Sensex & Nifty Rally: Understanding The 1400 & 23800 Point Surge

Table of Contents

Global Factors Driving the Sensex Nifty Rally

Several global factors contributed to the recent impressive Sensex Nifty rally. Understanding these external influences is crucial for interpreting the market's behavior.

Positive Global Sentiment

A wave of positive global sentiment significantly boosted investor confidence, directly impacting the Indian markets. This positive sentiment stemmed from:

- Improved global economic indicators: Particularly in the US, positive economic data suggested a resilient global economy, easing recession fears. This strengthened investor confidence worldwide, including in the Indian markets.

- Positive corporate earnings reports: Strong earnings reports from leading multinational companies across various sectors indicated robust global economic activity, further supporting investor optimism. This positive corporate news spilled over into emerging markets like India.

- Easing of global inflation concerns: Signs of easing inflation in several major economies, including the US, led to reduced expectations of aggressive interest rate hikes by central banks. This reduced the risk of a global economic slowdown, fostering a positive outlook for the Sensex and Nifty.

- Increased foreign institutional investor (FII) inflow: Reduced global uncertainty and improved economic indicators prompted increased FII investment in Indian equities. This influx of foreign capital significantly fueled the Sensex Nifty rally.

- Example: The recent positive Consumer Price Index (CPI) data from the US, signaling a slowdown in inflation, directly influenced FII investment in India, contributing substantially to the Sensex Nifty rally.

Geopolitical Stability

A relatively stable geopolitical landscape, compared to recent periods of volatility, played a vital role in the market's upward trajectory.

- Reduced uncertainty: A decrease in geopolitical tensions led to increased investor confidence, allowing them to focus on economic fundamentals rather than external risks.

- Increased investor confidence: The perception of reduced risk encouraged investors to increase their exposure to equities, contributing to the rally's momentum.

- Example: The easing of tensions in [mention specific geopolitical event, e.g., the Ukraine conflict showing signs of de-escalation] positively impacted investor sentiment globally, further boosting the Sensex Nifty rally.

Domestic Factors Fueling the Market Rise

In addition to global factors, strong domestic elements significantly contributed to the Sensex Nifty rally.

Strong Corporate Earnings

Robust performance by Indian companies across various sectors formed the bedrock of the market surge.

- Strong Q[Quarter] results: The impressive performance of Indian companies, especially in sectors like IT and banking, fueled positive market sentiment.

- Positive future outlook: Companies' positive future outlook and strong growth projections further solidified investor confidence.

- Improved profitability and margins: Increased profitability and improved margins across various sectors highlighted the strength of the Indian economy.

- Example: The strong Q2 results from major IT companies and the robust performance of public sector banks significantly contributed to the market’s upward trajectory and the strength of the Sensex Nifty rally.

Government Policies and Initiatives

Supportive government policies played a crucial role in boosting investor confidence and economic growth.

- Pro-growth policies: The government's focus on economic reforms and pro-growth policies created a favorable investment climate.

- Infrastructure development: Significant investments in infrastructure development projects further stimulated economic activity.

- Initiatives promoting domestic manufacturing: Policies aimed at boosting domestic manufacturing and attracting foreign investment fostered a positive environment for business growth.

- Example: The government's focus on infrastructure development through initiatives like the National Infrastructure Pipeline (NIP) has positively influenced investor confidence and fueled the Sensex Nifty rally.

Improved Macroeconomic Indicators

Positive trends in key macroeconomic indicators reinforced the positive market sentiment.

- Robust GDP growth: Strong GDP growth figures indicated a healthy and expanding economy, attracting investors.

- Stable inflation: Stable inflation rates further boosted investor confidence and reduced uncertainty.

- Stable Rupee: A relatively stable Indian Rupee against the US dollar also contributed to positive market sentiment.

- Example: The robust GDP growth figures for the [mention quarter] quarter showcased the strength of the Indian economy, contributing to the sustained Sensex Nifty rally.

Understanding the Technical Aspects of the Surge

Analyzing the technical aspects of the surge provides further insights into the market's behavior.

Increased Trading Volume

The significant increase in trading volume during the rally indicated strong participation from both domestic and foreign investors. This high volume suggested a sustained and powerful upward trend, reinforcing the strength of the Sensex Nifty rally.

Technical Indicators

Several technical indicators signaled the impending rally. Moving averages, for instance, showed a clear upward trend, while the Relative Strength Index (RSI) indicated bullish momentum.

Breakout Levels

The market's breaching of key resistance levels marked important technical milestones, confirming the rally's strength and indicating further potential upside.

- Example: The breakout above the [mention resistance level, e.g., 23500 level for Nifty] was a key technical factor contributing to the accelerated Sensex Nifty rally.

Conclusion

The remarkable Sensex Nifty rally, witnessed through the Sensex crossing 1400 points and the Nifty exceeding 23800, is a result of a confluence of global and domestic factors. Positive global sentiment, strong corporate earnings, supportive government policies, and improved macroeconomic indicators all played crucial roles. Understanding these underlying factors is crucial for investors to make informed decisions. To stay updated on market trends and future Sensex Nifty rallies, continue to follow financial news and analyses. Invest wisely and keep track of the Sensex Nifty movements for optimal investment strategies.

