Sensex & Nifty LIVE Updates: Significant Gains Across Sectors

Table of Contents

Sensex Performance: A Detailed Analysis

Opening Bell & Early Trends:

The Sensex opened today with a strong bullish momentum.

- Opening index value: 66,250 (Illustrative value – replace with actual opening value)

- Percentage change from previous closing: +1.5% (Illustrative value – replace with actual percentage change)

- Initial reactions from analysts: Analysts attributed the positive opening to positive global cues and expectations of strong Q2 earnings. Many expressed bullish sentiment for the short term.

- Key sectors showing early strength/weakness: Banking and IT sectors showed early signs of strength, while the energy sector started relatively subdued.

Intraday Movements & Key Influencers:

The Sensex experienced some intraday volatility but largely remained in positive territory throughout the day.

- High and low points of the day: The Sensex reached a high of 66,500 and a low of 66,100 (Illustrative values – replace with actual high and low).

- Impact of global market trends: Positive performance in the US markets overnight contributed to the bullish sentiment in India. Good economic news from Europe also boosted investor confidence.

- Influence of specific company announcements or events: A positive earnings announcement from a major banking conglomerate fueled further gains in the financial sector.

- Role of investor sentiment: Investor sentiment was largely bullish, with a significant increase in buying activity observed across various sectors.

Closing Figures & Overall Assessment:

The Sensex ended the day with substantial gains, reflecting a positive overall market sentiment.

- Final closing index value: 66,400 (Illustrative value – replace with actual closing value)

- Percentage change for the day: +1.8% (Illustrative value – replace with actual percentage change)

- Volume of trading: Trading volume was significantly higher than the average, indicating increased investor participation.

- Comparison to previous day's performance: This represents a significant improvement over yesterday's performance, signaling a strong upward trend.

Nifty 50 Index: Tracking the Key Indicators

Nifty's Parallel Movement with Sensex:

The Nifty 50 index mirrored the Sensex's upward trajectory throughout the day, exhibiting a strong positive correlation.

- Similar trends or divergences: Both indices showed similar trends, indicating a broad-based market rally. Minor divergences were observed in certain sectors but didn’t significantly impact the overall positive trend.

- Reasons for any divergence: Slight variations could be attributed to the different weightage of sectors in the two indices.

- Impact on overall market sentiment: The parallel movement reinforced the bullish sentiment and indicated a widespread market optimism.

Sectoral Performance within the Nifty:

Several sectors within the Nifty 50 contributed to the overall gains.

- Top performing sectors: Banking, IT, and Pharma sectors were the top performers, driven by strong earnings and positive investor sentiment.

- Underperforming sectors: The energy and consumer discretionary sectors showed relatively weaker performance compared to other sectors.

- Reasons for sectoral variations: Sector-specific factors, such as global commodity prices and regulatory changes, influenced the performance variations.

Key Nifty Stocks Driving the Gains:

Several key stocks within the Nifty 50 contributed significantly to the overall gains.

- Stock names and their percentage gains: (Insert names of top-performing stocks and their percentage gains). For example: HDFC Bank (+2.5%), Infosys (+2%), Reliance Industries (+1.8%) (Illustrative values – replace with actual data).

- Reasons for their strong performance: Strong quarterly earnings, positive future outlook, and increased investor demand contributed to these stocks' outstanding performance.

- Impact on investor confidence: The strong performance of these leading stocks boosted overall investor confidence and fueled further buying activity.

Implications for Investors & Traders

Investment Strategies based on Current Trends:

The current market trend suggests various strategies for investors.

- Advice for long-term investors: Long-term investors can consider accumulating high-quality stocks in sectors showing strong growth potential.

- Suggestions for short-term traders: Short-term traders might consider taking advantage of intraday price fluctuations but must manage risk carefully.

- Risk assessment and management strategies: Investors should carefully assess their risk tolerance before making any investment decisions. Diversification remains a key strategy to mitigate risk.

Looking Ahead: Future Market Outlook:

Predicting the future is always challenging, but current trends suggest potential positive momentum.

- Predictions for the coming days/weeks: The market might continue its upward trajectory in the near term, driven by positive earnings and overall economic sentiment.

- Factors that could influence future market movements: Global economic conditions, geopolitical events, and regulatory changes will continue to influence market movements.

- Cautions and potential risks: Investors should remain cautious and monitor market developments closely. Unexpected events can always impact market trends.

Conclusion:

The Sensex and Nifty experienced significant gains today, driven by positive factors across several sectors. This LIVE update highlighted key market movements, sectoral performances, and implications for investors. Understanding these Sensex and Nifty updates is crucial for informed decision-making. Stay tuned for more LIVE updates and analysis on the Indian stock market. Follow our website for continuous Sensex and Nifty LIVE Updates and gain valuable insights for your investment strategies. Don't miss out on crucial Sensex and Nifty updates; stay informed with our daily reports!

