Uber Stock: A Comprehensive Investment Analysis

Table of Contents

Uber's Business Model and Market Position

Uber's business model rests on two primary pillars: ride-sharing and food delivery. Let's examine each in detail to understand its market position and competitive landscape.

Ride-Sharing Dominance

Uber's ride-sharing service remains a global leader, though its dominance varies geographically. While it holds a significant market share in many major cities worldwide, competition from Lyft and regional players in specific markets presents a challenge. Understanding Uber's market capitalization is crucial for evaluating its overall valuation.

- Market Capitalization: (Insert current market cap data here)

- Revenue Streams: Ride-sharing generates a significant portion of Uber's revenue, but Uber Eats and freight services are contributing increasingly.

- Key Market Demographics: Uber's target demographic is broad, ranging from commuters and tourists to those needing last-mile delivery solutions. Analyzing shifts in demographics and their impact on demand is crucial.

- Competitive Landscape: Lyft is a major competitor in the US, while other regional players exist globally. Analyzing Uber's competitive strategies, such as pricing and promotional offers, is necessary to understand its market share and sustainability.

Uber Eats and Delivery Services

Uber Eats has emerged as a significant player in the rapidly growing food delivery market. However, intense competition from established players like DoorDash and Grubhub necessitates a close examination of its performance.

- Market Share in Food Delivery: (Insert relevant market share data here, comparing to DoorDash, Grubhub, etc.)

- Expansion Strategies: Uber Eats continues to expand its geographical reach and add new restaurant partners. Analyzing the success of these expansion efforts is critical.

- Profitability of the Segment: While Uber Eats is growing rapidly, its profitability compared to ride-sharing remains a key area of focus for investors. The impact of fluctuating fuel prices and delivery driver costs is a key factor.

- Impact of Consumer Habits: Changing consumer preferences for convenience and online ordering drive growth in the food delivery sector, but economic downturns can significantly impact demand.

Financial Performance and Growth Prospects

Assessing Uber's financial health and forecasting its future growth are vital for any investment decision.