Featured Posts

-

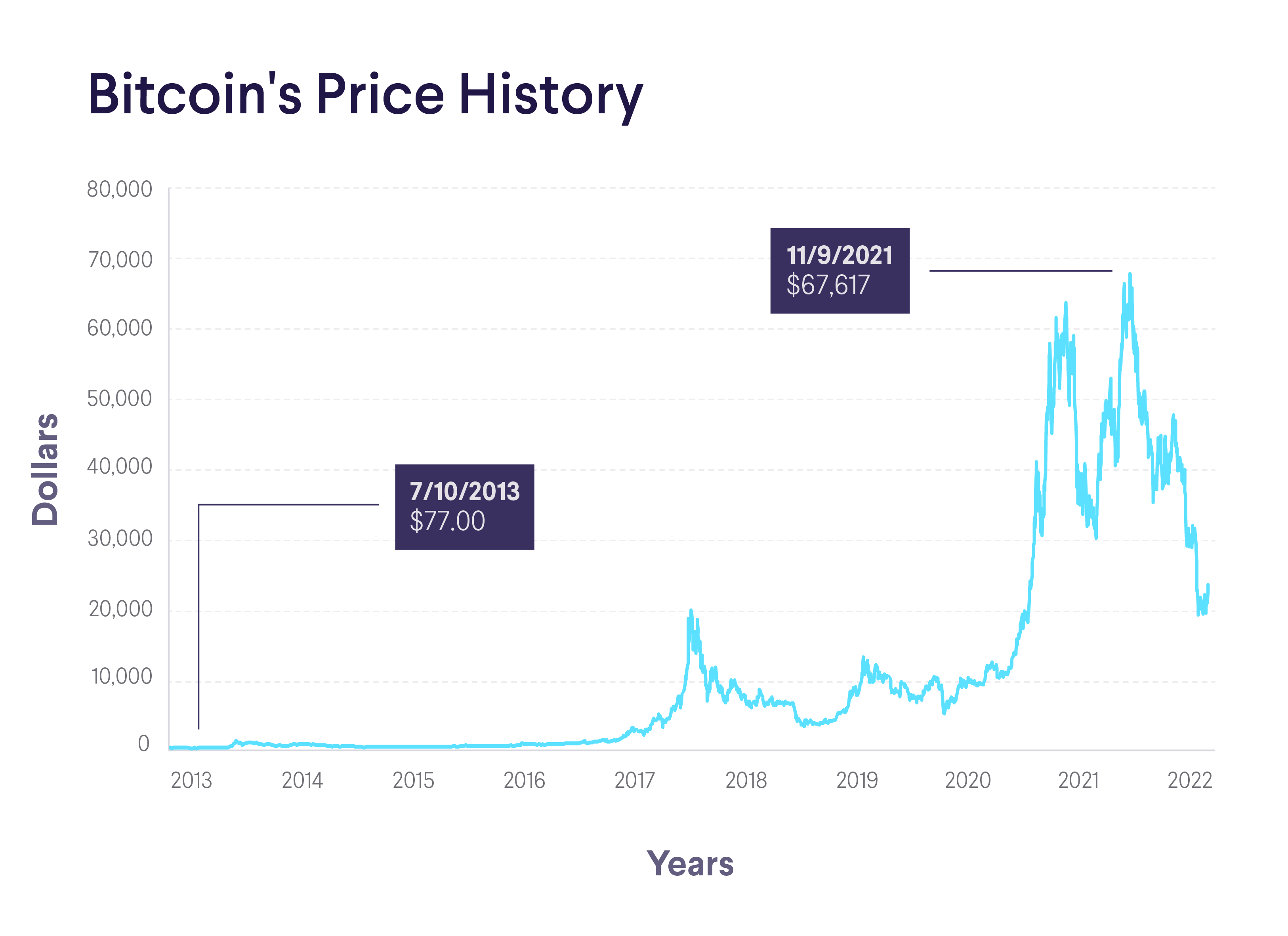

Black Rock Etf A 110 Growth Prediction And The Billionaire Buying Spree

May 09, 2025

Black Rock Etf A 110 Growth Prediction And The Billionaire Buying Spree

May 09, 2025 -

2025 Bitcoin Conference In Seoul A Key Industry Event

May 09, 2025

2025 Bitcoin Conference In Seoul A Key Industry Event

May 09, 2025 -

Nc Daycare Suspension What Parents Need To Know

May 09, 2025

Nc Daycare Suspension What Parents Need To Know

May 09, 2025 -

West Ham Face 25m Funding Shortfall Potential Solutions Explored

May 09, 2025

West Ham Face 25m Funding Shortfall Potential Solutions Explored

May 09, 2025 -

Dijon Trois Hommes Agresses Au Lac Kir Violente Attaque

May 09, 2025

Dijon Trois Hommes Agresses Au Lac Kir Violente Attaque

May 09, 2025