Shifting Sands: Taiwanese Investment In US Bond ETFs Slows

Table of Contents

Economic Factors Influencing Reduced Taiwanese Investment

Several macroeconomic factors have played a significant role in the reduced Taiwanese investment in US bond ETFs. These factors impact investment decisions by altering the risk-reward profile of these investments.

Rising Interest Rates in Taiwan

The increase in domestic interest rates in Taiwan significantly impacts the attractiveness of US bond ETFs.

- Higher yields on Taiwanese government bonds: The rise in Taiwanese government bond yields offers competitive returns, reducing the incentive for Taiwanese investors to seek higher yields in the US market. This makes domestic investments a more appealing alternative.

- Increased returns on local investments: Higher interest rates boost returns on various local investments, such as bank deposits and other fixed-income instruments. This provides a compelling reason to keep capital within Taiwan.

- Reduced incentive to seek higher yields abroad: With attractive returns available domestically, the perceived need to invest in US bond ETFs for higher yields diminishes. The risk-adjusted return may simply not justify the foreign investment.

The Strengthening Taiwanese Dollar (TWD)

The appreciation of the TWD against the USD directly affects the profitability of investments in US dollar-denominated assets.

- Currency exchange risks: Fluctuations in the exchange rate introduce currency risk, potentially reducing the overall return after conversion back to TWD. A strengthening TWD means less TWD received upon conversion.

- Reduced profitability after conversion back to TWD: Even if the US bond ETF generates positive returns in USD, the strengthening TWD can negate these gains when converting back to the investor's home currency. This makes the investment less attractive.

- Impact on overall portfolio returns: The currency exchange risk associated with US bond ETF investments negatively impacts the overall return of a diversified portfolio for many Taiwanese investors. This is a critical consideration in investment strategy.

Global Economic Uncertainty

Global economic uncertainty significantly impacts investor risk appetite and preferences for asset allocation.

- Geopolitical risks: Geopolitical tensions and uncertainties increase overall market volatility, making investors more cautious about foreign investments. The US bond market is not immune to these global events.

- Inflation concerns: High inflation globally reduces the real returns of bond investments, impacting the attractiveness of US bond ETFs. Investors seek investments that can better hedge against inflation.

- Potential recessionary pressures: Fears of a global recession can lead investors to favor more conservative investments within their home markets, reducing demand for riskier foreign assets. This shifts the focus to more stable domestic investments.

Regulatory and Policy Changes Affecting Investment Flows

Changes in both Taiwanese and US regulatory environments can influence investment flows into US bond ETFs.

Changes in Taiwanese Investment Regulations

Recent changes in Taiwanese regulations governing outbound investments could have impacted the flow of capital into US markets.

- New restrictions: The introduction of any new restrictions on foreign investments, even subtle ones, can discourage investors. This is especially true if alternative investment options exist.

- Increased reporting requirements: More stringent reporting requirements could increase the administrative burden and discourage some investors from investing abroad. Compliance costs are an important consideration.

- Changes in tax policies affecting foreign investments: Alterations in tax policies impacting foreign investments can impact the overall after-tax returns and significantly alter investment decisions. Tax efficiency is crucial.

US Regulatory Environment

The US regulatory environment also plays a role in influencing Taiwanese investment in US bond ETFs.

- Tax implications for foreign investors: Changes in US tax laws concerning foreign investors can impact the net returns received by Taiwanese investors, influencing their investment decisions. Tax treaties are an important factor.

- Reporting requirements: The complexity and stringency of reporting requirements for foreign investors in the US bond market can deter some investors. This is a significant administrative consideration.

- Potential changes in ETF regulations: Any changes to the regulatory framework governing ETFs in the US can affect investor confidence and investment flows. Clarity and stability in regulations are essential.

Alternative Investment Opportunities for Taiwanese Investors

The reduction in Taiwanese investment in US bond ETFs is partly due to the emergence of compelling alternative investment opportunities.

Increased Domestic Investment Opportunities

Growth in the Taiwanese domestic market is providing attractive alternatives to foreign investments.

- Expansion of local businesses: The expansion of successful businesses within Taiwan provides opportunities for investors seeking growth within their own market. This offers familiar market dynamics.

- Rising property values: Increases in property values create attractive investment opportunities within the domestic real estate market. This is a stable, traditional asset class.

- Increased infrastructure projects: Government investment in infrastructure projects can create opportunities for related investments, diverting capital away from foreign markets. This can offer strong growth potential.

