Understanding The Recent Increase In Bitcoin Mining Difficulty And Hashrate

Table of Contents

What is Bitcoin Mining Difficulty?

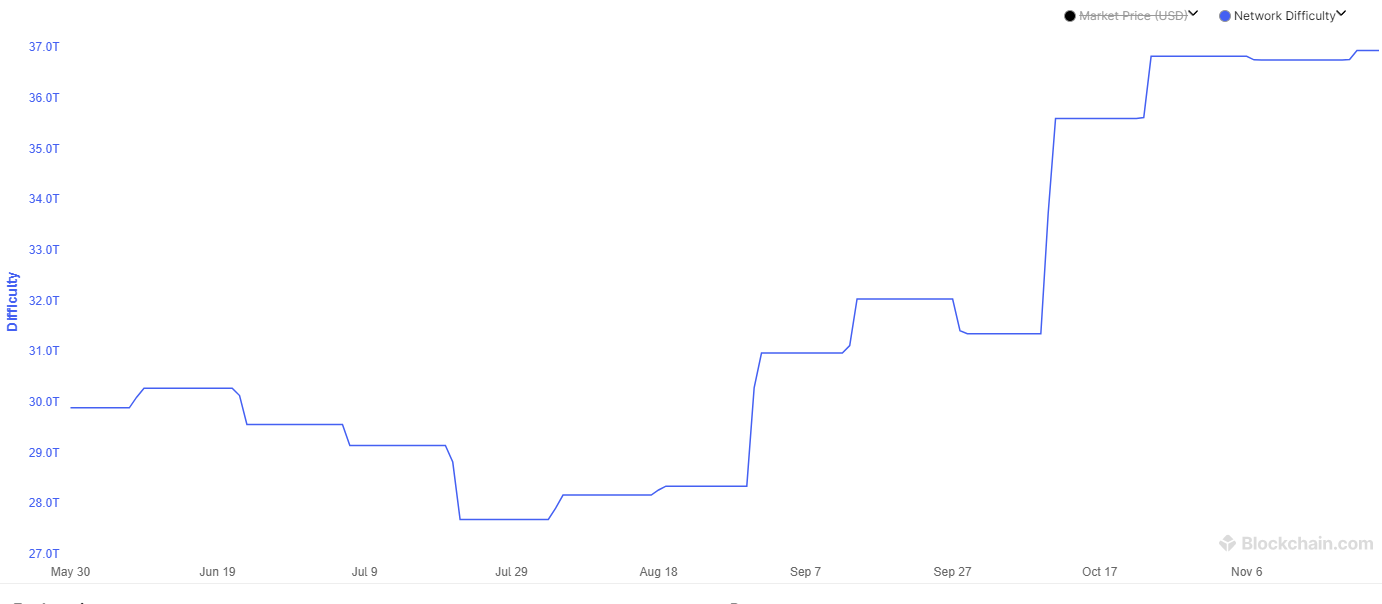

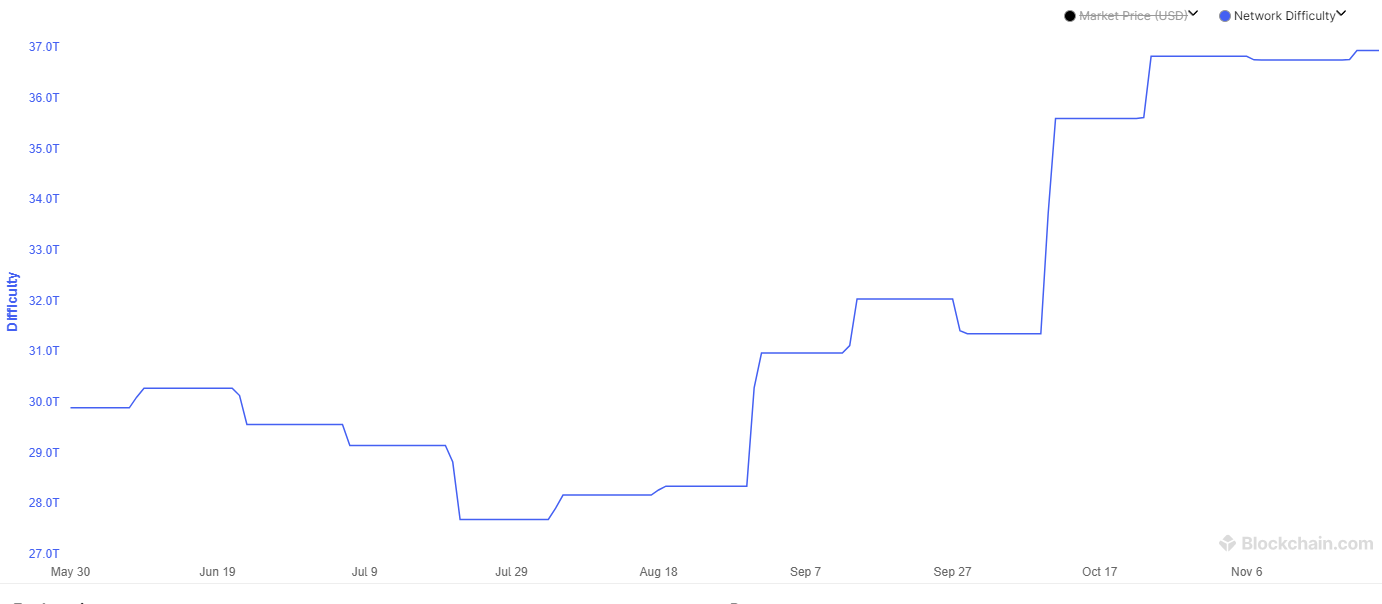

Bitcoin mining difficulty refers to a measure of how computationally difficult it is to successfully mine a block and add it to the Bitcoin blockchain. Its primary purpose is to maintain the security and stability of the network by ensuring that new blocks are added at a consistent rate, approximately every 10 minutes. This difficulty adjusts automatically based on the network's hashrate—the total computational power dedicated to Bitcoin mining.

