Should You Invest In Palantir Stock Before May 5th?

Table of Contents

Palantir's Recent Performance and Financial Health

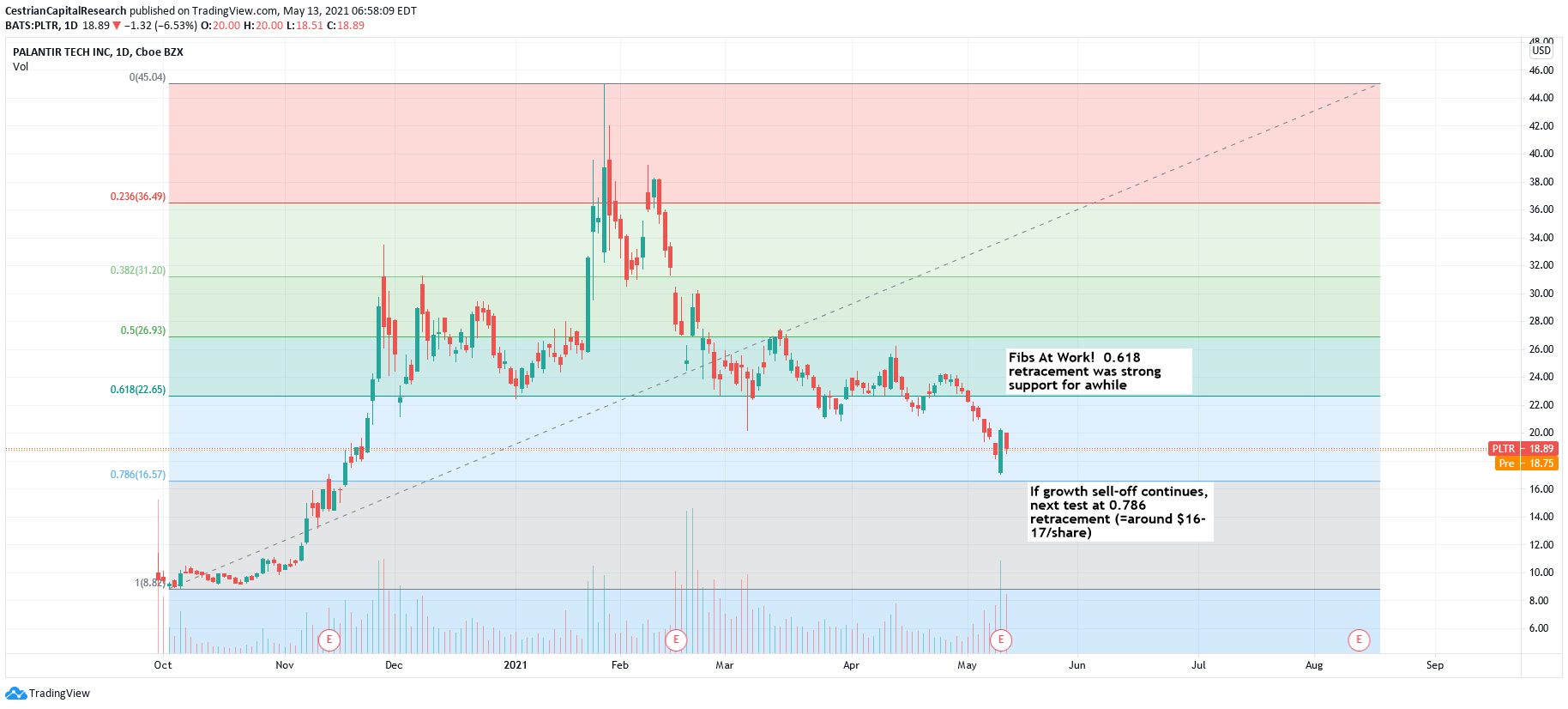

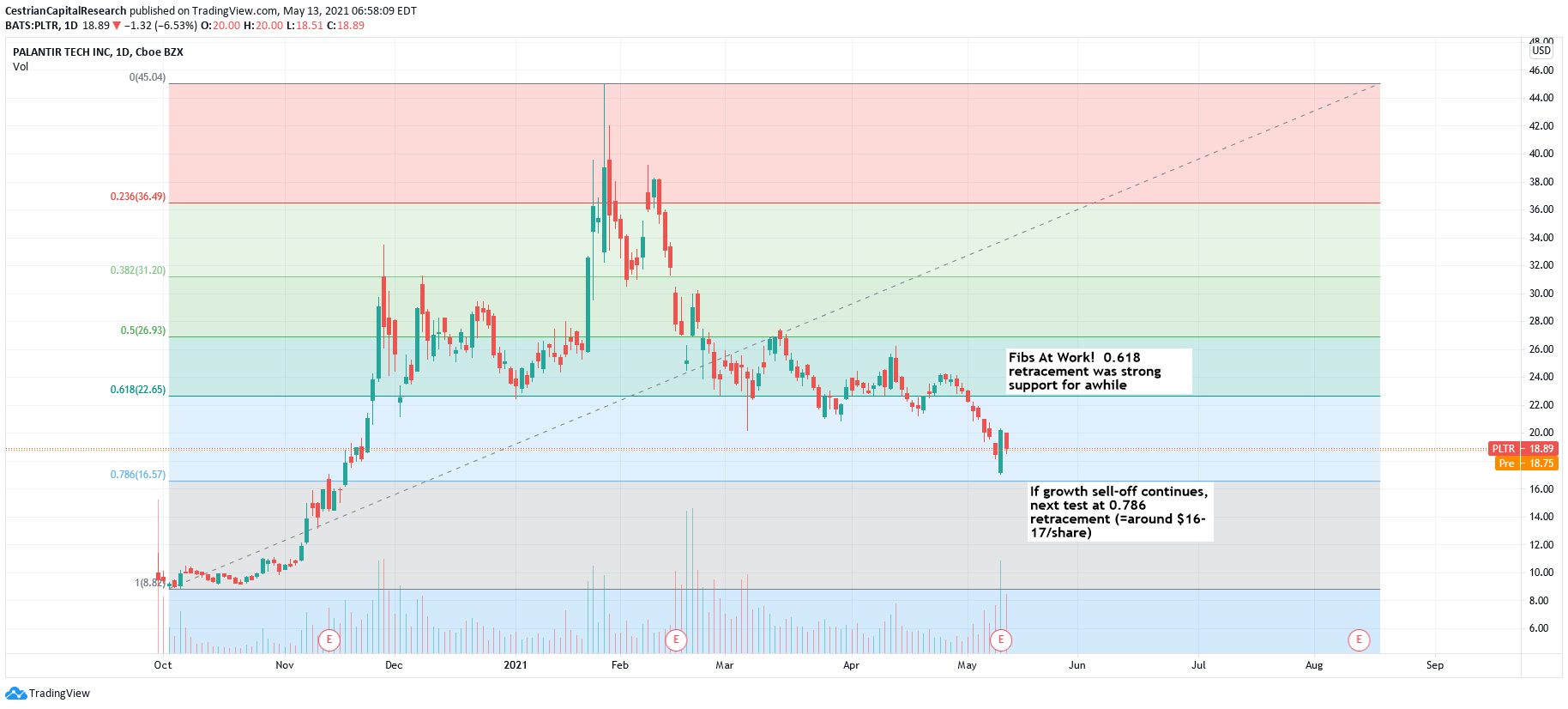

Understanding Palantir's recent performance is crucial before considering investment. Leading up to May 5th, Palantir stock experienced [Insert description of stock performance – e.g., a period of moderate growth following a recent earnings report, or a period of decline due to market conditions]. Analyzing key financial metrics paints a clearer picture. (Note: Replace the bracketed information below with actual data as close to May 5th as possible. Include charts and graphs if available.)

- Revenue Growth in Q1/Q2 2024: [Insert Data and percentage change]. This demonstrates [Interpretation of revenue growth – e.g., consistent growth, a slowdown, or acceleration].

- Profitability Margins:

- Gross Profit Margin: [Insert Data and percentage].

