Secure Your Future: Identifying The Real Safe Bet In Various Asset Classes

Table of Contents

Real Estate as a Safe Bet

Real estate has long been considered a cornerstone of long-term investment strategies, offering a compelling blend of potential growth and passive income generation. This makes it a strong contender for a "safe bet" in many portfolios.

Long-Term Appreciation and Rental Income Potential

Historically, real estate values have shown a consistent upward trend, though not without fluctuations. This long-term appreciation provides significant potential for capital growth. Furthermore, rental income from properties offers a valuable stream of passive income, supplementing your investment returns.

- Historical Appreciation: While past performance doesn't guarantee future results, data shows a general increase in real estate values over decades.

- Passive Income: Rental income can help offset mortgage payments and provide a steady cash flow.

- Potential Risks: Market fluctuations, property maintenance costs, vacancy periods, and interest rate changes are all potential downsides.

Diversification within Real Estate

Don't put all your eggs in one basket! Diversification within the real estate sector is key to mitigating risk.

- Residential Real Estate: Investing in single-family homes, apartments, or condos offers potential for rental income and appreciation.

- Commercial Real Estate: Investing in office buildings, retail spaces, or industrial properties can offer higher returns but often carries higher risks.

- REITs (Real Estate Investment Trusts): REITs provide exposure to a diversified portfolio of real estate properties without the direct management responsibilities.

- Geographic Diversification: Spreading investments across different geographic locations helps reduce risk associated with localized market downturns.

The Role of Bonds in a Secure Future

Bonds offer a contrasting approach to real estate, emphasizing stability and predictability over potentially higher, but riskier, returns.

Fixed Income and Lower Risk Profile

Bonds provide a fixed income stream, offering a predictable return over a defined period. Compared to stocks, bonds are generally considered a low-risk investment. However, it's crucial to acknowledge interest rate risk: rising interest rates can negatively impact bond values.

- Predictable Income: Bondholders receive regular interest payments until the bond matures.

- Lower Volatility: Bonds are generally less volatile than stocks, providing stability during market downturns.

- Interest Rate Risk: Changes in interest rates directly affect bond prices.

Diversifying Bond Holdings

Similar to real estate, diversification is essential for a successful bond investment strategy.

- Government Bonds: Issued by governments, these bonds are considered the lowest risk but may offer lower returns.

- Corporate Bonds: Issued by corporations, these bonds offer higher yields but carry more credit risk.

- Municipal Bonds: Issued by state and local governments, these bonds often offer tax advantages.

- Maturity Dates: Diversifying across bonds with different maturity dates helps manage interest rate risk. A well-structured bond portfolio should balance maturity dates to optimize risk and return.

Stocks: Balancing Risk and Reward for Long-Term Growth

Stocks, representing ownership in companies, offer the potential for significant returns but come with higher volatility.

The Potential for High Returns

Historically, the stock market has delivered strong long-term growth, outpacing inflation over extended periods. However, this growth is not linear, and short-term fluctuations are common. A long-term investment strategy is crucial to navigate these ups and downs.

- High Growth Potential: Stocks offer the possibility of substantial returns over the long term.

- Long-Term Perspective: Investing in stocks requires patience and a long-term outlook to overcome market volatility.

- Equity Investment: Owning stocks means owning a share of a company's assets and profits.

Mitigating Stock Market Risk

Risk mitigation is paramount in stock market investment. A well-diversified portfolio is key.

- Diversification: Spreading investments across different sectors and companies reduces the impact of any single stock's poor performance.

- Index Funds and ETFs: These investment vehicles provide broad market exposure, offering diversification with lower management fees.

- Sector Diversification: Investing across different sectors (technology, healthcare, energy, etc.) reduces the impact of sector-specific downturns.

Gold as a Safe Haven Asset

Gold has historically served as a safe haven asset, acting as a hedge against economic uncertainty.

Preserving Capital During Economic Uncertainty

During periods of inflation or economic downturn, gold investment can help preserve capital. Its value often increases when other assets decline, offering a buffer against market volatility.

- Inflation Hedge: Gold's value tends to rise during inflationary periods, protecting purchasing power.

- Safe Haven: Investors often flock to gold during times of economic or political instability.

- Capital Preservation: Gold can help protect your portfolio during market downturns.

Considerations for Gold Investment

While gold offers potential benefits, it's important to consider its limitations.

- No Income Generation: Unlike bonds or real estate, gold does not generate passive income.

- Price Fluctuations: The gold price can be volatile, subject to market forces and investor sentiment.