- Difficulty is measured in units: It's a relative measure, not an absolute value. A higher number indicates a higher difficulty.

- Higher difficulty means more computational power is needed: Miners need more powerful hardware and consume more energy to solve the complex cryptographic puzzles required to mine a block.

- Difficulty adjustments occur approximately every two weeks: The Bitcoin protocol automatically adjusts the mining difficulty every 2016 blocks, roughly every two weeks, to maintain the target block time. This adjustment ensures network stability even amidst fluctuations in the hashrate. The Bitcoin mining difficulty adjustment algorithm is a crucial component of the network's self-regulating mechanism. This ensures the consistent creation of new Bitcoin blocks regardless of the overall network hashrate. The block reward also plays a crucial role, incentivizing miners to contribute their computational power to the network.

Understanding Bitcoin Hashrate

Bitcoin hashrate represents the combined computational power of all miners working to solve cryptographic problems and validate Bitcoin transactions. It's a key indicator of the network's health, security, and decentralization. A higher hashrate means more miners are participating, making the network more resistant to attacks and more secure.

- Hashrate is measured in hashes per second (H/s): This metric quantifies the speed at which miners can perform cryptographic calculations.

- Higher hashrate means more miners are participating: This indicates a robust and resilient network. A higher hashrate often signifies increased confidence in Bitcoin's value proposition.

- A rising hashrate generally indicates a healthier and more secure network: It suggests increased interest in mining, often driven by factors like higher Bitcoin prices and technological advancements in mining hardware. The SHA-256 algorithm, the core of Bitcoin's mining process, plays a significant role in determining the overall hashrate.

The Correlation Between Bitcoin Mining Difficulty and Hashrate

There's a direct and inverse relationship between Bitcoin's hashrate and its mining difficulty. When the hashrate increases, the network automatically adjusts the mining difficulty upward to maintain the target block time of approximately 10 minutes. Conversely, a decrease in hashrate leads to a reduction in mining difficulty.

- Difficulty adjusts to maintain a consistent block time: This is crucial for the network's stability and predictability.

- Difficulty increases make mining less profitable for less efficient miners: This can lead to a consolidation of the mining industry, with only the most efficient miners remaining profitable. This increased competition within Bitcoin mining pools further shapes the dynamics of the network.

- A stable hashrate suggests a balanced and secure network: Significant and sustained fluctuations can be a cause for concern, potentially indicating vulnerabilities or imbalances within the ecosystem.

Recent Increase in Bitcoin Mining Difficulty and Hashrate: Reasons and Implications

The recent simultaneous increase in both Bitcoin mining difficulty and hashrate is a significant event. Several factors likely contributed to this trend:

- Increased miner adoption: More miners are joining the network, drawn by Bitcoin's price appreciation and potential for profit.

- Advancement in mining hardware (ASICs): The development of more efficient and powerful Application-Specific Integrated Circuits (ASICs) allows miners to increase their computational power.

- Institutional investment in Bitcoin mining: Large-scale institutional investors are entering the Bitcoin mining space, significantly boosting the overall hashrate.

- Price increase of Bitcoin: Higher Bitcoin prices incentivize more mining activity as profitability increases.

This trend has several implications:

- Increased competition among miners: Profit margins will likely shrink as more miners compete for block rewards.

- Potential for consolidation within the mining industry: Less efficient miners may be forced to exit the market, leading to greater centralization.

- Impact on Bitcoin's energy consumption: The increased hashrate will likely lead to a higher energy consumption by the network. This is a key area of ongoing discussion and research within the Bitcoin community. The development of more energy-efficient mining hardware and the exploration of renewable energy sources are vital in addressing these concerns.

Conclusion

The recent surge in Bitcoin mining difficulty and hashrate highlights the dynamic nature of the Bitcoin network. The direct relationship between these two metrics is fundamental to understanding the network's security and stability. Understanding this correlation is crucial for navigating the complexities of the Bitcoin market. The increase in both metrics reflects growing adoption, technological advancements, and increased institutional involvement. While this increased activity strengthens network security, it also raises concerns about energy consumption and potential centralization. Stay updated on the latest trends in Bitcoin mining difficulty and hashrate to make informed decisions in this dynamic market. Continue your research and understand the implications of these key metrics for the future of Bitcoin.

Featured Posts

-

Analysts Reset Palantir Stock Forecast Understanding The Recent Rally

May 09, 2025

Analysts Reset Palantir Stock Forecast Understanding The Recent Rally

May 09, 2025 -

The Irony Of Davids Casting In High Potential Episode 13

May 09, 2025

The Irony Of Davids Casting In High Potential Episode 13

May 09, 2025 -

A Real Safe Bet Assessing Risk Tolerance Before Investing

May 09, 2025

A Real Safe Bet Assessing Risk Tolerance Before Investing

May 09, 2025 -

Palantir Stock Is A 40 Rise In 2025 Realistic Should You Invest Now

May 09, 2025

Palantir Stock Is A 40 Rise In 2025 Realistic Should You Invest Now

May 09, 2025 -

Agression Au Lac Kir De Dijon Trois Victimes Blessees

May 09, 2025

Agression Au Lac Kir De Dijon Trois Victimes Blessees

May 09, 2025