Diversification into Other Asset Classes

Taiwanese investors are likely exploring different asset classes to diversify their portfolios.

- Increased interest in Asian markets: Growing interest in other Asian markets provides attractive diversification opportunities within the region. This reduces reliance on a single market.

- Diversification into equities: Shifting investment towards equities provides the potential for higher returns, although it entails higher risk compared to bonds. This is a common portfolio diversification strategy.

- Real estate investments: Real estate investments, both domestically and internationally, offer another avenue for diversification and potentially higher returns. This asset class complements bond holdings.

Conclusion

The recent slowdown in Taiwanese investment in US bond ETFs is a multifaceted phenomenon driven by a combination of economic, regulatory, and market factors. Rising interest rates in Taiwan, a strengthening TWD, global uncertainty, and the emergence of compelling domestic investment opportunities have all contributed to this shift. Understanding these underlying dynamics is crucial for investors, policymakers, and financial analysts. To stay informed about future trends in Taiwanese investment in US Bond ETFs and to make well-informed investment decisions, continuous monitoring of macroeconomic indicators and regulatory changes is essential. Further research into the evolving landscape of global investment flows will be critical to understanding the long-term implications of this trend. Staying abreast of changes affecting Taiwanese investment in US Bond ETFs is vital for making sound financial decisions.

Featured Posts

-

New Details Emerge When Can We Expect The James Gunn Superman Movie

May 08, 2025

New Details Emerge When Can We Expect The James Gunn Superman Movie

May 08, 2025 -

Trump Medias Crypto Etf Launch With Crypto Com Sends Cro Higher

May 08, 2025

Trump Medias Crypto Etf Launch With Crypto Com Sends Cro Higher

May 08, 2025 -

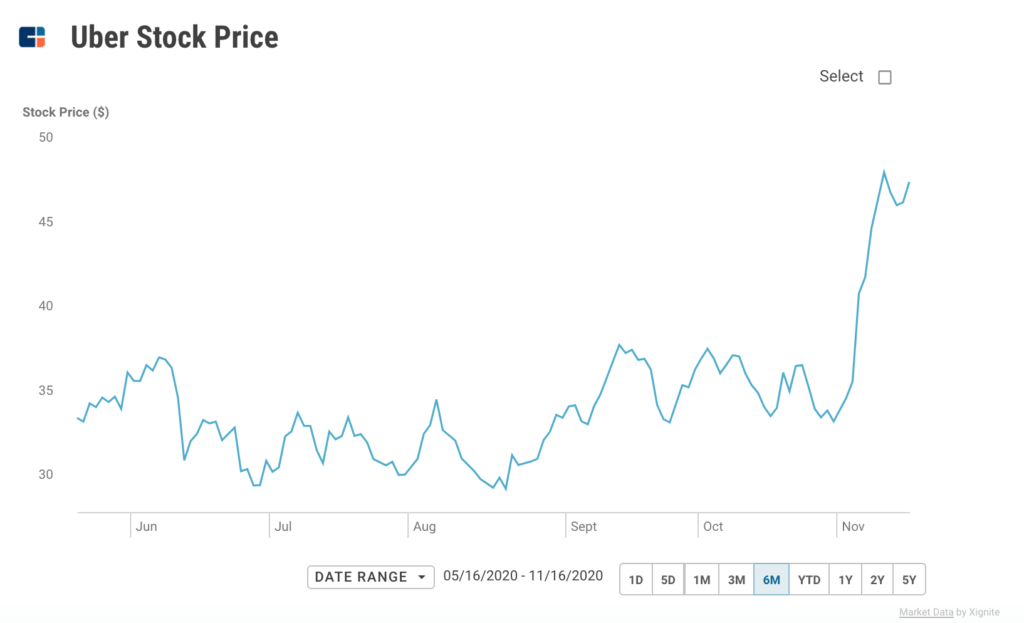

Uber Stock A Comprehensive Investment Analysis

May 08, 2025

Uber Stock A Comprehensive Investment Analysis

May 08, 2025 -

Assassins Creed Shadows Ps 5 Pro Visual Upgrade Analysis

May 08, 2025

Assassins Creed Shadows Ps 5 Pro Visual Upgrade Analysis

May 08, 2025 -

Ethereum Price Analysis Potential For 2 000 Breakout

May 08, 2025

Ethereum Price Analysis Potential For 2 000 Breakout

May 08, 2025