- Operating Profit Margin: [Insert Data and percentage].

- Net Income: [Insert Data]. This indicates [Interpretation of profitability – e.g., improving profitability, consistent profitability, or losses].

- Debt-to-Equity Ratio: [Insert Data]. A [high/low] ratio suggests [Interpretation of debt levels and their potential impact].

- Cash Flow and Future Projections: Palantir's cash flow is [Strong/Weak/Stable], indicating [positive/negative] implications for future investments and growth. Future projections suggest [Summarize future projections].

Analyzing Palantir's Growth Potential and Future Prospects

Palantir's growth strategy hinges on its ability to penetrate both the government and commercial sectors with its advanced data analytics solutions. Its competitive advantage lies in its [Mention key competitive advantages such as proprietary algorithms, strong government relationships, or specialized expertise].

Potential catalysts for future growth include:

-

New Product Launches or Partnerships: Palantir is continually innovating and expanding its product portfolio. Recent [mention any recent product launches or partnerships] showcases its commitment to growth.

-

Expansion into New Markets: Palantir is actively seeking opportunities to expand geographically and into new industry verticals, further fueling its growth potential.

-

Government Contracts: The securing of significant government contracts remains a major driver of Palantir's revenue. [Mention any significant recent contract wins or losses].

-

Market Size and Growth Potential: The big data analytics market is experiencing exponential growth, offering significant opportunities for Palantir.

-

Palantir's Innovative Technologies: Palantir's cutting-edge technology provides a competitive edge in the rapidly evolving data analytics landscape.

-

Competitive Advantages: Palantir's unique platform and strong client relationships provide a significant barrier to entry for competitors.

Risks Associated with Investing in Palantir Stock

While Palantir presents exciting growth opportunities, investors should carefully consider the associated risks:

-

Market Risk: The volatility of the tech sector and broader stock market poses a significant risk to Palantir stock.

-

Dependence on Government Contracts: A substantial portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and priorities.

-

Competition Risk: The data analytics market is becoming increasingly competitive, with established players and new entrants vying for market share.

-

Potential for Future Losses: Despite its growth potential, Palantir's profitability is not guaranteed, and future losses are a possibility.

-

Geopolitical Risk: Global political instability and international relations can significantly impact Palantir's business, particularly its government contracts.

-

Regulatory Risk: Changes in data privacy regulations and government policies can impact Palantir's operations and growth.

Expert Opinions and Analyst Forecasts on Palantir Stock

Analyst opinions on Palantir stock vary. [Insert summaries of analyst ratings and price targets, citing sources]. While some analysts express optimism regarding Palantir's long-term potential, others express concerns about its valuation and dependence on government contracts. [Include quotes from reputable financial analysts, if available].

Conclusion: Should You Invest in Palantir Stock Before May 5th? A Final Verdict

Investing in Palantir stock before May 5th requires careful consideration. While the company demonstrates growth potential and innovative technology, significant risks remain. The analysis suggests [state whether a buy, hold, or sell recommendation is suggested, and justify the recommendation based on the analysis presented].

Remember, this is not financial advice. Before making any investment decisions regarding Palantir stock, conduct your own thorough research and consult with a qualified financial advisor. Your personal risk tolerance and investment goals should heavily influence your decision. Understanding the intricacies of Palantir stock requires diligent due diligence.

Featured Posts

-

Adani Ports And Eternal Sensex And Niftys Biggest Movers Today

May 10, 2025

Adani Ports And Eternal Sensex And Niftys Biggest Movers Today

May 10, 2025 -

Katya Joness Bbc Exit Was Wynne Evans Involved

May 10, 2025

Katya Joness Bbc Exit Was Wynne Evans Involved

May 10, 2025 -

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025 -

International Transgender Day Of Visibility Practical Steps For Allyship

May 10, 2025

International Transgender Day Of Visibility Practical Steps For Allyship

May 10, 2025 -

Woman Sentenced For Unprovoked Racist Stabbing Death

May 10, 2025

Woman Sentenced For Unprovoked Racist Stabbing Death

May 10, 2025