Featured Posts

-

Broadcoms Proposed V Mware Price Hike A 1050 Increase For At And T

May 09, 2025

Broadcoms Proposed V Mware Price Hike A 1050 Increase For At And T

May 09, 2025 -

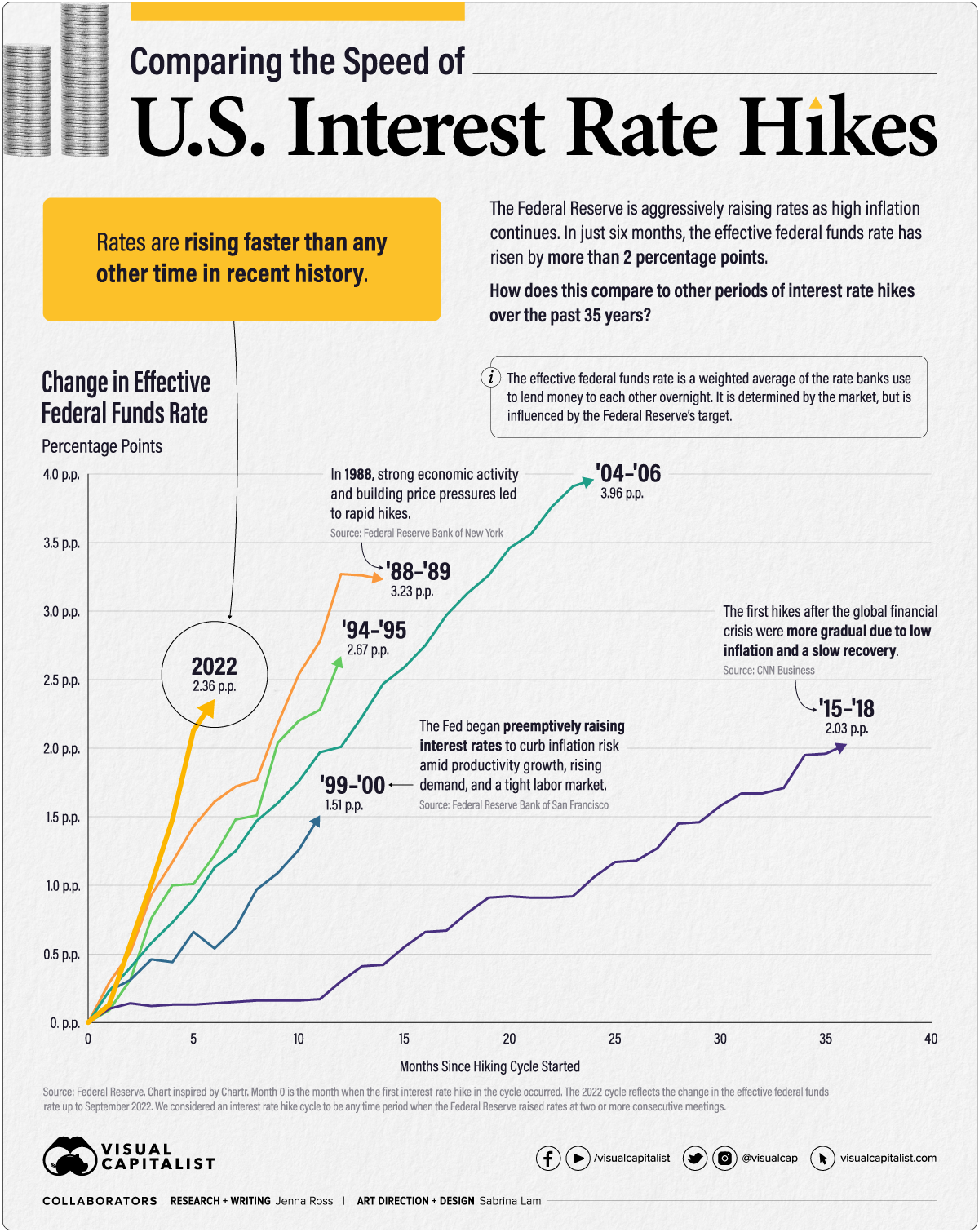

Interest Rate Hikes Understanding The Feds Different Strategy

May 09, 2025

Interest Rate Hikes Understanding The Feds Different Strategy

May 09, 2025 -

Whittier Community Rallies Behind American Samoan Family Facing Voter Fraud Charges

May 09, 2025

Whittier Community Rallies Behind American Samoan Family Facing Voter Fraud Charges

May 09, 2025 -

Nyt Strands April 9 2025 Complete Walkthrough And Spangram

May 09, 2025

Nyt Strands April 9 2025 Complete Walkthrough And Spangram

May 09, 2025 -

Oilers Vs Sharks Nhl Game Predictions Betting Picks And Best Odds

May 09, 2025

Oilers Vs Sharks Nhl Game Predictions Betting Picks And Best Odds

May 09, 2025