Revenue and Profitability

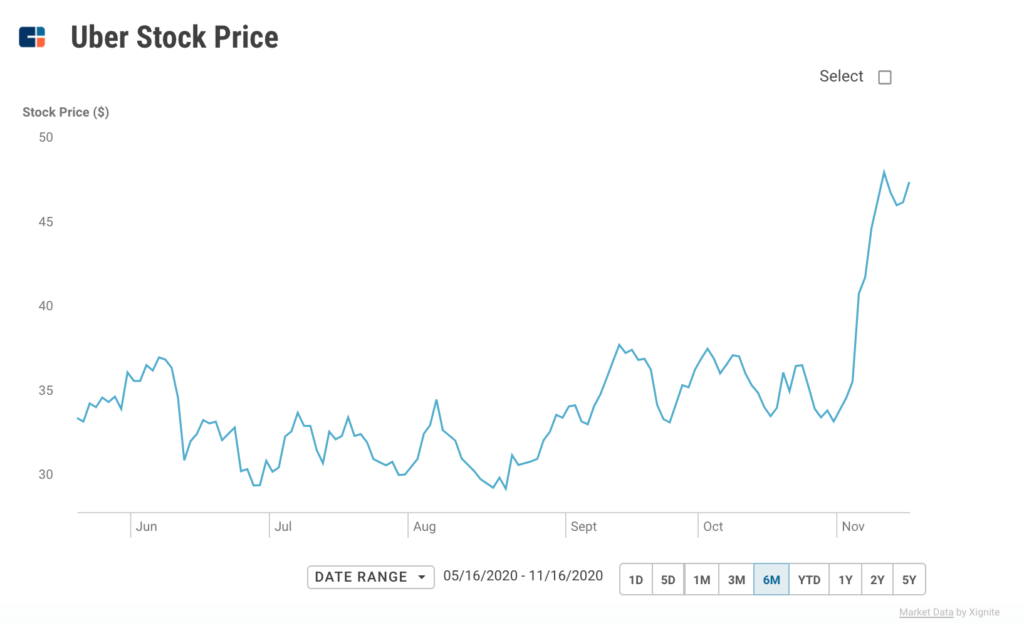

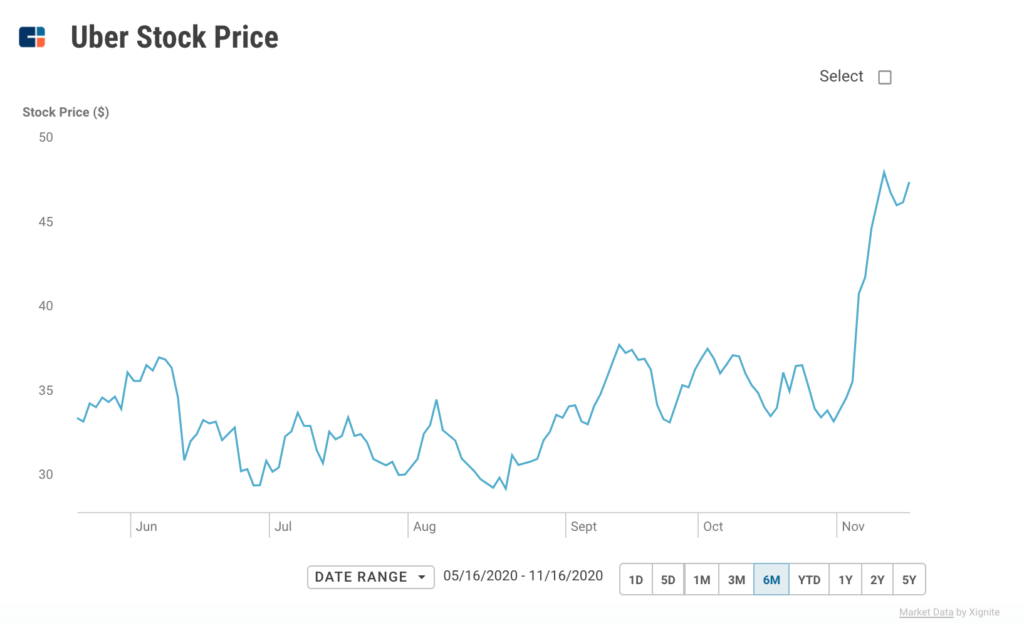

Uber's historical financial performance reveals a company experiencing significant revenue growth, but profitability has been a persistent challenge.

- Year-over-Year Revenue Growth: (Insert relevant data, including charts and graphs showcasing historical revenue trends)

- Net Income: (Insert data, highlighting profitability or losses and trends)

- Operating Margins: (Insert data, indicating efficiency and profitability)

- Debt Levels: (Insert data, analyzing financial risk)

- Cash Flow: (Insert data, demonstrating financial stability and ability to invest in growth)

Future Growth Drivers

Several factors could drive Uber's future growth, though their realization is subject to market conditions and external factors.

- New Service Offerings: Expansion into new service areas like autonomous vehicles, drone delivery, and other logistics services could unlock significant growth opportunities.

- International Expansion Plans: Penetration into new markets globally presents substantial potential for increased revenue.

- Technological Innovation: Investing in and implementing cutting-edge technologies will be vital to improving efficiency and maintaining a competitive edge. Autonomous vehicles, in particular, could be a game-changer.

- Potential Acquisitions: Strategic acquisitions of smaller companies could expand Uber's capabilities and market share.

- Regulatory Changes: Favorable regulatory changes could unlock further growth potential.

Risks and Challenges Facing Uber

Despite the potential, Uber faces significant challenges that investors must consider.

Regulatory Hurdles

Navigating the complex regulatory landscape is a key risk for Uber. Classifying drivers, ensuring safety standards, and complying with licensing requirements vary widely across regions.

- Legal Battles: Uber has faced numerous legal battles regarding driver classification and other regulatory issues. The outcome of these battles could significantly impact profitability.

- Potential Fines: Non-compliance with regulations can result in substantial fines.

- Evolving Regulatory Landscapes: The regulatory environment is constantly changing, creating uncertainty.

Competition and Market Saturation

The ride-sharing and food delivery markets are highly competitive and show signs of saturation in some areas.

- Competitive Pricing Pressures: Competition often leads to price wars, reducing profitability.

- Market Share Erosion: The potential for losing market share to competitors is a real threat.

- Potential for Mergers and Acquisitions: Consolidation within the industry is a possibility, potentially impacting Uber's position.

Economic Sensitivity

Uber's business is highly sensitive to macroeconomic factors.

- Impact of Recessionary Periods: Economic downturns typically lead to reduced consumer spending, directly impacting demand for ride-sharing and food delivery services.

- Price Elasticity of Demand: The price sensitivity of Uber's services needs to be carefully analyzed.

- Fuel Cost Fluctuations: Changes in fuel prices directly affect operating costs and profitability.

Conclusion

This analysis has explored various facets of Uber stock, from its dominant market position in ride-sharing and food delivery to the financial performance and inherent risks. While Uber shows strong growth potential in certain areas, investors must carefully weigh the potential rewards against the significant challenges, including regulatory hurdles and intense competition. Uber's future performance will significantly depend on its ability to navigate these challenges and capitalize on emerging opportunities.

Call to Action: Before making any investment decisions regarding Uber stock, conduct thorough due diligence, considering your own risk tolerance and financial goals. This comprehensive analysis provides valuable insight, but further research is crucial before investing in UBER stock. Remember, this is not financial advice.

Featured Posts

-

Ikea And Sonos Partnership Officially Over The Impact On Smart Home Speakers

May 08, 2025

Ikea And Sonos Partnership Officially Over The Impact On Smart Home Speakers

May 08, 2025 -

Ryujinx Emulator Project Closure Official Statement Following Nintendo Intervention

May 08, 2025

Ryujinx Emulator Project Closure Official Statement Following Nintendo Intervention

May 08, 2025 -

Investor Concerns Deciphering The Scholar Rock Stock Dip On Monday

May 08, 2025

Investor Concerns Deciphering The Scholar Rock Stock Dip On Monday

May 08, 2025 -

Bitcoins 10x Multiplier Scenario Implications For Wall Street

May 08, 2025

Bitcoins 10x Multiplier Scenario Implications For Wall Street

May 08, 2025 -

April 16 2025 Daily Lotto Winning Numbers Announced

May 08, 2025

April 16 2025 Daily Lotto Winning Numbers Announced

May 08, 2025