Should You Buy Apple Stock At $200? A $254 Price Target Analysis

Table of Contents

Apple's Recent Financial Performance and Future Projections

Apple's consistent financial success underpins its attractive stock valuation. Examining its recent performance and future projections is critical in evaluating the $254 price target.

Revenue Growth and Profitability

Apple's recent quarterly and annual reports paint a picture of robust revenue growth and impressive profit margins. Let's look at the numbers:

- Key Revenue Streams: The iPhone remains a dominant revenue generator, consistently contributing a significant portion to Apple's overall revenue. However, impressive growth is also seen in the Services segment (including App Store, Apple Music, iCloud), Wearables (Apple Watch, AirPods), and Mac sales. This diversification reduces reliance on a single product category, improving overall financial stability.

- Impact of Macroeconomic Factors: Global economic headwinds, including inflation and supply chain disruptions, have impacted Apple's performance. However, the company has shown resilience, adapting to challenges and demonstrating the strength of its brand and product ecosystem. This adaptability is a crucial factor influencing its long-term growth prospects.

Innovation and Product Pipeline

Apple's continued innovation is a key driver of its stock price. The company's robust product pipeline holds significant potential for future revenue growth.

- Upcoming Products and Services: Anticipation is high for the release of new iPhones, along with potential advancements in AR/VR technology, which could disrupt existing markets and open new revenue streams. These innovations represent significant opportunities to drive future growth and maintain Apple's competitive edge.

- Competitive Landscape: While facing competition from Android manufacturers and other tech giants, Apple continues to command a premium market share thanks to its strong brand loyalty and a highly integrated ecosystem. This brand strength is a significant asset that safeguards its market position.

Market Analysis and Valuation

Understanding the broader technology market and Apple's position within it is crucial for evaluating its stock price.

Industry Trends and Market Opportunities

The technology sector is dynamic, shaped by several significant trends:

- Growth Markets: The global mobile market continues to expand, presenting a large addressable market for Apple's iPhone and related services. The burgeoning wearables market and the expanding metaverse also offer exciting opportunities for Apple to further diversify its revenue streams.

- Potential Risks: Geopolitical instability and increased competition from rapidly developing tech companies pose potential threats. Supply chain disruptions and regulatory changes also represent ongoing challenges for Apple.

Apple Stock Valuation and Price Target Justification

The $254 price target is derived using a combination of valuation methods:

- Valuation Methods: The analysis incorporates discounted cash flow (DCF) analysis, considering projected future cash flows, and a Price-to-Earnings (P/E) ratio comparison with industry peers. These methods provide different perspectives on the intrinsic value of Apple stock.

- Factors Supporting the $254 Price Target: This projection is supported by Apple's strong financial performance, consistent innovation, and the potential for growth in key market segments. However, it is essential to remember that this is a projection, not a guaranteed outcome. The analysis accounts for conservative assumptions and inherent market volatility.

Risks and Considerations

While the $254 price target is promising, understanding the potential risks is crucial for informed investing.

Potential Downside Risks

Several factors could negatively impact Apple's stock price:

- Challenges and Threats: Supply chain disruptions could limit production and impact revenue. Increasing competition, particularly in the smartphone market and emerging technologies like AI, poses a challenge. Macroeconomic downturns and regulatory hurdles add further uncertainty.

- Impact of Negative News: Negative news related to product recalls, security breaches, or unfavorable regulatory decisions can significantly influence Apple's stock price. Therefore, staying informed on relevant news is critical.

Diversification and Investment Strategy

Remember: investing in Apple stock should be part of a diversified portfolio.

- Financial Advice: It's crucial to consult with a qualified financial advisor before making any investment decisions. They can help you assess your risk tolerance and create a portfolio aligned with your financial goals.

- Risk Management: Diversification across various asset classes minimizes risk. Investing solely in Apple stock could expose you to significant losses if the company underperforms.

Conclusion: Should You Buy Apple Stock at $200? Final Thoughts and Call to Action

This analysis suggests that Apple stock, at $200, presents a potentially attractive investment opportunity, given the $254 price target. However, this projection is based on various assumptions and market forecasts. The potential for growth is significant, but inherent risks remain.

Remember, investing in Apple stock or any other stock carries risk. Your decision should be based on your own thorough research, risk tolerance, and financial goals. Before making any investment decisions regarding Apple stock, consider consulting a financial advisor and conducting your own in-depth research on Apple’s financials and the current market conditions. Consider exploring other investment avenues to maintain a diversified portfolio. Should you choose to invest in Apple stock, make sure it aligns with your investment strategy. For additional resources on Apple stock performance, consider visiting [link to a reputable financial news source].