- Investment Options: Gold can be purchased in various forms, including gold bars, gold coins, and gold ETFs.

Securing Your Future: The Best Safe Bet for You

In conclusion, there's no single "best" safe bet in investing. Real estate offers potential for long-term growth and passive income, while bonds provide stability and predictable returns. Stocks, though riskier, offer the highest growth potential over the long term, while gold acts as a hedge against uncertainty. The optimal strategy involves diversifying across these asset classes based on your individual risk tolerance and financial goals. Remember, successful investing requires long-term planning and a well-diversified portfolio. Before making any investment decisions, seeking professional financial advice is crucial. Start planning for your secure future today by researching these asset classes and consulting a financial advisor to determine the best "safe bet" investment strategy for your unique needs.

Featured Posts

-

Stephen Kings Thoughts On Stranger Things And It A Comparison

May 09, 2025

Stephen Kings Thoughts On Stranger Things And It A Comparison

May 09, 2025 -

Colin Cowherd And Jayson Tatum A Deep Dive Into The Ongoing Debate

May 09, 2025

Colin Cowherd And Jayson Tatum A Deep Dive Into The Ongoing Debate

May 09, 2025 -

Jeremy Clarksons Plan To Save F1 Will Ferrari Dq Fears Materialize

May 09, 2025

Jeremy Clarksons Plan To Save F1 Will Ferrari Dq Fears Materialize

May 09, 2025 -

Epicure Et La Cite De La Gastronomie De Dijon Une Situation Compliquee

May 09, 2025

Epicure Et La Cite De La Gastronomie De Dijon Une Situation Compliquee

May 09, 2025 -

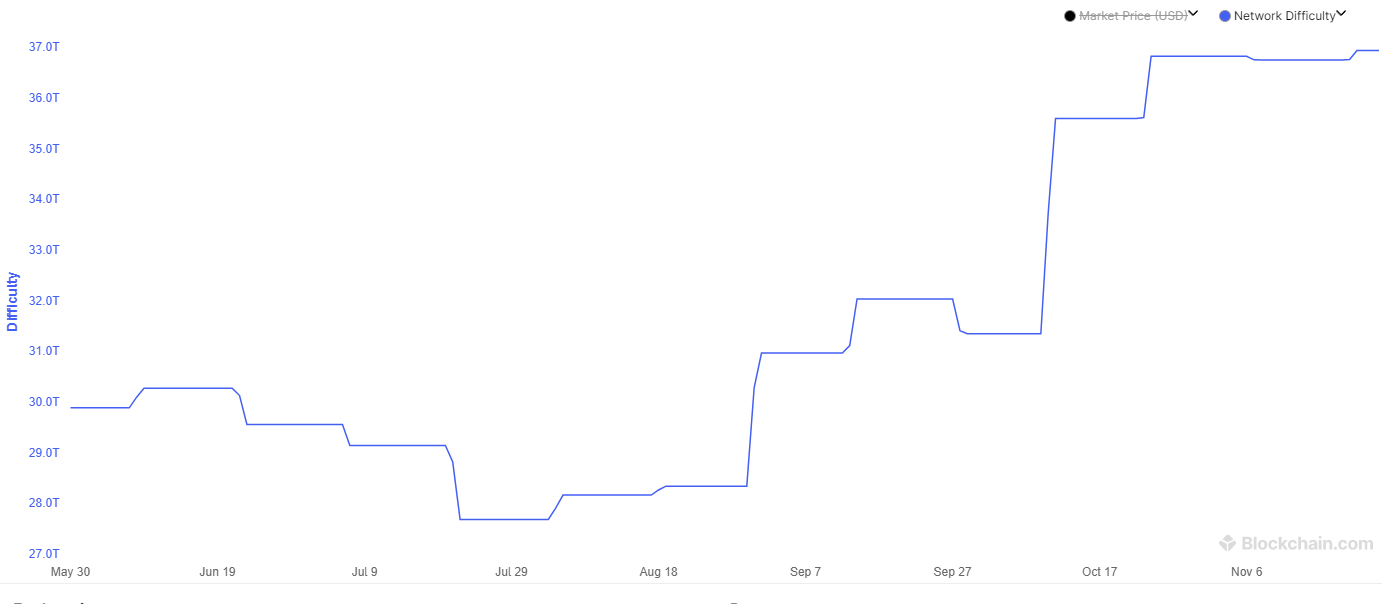

Understanding The Recent Increase In Bitcoin Mining Difficulty And Hashrate

May 09, 2025

Understanding The Recent Increase In Bitcoin Mining Difficulty And Hashrate

May 09, 2025