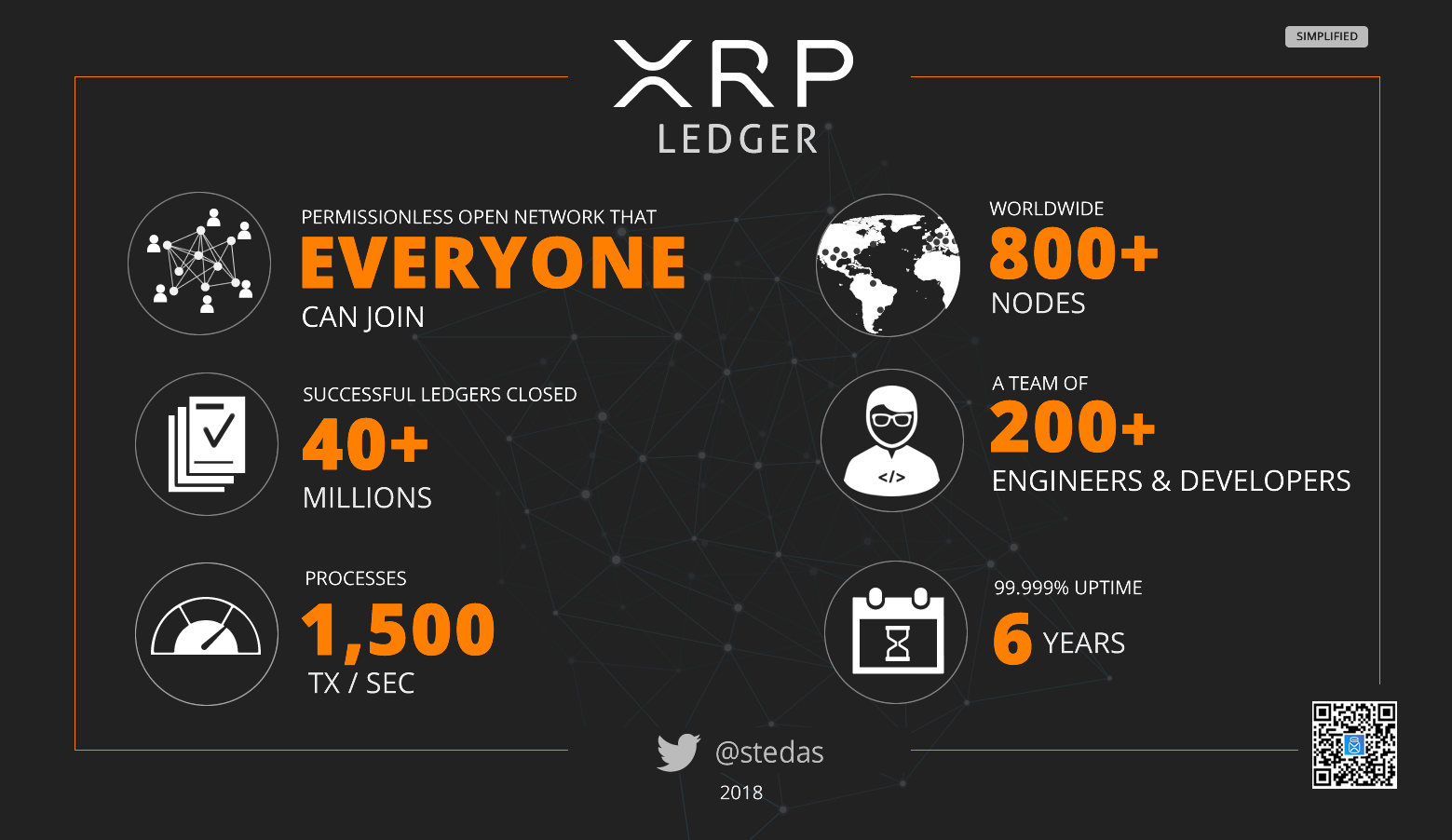

Ripple's Technological Developments

- Advancements in RippleNet: Progress in Ripple's payment network, RippleNet, can directly enhance XRP's utility and demand.

- Adoption of XRP by new businesses: Increased adoption of XRP by businesses for cross-border payments can significantly boost demand.

- Improvements to the XRP Ledger: Continuous improvements to the XRP Ledger's efficiency and scalability can drive increased usage and value.

Ripple's own efforts to improve the XRP ecosystem play a key role in its long-term price performance, independent of SEC decisions.

Conclusion

The SEC's decision on a potential Grayscale XRP ETF is a pivotal moment for XRP. While approval promises significant potential for price growth through increased institutional investment and improved liquidity, rejection or delay could lead to negative market sentiment and prolonged uncertainty. It's crucial to consider both the positive and negative implications, alongside broader market trends and Ripple's own technological progress, when assessing the future of XRP. Stay informed about the SEC’s review of a potential Grayscale XRP ETF and its potential impact on the XRP price. Understanding these factors will enable you to make more informed decisions regarding your XRP investment and navigate this dynamic market effectively.

Featured Posts

-

Lahore School Timetable Changes Psl 2024 Considerations

May 08, 2025

Lahore School Timetable Changes Psl 2024 Considerations

May 08, 2025 -

Ripples Xrp After A 400 Increase Where Could The Price Go

May 08, 2025

Ripples Xrp After A 400 Increase Where Could The Price Go

May 08, 2025 -

Arsenal News Expert Collymore Questions Artetas Future

May 08, 2025

Arsenal News Expert Collymore Questions Artetas Future

May 08, 2025 -

Yavin 4s Return A Star Wars Retrospective

May 08, 2025

Yavin 4s Return A Star Wars Retrospective

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Altering Performance

May 08, 2025

Saturday Night Live And Counting Crows A Career Altering Performance

May 08, 2025