Featured Posts

-

Luxury Carmakers Struggle In China More Than Just Bmw And Porsche

May 24, 2025

Luxury Carmakers Struggle In China More Than Just Bmw And Porsche

May 24, 2025 -

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 24, 2025

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 24, 2025 -

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

Daks Alalmany Ytjawz Dhrwt Mars Awl Mwshr Awrwby Yewd Bqwt

May 24, 2025

Daks Alalmany Ytjawz Dhrwt Mars Awl Mwshr Awrwby Yewd Bqwt

May 24, 2025 -

Is This Us Band Playing Glastonbury Social Media Ignites Debate

May 24, 2025

Is This Us Band Playing Glastonbury Social Media Ignites Debate

May 24, 2025

Latest Posts

-

The End Of The Nfls Butt Targeting Rule The Tush Push Controversy Explained

May 24, 2025

The End Of The Nfls Butt Targeting Rule The Tush Push Controversy Explained

May 24, 2025 -

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025 -

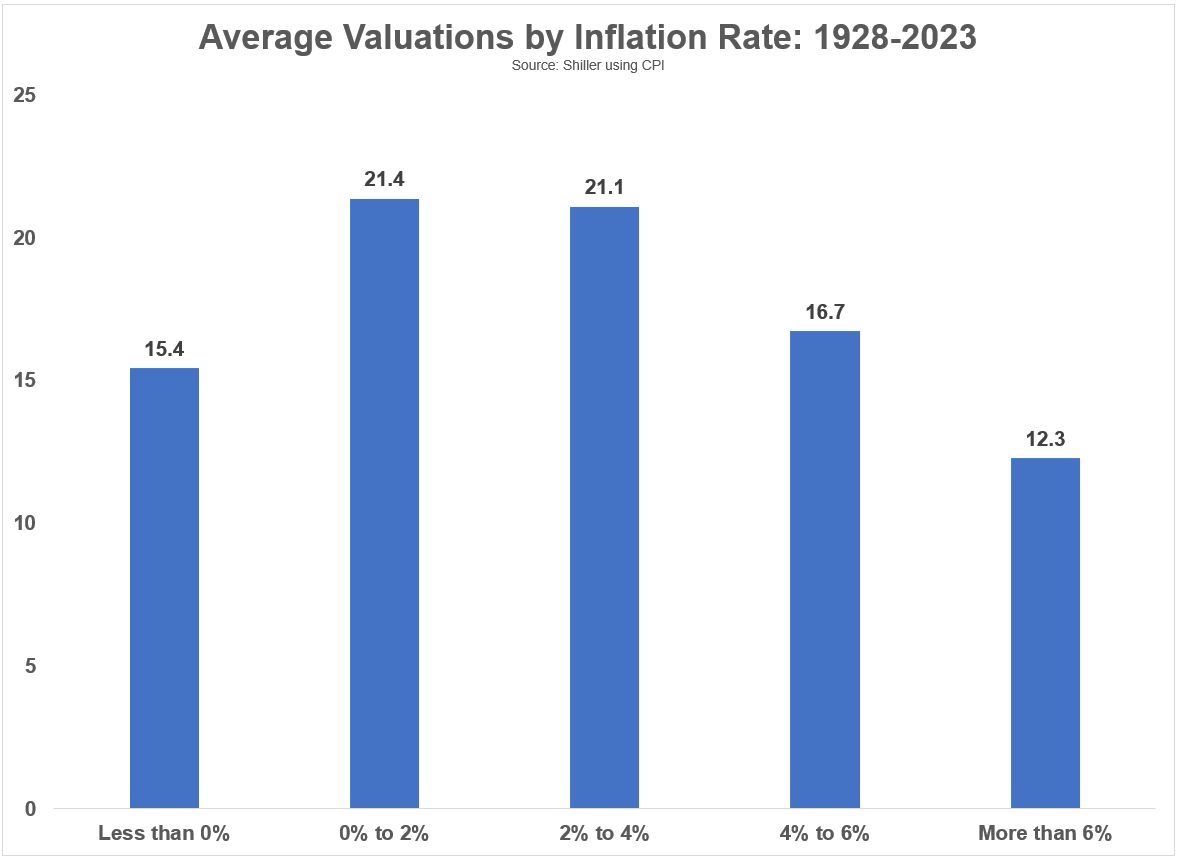

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025 -

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025 -

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025